PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1438377

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1438377

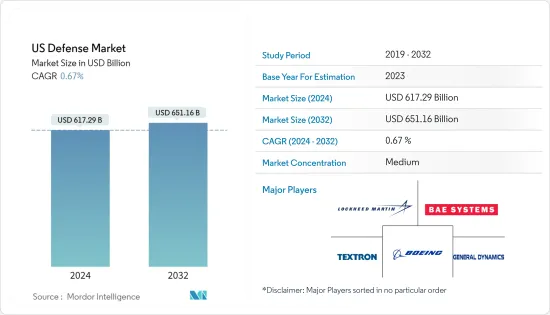

US Defense - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2032)

The US Defense Market size is estimated at USD 617.29 billion in 2024, and is expected to reach USD 651.16 billion by 2032, growing at a CAGR of 0.67% during the forecast period (2024-2032).

The COVID-19 pandemic impacted the country's economy seriously. The US economy contracted by approximately 3.5% in 2020 due to the closing of various businesses like restaurants and airlines. In 2021, the US economy grew considerably compared to 2020, and it is expected to witness a moderate growth rate in 2022. Despite the impact of the pandemic, the country continued to increase its defense spending in 2020, with a focus on research and development and implementation of several long-term projects.

In the United States, military spending has been considered the second-largest allocation in the federal budget, after social security. The country's spending on its defense is greater than that of the cumulative defense spending of countries like China, Saudi Arabia, Russia, the United Kingdom, India, France, Japan, Germany, and South Korea. In 2020, the US defense spending was USD 778 billion.

The current ongoing political tensions with China and Russia and planned procurements of advanced military equipment to replace the aging equipment currently in service are expected to accelerate the market's growth.

The fight against terrorism, externally and internally, is also expected to support the growth of the defense market in the United States.

The growing investments in developing advanced technologies like additive manufacturing technology for applications like body armor, directed energy weapons, and artificial technologies to support the armed forces are expected to provide future growth opportunities.

US Defense Market Trends

The Airforce Segment is Expected to Dominate The Market During the Forecast Period

The air force segment is expected to experience major growth in the US defense market during the forecast period, owing to various procurement plans for replacing aging combat aircraft and new unmanned aerial vehicles. The US Air Force is the world's most powerful and strongest air force in the world. The Air Force is equipped with the most modern technology that provides air support for land and naval forces and aids the troops on and around a battlefield. The Air Force continues the development and procurement of next-generation aircraft to meet the demands of great power conflicts with Russia and China. Currently, the US Air Force comprises a total of 13,247 aircraft that are part of an operational, reserve, and out-of-service fleet.

The country's diplomatic and military relations with nations such as Japan and Taiwan have compelled it to drive significant investments into increasing the fleet of aircraft to counter any provocative military action from China successfully. Furthermore, the United States' involvement in the military conflict in the Middle-Eastern region majorly drove its procurement of attack aircraft and transport aircraft.The Department of Air Force proposed a budget request of USD 194 billion for FY2023, a USD 20.2 billion or 11.7% increase from the FY2022 budget request. A major chunk of this budget will be channeled toward the procurement of new aircraft and research and development of new technologies that can aid the military actions undertaken by the country.

The country's defense agencies have been on a spree of procurements in view of the Russia-Ukraine war that drove significant US weapon supply to Ukraine. To successfully tackle any Russian threat, the air force has been carrying out growth in procurement. For instance:

Recently, in March 2022, the Pentagon requested a USD 11 billion fund for 61 Lockheed Martin F-35 Lightning II aircraft for FY2023. About 45% of that procurement plan is for combat aircraft (USD 8.389 billion) and 23% for modifying in-service platforms (USD 4.257 billion).

Furthermore, the budget proposal included procurements for 33 F-35A conventional variants for the US Air Force, leaving a significant number of aircraft procurements to be included in the operational fleet of the USAF during the forecast period. Owing to major procurement initiatives, together with the future-ready plans of the USAF, the demand in the air force segment of the US defense market is expected to register a significant growth rate during the forecast period.

The US Defense Market is Expected to Experience a Steady Growth in the Next Few Years

The international security system has been undermined by growing hegemonism, unilateralism, and power politics as a result of the profound changes in the international strategic landscape. With the growing threats from adversaries like Russia and China, the global military powerhouse, the United States has been increasing its military expenditure tremendously each year. In the United States, military spending has been considered the second-largest allocation in the federal budget, after social security. The country's spending on its defense is greater than that of the cumulative defense spending of countries like China, Saudi Arabia, Russia, the United Kingdom, India, France, Japan, Germany, and South Korea.

