PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644654

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644654

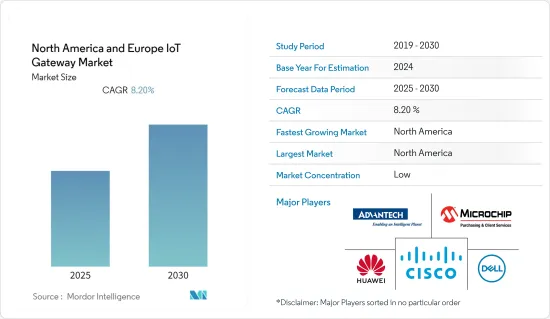

North America and Europe IoT Gateway - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North America and Europe IoT Gateway Market is expected to register a CAGR of 8.2% during the forecast period.

The IoT gateway functions by integrating protocols for networking, managing storage, and edge analytics of the data and facilitating data transfers between the entry-point edge devices and the cloud. As intelligent gateways and management systems have emerged to bring and connect legacy equipment and devices and next-generation devices to the IoT, the increasing demand for big data analytics has led to a more significant requirement for IoT gateways.

The key drivers for the IoT gateway market include the growth of application-specific MCUs, flexible SOC-type designs, and the emerging development of smart cities. Building electronic circuits within a system-on-chip (SoC) has significant benefits, such as improving efficiency and compatibility while reducing space requirements and development speed. IoT with SoC, including wireless technology, helps prevent the implementation challenges, such as network integration, incompatibility, and reliability issues.

Processors act as a main component of the IoT gateway. Companies like TI are offering the TM4C129x family of IoT microcontrollers (MCUs). The TM4C129x MCUs simplify IP connectivity for gateways by combining multiple key technologies. With its TLS/SSL stack and hardware-based cryptographic acceleration, the TM4C129x MCUs enable OEMs to implement robust security mechanisms with low overhead to maximize data protection and minimize threats.

Some IoT gateways are designed for vertical usage in fields such as smart city, fleet management, and infotainment, or for Industrial Internet of Things (IIoT) applications in robotics, smart grid, or factory automation. The healthcare industry is expected to witness considerable growth as hospitals, laboratories, and medical device manufacturers strive to maintain quality and patient care while under primary cost containment or even cost-cutting pressures. IoT gateway solutions safeguard and automate data collection and dissemination and facilitate remote patient monitoring, reduced service costs, and asset tracking.

Further, the factors challenging the growth of the IoT gateway market include the concerns regarding the security and privacy of the user data and the lack of common protocols and communication standards of IoT technology. The standardization communication protocols of IoT technology are at a developing stage. However, the standard protocols are expected to happen in the next few years, making the impact of the challenge gradually low in the next few years.

North America & Europe IoT Gateway Market Trends

Industrial Application is Expected to Hold a Significant Market Share

An IoT gateway is a device that aggregates data from different devices and performs critical functions, such as device connectivity, translating protocols, managing and filtering data, and much more; bridging the communication gap between different IoT devices such as sensors, equipment, systems, and the cloud, where the data is finally processed.

An IoT gateway is necessary for scalability, mitigating risks, improving time-to-market, cost benefits, lower latency, and security. In Industrial IoT, the gateway connects machinery, sensors, actuators, and many other automation-enabled devices.

Due to increasing emphasis on Industry 4.0 and the adoption of smart technologies, IoT gateways have become a crucial part of the entire industrial ecosystem. Owing to increasing demand, vendors in the market are introducing more enhanced versions of IoT gateways.

In September 2020, VOLANSYS, a one-stop IoT solutions provider, announced the launch of a new program called IoTPAD. As part of IoTPAD, qualifying participants will be eligible to leverage VOLANSYS Gateway & Cloud platforms at zero cost during the pre-launch period.

IoT solution developers face multiple challenges in the form of identifying the right ready-to-use yet customizable platform, resources to convert this platform into an end product, and up-front investment to maneuver through development and pilot phases. To help ecosystem partners develop cost-effective solutions, VOLANSYS brings an IoTPAD program for OEMs, startups, and enterprises looking to realize their IoT Product ideas.

In February 2021, Newark, an Avnet Company, announced that it is partnering with Cisco to offer industrial IoT network solutions for harsh and non-carpeted environments to customers across North America. The partnership brings over 350 products to the Newark customer base, that including ruggedized industrial switches, industrial routers, IoT gateways, and wireless access points designed to withstand extended exposure to dust, water, and other extreme environmental conditions.

United States is Expected to Account for the Largest Market Share

The Things Network is on a mission to build an open crowdsourced Internet of Things (IoT) data network owned and operated by its users. Technically, in the United States, they use the US915 band plan of LoRaWAN and have standardized their gateways on subband 2. Further, businesses realize the strain distributed IoT deployments can put on their network. They are looking for solutions to better plan and manage IoT network resources and large-scale sensor-based device deployments.

LoRaWAN IoT gateway is a technology that is fitted for a broad range of Smart Building applications, including asset tracking, equipment monitoring, lighting controls, room occupancies, biometrics, motion sensing, and contact tracing. In July 2021, Senet Inc. and ADTRAN Inc., a provider of business and residential connectivity solutions, announced the partnership for delivering carrier-grade LoRaWAN network services for IoT applications across enterprise and campus environments in the United States. This provides clients with a clear path to deploying and managing cost-effective and secure LoRaWAN connectivity in and around commercial buildings at scale.

Further, recent development is expected to cater a significant growth. In March 2021, Impulse Embedded, one of the leading providers of Industrial computing systems and solutions, announced the availability of UST210-83K-FL, a new compact DIN-rail fanless in-vehicle Box-PC powered by Intel Atom x5-E3940 processor. The flexible in-vehicle IoT gateway provides secure bi-directional communications. It is aimed at many vehicle-based applications, including public transport and shuttle buses, police cars, ambulances, commercial vehicles, and heavy-duty trucks.

Also, in March 2021, Taoglas announced its Taoglas Genset Insights solution, enabling businesses to optimize their fleet of generators with real-time data and analytics anywhere, anytime. With a rapid 5-minute install, the solution includes the Taoglas EDGE IG10 industrial gateway combined with the Taoglas Insights enterprise-level software vendor-agnostic platform that allows managing all the equipment remotely on one platform.

Further, 5G is driving tremendous potential for high-tech companies developing connected devices and smart products. The application of IoT gateway in defense and military applications is expected to cater to growth by demand of providing security and high-performance computing.

Further, with the current COVID-19 outbreak, the task of monitoring and managing quarantined, and isolated personnel remains a critical challenge. Health services employees, including disease control and prevention teams, are increasingly leveraging smarter applications based on IoT to provide efficient, high-quality care to their communities.

North America & Europe IoT Gateway Industry Overview

North America and Europe IoT Gateway Market are highly competitive owing to multiple vendors providing IoT Gateway to the domestic and international markets. The market appears to be moderately fragmented, with the significant vendors adopting strategies for mergers and acquisitions and strategic partnerships, among others, to expand their reach and stay competitive in the market. Some major players in the market are Cisco Systems Inc., Advantech Co. Ltd, Dell Inc., and Aeris Communications Inc., among others. Some of the recent developments in the market are:

- June 2021 - Cisco introduced a new line of Catalyst industrial edge routers for mobile and fixed asset connectivity and an IoT gateway series for IoT use cases. The new portfolio of three routers and a new IoT gateway series would extend the enterprise network and SD-WAN to the edge and allow businesses to tap into that valuable data to power connected operations rather than edge environments that work in isolation. The routers would also help connect and power new use cases cropping up in new places due to digital transformation, including connected utility substations and transportation.

- April 2021 - Advantech partnered with Momenta Ventures to launch the AIoT Ecosystem Fund, a USD 50 million venture capital fund focused on the digital industry. This fund targets early growth stage companies emerging at the intersection of Artificial Intelligence (AI) and the Industrial Internet of Things (IoT). The fund would deliver venture capital investment and direct value creation to innovators in North America and Europe.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness -Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of Application-specific MCUs and Flexible SOC-type Designs

- 5.1.2 Acceptance of IoT Devices across multiple applications areas by Stakeholders

- 5.2 Market Challenges

- 5.2.1 Concerns Regarding the Security and Privacy of the User Data

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Home Automation and Security

- 6.1.2 Mobility and Transportation

- 6.1.3 Industrial and Infrastructure

- 6.2 By End-user Industry

- 6.2.1 Automotive and Transportation

- 6.2.2 Industrial

- 6.2.3 Oil & Gas

- 6.2.4 Retail

- 6.2.5 BFSI

- 6.2.6 Aerospace and Defense

- 6.2.7 Others

- 6.3 By Region

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Rest of Europe

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Advantech Co. Ltd

- 7.1.3 Dell Inc.

- 7.1.4 Microchip Technology Inc.

- 7.1.5 Huawei Technologies Co. Ltd

- 7.1.6 Hewlett Packard Enterprise Development LP

- 7.1.7 Eurotech Inc.

- 7.1.8 ADLINKTechnology Inc.

- 7.1.9 Kontron S&T AG

- 7.1.10 Hongdian

- 7.1.11 TEKTELIC Communications Inc.

- 7.1.12 VOLANSYS

- 7.1.13 Aeris Communications Inc.

- 7.1.14 Embitel

- 7.1.15 Climax Technology Co., Ltd.

- 7.1.16 Sercomm Corporation

8 INVESTMENT ANALYSIS

9 MARKET OUTLOOK