PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907268

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907268

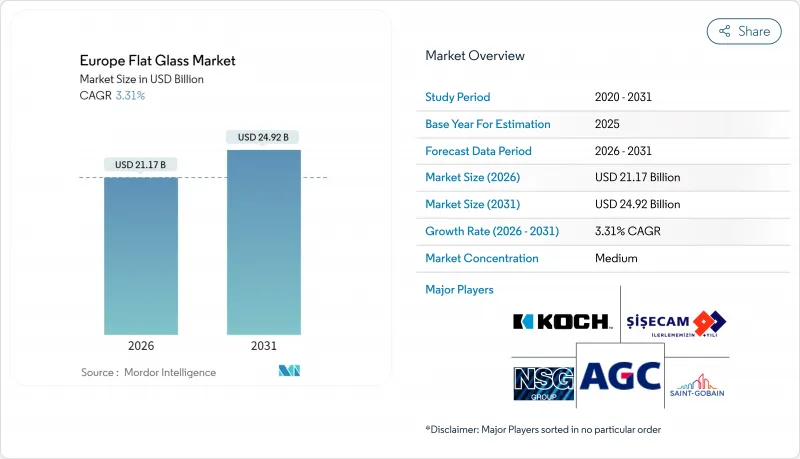

Europe Flat Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe Flat Glass Market was valued at USD 20.49 billion in 2025 and estimated to grow from USD 21.17 billion in 2026 to reach USD 24.92 billion by 2031, at a CAGR of 3.31% during the forecast period (2026-2031).

The strong correlation between energy-efficient construction regulations, vehicle lightweighting trends, and solar-photovoltaic capacity additions underpins this expansion of the Europe flat glass market. Builders across the region are accelerating the installation of low-emissivity (low-E) and vacuum-insulated units, while automakers are embedding panoramic glazing to cut carbon emissions and improve cabin aesthetics. Simultaneously, Europe's accelerating solar roll-out fuels demand for patterned and cover glass, creating a structural growth pillar distinct from conventional construction cycles. Producers are mitigating volatile soda-ash and natural-gas costs by investing in electric and hydrogen furnaces, even as EU-ETS Phase IV carbon prices reshape cost curves. Across every end-use, the Europe flat glass market benefits from regulatory tailwinds that make high-performance glazing a compliance necessity rather than a discretionary upgrade.

Europe Flat Glass Market Trends and Insights

Increasing Construction and Facade Renovation Across Europe

Infrastructure programs and commercial retrofits are reviving demand after the 2024 downturn. Siemens booked EUR 24 billion of smart-infrastructure orders in 2024, much of it tied to energy-efficient building envelopes that specify triple-insulated glazing. Danish prime office investors prioritize ESG-aligned refurbishments, translating to higher volumes of low-E units. Older housing stock in France and Italy is also entering a mandated upgrade cycle that prescribes U-values below 1.0 W/m2K. This dynamic lifts baseline volumes for the Europe flat glass market, even as high construction costs temper new-build activity. Producers with coated and vacuum-insulated portfolios are best positioned to capture this compliance-driven wave.

Automotive Lightweighting and Panoramic Glazing Adoption in EU-27 Vehicle Platforms

OEMs are replacing steel roof panels with multi-panel panoramic glass modules that cut weight and improve battery-electric range. Webasto and Gauzy report double-digit growth in panoramic roofs, while AGC has commercialized augmented-reality windshields for heads-up displays. Heated, antenna-embedded, and acoustic laminates command premium margins and push processed-glass demand higher. Commercial-vehicle makers follow the same trajectory as aerodynamic regulations tighten. These trends collectively widen average square-meter consumption per vehicle, reinforcing demand resilience when broader auto output softens.

High Electricity Intensity and Carbon Pricing Under EU-ETS Phase IV

Phase IV allocates fewer free allowances, lifting carbon costs above EUR 85/tCO2 in 2025. Flat-glass melting ranks among the top three industrial emitters per USD of value added, so producers pay both direct and indirect carbon charges via power tariffs. The competitive gap versus imports from low-carbon-price regions widens, raising calls for carbon-border adjustments. Investments in oxy-fuel burners, photovoltaic-powered frit kilns, and hydrogen trials aim to future-proof assets but require multi-year paybacks that not all operators can absorb.

