PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687856

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687856

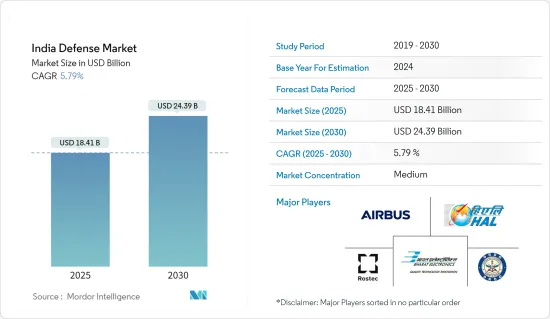

India Defense - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The India Defense Market size is estimated at USD 18.41 billion in 2025, and is expected to reach USD 24.39 billion by 2030, at a CAGR of 5.79% during the forecast period (2025-2030).

The Indian defense market has a strong emphasis on modernization and self-reliance. The government has actively promoted indigenous production, research, and development in defense technologies. This approach aligns with the "Make in India" initiative, fostering partnerships with domestic and international defense companies to enhance capabilities and reduce import dependency. Most of India's need for military equipment arises from its border conflicts with neighboring countries. China, Pakistan, and Bangladesh have executed military actions to choke India from multiple directions. Moreover, the on-ground military dispute at the line of actual control (LAC) with China and a similar conflict with Pakistan have necessitated procuring large-caliber munition for India. The Stockholm International Peace Research Institute (SIPRI) report 2022 stated that India was the fourth largest defense spender in the world, with a defense of USD 81.4 billion.

However, one of the pivotal drivers of the Indian defense market is the consistent growth in the nation's defense budget. The Government of India has set aside USD 19.64 billion to procure new weapons and platforms for 2023-2024. The Indian government has planned to invest USD 2.79 billion in defense-related research and development to promote "Atmanirbhar Bharat" indigenous manufacturing of defense systems. Such investments are expected to drive the defense market in India during the forecast period. On the other hand, India's limited indigenous capabilities in defense technology necessitate reliance on foreign suppliers for critical components. This reliance can create vulnerabilities in the supply chain, posing potential risks to security and procurement timelines. Such factors hamper the market growth.

Indian Defense Market Trends

The Air Force Segment is Expected to Hold the Highest Shares in the Market During the Forecast Period

The increased focus on the modernization of aircraft capabilities with the projected deliveries of various aircraft, including the Dassault Rafale, Ilyushin Il-76 (A50E) (AEW), HAL Tejas LCA Mk1, Dornier 228, HAL Dhruv ALH/Rudra, and HAL Light Combat Helicopter within the forecast period, are expected to drive the growth of the segment. India's increasing efforts toward self-reliance in manufacturing and operations will create significant opportunities for regional vendors. For instance, India is currently working on its AMCA project. The aircraft's first flight is expected from 2025 to 2026, while total production may occur by 2030.

In February 2023, HAL announced that it was involved in developing a new 13-ton-class helicopter for the Indian Armed Forces. The indigenous medium-lift helicopter may replace all imports in the class for the armed forces. Considering the scale of investments needed, this program may be the most extensive helicopter design attempted by India so far. In addition, the development of the Tejas Mk 2 started in 2023, with the series production to begin in 2026. The IAF is working on plans to continue the long-deferred requirement for 114 Medium Multi-role Combat Aircraft (MMRCA) 2.0 deal, worth an estimated USD 18-20 billion. The IAF also focuses on developing its air defense capabilities and has invested in developing related capabilities by procuring indigenous and foreign-made systems. Some notable ongoing programs include Akash SAM, S-400, and IAI MRSAM. Such programs are expected to drive the segment's growth during the forecast period.

The Naval Vessel Segment to Exhibit the Largest Market Share During the Forecast Period

Indian Navy, a vital component of the nation's defense, boasts an array of formidable vessels safeguarding the country's maritime interests. The primary objective of the navy is to protect the country's maritime borders and detect any threats or aggression against the nation's territory, people, or naval interests, both in war and peace. The country's annual rising defense expenditure drives demand for this segment. For instance, in 2022, the country's defense spending was USD 81.4 billion, a growth of 7% compared to 2021.

The Indian Navy has 181 surface vessels (frigates, aircraft carriers, destroyers, patrol vessels, and corvettes) and 18 submarines. Apart from this active naval fleet, the Indian Navy is also exploring innovative solutions such as the procurement of unmanned vessels and underwater systems to protect warships, besides the induction of clip-on suites that can be used by individual vessels. For instance, in February 2024, the Indian Navy commissioned its first survey vessel, a large (SVL) ship, INS Sandhayak. The ship has been designed to perform comprehensive hydrographic surveys of ports, harbors, navigational routes and channels, coastal areas, and deep seas. Its primary objective is to facilitate safe marine navigation. In November 2023, the Indian Navy announced that approximately 67 ships are under construction and are being developed under the Make in India initiative. Such developments are expected to drive the demand for this segment in India during the forecast period.

India Defense Industry Overview

The Indian defense market is semi-consolidated, with a few OEMs holding significant shares in the market. Bharat Electronics Limited (BEL), Hindustan Aeronautics Limited (HAL), Defense Research and Development Organisation (DRDO), Rostec, and Airbus SE are some of the major players in the market. The Make in India initiative, launched by the Indian government, has propelled several partnerships between foreign and local manufacturers. Partnerships between Indian companies and their international counterparts as a transfer of technology (ToT) agreement are also anticipated to improve the current capabilities of the Indian conglomerates.

For instance, the collaboration between Hinduja Group, Ashok Leyland, and Elbit Systems Ltd, Tata Motors with Bharat Forge and General Dynamics for military vehicles, the partnership between India and Russia for Frigates and AK-203 Assault Rifles, and Boeing's partnership with HAL and Mahindra for the production of F/A-18 Super Hornet fighters are some of the significant alliances in the recent past. India is also trying to develop its manufacturing capabilities and focusing on expanding the product range of the defense equipment that it can produce locally, thereby reducing its dependency on the import of defense equipment. Also, several public firms are developing new indigenous technologies, which are expected to enhance the market share of the local players during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Armed Forces

- 5.1.1 Army

- 5.1.2 Navy

- 5.1.3 Air Force

- 5.2 Type

- 5.2.1 Fixed-wing Aircraft

- 5.2.2 Rotorcraft

- 5.2.3 Ground Vehicles

- 5.2.4 Naval Vessels

- 5.2.5 C4ISR

- 5.2.6 Weapons and Ammunition

- 5.2.7 Protection and Training Equipment

- 5.2.8 Unmanned Systems

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Hindustan Aeronautics Limited (HAL)

- 6.2.2 Defense Research and Development Organisation (DRDO)

- 6.2.3 Ordance Factory Board (OFB)

- 6.2.4 Bharat Electronics Limited (BEL)

- 6.2.5 Goa Shipyard Limited (GSL)

- 6.2.6 Larsen & Toubro Limited

- 6.2.7 Hinduja Group

- 6.2.8 Kalyani Group

- 6.2.9 Tata Sons Private Limited

- 6.2.10 Reliance Group

- 6.2.11 Mahindra & Mahindra Ltd

- 6.2.12 Rafael Advanced Defense Systems Ltd

- 6.2.13 IAI Group

- 6.2.14 Rostec

- 6.2.15 Airbus SE

- 6.2.16 The Boeing Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS