PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689920

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689920

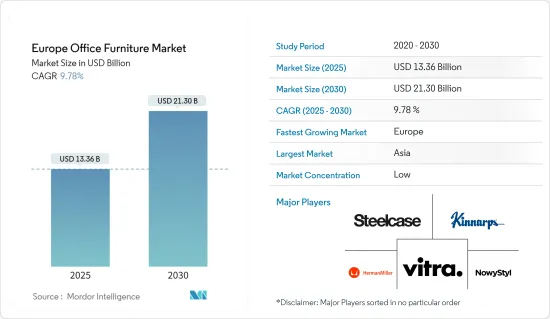

Europe Office Furniture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Europe Office Furniture Market size is estimated at USD 13.36 billion in 2025, and is expected to reach USD 21.30 billion by 2030, at a CAGR of 9.78% during the forecast period (2025-2030).

The European office furniture industry deals with design, manufacturing, and distribution, especially for office spaces. It consists of various types of furniture, such as desks, chairs, storage units, and conference tables. The European office furniture sector comprises multinational corporations and small and medium-sized enterprises.

Factors such as increasing commercial projects, rising focus on workplace ergonomics, and the growing trend of the remote working environment contribute to the market growth in Europe. There is a rising awareness among businesses regarding the importance of ergonomic furniture to promote employee health and productivity. Therefore, increased demand for ergonomic furniture increased the growth of the office furniture industry in Europe.

The rising growth of e-commerce platforms in Europe significantly contributed to the market's growth. Online platforms provide users with convenience, a wide product range, and attractive pricing, which increases consumers' online shopping rate and boosts the development of the European office furniture industry.

European Office Furniture Market Trends

Growing Environmental Awareness And Sustainability Drive the Market

The demand for office furniture increased in Europe due to the rising emphasis on environmental responsibility and sustainability. Organizations are highly focussing on conserving the environment, so European manufacturers are hugely producing office furniture made of recyclable or sustainably sourced materials. The shift towards sustainable practices for the conservation of the environment increases the consumer's consumption of office furniture. Therefore, the demand for office furniture increased due to eco-consciousness and functional factors.

Sustainability has become a priority for both consumers and businesses. So, office furniture manufacturers are producing environmentally friendly products made of recycled materials and adopting eco-friendly manufacturing processes.

Germany Dominates The Market

German office furniture is a powerhouse in the European furniture market due to its strong economy, robust manufacturing sector, and high quality. The country is focusing on product innovation, design, and technology. The customer demand for German furniture is due to sustainable practices and the fact that furniture is made of eco-friendly materials.

The demand for office furniture in Germany is increasing due to the number of office spaces and employees. Therefore, the growing number of various industries and the rising number of employees are critical factors for the growth of the office furniture market in Germany.

European Office Furniture Industry Overview

The European office furniture market needs to be more cohesive. European furniture manufacturers have a good reputation worldwide due to their creative capacity for new designs and responsiveness to new demands. The industry can combine new technologies and innovation with cultural heritage and style and provide jobs for highly skilled workers. The major market players are Steelcase, Herman Miller Europe, Kinnarps, Nowy Styl, and Vitra.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Corporate Office Expansions and Renovations Drives Market Growth

- 4.2.2 Increasing Focus On Sustainability Drives The Market

- 4.3 Market Restraints

- 4.3.1 Intense Competition Leading To Price Wars And Reduced Profitability

- 4.3.2 Challenges in Implementing Sustainable Practices

- 4.3.3 Market Oppurtunities

- 4.3.3.1 Technological Advancements In Office Furniture Market

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights of Technological Innovations in the Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Wood

- 5.1.2 Metal

- 5.1.3 Plastics

- 5.2 By Products

- 5.2.1 Meeting Chairs

- 5.2.2 Lounge Chairs

- 5.2.3 Swivel Chairs

- 5.2.4 Office Tables

- 5.2.5 Storage Cabinets

- 5.2.6 Desks

- 5.3 By Distribution Channel

- 5.3.1 Direct

- 5.3.2 Indirect

- 5.4 By Geography

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 France

- 5.4.4 Spain

- 5.4.5 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Competition Overview

- 6.2 Company Profiles

- 6.2.1 Steelcase

- 6.2.2 Kinnarps

- 6.2.3 Nowy Styl

- 6.2.4 Ahrend Group

- 6.2.5 Haworth Europe

- 6.2.6 Herman Miller Europe

- 6.2.7 Narbutas

- 6.2.8 Sedus Stoll

- 6.2.9 Senator

- 6.2.10 Vitra

- 6.2.11 Kinnarps

- 6.2.12 European Furniture Group

- 6.2.13 Poltrona Frou*

7 MARKET FUTURE TRENDS

8 DISCLAIMER AND ABOUT US