PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444059

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444059

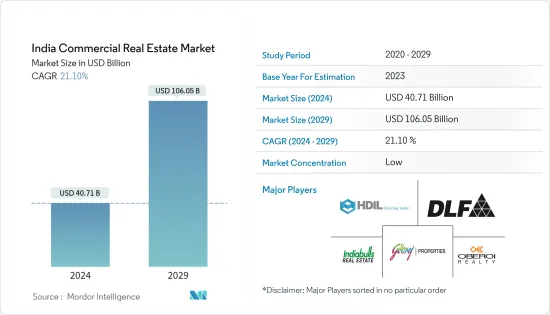

India Commercial Real Estate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The India Commercial Real Estate Market size is estimated at USD 40.71 billion in 2024, and is expected to reach USD 106.05 billion by 2029, growing at a CAGR of 21.10% during the forecast period (2024-2029).

Key Highlights

- The COVID-19 pandemic resulted in the work-from-home (WFH) culture, which had a short-term impact on new space obligations. In 2022 New office space in the seven cities ((Mumbai, Delhi NCR, Bengaluru, Hyderabad, Chennai, Kolkata, and Pune) in India was 38.25 million sq. ft that year, down by 30% from the previous year. In the first quarter of 2023 (January-March), net office absorption in the top six cities stood at 8.3 million sq. ft.

- According to industry experts, from September 2022, grade A offices in Indian cities, such as Bengaluru and Mumbai, had an average cap rate of 8.25 in core locations. In comparison, the cap rate of grade A offices in Taipei was 2.35 on average that year. As of the second quarter of that year, other regions of Gurugram had the highest vacancy rate combined at 35.9%. In comparison, the Cybercity of Gurugram in India had a vacancy rate of 5.4%, the lowest amongst other submarkets of the Delhi NCR region, according to industry experts.

- Retail and hospitality are also growing significantly in the commercial real estate market, providing the much-needed infrastructure for India's growing needs. India's commercial real estate sector is projected to be accelerated by large-scale investments by institutional investors in the coming years. The retail real estate sector in the country has been dramatically boosted by government initiatives, such as Make in India, and other reforms in the realty sector, such as the introduction of the Real Estate Regulatory Authority (RERA) and GST.

- Despite their initial troubles, developers and buyers are moving to the commercial real estate sector due to the transparency and competence of the industry, which has attracted increasing amounts of foreign direct investments (FDI) in commercial estate. The country's economic growth is driving demand for commercial property. Government initiatives and urban development policies and programs (Smart City, AMRUT) are expected to contribute to the need for real estate infrastructure.

- The demand for office space in the nation is driven by reasons such as flexibility, comfort, and convenience. Most businesses in various industries, including IT, manufacturing, BFSI, startups, and even boutique businesses, are looking for office space to accommodate their employees. Additionally, many companies intend to expand to new areas, open remote or satellite offices, or both, adding to the demand for these spaces.

- Technology development has elevated commercial real estate to a new level. It is now feasible to offer virtual property tours, improve customer relationship management, conduct online transactions, and improve communication between the seller and the buyer thanks to cutting-edge technology like artificial intelligence, virtual reality, and data analytics.

India Commercial Real Estate Market Trends

Office space demand to propel the market in India

Investor confidence in a swift economic recovery is being boosted by the rapid pace of the vaccine campaign, which is backed by a decrease in COVID-19 cases. With the gradual unlocking of economic activities and employers' shift in office premises for increased demand for co-working space, developers are optimistic about a healthy rebound in office leasing activity.

Bengaluru recorded the highest influx of new office supply, accounting for 28% of the total new office supply across seven major cities of India. Hyderabad contributed 23% of the total share and was second. Chennai recorded a rise of 124 per cent YoY with leasing of one msf recorded in 2022. Ahmedabad also recorded a substantial 165 per cent YoY rise in gross leasing in 2022, albeit on a low base.

According to research published by real estate consultant Colliers India, office space supply increased 49% to 32.8 million square feet during January-September this year across six cities due to the completion of numerous commercial developments to fulfill the increasing demand. According to Colliers India, the same amount was 22 million square feet in the same period across six cities Bengaluru, Chennai, Delhi-NCR, Hyderabad, Pune, and Mumbai.

The new office supply, which was 8.1 million square feet from January through September, decreased by 1% from the year before. From 2.1 million square feet in fresh supply, India's financial hub saw a 16% decrease to 1.8 million square feet. Chennai experienced the most significant increase in the number of new offices, which went from 0.9 million square feet to 4.2 million square feet. Delhi-NCR had a 133% increase in floor space from 2.7 million square feet to 6.3 million square feet, while a 56% increase in new office space supply increased from 5.1 million square feet to 7.9 million square feet.

