PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644280

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644280

United Kingdom Third Party Logistics (3PL) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

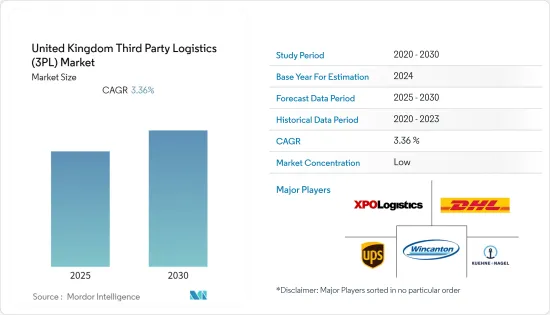

The United Kingdom Third Party Logistics Market is expected to register a CAGR of 3.36% during the forecast period.

Key Highlights

- The United Kingdom is one of the major trading countries globally, which exports most of its products to many European countries. The country's freight and logistics market has gained a strong base due to its developed infrastructure, sophisticated supply chain network, and presence of global players.

- The large retail and e-commerce sectors are among the country's key third-party logistics users. In highly-competitive markets, such as the United Kingdom, delivery time is a key competitive factor for retailers and online stores. So, retailers outsource their logistics to delivery specialists, and large and small retailers can compete on on-demand, next-day delivery.

- Shippers are continuing to leverage what 3PLs offer, allowing them to optimize the supply chain, minimize costs, create value, and align expectations to achieve success for both parties. The high-end technology integration by 3PLs, industry expertise, and cost reduction are reasons for an increase in outsourcing services. This outsourcing of services indicates that the demand for 3PLs is rising and driving the market.

- Mobile technology is revolutionizing 3PL. Many 3PL companies have already begun using mobile devices and apps to improve agility. Devices fitted with radio frequency identification (RFID) chips are not only capable of transmitting their location, but they also have the potential to hold data about themselves so that they can be instantly tracked and identified. Customers can order, process, and track freight shipments anytime using mobile apps installed on their mobile phones.

UK Third Party Logistics (3PL) Market Trends

Growth in Logistics Parks and Fulfilment Centers

The logistics sector is experiencing massive disruption where consumers will now be able to receive their items in time as little as one hour. The rapidly-delivered services are already familiar to most urban consumers. Leaders like Deliveroo, Ofo, and Uber have already made extreme efficiency a day-to-day reality for food and rides.

The United Kingdom is experiencing a record-breaking boom in constructing massive sheds to serve the soaring increase of internet shopping during the pandemic. Nearly 37 million square feet (3.4 million square meter) of warehouse space was slated for construction in 2021, up from 23 million square feet in 2020.

E-commerce continues to drive demand for warehouse expansion, but new warehouses are also needed to support the development of innovative technologies and sustainable energy. The UK warehousing sector is anticipated to continue strong for the foreseeable future.

As of January 2022, the East Midlands region had over 4.4 million square feet of the total 18.6 million square feet of speculative warehouse space under construction in the United Kingdom. This made the region with the most construction activity in the speculative market. Speculative development refers to construction projects that are undertaken without a commitment to a buyer or occupier.

E-Commerce Driving the Growth of the Market

The rapid growth of e-commerce is driving the demand for 3PL services in the United Kingdom. The unrelenting growth of e-commerce is fundamentally changing the third-party logistics (3PL) landscape. With the increasing consumer expectations for on-time and accurate deliveries and to stay competitive, more e-commerce retailers are outsourcing mission-critical components of their distribution and fulfillment operations to 3PL partners.

Many e-commerce retailers are small in size and need help to afford to have in-house logistic services. Therefore, services such as supply chain management, warehousing, consolidation service, and order fulfillment are outsourced to 3PL companies. However, major e-commerce retailers like Amazon and Alibaba are developing their logistics infrastructure.

Meanwhile, the growth of e-commerce and change in consumer expectations are also presenting challenges to the 3PL companies in terms of reducing parcel delivery times, increasing efficiency, adopting the latest and advanced technologies, etc. A huge transformation is taking place in last-mile delivery, with companies looking at alternatives, such as delivery lockers, pickup points, crowdsourced deliveries, drone deliveries, and autonomous vehicles. The evolution of technology is reshaping the entire supply chain and reinventing the parcel industry. Technology is becoming a crucial enabler in increasing efficiency and reaching consumer expectations.

UK Third Party Logistics (3PL) Industry Overview

The United Kingdom third-party logistics (3PL) market is fragmented in nature, with several large companies strategically forming alliances with mid-sized or small-sized companies to leverage their regional capabilities in the market. Major regional players have been observed to venture into new regions, allowing the companies to improve their geographic reach. New competitors are entering the United Kingdom third-party logistics (3PL) market with customized and industry-specific services. Some of the major players in the market include DHL International GmbH, Kuehne + Nagel, UPS, Wincanton PLC, and XPO Logistics Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Market Definition

- 1.3 Scope of the Study

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Government Initiatives

- 4.2.1.2 Increase of Trade

- 4.2.2 Restraints

- 4.2.2.1 Shortage of Labor

- 4.2.3 Opportunities

- 4.2.3.1 Technological Advancements in the Logistic Sector

- 4.2.3.2 Reverse Logistics

- 4.2.1 Drivers

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitutes Products and Services

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Industry Policies and Regulations

- 4.6 General Trends in Warehousing Market

- 4.7 Demand From Other Segments, Such as CEP, Last Mile Delivery, Cold Chain Logistics Etc.

- 4.8 Technological Developments in the Logistics Sector

- 4.9 Insights on Ecommerce Business

- 4.10 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Services

- 5.1.1 Domestic Transportation Management

- 5.1.2 International Transportation Management

- 5.1.3 Value-added Warehousing and Distribution

- 5.2 By End User

- 5.2.1 Manufacturing and Automotive

- 5.2.2 Oil & Gas and Chemicals

- 5.2.3 Distributive Trade (Wholesale and Retail Trade Including E-commerce)

- 5.2.4 Pharmaceuticals and Healthcare

- 5.2.5 Construction

- 5.2.6 Other End Users

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Kuehne Nagel

- 6.2.2 DHL Supply Chain

- 6.2.3 United Parcel Service of America

- 6.2.4 Wincanton

- 6.2.5 Eddie Stobart

- 6.2.6 FedEx

- 6.2.7 XPO Logistics

- 6.2.8 CEVA Logistics

- 6.2.9 Tarlu Ltd

- 6.2.10 Schenker Limited

- 6.2.11 Yusen Logistics

- 6.2.12 Bibby Distribution

- 6.2.13 Xpediator

- 6.2.14 Rhenus Logistics

- 6.2.15 Torque

- 6.2.16 Lloyd Fraser

- 6.2.17 Pointbid Logistics Systems Ltd

- 6.2.18 Parcel Hub*

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution, by Activity, Contribution of Transport and Storage Sector to economy)

- 8.2 External Trade Statistics - Exports and Imports, by Product

- 8.3 Insights into Key Export Destinations and Import Origin Countries