Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644839

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644839

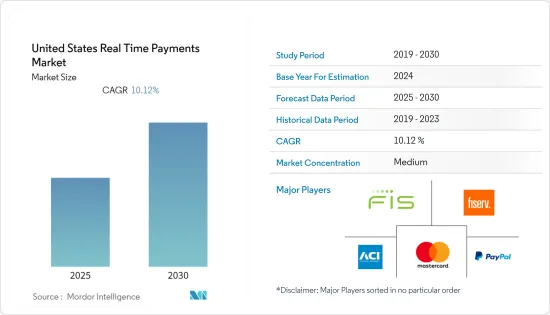

United States Real Time Payments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The United States Real Time Payments Market is expected to register a CAGR of 10.12% during the forecast period.

Key Highlights

- Surging smartphone penetration across the country and rising customer expectation are expected to support market growth in the long run. The rising expectation of individuals from smartphones to make a payment from anywhere and at any time, including on weekends and public holidays, will bolster market demand. In addition, the increasing demand for quicker payment settlements and rising investments from government and financial institutes to support the adoption of real-time payment solutions are anticipated to accelerate the market's growth.

- The dependence on traditional banking has fallen dramatically in the past, as customers demand more flexibility and convenient ways to make payments. The existing banking infrastructure fails to cope with the payment frequency. The emergence of new fin-tech payment providers and secure gateways has enhanced the real-time payments market.

- Increase efficiencies in the payments system and ease of convenience, particularly where they displace high-cost instruments such as cheques. Real-time payments can also release money locked up in the financial system and boost competition to incorporate more new features.

- Security concerns in real-time payment and payment frauds are some of the factors that might affect the market adversely. It can cause uneasiness amongst come users and thus, restricts the adoption of the real-time payment technology in the future.

- Also, the COVID-19 played a massive role in this shift; the government got the opportunity to expand the scope of real-time payment methods and change consumer behaviors, which further supported the market growth.

US Real Time Payments Market Trends

Rise in the P2B Payment

- P2B payments refer to transactions of money between customers and businesses. The constant growth of e-commerce and mobile commerce is a key factor driving the segment's growth. For instance, as per Monetate; Kibo, The average value of U.S. online shopping orders in 2021 is increased on desktop compared to the same quarter in 2020. In the third quarter of 2021, online orders from a desktop computer had an average value of USD 177.38, up from USD 139.67 in the same period of the previous year. The orders fulfilled from the mobile phone were worth USD 125.57 on average.

- Real-time payment and mobile payment is revolutionizing the way payments are made today. For instance, the P2B high-value payment such as a car purchase, the demand for real-time availability of funds, and confirmation after transaction is very important for both consumer and the business.

- Additionally, companies like Google have made payments more convenient for smartphone users. The technology uses near-field communication (NFC) on supported smartphones and smartwatches. The user stores the debit or credit card information on the Android Pay account; the user can then pay for a service or item by simply placing the phone or watch near the retailer's point-of-sale terminal, which deducts the money from the customer account through NFC hardware.

- The demand for real-time payments market in the United States is highly contributed by the increasing awareness regarding the technology. Since the first wave of early adoption went live with The Clearing House (TCH) 's RTP network, numerous large banks in the United States have signed up for real-time payment, with hundreds of smaller institutions slated to follow.

- The shifts in payment behavior were majorly due to the pandemic. The U.S experienced the adoption of real-time payments and migration to online commerce from in-store. These shifts create new opportunities for payment players as government policies encourage the growth of digital payments, which is anticipated to aid the growth of real-time payment methods amongst consumers.

Growth in the Retail and E-commerce Sector

- Real-time payments were introduced primarily for retail/consumer, but now the benefits it can offer, corporate, business, and government payments are taking advantage of them. This has accelerated the adoption in the last few years in the region.

- The retail sector is growing exponentially; retail companies are using digital technologies and data to tailor services, products, experiences, and promotions to the individual and shift from maximizing supply chains to personalizing demand chains. This will boost the mobile payments method in the forecast time frame.

- Additionally, the United States is experiencing growth in sales as the eCommerce vendors are providing discounts on prepayments and monthly subscriptions. For instance, Amazon has witnessed growth in sales across selected leading markets. The net sales in the United States were Amazon's biggest market in 2021as; it generated USD 314 billion in net sales. This is expected to promote real-time payment methods in the United States.

- The surging demand for instant payment settlement from merchants and retailers has augmented the adoption of real-time payment solutions. These solutions provide a competitive edge to the retailers by offering them an affordable and efficient mode of payment. The proliferation preference for mobile-based shopping across the United States is also emerging as a major driver for the growth of this segment.

US Real Time Payments Industry Overview

The market is moderately fragmented with the presence of various large players like ACI Worldwide, Worldpay and the emergence of new start-ups.

- September 2021 - M2P Solutions, Asia's largest API infrastructure company, signed a strategic partnership with Buckzy Payments, Inc, a Toronto-based global fintech delivering industry-leading payment solutions. M2P's platform will enable cross-border payments for its partners in the MENA region through Buckzy's safe, secure and convenient ecosystem to markets spanning North America, Canada, Latin America, and Europe.

- August 2021 - JPMorgan Chase & Company, a global payments giant has launched a real-time payments option that it hopes will increase its edge in the financial industry's battle to handle more of the surging volumes of global digital payments. The new product, Request for Pay, lets corporate clients send payment requests to the bank's roughly 57 million retail clients who use its app or website, cutting the cost and time it takes for those companies to get paid.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 91282

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Evolution of the payments landscape in the country

- 4.4 Key market trends pertaining to the growth of cashless transaction in the country

- 4.5 Impact of COVID-19 on the payments market in the country

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Smartphone Penetration

- 5.1.2 Falling Dependence on Traditional Banking

- 5.1.3 Ease of Convenience

- 5.2 Market Challenges

- 5.2.1 Payment Fraud

- 5.2.2 Existing Dependence on Cash

- 5.3 Market Opportunities

- 5.3.1 Government Policies Encouraging the Growth of Digital Paymentis expected to aid the growth of Real Time Payment methods amongst commoners

- 5.4 Key Regulations and Standards in the Digital Payments Industry

- 5.4.1 Regulatory Landscape Across the World

- 5.4.2 Business Models with Potential Regulatory Roadblocks

- 5.4.3 Scope for Development in Lieu of Evolving Business Landscape

- 5.5 Analysis of major case studies and use-cases

- 5.6 Analysis of Real Payments Transactions as a share of all Transactions in the Country

- 5.7 Analysis of Real Payments Transactions as a share of Non-Cash Transactions in the Country

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 P2P

- 6.1.2 P2B

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ACI Worldwide, Inc.

- 7.1.2 FIS

- 7.1.3 Fiserv, Inc.

- 7.1.4 Mastercard Inc.

- 7.1.5 PayPal Holdings, Inc.

- 7.1.6 Visa Inc.

- 7.1.7 Worldpay, Inc.

- 7.1.8 Temenos AG

- 7.1.9 Volante Technologies Inc

- 7.1.10 Montran Corporation

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.