PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907320

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907320

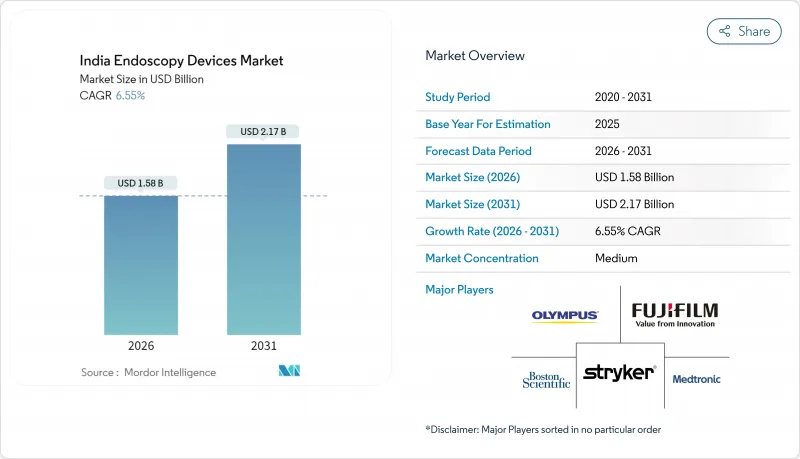

India Endoscopy Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The India endoscopy devices market was valued at USD 1.48 billion in 2025 and estimated to grow from USD 1.58 billion in 2026 to reach USD 2.17 billion by 2031, at a CAGR of 6.55% during the forecast period (2026-2031).

Growth is anchored in the rising burden of gastrointestinal cancers, government incentives that push local manufacturing, and rapid upgrades from standard-definition equipment to 4K and AI-enabled visualization. Domestic production strengthened by the Production-Linked Incentive (PLI) scheme is beginning to soften import dependence while lowering price points that once limited access outside metros. At the same time, day-care ambulatory surgical center (ASC) chains are spreading across tier-2 cities, adding fresh demand for mid-tier systems that balance performance and cost. Although reusable scopes still dominate, single-use devices are gaining traction as hospitals respond to stricter infection-control norms established in the post-COVID era.

India Endoscopy Devices Market Trends and Insights

Rising Burden of Gastrointestinal Cancers & Disorders

Incidence of gastrointestinal cancers is projected to climb from 1.41 million cases in 2022 to 2.2 million by 2040, increasing procedural volumes for the India endoscopy devices market. North-East India records notably higher gastric and esophageal cancer rates, magnifying regional demand for early-stage detection platforms. Early gastric cancer detection sits at 0.6% in prospective screening studies, suggesting a large diagnostic gap that flexible and capsule endoscopy can help close. Indian tertiary centers now report en-bloc resection rates above 90% when using endoscopic submucosal dissection, but diffusion beyond metros is constrained by skills shortages and infrastructure gaps. Collectively, these factors accelerate uptake of high-definition and AI-enabled visualization systems that lift detection sensitivity.

Government PLI Scheme Catalysing Domestic Manufacturing

The PLI program aims to lift India's medical-device output, granting tax breaks and subsidies to local factories. Device makers such as BPL MedTech have already opened second plants in Bengaluru, adding capacity for endoscopy consoles and accessories. Local sourcing trims delivery lead-times for hospitals in tier-2 cities, broadens service networks, and compresses average selling prices, boosting unit demand. The 2023 National Medical Devices Policy further simplifies product registration, encouraging both multinationals and domestic players to site R&D hubs in India. Over time, these incentives should raise the India endoscopy devices market's self-reliance ratio and export capability.

Shortage of Trained Endoscopy Technicians

India has no unified curriculum for GI technicians, and professional societies warn that uneven skill levels restrict adoption of complex procedures. Rural districts feel the squeeze most, with late-stage cancer prevalence still topping 80% of presentations. National task forces propose a three-tier certification ladder, yet funding for simulation labs remains sparse. Premier centers in Mumbai and Hyderabad now run train-the-trainer courses that eventually cascade skills into peripheral hospitals, but near-term staffing gaps persist and temper the pace at which advanced platforms penetrate the India endoscopy devices market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Penetration of Day-Care ASC Chains Across Tier-2 Cities

- Integration of AI-Assisted CADx Modules

- High Capital & Maintenance Cost of Advanced Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Endoscopes generated 61.62% of India endoscopy devices market revenue in 2025 by virtue of their essential diagnostic role across GI, respiratory, and surgical specialties. Flexible scopes dominate, while capsule units are opening non-invasive pathways in small-bowel imaging. Over the forecast window, visualization equipment is set to register an 8.55% CAGR, outpacing hardware growth as hospitals upgrade to 4K, 3D, and ultrasound-endoscopy towers. The India endoscopy devices market size for visualization is projected to widen further as AI software licenses are increasingly bundled with image processors, elevating console value without physical footprint expansion.

Growth in disposable endoscope volumes is propelled by infection-control mandates, even though environmental debates linger. Manufacturers now trial bio-derived plastics and recycling partnerships to neutralize sustainability pushback. Robot-assisted platforms remain niche today, but as patents expire and local engineering talent matures, capital prices are expected to fall, inviting broader uptake among high-volume cancer centers.

