Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640572

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640572

MEA Alcoholic Drinks Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

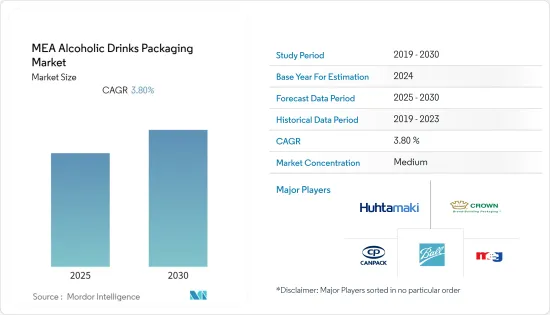

The MEA Alcoholic Drinks Packaging Market is expected to register a CAGR of 3.8% during the forecast period.

Key Highlights

- According to USDA Foreign Agricultural Service, South Africa's wine grape production was projected to increase marginally by 1% to 1.25 million metric tons in 2020. The irrigation facilities are improving with favorable weather conditions and improved yields, and some regions also recovered from the 2016-2018 drought conditions. Wine production was projected to reach 947 million liters in 2020. While the South African wine industry is showing signs of rebounding, it also faces threats from imports of low-value wine suppliers and rising stocks.

- There has been a mixed impact of the COVID-19 pandemic on the alcoholic drinks market in the region. For instance, in South Africa, during the lockdown, transportation and sale of alcoholic drinks were banned entirely within the country, meaning that on-trade sales could not simply move into the off-trade during the period of on-trade closures. However, in the United Arab Emirates, due to the continued availability of the products and supply chain resilience, the market has seen increased purchases in off-trade outlets for home consumption. Sales of non-alcoholic beer, the only category present in alcoholic drinks in Saudi Arabia, declined throughout 2020 as the COVID-19 pandemic led to the government-mandated closure of all on-trade establishments.

- Alcohol-free alternatives of beer, wine, and spirits offer a premium trade-up alternative for consumers in the Middle Eastern markets where alcohol is banned. Such innovations may also suit the market where alcohol consumption is restricted. Saudi Arabia was one of the largest markets for alcohol-free beer consumption globally. Volume consumption of non-alcohol beer almost doubled in the country between 2015 and 2019. It is expected to grow further in the future.

- In the United Arab Emirates (UAE), alcohol growth is majorly contributed by tourism and its vast expatriate population. Emiratis make up 10% of the people, while expatriates account for 90%. According to the World Health Organization, spirits were the most popular alcohol in the United Arab Emirates, with a share of 82%, followed by beer (10%) and wine (8%).

- Furthermore, the United Arab Emirates made new laws and removed punishments for the consumption, sales, and possession of alcohol for those 21 years and over. The easing of alcohol restrictions is part of an overhaul of the country's Islamic personal laws. Relaxing personal regulations aim to "consolidate the UAE's principles of tolerance." This move reflects the country's changing reputation as a hub for international tourism and business. These changes will boost the consumption of alcoholic beverages in the region.

MEA Alcoholic Drinks Packaging Market Trends

Metal Can Packaging is Expected to Grow Significantly

- In Turkey, the demand for metal beverage cans has increased in the beer segment. The share of metal cans in domestic lager is growing rapidly, accounting for just under half of the total volume share. The price difference between beer in glass bottles and metal beverage cans drives the sales of cans.

- Wine in a can is a new trend penetrating the South African wine packaging market, with winemakers introducing canned versions of their popular offerings. For example, local player Perdeberg Wines has launched a 250ml can format of its Soft Smooth Red range, with the pack featuring a striking zebra-print design.

- In the United Arab Emirates, many brands are increasingly offering their products in metal beverage cans. All imported brands use this type of packaging, with a beer in the 330 ml format in a 24-pack being cheaper than the equivalent packaging for glass bottles. Brands offer smaller size packages for testing new spirits.

