PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644491

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644491

India Office Real Estate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

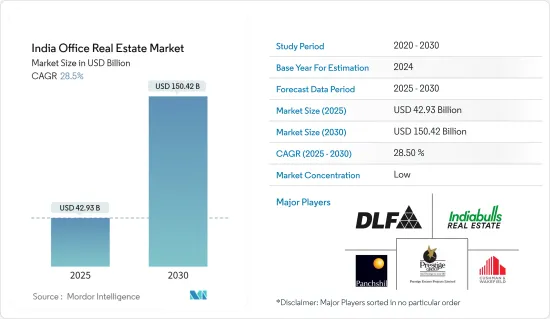

The India Office Real Estate Market size is estimated at USD 42.93 billion in 2025, and is expected to reach USD 150.42 billion by 2030, at a CAGR of 28.5% during the forecast period (2025-2030).

In H12024, India's office market achieved its best performance to date, continuing its impressive growth trajectory. All top seven cities - Mumbai, Delhi-NCR, Bengaluru, Chennai, Kolkata, Pune, and Hyderabad - recorded groundbreaking gross leasing volumes of at least 1 million sq. ft (msf) in H1 2024. Additionally, leasing volumes reached 33.5 msf in H1 2024 , marking the best-ever first half and surpassing the previous peak set in 2019. This robust growth underscores the resilience and strength of the Indian office market.

As hybrid work models gain traction and the demand for flexible workspaces surges, the landscape of office real estate is poised for transformation. While traditional office spaces remain significant, a pronounced shift towards flexibility is evident. This shift is fueled by aspirations for improved work-life balance, cost efficiencies, and the demand for adaptable work settings. In response, office landlords are evolving their properties, introducing flexible leasing terms and modern amenities. Meanwhile, occupiers are not only seeking enriched workplace experiences but are also embracing diverse strategies to bolster their growth ambitions.

India Office Real Estate Market Trends

IT and BPM Sectors Drive Demand for Office Space

In India, the office sector has witnessed a dynamic surge, attracting investments exceeding USD 3 billion, marking a 53% rise from the prior year. This upswing is largely fueled by the escalating demand from Global Capability Centers (GCCs) and vigorous leasing endeavors by Indian corporations, which presently constitute 46% of the overall market leasing activities.

The GCC model is also now evolving from primarily cost arbitrage/standardisation focused centers to customer experience and technology led hubs. Technology consistently drives the demand for office space leasing. Accounting for approximately 35% of the overall demand, the tech sector's influence surges beyond 40% in cities such as Bengaluru and Hyderabad. Bolstered by government infrastructure investments, the BFSI sector is flourishing. Meanwhile, the rise of hybrid work has spotlighted the importance of flexible workspaces. Additionally, engineering and manufacturing sectors have expanded, fueled by global supply chain realignments.

Bengaluru Leads the Boom for Office Real Estate

Bengaluru, India's IT capital, is projected to maintain its dominance in the country's commercial real estate market, boasting an office stock of 330-340 million sq. ft by 2030, as per the Confederation of Indian Industry. As of June 2024, the city's office stock has surged to over 223 million sq. ft, more than doubling from 100 million sq. ft from a decade ago. In H1 2024, transactions for office spaces exceeding 100,000 sq. ft surged by 54% year-on-year, climbing from 10.18 million sq. ft in H1 2023 to 15.69 million sq. ft in H1 2024. This growth positions the city as the leading hub for office space among all major cities in the country.

In the lead-up to 2030, Bengaluru's office market is poised to be primarily driven by the technology, engineering, manufacturing, and BFSI sectors. Additionally, life sciences, aviation, and the automobile industry are emerging as significant contributors to this demand surge. Currently, the technology sector dominates, accounting for 30-35% of the city's annual absorption, with a strong presence in the commercial hubs of Outer Ring Road and Whitefield.

Between 2022 and June 2024, Bengaluru commanded a dominant 41% share in the demand from GCCs in India. This achievement is attributed to Bengaluru's unique offerings: a skilled workforce, premium Grade-A assets, and a robust tech infrastructure.

India Office Real Estate Industry Overview

The Indian office real estate market is highly competitive, as the sector's domestic and foreign participants have created a competitive environment. There are many opportunities for small and medium companies in tier 2 cities. Some of the office real estate developers in the country include Indiabulls Real Estate, DLF Ltd., Prestige Estate Projects Ltd., Supertech Limited, and Oberoi Realty, and office real estate consultancy firms include Cushman & Wakefield, CBRE Group, etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Policies and Regulations

- 4.3 Government Regulations and Initiatives

- 4.4 Supply Chain/Value Chain Analysis

- 4.5 Insights into Technological Innovation in the India Office Real Estate Sector

- 4.6 Impact of Geopolitics and Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid growth of BPM and IT sectors in India

- 5.1.2 Growing foreign investments

- 5.2 Market Restraints

- 5.2.1 Rising construction costs

- 5.2.2 Regulatory hurdles

- 5.3 Market Opportunities

- 5.3.1 Expanding e-commerce and manufacturing sectors in India

- 5.3.2 Infrastructure support from government

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 Major Cities

- 6.1.1 Bangaluru

- 6.1.2 Hyderabad

- 6.1.3 Mumbai

- 6.1.4 Other Cities

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 Savills

- 7.2.2 Cushman & Wakefield

- 7.2.3 CBRE Group

- 7.2.4 JLL

- 7.2.5 Panchshil Realty

- 7.2.6 Indiabulls Real Estate

- 7.2.7 DLF Limited

- 7.2.8 Prestige Estate Projects Ltd

- 7.2.9 Supertech Limited

- 7.2.10 Oberoi Realty

- 7.2.11 HDIL Ltd*

- 7.3 Other Companies

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

9 APPENDIX

- 9.1 Macroeconomic Indicators (GDP Distribution, by Activity)

- 9.2 Economic Statistics - Transport and Storage Sector Contribution to the Economy

- 9.3 External Trade Statistics - Export and Import, by Product