Gastroenterology continues to anchor 44.20% of India endoscopy devices market share thanks to ongoing colorectal and gastric cancer screening campaigns. Nonetheless, ENT surgery displays the fastest momentum, expanding 8.95% annually as sinus, laryngeal, and skull-base procedures pivot to minimally invasive optics. Pulmonology follows closely, driven by bronchoscopy's rising role in lung-cancer staging and therapeutic tumor ablation. Together, these trends underscore a gradual pivot from purely diagnostic GI scopes toward cross-specialty, therapy-oriented devices within the India endoscopy devices market.

Migrating ENT, gynecology, and urology procedures to endoscopic workflows also shifts device ergonomics demands: slimmer diameters, articulating tips, and specialty accessory channels all spur product redesigns. Bariatric and orthopedic interventions further widen the opportunity landscape, positioning multi-modality towers as a cost-effective foundation for diverse departments.

The India Endoscopy Devices Market Report is Segmented by Type of Device (Endoscopes [Rigid Endoscope, and More], Endoscopic Operative Devices [Access Devices, and More], and Visualization Equipment), Application (Gastroenterology, Pulmonology, Cardiology, and More), End-User (Hospitals, Specialty Clinics, and More), Usage (Re-Usable Devices and Single-Use Devices). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Olympus

- Karl Storz

- Boston Scientific

- Medtronic

- FUJIFILM

- Stryker

- Johnson & Johnson(Ethicon Inc)

- Conmed

- Richard Wolf

- Shaili Endoscopy Private Ltd

- Ambu

- PENTAX Medical (HOYA Corp.)

- Cook Group

- Smiths Group

- STERIS Endoscopy

- CapsoVision

- EndoMed Systems GmbH

- Mitra Endoscopy Pvt Ltd

- Pristine Endoscopy Solutions

- Carestream Health India

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Burden Of Gastrointestinal Cancers & Disorders

- 4.2.2 Government PLI Scheme Catalysing Domestic Manufacturing

- 4.2.3 Rapid Penetration Of Day-Care ASC Chains Across Tier-2 Cities

- 4.2.4 Integration Of AI-Assisted Cadx Modules

- 4.2.5 Post-COVID Backlog Of Elective Endoscopic Procedures

- 4.2.6 Expanding Private Health-Insurance Coverage

- 4.3 Market Restraints

- 4.3.1 Shortage Of Trained Endoscopy Technicians

- 4.3.2 High Capital & Maintenance Cost Of Advanced Systems

- 4.3.3 Limited Public-Sector Reimbursement For Therapeutics

- 4.3.4 Cyber-Security Risk For Networked Endoscopy Video Systems

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Type of Device

- 5.1.1 Endoscopes

- 5.1.1.1 Rigid Endoscope

- 5.1.1.2 Flexible Endoscope

- 5.1.1.3 Capsule Endoscope

- 5.1.1.4 Robot-assisted Endoscope

- 5.1.1.5 Single-use/Disposable Endoscope

- 5.1.2 Endoscopic Operative Devices

- 5.1.2.1 Access Devices

- 5.1.2.2 Retrieval Devices

- 5.1.2.3 Insufflation Devices

- 5.1.2.4 Energy & Hemostasis Devices

- 5.1.2.5 Closure Devices

- 5.1.3 Visualization Equipment

- 5.1.3.1 Endoscopic Camera

- 5.1.3.2 SD Visualization System

- 5.1.3.3 HD Visualization System

- 5.1.3.4 4K / 3D Visualization System

- 5.1.3.5 Ultrasound Endoscopy (EUS) Systems

- 5.1.1 Endoscopes

- 5.2 By Application

- 5.2.1 Gastroenterology

- 5.2.2 Pulmonology

- 5.2.3 Orthopedic Surgery

- 5.2.4 Cardiology

- 5.2.5 ENT Surgery

- 5.2.6 Gynecology

- 5.2.7 Urology

- 5.2.8 Neurology

- 5.2.9 Bariatric Surgery

- 5.2.10 Other Applications

- 5.3 By End-User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Specialty Clinics

- 5.3.4 Diagnostic Imaging Centers

- 5.4 By Usage

- 5.4.1 Re-usable Devices

- 5.4.2 Single-use Devices

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Olympus Corporation

- 6.3.2 KARL STORZ SE & Co. KG

- 6.3.3 Boston Scientific Corporation

- 6.3.4 Medtronic plc

- 6.3.5 Fujifilm Holdings Corporation

- 6.3.6 Stryker Corporation

- 6.3.7 Johnson & Johnson(Ethicon Inc)

- 6.3.8 CONMED Corporation

- 6.3.9 Richard Wolf GmbH

- 6.3.10 Shaili Endoscopy Private Ltd

- 6.3.11 Ambu A/S

- 6.3.12 PENTAX Medical (HOYA Corp.)

- 6.3.13 Cook Medical Inc.

- 6.3.14 Smith & Nephew plc

- 6.3.15 STERIS Endoscopy

- 6.3.16 CapsoVision Inc.

- 6.3.17 EndoMed Systems GmbH

- 6.3.18 Mitra Endoscopy Pvt Ltd

- 6.3.19 Pristine Endoscopy Solutions

- 6.3.20 Carestream Health India

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment