Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640614

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640614

NA Inertial Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

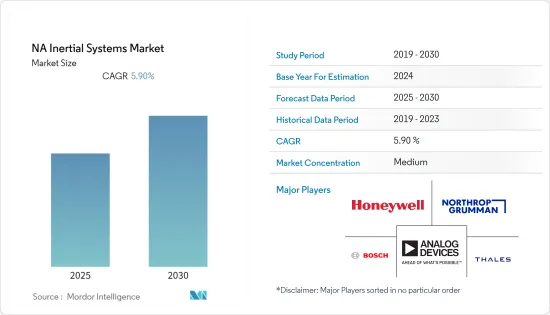

The NA Inertial Systems Market is expected to register a CAGR of 5.9% during the forecast period.

Key Highlights

- Inertial system equipment includes gyroscopes, accelerometers, inertial measurement units, inertial navigation systems, and multi-axis sensors. The report segments the market by area of application with an in-depth analysis of every segment in each area. Aerospace, land-based, marine, and sub-sea applications are explained with a comprehensive market analysis of each segment.

- The United States has one of the highest numbers of submarines and warships. It has around 68 submarines and more than 490 ships with the US Navy. It is also home to big shipping yards that make ships. Inertial systems are key to these ships and submarines. Thus, with the growing production of submarines and warships for the defense sector and ships for increasing trade, the inertial sensors market is estimated to grow in the coming years.

- The changes in lifestyles worldwide have resulted in the need for equipment with greater ease of use, enabled by the use of motion-sensing technology, which uses inertial sensors extensively. It is a key driving factor in the market and will play an important role in defining the market for the next few years.

- The North American inertial navigation market is now mature. However, the advanced technology and demand for low-cost micro-electro-mechanical systems (MEMS) are boosting the market's growth. The Fiber Optic Gyro (FOG), Ring Laser Gyro (RLG), and MEMS are the major technologies adopted in the region for technological advancements in aviation, military, and marine applications.

- Commercial operations have been temporarily halted due to the pandemic. Due to the disturbance in the process, system components are in short supply, and demand for unmanned vehicles for commercial operations such as oil tank testing, pipeline inspection, windmill inspection, and field mapping is down. Vital industrial units worldwide were shut down during the lockdown, which had an impact on the development of inertial navigation system components and the market's growth.

North America Inertial Systems Market Trends

Increasing Demand in Accuracy to Drive the Market

- A high level of accuracy and reliability are the prime features of a navigational system. Inertial navigational systems have a distinct advantage over other forms of navigation systems in terms of their lack of dependence on external aids to determine the rotation and acceleration of a moving object. These systems use a combination of gyroscopes, accelerometers, and magnetometers to determine the vector variables of a vehicle or a moving object.

- Navigational systems are inherently suited for use in integrated navigation, control, and guidance of vehicles in challenging environments. Unlike GPS and other kinds of navigation systems, inertial systems can retain their performance even under difficult conditions. Inertial measurement units (IMU) are well suited to calculate several metrics for navigational systems. These systems remain unaffected by radiation and jamming problems. Strapdown inertial systems find more usage in inertial navigation systems than gimbaled systems, as they are strapped to the moving object and offer better reliability and performance. They also provide cost-effectiveness as they are incorporated with MEMS techniques.

- As advanced technologies such as AI and machine learning become more widely adopted, advanced robotics cars that can be controlled remotely via sensor technology are becoming more common. Unmanned underwater vehicles, unmanned aerial vehicles, and unmanned ground vehicles are being updated with this new technology. In today's battle scenario, accurate position parameters, such as altitude and orientation of tactical-grade equipment, are important.

- Inertial navigation systems are now available for commercial use in private aircraft, UAVs, and military and defense units. They form an integral part of the navigational control systems. They can also interact with other navigational systems due to incremental advancements in the processing ability of the systems. Several forms of inertial systems, like magnetometers, are widely used to determine the orientation and presence of a magnetic field in conjunction with other inertial systems.

- Multi-axis systems like IMUs and AHRS are used to determine moving objects' altitude, position, acceleration, and velocity. Inertial systems are ideal for providing high accuracy in navigational systems by combining accelerometers, gyroscopes, and magnetometers.

Availability of Advanced IMUs to Favor Market Growth

- IMUs in military operations, particularly in unmanned aerial vehicles (UAVs), have spurred companies to develop advanced solutions for this technology. As a result, next-generation IMUs are widely available on the market. For example, EMCORE's Systron Donner Inertial makes solid-state micro-electromechanical systems (MEMS) IMUs for drones that can function in extreme climates.

- SBG Systems, established in France, creates and sells MEMS-driven inertial sensors for unmanned vehicles. The Ellipse 2 Micro Series is the company's smallest and lightest IMU, designed to give precise location data for unmanned systems. Such breakthroughs in inertial sensor technologies are broadening the scope and speeding up the growth of the IMU market.

- Previously, IMU sensors in the car sector were limited to navigation systems. On the other hand, the current use of automotive IMU sensors in various other automotive applications has necessitated the need for more robust sensors with high performance and small size. As a result, suppliers are attempting to meet the industry's ever-changing demands.

- The demand for systems like ADAS and airbags is a major driver of the automotive IMU sensors market's growth. ADAS systems are placed in cars to decrease human errors that might cause driving accidents. ADAS is especially useful for long rides when weariness is the leading cause of accidents.

- Developed countries, such as the United States and Canada, are expected to be the biggest ADAS markets. Airbags are included in automobiles to protect the occupants in the event of an accident. These airbags are controlled by an airbag control unit, which receives data from various sensors, including automotive IMU sensors.

North America Inertial Systems Industry Overview

The North American inertial systems market is moderately fragmented due to the presence of various inertial systems solution providers. However, vendors consistently focus on product development to enhance their visibility and presence. The companies are also undergoing strategic partnerships and acquisitions to gain market traction and increase their market share.

- February 2023 - SBG Systems released the Quanta Plus, a next-generation GNSS-aided inertial navigation system (INS) in OEM form. The system combines a tactical-grade MEMS IMU with a high-performance GNSS receiver to provide accurate position and attitude data even in GNSS-denied environments. In UAV-based survey systems, Quanta Plus is easily integrated with LiDAR or other third-party sensors.

- July 2022 - Inertial Labs released the CheetahNAV, a tactical-grade GNSS-Aided Inertial Navigation System (INS) designed to provide high-accuracy position, navigation, time, velocity, and orientation information to ground vehicle drivers and crews in both GNSS-enabled and GNSS-denied environments. The system includes a tactical-grade MEMS-based Inertial Measurement Unit (IMU) and an embedded multi-constellation and multi-frequency GNSS receiver and provides continuous situational awareness information via real-time moving map technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 55720

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emergence of MEMS Technology

- 5.1.2 Inclination of Growth Toward Defense and Aerospace

- 5.1.3 Technological Advancements in Navigation Systems

- 5.2 Market Restraints

- 5.2.1 Operational Complexity and High Maintenance Costs

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Civil Aviation

- 6.1.2 Defense

- 6.1.3 Consumer Electronics

- 6.1.4 Automotive

- 6.1.5 Energy and Infrastructure

- 6.1.6 Medical

- 6.1.7 Other Applications

- 6.2 By Component

- 6.2.1 Accelerometer

- 6.2.2 Gyroscope

- 6.2.3 IMU

- 6.2.4 Magnetometer

- 6.2.5 Attitude Heading and Navigation System

- 6.2.6 Other Components

- 6.3 Geography

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Honeywell Aerospace Inc.

- 7.1.2 Northrop Grumman Corporation

- 7.1.3 Bosch Sensortec GmbH

- 7.1.4 Analog Devices Inc.

- 7.1.5 Thales Group

- 7.1.6 Rockwell Collins Inc.

- 7.1.7 Moog Inc.

- 7.1.8 Fairchild Semiconductor (ON Semiconductors)

- 7.1.9 VectorNav Technologies

- 7.1.10 STMicroelectronics NV

- 7.1.11 Safran Group (SAGEM)

- 7.1.12 InvenSense Inc.

- 7.1.13 Meggitt PLC

8 Vendor Market Share Analysis

- 8.1 Vendor Positing Analysis (Inertial Systems)

- 8.2 Vendor Market Share (High-End Inertial Systems)

- 8.3 Vendor Market Share (MEMS Industry)

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.