Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686644

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686644

India Seed Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 164 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

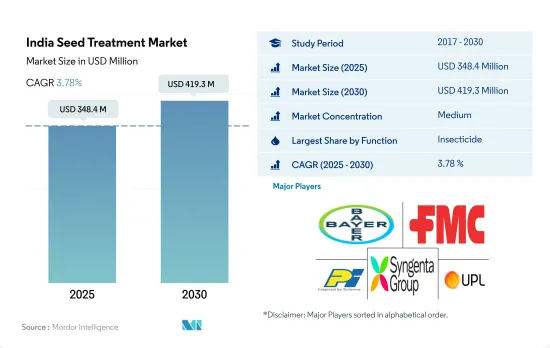

The India Seed Treatment Market size is estimated at 348.4 million USD in 2025, and is expected to reach 419.3 million USD by 2030, growing at a CAGR of 3.78% during the forecast period (2025-2030).

The market is driven by the growing need for advanced seed technologies and government support

- The Indian seed treatment market for chemical fungicides has experienced significant growth during the historical period due to the rising awareness about the importance of seed treatment in crop protection. Seed treatment is crucial in safeguarding seeds from fungal diseases, improving germination rates, and ensuring healthy plant establishment.

- Fungicides are the second most important among seed treatment chemicals, and they accounted for a share of 9.0% in 2022. This is because the seeds and seedling stages of plants are more vulnerable to soil and seed-borne diseases.

- The insecticide segment in the seed treatment market was valued at USD 280.6 million in 2022. Active ingredients such as imidacloprid, clothianidin, thiamethoxam, fipronil, and chlorpyrifos are of high importance in chemical insecticide seed treatment.

- Farmers in the country are also looking to buy seeds that are pre-treated with these chemicals to ensure high quality and a maximum percentage of germination after sowing. The central government and several state governments are taking initiatives to make farmers aware of the use of seed treatment and enhance their motivation toward modern agricultural practices. For instance, the Government of Madhya Pradesh launched a spiral grader and seed treatment drum program to train the less-knowledgeable farmers in 1,000 villages and boost the cultivation of crops like soybeans.

- Root-knot nematode is the most dangerous among the nematode species that affect fruits and vegetable crops and is known to cause a yield loss of 34.0% in carrots, 26.0% in potatoes, 23.0% in tomatoes, 22.0% in the battleground, and 21.0% in brinjal. Nematicide seed treatment is most common in fruits and vegetable crops, and it accounted for a share of 9.1% in 2022.

India Seed Treatment Market Trends

Growing awareness and adoption of early control of diseases and pests are raising the seed treatment consumption

- Over the historical period, the per-hectare consumption of seed treatment pesticides has remained consistent. In 2022, the recorded consumption stood at 125.46 grams per hectare. This stability can be attributed to various factors, such as advancements in seed treatment technologies, improved disease and pest management practices, and the efficacy of existing pesticide formulations.

- Seed treatment plays a crucial role in protecting seeds and seedlings against the harmful impact of seed and soil-borne diseases and insect pests. Seed treatment products control pests and diseases in significant crops such as sugarcane (root rot and wilt), groundnut (stem rot, seed rot, seedling rot, and white grubs), and rice (root-knot nematode and root rot disease).

- Crop emergence and growth can be effectively shielded from these detrimental factors by employing seed treatment methods. The significant advantages associated with seed treatment products are driving their indispensable utilization in the agriculture sector.

- Approximately 70% of seed requirements are fulfilled by farmers utilizing their own seed stock. However, these seeds are more vulnerable to seed and soil-borne diseases. Thus, it is crucial to implement seed treatment to safeguard crops from the emergence of diseases and pests. This necessity consequently increased the utilization of seed treatment products.

- Expanding agricultural activities necessitate effective crop protection measures, including seed treatment. Farmers' heightened awareness of the benefits of seed treatment in protecting crops from early-stage diseases and pests has contributed to the increased adoption of these products and their application rates per hectare.

Promotional activities of government agencies to use seed treatments to increase the marketability of seeds

- Seed treatment plays an important role in protecting seeds and seedlings from seed and soil-borne diseases and insect pests affecting crop emergence and growth. Seed-borne diseases and pests are a few major challenges farmers face that decrease crop yield. Cypermethrin, abamectin, azoxystrobin, malathion, and metalaxyl are the most commonly used seed treatment chemicals in India.

- Cypermethrin is a non-systemic soil-acting pyrethroid insecticide seed treatment for reducing wheat bulb fly and wireworm damage to autumn or winter-sown wheat and barley in India. It was valued at a price of USD 21.0 thousand per metric ton in 2022.

- Abamectin belongs to the ivermectin chemical class and has high intrinsic activity against nematodes. It is used to protect young plants from root-attacking nematodes in the production of corn, soybeans, and cotton. It was priced at USD 8.7 thousand per metric ton in 2022.

- Azoxystrobin is a broad-spectrum, preventative seed treatment fungicide with systemic properties recommended for the control of Deuteromycetes, Oomycetes, Ascomycetes, and Basidiomycetes fungi that cause yield losses in crops. In 2022, azoxystrobin was priced at USD 4.5 thousand per metric ton.

- Various regulations and government agencies are encouraging the use of seed treatments to increase the marketability of seeds. For instance, the Government of India announced plans to launch a countrywide campaign for ensuring 100% seed treatment in all important crops during the kharif season. Pesticide industry associations, ATMAs, CIPMCs, KVKs, farmers clubs, SAUs, NGOs, etc., can play an important role in the campaign for 100% seed treatment. This is expected to further affect the price of seed treatment chemicals in the country.

India Seed Treatment Industry Overview

The India Seed Treatment Market is moderately consolidated, with the top five companies occupying 56.48%. The major players in this market are Bayer AG, FMC Corporation, PI Industries, Syngenta Group and UPL Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 53540

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 India

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Function

- 5.1.1 Fungicide

- 5.1.2 Insecticide

- 5.1.3 Nematicide

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 Crystal Crop Protection Ltd

- 6.4.6 FMC Corporation

- 6.4.7 PI Industries

- 6.4.8 Rallis India Ltd

- 6.4.9 Syngenta Group

- 6.4.10 UPL Limited

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.