The demand for flexible and co-working spaces is on the rise

According to industry experts, as of March, Bengaluru recorded the most operational flex space centers among all tier-1 cities in India. Mumbai followed with 343 flex space centers. Around the same time, Bengaluru recorded around 25 thousand leased flex seats, the highest among all tier-1 cities in India. Pune followed with more than 16 thousand leased flex seats.

In the financial year, 147 flex seat transactions were concluded in the Delhi NCR region, the highest among other tier-1 cities of India. Mumbai followed with 133 flex seat transactions during the same year. The information technology and the new tech sector contributed 30% to the flex seat take-up, the highest among all other sectors in India. Start-ups also opted for flex and co-working spaces and took 18% of the total share. The demand for flexible and co-working spaces is on the rise in the Indian office real estate market.

Once dominated by information technology, office spaces are being increasingly leased by other sectors such as BFSI (banking, financial services, and insurance), engineering, manufacturing, e-commerce, and co-working sectors. COVID-19-induced changes include the introduction of a hybrid work model in workplaces across the country. Smaller homes and larger family sizes propelled the growth of flex and co-working spaces in the country. IT-ITes, BFSI, e-commerce, and professional services employees emerged as the key occupiers of these flexible working spaces. Start-ups and small and medium enterprises (SMEs) focusing on tapping the talent of the mobile workforce also resulted in the demand for flex seats.

India Commercial Real Estate Industry Overview

The Indian commercial real estate market is partially fragmented and highly competitive. Indian retail real estate is becoming a preferred destination for global institutional investors, driven by robust office space take-up, declining vacancy levels, and rising rentals. Some of the country's major commercial real estate players include DLF, Godrej Properties, Housing Development and Infrastructure Ltd (HDIL), and Oberoi Realty. The Indian retail real estate market is reaching an intermediate consolidation phase as the number of developers offering commercial properties is decreasing. The small-scale developers are also merging with the big real estate developers or exiting the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Commercial Real Estate Buying Trends - Socioeconomic and Demographic Insights

- 4.3 Government Initiatives and Regulatory Aspects for Commercial Real Estate Sector

- 4.4 Insights on Existing and Upcoming Projects

- 4.5 Insights on Interest Rate Regime for General Economy and Real Estate Lending

- 4.6 Insights on Rental Yields in the Commercial Real Estate Segment

- 4.7 Insights on Capital Market Penetration and REIT Presence in Commercial Real Estate

- 4.8 Insights on Public-Private Partnerships in Commercial Real Estate

- 4.9 Insights on Real Estate Tech and Startups Active in the Real Estate Segment (Broking, Social Media, Facility Management, Property Management)

- 4.10 Impact of COVID-19 on the Market

- 4.11 Market Drivers

- 4.11.1 Increasing need for contemporary office spaces

- 4.11.2 Urban and semi-urban lodging are acting as other significant growth-inducing factors

- 4.12 Market Restraints

- 4.12.1 Availability of Financing

- 4.13 Market Opportunities

- 4.13.1 Foreign investment

- 4.14 Industry Attractiveness - Porter's Five Forces Analysis

- 4.14.1 Bargaining Power of Suppliers

- 4.14.2 Bargaining Power of Consumers / Buyers

- 4.14.3 Threat of New Entrants

- 4.14.4 Threat of Substitute Products

- 4.14.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Offices

- 5.1.2 Retail

- 5.1.3 Industrial and Logistics

- 5.1.4 Hospitality

- 5.2 By Key Cities

- 5.2.1 Mumbai

- 5.2.2 Bangalore

- 5.2.3 Delhi

- 5.2.4 Hyderabad

- 5.2.5 Other Cities

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles - Developers

- 6.2.1 DLF Ltd

- 6.2.2 Godrej Properties Ltd

- 6.2.3 Housing Development and Infrastructure Ltd (HDIL)

- 6.2.4 Oberoi Realty

- 6.2.5 IndiaBulls Real Estate

- 6.2.6 Prestige Estate Projects Ltd

- 6.2.7 Supertech Limited

- 6.2.8 HDIL Ltd

- 6.2.9 Brigade Group

- 6.2.10 Unitech Real Estate Pvt Ltd*

- 6.3 Other Companies (Real Estate Agencies, Startups, Associations, Etc.)

- 6.3.1 MagicBricks

- 6.3.2 99 Acres

- 6.3.3 Sulekha Properties

- 6.3.4 RE/MAX India

- 6.3.5 JLL India

- 6.3.6 Anarock Property Consultants

- 6.3.7 Awfis*

7 FUTURE OF THE MARKET

8 APPENDIX