- A growing preference for metal cans is expected to be seen in the non-alcoholic beer segment. A non-alcoholic beer brand, Barbican, is driving this trend by shifting from glass packaging to metal cans with refreshing designs for its pomegranate, apple, and strawberry flavors.

The South African Market is Expected to Grow Significantly

- In the last decade, while the country's beer fans embraced Pale Ales and Lagers, the reach of local sorghum-based beer remained limited to rural areas. Also, homebrewed and commercial sorghum beer is often sold in unhygienic and unsafe packaging that is not tamper-proof. However, a few of South Africa's new microbreweries recently started to turn sorghum-based beer into their modern recipes. They also introduced paper-based packaging 'conical cartons' for this beer, which are sealed pack cartons. Therefore, this type of packaging ensures retailers' and consumers' trust regarding the quality of the beer inside a sealed carton.

- The sustainability trend is gaining traction among consumers and major players in the alcoholic drinks market. Recently, South African Breweries launched its new Cold Lock secondary packaging for its Castle Lite range that claims to keep the beer colder for longer without using ice after refrigeration.

- According to #BizTrends2020, the premium rum trend gained momentum in the country. Champagne and Cognac will continue to be popular as the population of black middle-class increases in South Africa. The rise of sparkling wine continues as consumers develop a taste for premium and imported wines. With the severe economic pressure faced by consumers, ready-to-drink (RTD) and international beers may continue to drive category growth as consumers use the international brand credentials and accessible price points to differentiate themselves from their peers.

- During COVID-19, the declining consumer purchasing power and reduced disposable incomes drove the emergence of larger value-for-money packaging. For instance, the 1 liter Carling black label size recorded strong growth, albeit from a low base.

MEA Alcoholic Drinks Packaging Industry Overview

The availability of several players providing packaging solutions for alcoholic beverages has intensified the competition in the market. Therefore, the Middle-East and African alcoholic drinks packaging market is moderately fragmented, with many companies developing expansion strategies. Some of the recent developments are:

- June 2021 - Can-Pack collaborated with SSHS Group Hungary to give its Regenera brand a gentle, modern, premium look and feel for its can using subtle color with a matte finish. Regenera is a fruit-flavored, functional drink made from herbal extracts that aim to combat the side effects of hangovers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 55052

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Growth in Purchasing Power of Consumers

- 4.4.2 Growing Awareness Among Alcoholic Beverage Manufacturers to Differentiate Their Products Over Packaging

- 4.5 Market Challenges

- 4.5.1 Government Restrictions on Alcoholic Drinks Consumption

- 4.6 Assessment of the Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Primary Material

- 5.1.1 Glass

- 5.1.2 Metal

- 5.1.3 Plastic

- 5.1.4 Paper

- 5.2 By Alcoholic Products

- 5.2.1 Wine

- 5.2.2 Spirits

- 5.2.3 Beer

- 5.2.4 Other Types of Alcoholic Beverages

- 5.3 By Product Type

- 5.3.1 Glass Bottles

- 5.3.2 Metal Cans

- 5.3.3 Plastic Bottles

- 5.3.4 Other Product Types

- 5.4 By Country

- 5.4.1 United Arab Emirates

- 5.4.2 South Africa

- 5.4.3 Egypt

- 5.4.4 Turkey

- 5.4.5 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Ball Corporation

- 6.1.2 Crown Holdings Inc.

- 6.1.3 Huhtamaki Oyj

- 6.1.4 Saudi Arabian Glass Co. Ltd

- 6.1.5 Saverglass SAS

- 6.1.6 Consol Glass Ltd

- 6.1.7 Middle East Glass Manufacturing Company SAE

- 6.1.8 Bonpak (Pty) Ltd

- 6.1.9 The National Company For Glass Industries (Zouja)

- 6.1.10 Majan Glass Company SAOG

- 6.1.11 Nampak Ltd

- 6.1.12 Can-Pack SA

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.