The US military's spending totaled USD 801 billion in 2021, representing an increase of 2.9% compared with 2020. According to the Stockholm International Peace Research Institute (SIPRI), the US spent USD 801 billion on its military in 2021, which accounted for about 38% of the global military expenditure. Furthermore, the revised budget estimates for 2022 amounted to USD 782 billion, a 5.6% increase over the 2021 budget estimates. The budget earmarks about USD 15.7 billion for the Air Force's aircraft procurement. Furthermore, the FY 2023 budget request of the Air Force is approximately USD 169.5 billion, of which USD 18.5 billion is sought for aircraft procurement. The country's high levels of military expenditure enable it to procure sophisticated military aircraft each year as the development, procurement, and maintenance of military aircraft demand huge defense spending from the country.

Under the defense budget of 2022, the US Department of Defense (DoD) allocated a budget for the procurement of 85 F-35 Joint Strike Fighter, 12 F-15EX, and 12 F/A-18 Super Hornet models. Similarly, the DoD plans to allocate a budget for 24 F-15EX and 61 F-35 Joint Strike Fighters in 2023. In addition, the 2023 budget of the US Navy proposes the acquisition of 10 aircraft for its Multi-Engine Training System (METS), with plans to procure a total of 58 aircraft in three years. These plans will drive the demand for training and light attack aircraft. Such procurements are likely to impetus the demand over the forecast period, which is likely to aid the revenue bars of the US defense market.

US Defense Industry Overview

There are several players in the market that support the US defense market. However, Lockheed Martin Corporation, The Boeing Company, Raytheon Technologies Corporation, General Dynamics Corporation, and Northrop Grumman Corporation are some prominent players expected to hold a significant share.

Companies conduct various initiatives and product innovations to strengthen their presence in the market. In this regard, as of May 2021, FLIR Systems Inc. was awarded a contract worth over USD 70 million from the US Armed Services for about 600 FLIR Centaur robots and related equipment. The ground robots will be delivered to the US Army, Navy, Air Force, and Marine Corps. The delivery of unmanned ground vehicles was planned to begin in the third quarter of 2021. The provision of long-term contracts for the development of new military equipment and technologies is anticipated to propel the revenues of various companies in the United States. For instance, in March 2021, Lockheed Martin Corporation was awarded multiple contracts worth more than USD 125 million to deliver 9 UH-60M and 21 HH-60M helicopters to the US Army. The delivery of the helicopters was planned to be completed in June 2023. Such contracts are expected to help the companies increase their market share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

- 3.1 Market Size and Forecast, Global, 2018 - 2030

- 3.2 Key Findings

- 3.3 Expert Opinion on the United States Defense Market

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Technology Trends

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers/Consumers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size and Forecast by Value - USD billion, 2018 - 2030)

- 5.1 Armed Force

- 5.1.1 Army

- 5.1.2 Navy

- 5.1.3 Air Force

- 5.2 Type

- 5.2.1 Fixed-wing Aircraft

- 5.2.2 Rotorcraft

- 5.2.3 Ground Vehicles

- 5.2.4 Naval Vessels

- 5.2.5 C4ISR

- 5.2.6 Weapons and Ammunition

- 5.2.7 Protection and Training Equipment

- 5.2.8 Unmanned Systems

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Lockheed Martin Corporation

- 6.2.2 The Boeing Company

- 6.2.3 Raytheon Technologies Corporation

- 6.2.4 General Dynamics Corporation

- 6.2.5 Northrop Grumman Corporation

- 6.2.6 L3Harris Technologies Inc.

- 6.2.7 BAE Systems PLC

- 6.2.8 CACI International Inc.

- 6.2.9 Textron Inc.

- 6.2.10 Elbit Systems Ltd

- 6.2.11 Huntington Ingalls Industries Inc.

- 6.2.12 Kongsberg Gruppen ASA

- 6.3 Other Players

- 6.3.1 Airbus SE

- 6.3.2 Teledyne Technologies Incorporated

- 6.3.3 General Atomics

- 6.3.4 AeroVironment Inc.

- 6.3.5 Sig Sauer Inc.

- 6.3.6 Leidos Holdings Inc.

- 6.3.7 Saab AB

7 MARKET OPPORTUNITIES AND FUTURE TRENDS