Other drivers and restraints analyzed in the detailed report include:

- Surging Solar-PV Capacity Additions Driving Demand for Solar and Pattern Glass

- EU "Renovation Wave" Subsidies for Low-E and Vacuum-Insulated Glazing

- New Skill Gap for On-Site Installation of Oversized Insulated Glazing

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Europe flat glass market size attributable to annealed substrates reached 51.88% of the total value in 2025. Regulatory upgrades steer growth into processed categories. Tempered and laminated panes meet safety codes, while insulated units satisfy low-E mandates. Coated solutions incorporating soft-coat silver layers add solar-control functionality that can cut HVAC loads by 20%. Mirrors maintain niche uptake in furniture, yet remain tied to broader consumer spending cycles.

Processed glass volumes outpace commodity float because producers continually push the technology frontier. Sedak's curved-tempering line fabricates 6.5 m panels, unlocking design latitude for airports and museums. LiSEC's robotic sorting shrinks waste and delivers pane thickness variance within +-0.1 mm, a metric critical for triple-unit assemblies. Automation also improves traceability, aiding ESG audits now required by many lenders. These innovations fortify European competitive advantage against lower-cost imports.

The Europe Flat Glass Market Report is Segmented by Product Type (Annealed, Coated, Reflective, Processed, Mirrors), End-User Industry (Building and Construction, Automotive, Solar and Photovoltaic, Furniture and Interior Decor, Others), and Geography (Germany, United Kingdom, France, Italy, Spain, Poland, Benelux, Nordics, Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- AGC Inc.

- AGP Group

- Ardagh Group S.A,

- Bohle AG

- Euroglas

- Interpane Glas Industrie AG

- Koch Industries

- Nippon Sheet Glass Co., Ltd.

- OGIS GmbH

- Press Glass SA

- Saint-Gobain

- SCHOTT

- Sisecam

- Vitro

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing construction and facade renovation across Europe

- 4.2.2 Automotive lightweighting and panoramic glazing adoption in EU-27 vehicle platforms

- 4.2.3 Surging solar-PV capacity additions driving demand for solar and pattern glass

- 4.2.4 EU "Renovation Wave" subsidies for low-E and vacuum-insulated glazing

- 4.2.5 Rise of building-integrated-photovoltaic (BIPV) curtain-walls

- 4.3 Market Restraints

- 4.3.1 Volatile soda-ash, silica-sand and natural-gas prices

- 4.3.2 High electricity intensity and carbon-pricing under EU-ETS Phase IV

- 4.3.3 New skill-gap for on-site installation of oversized insulated glazing

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Annealed (incl. Tinted)

- 5.1.2 Coated (low-E, solar-control)

- 5.1.3 Reflective

- 5.1.4 Processed (tempered, laminated, IGU)

- 5.1.5 Mirrors

- 5.2 By End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Automotive

- 5.2.3 Solar and Photovoltaic

- 5.2.4 Furniture and Interior Decor

- 5.2.5 Others (appliances, rail, marine)

- 5.3 By Geography

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 France

- 5.3.4 Italy

- 5.3.5 Spain

- 5.3.6 Poland

- 5.3.7 Benelux

- 5.3.8 Nordics (Sweden, Norway, Denmark, Finland)

- 5.3.9 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share**/Ranking Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AGC Inc.

- 6.4.2 AGP Group

- 6.4.3 Ardagh Group S.A,

- 6.4.4 Bohle AG

- 6.4.5 Euroglas

- 6.4.6 Interpane Glas Industrie AG

- 6.4.7 Koch Industries

- 6.4.8 Nippon Sheet Glass Co., Ltd.

- 6.4.9 OGIS GmbH

- 6.4.10 Press Glass SA

- 6.4.11 Saint-Gobain

- 6.4.12 SCHOTT

- 6.4.13 Sisecam

- 6.4.14 Vitro

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment