PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851372

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851372

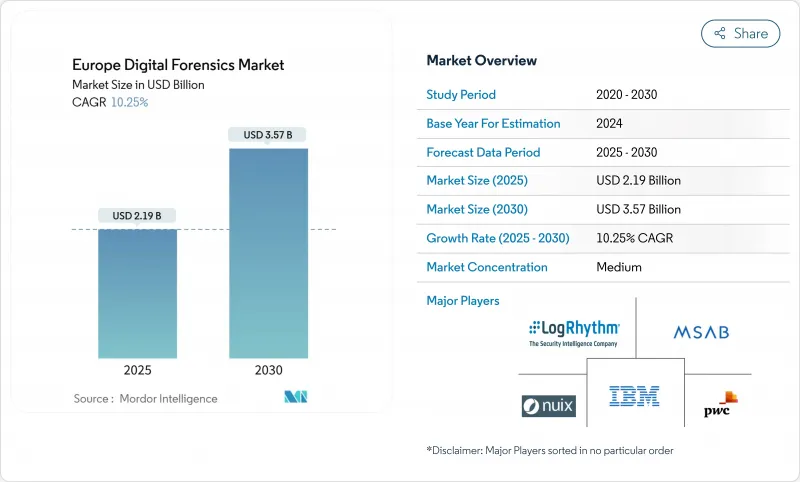

Europe Digital Forensics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Europe digital forensics market size sits at USD 2.19 billion in 2025 and is forecast to reach USD 3.57 billion by 2030, advancing at a 10.25% CAGR during the period.

Consistent public-sector funding, tighter resilience rules such as the Digital Operational Resilience Act, and rising cross-border cybercrime keep spending on investigation platforms high. Technology refresh cycles are shortening as AI analytics, cloud evidence capture, and automated case management replace legacy point tools, prompting vendors to pursue subscription models and managed offerings. Heightened ransomware activity across DACH, Benelux, and Nordic banking clusters forces enterprises to embed forensic readiness in incident-response playbooks. Venture funding for smart-vehicle and 5G security startups accelerates demand for new data-capture probes focused on in-vehicle systems and high-traffic edge nodes.

Europe Digital Forensics Market Trends and Insights

EU DORA & NIS2 Compliance Accelerating Forensic Readiness

Since 17 January 2025, financial entities across the bloc must prove continuous monitoring, incident logging, and third-party oversight, turning forensic readiness from an optional add-on into a regulatory baseline. Supervisors now audit registers of ICT providers, so banks procure enterprise-wide evidence repositories that plug directly into SIEM stacks and automate breach notification. Harmonisation with NIS2 extends similar obligations to energy utilities and digital service providers, widening the European digital forensics market beyond core finance. Budget reallocations favour multi-tenant cloud platforms offering chain-of-custody validation, which lifts recurring revenue for software vendors.

Proliferation of Encrypted Messaging Apps Boosting Mobile Forensics Demand

End-to-end encryption in iOS 18 and disappearing-message defaults push investigators toward advanced bypass techniques that combine logical extraction, backup parsing, and AI pattern matching. Research shows 83.33% of deleted WhatsApp messages remain recoverable through notification artefacts when sophisticated tooling is used.Greater technical complexity makes professional services indispensable, fuelling the services segment's double-digit growth trajectory.

GDPR Privacy Limits on Evidence Acquisition

Privacy Impact Assessments now accompany most large-scale forensic cases, lengthening engagement cycles and pushing smaller labs to defer complex cross-border work. National differences in supervisory interpretation mean evidence gathered legally in one state may face challenge in another, adding legal-review overhead. Investment is shifting toward selective-collection software that can hash and flag personally identifiable data instead of extracting entire disk images, aligning practice with data-minimisation rules.

Other drivers and restraints analyzed in the detailed report include:

- Spike in Ransomware Incidents Across DACH & Benelux Elevating Incident-Response Forensics

- Connected-Vehicle Growth Creating New Vehicle/IoT Forensics Workloads

- End-to-End Encryption Increasing Investigation Time & Cost

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software retains the dominant 45% slice of the European digital forensics market in 2024, thanks to scaled subscription pricing and continuous feature updates covering mobile, cloud, and SaaS artefact parsing. Hardware spend slows as acquisition tasks shift into virtual machines, yet proprietary dongles for chip-off extraction and high-speed write-blockers stay necessary for severe criminal investigations. Overall, a service-centric operating model positions providers to capture expansion budgets while protecting customers from skills shortages.

Services recorded the quickest 11.2% CAGR between 2025-2030 as corporates outsource complex evidence collection to specialised teams that operate remote labs and on-demand analytics. Large financial institutions sign multi-year managed forensics contracts that embed consultants during resilience-testing cycles mandated by DORA.Vendors differentiate through court-ready documentation workflows and API integrations with e-discovery suites, reducing hand-off friction for legal counsel

Mobile platforms captured 35% of the Europe digital forensics market size in 2024, reflecting smartphone ubiquity across personal and enterprise workflows. Investigators focus on encrypted chat artefacts, sensor fusion data, and artefact timeline stitching to recreate user journeys. Companion wearables add another evidence layer, further cementing handset analysis as a foundational discipline.

Cloud forensics grows at 11.4% CAGR as multi-tenant SaaS moves key evidence off-premise. Providers now supply snapshot tooling that freezes virtual instances and automates jurisdiction mapping to maintain legal validity. Computer forensics share declines, though endpoint artefacts still anchor insider-threat and fraud probes. Emergent vehicle and IoT evidence types spur integrated platforms able to stitch log data from ECUs, smart sensors, and central clouds in a single case file.

The Europe Digital Forensics Market Report is Segmented by Component (Hardware, Software, Services), Type (Computer, Mobile Device, Network, Cloud, and More), Tool (Data Acquisition and Prevention, Data Recovery, and More), Enterprise Size (Large Enterprises, Smes), End-User (Government, BFSI, IT, Healthcare, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- MSAB AB

- LogRhythm Inc.

- IBM Corporation

- PricewaterhouseCoopers LLP

- Nuix Ltd.

- Cellebrite DI Ltd.

- Magnet Forensics Inc.

- OpenText Corp. (Guidance Software)

- FireEye Inc. (Trellix)

- Envista Forensics

- Cellebrite (Digital Intelligence)

- ADF Solutions LLC

- AccessData (Exterro)

- Oxygen Forensics Inc.

- Paraben Corp.

- BAE Systems Applied Intelligence

- Atos SE (Evidian)

- Sytech Digital Forensics

- CCL Solutions Group Ltd.

- Evidence Talks Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU DORA and NIS2 Compliance Accelerating Forensic Readiness

- 4.2.2 Proliferation of Encrypted Messaging Apps Boosting Mobile Forensics Demand

- 4.2.3 Spike in Ransomware Incidents Across DACH and Benelux Elevating Incident-Response Forensics

- 4.2.4 Connected-Vehicle Growth Creating New Vehicle/IoT Forensics Workloads

- 4.2.5 5G Roll-out Driving AI-based Network Forensics Investments

- 4.3 Market Restraints

- 4.3.1 GDPR Privacy Limits on Evidence Acquisition

- 4.3.2 End-to-End Encryption Increasing Investigation Time and Cost

- 4.3.3 Fragmented Police Procurement Budgets Slowing Adoption

- 4.3.4 Shortage of ISO/IEC 17025-Accredited Labs in Europe

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Type

- 5.2.1 Computer Forensics

- 5.2.2 Mobile Device Forensics

- 5.2.3 Network Forensics

- 5.2.4 Cloud Forensics

- 5.2.5 Database Forensics

- 5.2.6 IoT and Embedded Device Forensics

- 5.3 By Tool

- 5.3.1 Data Acquisition and Preservation

- 5.3.2 Data Recovery and Reconstruction

- 5.3.3 Forensic Data Analysis

- 5.3.4 Review and Reporting

- 5.3.5 Forensic Decryption and Password Cracking

- 5.4 By Enterprise Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises

- 5.5 By End-user Industry

- 5.5.1 Government and Law Enforcement Agencies

- 5.5.2 BFSI

- 5.5.3 IT and Telecom

- 5.5.4 Healthcare

- 5.5.5 Retail and E-commerce

- 5.5.6 Energy and Utilities

- 5.5.7 Manufacturing

- 5.5.8 Transportation and Logistics

- 5.5.9 Defense and Aerospace

- 5.5.10 Education

- 5.6 By Country

- 5.6.1 United Kingdom

- 5.6.2 Germany

- 5.6.3 France

- 5.6.4 Italy

- 5.6.5 Spain

- 5.6.6 Nordics

- 5.6.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 MSAB AB

- 6.4.2 LogRhythm Inc.

- 6.4.3 IBM Corporation

- 6.4.4 PricewaterhouseCoopers LLP

- 6.4.5 Nuix Ltd.

- 6.4.6 Cellebrite DI Ltd.

- 6.4.7 Magnet Forensics Inc.

- 6.4.8 OpenText Corp. (Guidance Software)

- 6.4.9 FireEye Inc. (Trellix)

- 6.4.10 Envista Forensics

- 6.4.11 Cellebrite (Digital Intelligence)

- 6.4.12 ADF Solutions LLC

- 6.4.13 AccessData (Exterro)

- 6.4.14 Oxygen Forensics Inc.

- 6.4.15 Paraben Corp.

- 6.4.16 BAE Systems Applied Intelligence

- 6.4.17 Atos SE (Evidian)

- 6.4.18 Sytech Digital Forensics

- 6.4.19 CCL Solutions Group Ltd.

- 6.4.20 Evidence Talks Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment