PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687057

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687057

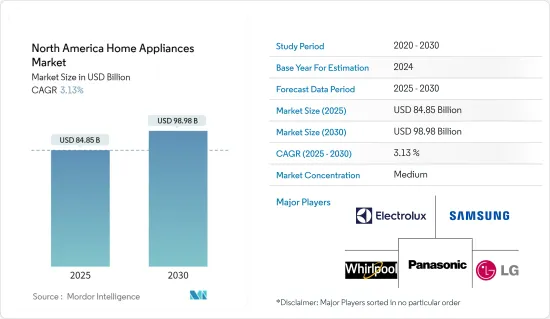

North America Home Appliances - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North America Home Appliances Market size is estimated at USD 84.85 billion in 2025, and is expected to reach USD 98.98 billion by 2030, at a CAGR of 3.13% during the forecast period (2025-2030).

The North American home appliances market is a significant and mature market with a wide range of products catering to various household needs. It includes refrigerators, washing machines, dishwashers, ovens, microwaves, vacuum cleaners, and more. Rising disposable incomes and improving living standards have increased home appliance spending.

The market has witnessed innovations such as smart appliances with internet connectivity, energy-efficient appliances, and advanced features, driving consumer demand. Consumers often replace or upgrade their appliances due to aging, wear and tear, or to take advantage of new features and energy efficiency. Rapid urbanization in North America has resulted in an increasing number of households, creating a demand for home appliances. Online retail platforms have gained popularity, offering consumers convenience and a wide range of options.

North America Home Appliances Market Trends

Small Appliances are Dominating the Market

In contrast to major appliances such as refrigerators, washing machines, dryers, freezers, dishwashers, and microwave ovens, small appliances such as vacuum cleaners, coffee makers, toasters, hairdryers, curlers, kettles, steam units, and fryers are constantly growing. Smart home appliance sales are constantly increasing, owing to factors like their low presence rate in the market, the improving innovation and automation they hold, affordable prices, and the precision they bring to the task at hand. These products ease the working population's lives, which comforts consumers by minimizing their time on tasks.

Increasing Online Sales Driving the Market

The North American home appliances market has witnessed substantial growth in online sales. This trend has been particularly prominent in the home appliances sector. Online shopping offers convenience to consumers, allowing them to browse and purchase home appliances from the comfort of their homes. This convenience factor has appealed to many consumers, from busy professionals to individuals who prefer to avoid crowded stores. Manufacturers and retailers have recognized the importance of online channels and have invested in expanding their e-commerce capabilities to cater to the increasing demand. Overall, the convenience, extensive product selection, competitive pricing, and improved customer experience offered by online sales have been instrumental in driving the growth of the home appliances market in North America.

North America Home Appliances Industry Overview

The North American home appliances market is moderately competitive, with many prominent players operating in the region. Whirlpool Corporation, Electrolux AB, Samsung Electronics, Panasonic Corporation, and LG Electronics are a few of the major players. Market participants engaged in partnerships, and mergers and acquisitions to increase their market share during the study period. During the forecast period, the market offers growth prospects, which are anticipated to intensify competition. However, mid-size to smaller businesses are expanding their market presence by landing new contracts and breaking into untapped sectors thanks to product innovation and technology improvement.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Urbanization is Driving the Market

- 4.2.2 Rising Disposable Income is Driving the Market

- 4.3 Market Restraints

- 4.3.1 Price Sensitivity of Consumers is Restraining the Market

- 4.3.2 Saturation of the Market, with Availability of Wide Range of Brands and Products

- 4.4 Market Opportunities

- 4.4.1 Increasing Trend of Smart Home Technology

- 4.5 Supply Chain/Value Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights into Technological Innovations in the Market

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Major Appliances

- 5.1.1 Refrigerators

- 5.1.2 Freezers

- 5.1.3 Dishwashing Machines

- 5.1.4 Washing Machines

- 5.1.5 Cookers and Ovens

- 5.2 By Small Appliances

- 5.2.1 Vacuum Cleaners

- 5.2.2 Small Kitchen Appliances

- 5.2.3 Hair Clippers

- 5.2.4 Irons

- 5.2.5 Toasters

- 5.2.6 Grills and Roasters

- 5.2.7 Hair Dryers

- 5.3 By Distribution Channel

- 5.3.1 Supermarkets/Hypermarkets

- 5.3.2 Specialty Stores

- 5.3.3 E-Commerce Stores

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Analysis

- 6.2 Company Profiles

- 6.2.1 Whirlpool Corporation

- 6.2.2 Electrolux AB

- 6.2.3 LG Electronics

- 6.2.4 Samsung Electronics

- 6.2.5 Panasonic Corporation

- 6.2.6 Haier Electronics Group Co. Ltd

- 6.2.7 BSH Hausgerate GmbH

- 6.2.8 Arcelik AS

- 6.2.9 Gorenje Group

- 6.2.10 Mitsubishi Electric Corporation*

7 MARKET OPPORTUNTIES AND FUTURE TRENDS

8 APPENDIX AND ABOUT US