PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850037

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850037

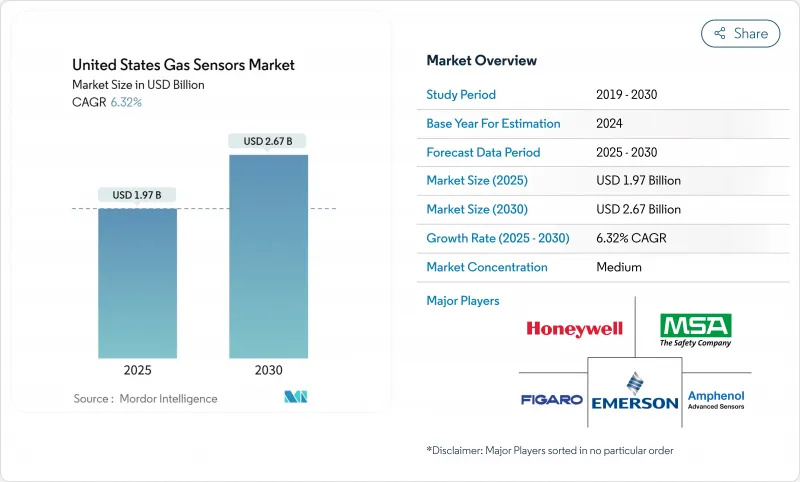

United States Gas Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The United States gas sensors market size is estimated at USD 1.97 billion in 2025 and is projected to reach USD 2.67 billion by 2030, advancing at a 6.32% CAGR.

Demand is sustained by federal safety rules that push factories and refineries to install continuous leak-detection systems, while stricter ASHRAE ventilation standards extend adoption across commercial buildings. Wireless and IoT-ready devices are rapidly gaining favour as low-power networks cut installation costs and enable remote diagnostics that improve uptime. Edge-AI analytics now run directly on the sensor node, turning raw data into real-time alerts that help prevent costly incidents. Hydrogen infrastructure rollouts are creating a surge of orders for ultra-sensitive detectors, and MEMS-based designs are lowering size and power requirements, opening new uses in wearables and portable safety gear. Competitive intensity is moderate: diversified safety leaders still dominate critical-process niches, but semiconductor specialists are carving out share with compact, software-driven platforms.

United States Gas Sensors Market Trends and Insights

OSHA and EPA Compliance Driving Industrial Demand

Regulatory updates on methane and toxic gas emissions require plants to verify leaks at lower thresholds and carry penalties that can reach USD 25,000 per day. Facilities therefore invest in multi-gas arrays that detect parts-per-billion concentrations, adding process-control value beyond compliance. Engineering teams are now specifying detectors that integrate with safety-instrumented systems to automate shutdowns when hazardous levels arise, a capability that shortens response time and limits liability exposure. Compliance spending is heaviest in oil, gas, and chemical clusters across Texas, Louisiana, and Pennsylvania, securing a reliable revenue stream for suppliers. Large buyers prefer product lines supported by calibration programs and cloud-based audit trails that simplify regulatory reporting.

Growing HVAC / IAQ Adoption (ASHRAE 62.1)

The 2024 update to ASHRAE 62.1 tightened accuracy targets for CO2 meters, prompting building operators to swap older hardware for advanced optical or electrochemical devices. Office towers, hospitals, and schools now integrate occupancy-based ventilation controls that link gas readings to air-handling units, balancing energy savings with health criteria. Portfolio owners see indoor-air data as an amenity that supports tenant retention, elevating gas sensors from back-of-house equipment to a visible part of wellness branding. Strongest adoption is in the Northeast and California, where state incentives pair with sustainability mandates. System integrators bundle sensors with analytics dashboards to provide fault alerts and ventilation scorecards in a single view.

High Calibration & Maintenance Costs

Quarterly calibration protocols require specialty test gas, trained staff, and downtime that can push lifetime ownership costs to 40% of equipment spend. Smaller plants often delay service intervals, risking false alarms or undetected leaks that undermine safety investments. Manufacturers respond with self-calibrating cells and remote diagnostics, yet capital prices rise, forcing buyers to weigh upfront savings against recurring labour. Skill shortages in rural regions worsen the burden, prompting some operators to outsource maintenance contracts that bundle sensors, service, and compliance documentation.

Other drivers and restraints analyzed in the detailed report include:

- Automotive Cabin-Air Quality & Emissions Monitoring

- Edge-AI and IoT-Enabled Predictive Maintenance

- Methane-Leak Rules Under IIJA Pipelines Program

- Sensor Price Commoditisation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The wired category maintained a 54% position in the United States gas sensors market during 2024, anchored by process industries that require uninterrupted power and fail-safe communication. These installations typically connect directly to distributed control systems, ensuring compliance in hazardous zones. However, wireless nodes are growing at an 11.5% CAGR, propelled by low-power wide-area technologies that stretch battery life to more than five years. Facility managers deploy mesh networks that allow temporary placement during turnarounds or in legacy buildings where cabling is cost prohibitive. Wireless flexibility supports granular sensor placement, elevating coverage in multi-story schools and hospitals that seek better ventilation insight. Integrators combine wireless gas data with occupancy and energy metrics, bundling value propositions that extend beyond safety into operational efficiency.

The rise of wireless options also reshapes service models. Vendors now offer subscription packages that wrap hardware, network connectivity, and analytics dashboards in single agreements. This shift reduces capital budgets and enables evergreen upgrades when new sensors emerge. As the United States gas sensors market size relevant to wireless installations climbs, procurement teams pivot toward total-cost evaluations that emphasize lifetime value and software functionality. While wired systems will remain standard in high-risk areas, hybrid architectures emerge, pairing permanent wired detectors in Class I Division 1 zones with wireless devices in less hazardous spaces to optimize spend.

Electrochemical cells held 31.5% of the United States gas sensors market share in 2024 due to their proven accuracy for CO, H2S, and NO2. Catalytic-bead designs persisted as the go-to choice for combustible gases in Class I environments, while NDIR optics gained popularity for CO2 in HVAC controls. PIDs served niche roles monitoring VOCs during hazmat response and industrial hygiene campaigns.

MEMS MOS devices are on track to post 13.2% CAGR growth between 2025 and 2030 as semiconductor production reduces per-unit costs and enables multi-gas identification in coin-sized packages. Machine-learning algorithms compensate for cross-sensitivity, letting a single die discriminate among methane, hydrogen, and volatile organics with contextual accuracy. Wearables for lone-worker safety and consumer electronics integrate these chips to alert users to hazardous environments in real time. The migration to MEMS also lowers power draw, extending battery life in wireless nodes and aligning with sustainability objectives that discourage frequent battery swaps.

The US Gas Sensors Market Segmented by Type (Wired, Wireless), Gas Type (Oxygen, Carbon Monoxide and More), Technology (Electrochemical, Photo-Ionisation Detector (PID) and More), Application (Medical and Healthcare, Building Automation and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Honeywell International Inc.

- Sensirion AG

- Amphenol Advanced Sensors

- Figaro Engineering Inc.

- Emerson Electric Co.

- MSA Safety Inc.

- Robert Bosch GmbH

- City Technology Ltd

- Renesas Electronics Corp.

- AMS OSRAM AG

- Trolex Ltd

- Sensata Technologies

- Draeger Safety AG

- NevadaNano

- Aeroqual Ltd

- SPEC Sensors LLC

- AlphaSense Inc.

- Figaro USA Inc.

- Membrapor AG

- Cubic Sensor and Instrumentation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 OSHA and EPA compliance driving industrial demand

- 4.2.2 Growing HVAC / IAQ adoption (ASHRAE 62.1)

- 4.2.3 Automotive cabin-air quality and emissions monitoring

- 4.2.4 Edge-AI and IoT-enabled predictive maintenance

- 4.2.5 Hydrogen refueling leak-detection roll-out

- 4.2.6 Methane-leak rules under IIJA pipelines program

- 4.3 Market Restraints

- 4.3.1 High calibration and maintenance costs

- 4.3.2 Sensor price commoditisation

- 4.3.3 Domestic MEMS-fab capacity bottlenecks

- 4.3.4 Cyber-security worries for cloud-connected sensors

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Pandemic and Macroeconomic Impact Assessment

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Wired

- 5.1.2 Wireless

- 5.2 By Gas Type

- 5.2.1 Oxygen

- 5.2.2 Carbon Monoxide

- 5.2.3 Carbon Dioxide

- 5.2.4 Nitrogen Oxide

- 5.2.5 Hydrocarbon

- 5.2.6 Others

- 5.3 By Technology

- 5.3.1 Electrochemical

- 5.3.2 Photo-Ionisation Detector (PID)

- 5.3.3 Solid-State / MOS

- 5.3.4 Catalytic Bead

- 5.3.5 Infra-Red (NDIR)

- 5.3.6 Semiconductor

- 5.4 By Application

- 5.4.1 Medical and Healthcare

- 5.4.2 Building Automation

- 5.4.3 Industrial Safety and Process

- 5.4.4 Food and Beverage

- 5.4.5 Automotive

- 5.4.6 Transportation and Logistics

- 5.4.7 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Honeywell International Inc.

- 6.4.2 Sensirion AG

- 6.4.3 Amphenol Advanced Sensors

- 6.4.4 Figaro Engineering Inc.

- 6.4.5 Emerson Electric Co.

- 6.4.6 MSA Safety Inc.

- 6.4.7 Robert Bosch GmbH

- 6.4.8 City Technology Ltd

- 6.4.9 Renesas Electronics Corp.

- 6.4.10 AMS OSRAM AG

- 6.4.11 Trolex Ltd

- 6.4.12 Sensata Technologies

- 6.4.13 Draeger Safety AG

- 6.4.14 NevadaNano

- 6.4.15 Aeroqual Ltd

- 6.4.16 SPEC Sensors LLC

- 6.4.17 AlphaSense Inc.

- 6.4.18 Figaro USA Inc.

- 6.4.19 Membrapor AG

- 6.4.20 Cubic Sensor and Instrumentation

7 MARKET OPPORTUNITIES & FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment