PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1237832

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1237832

Electric Vehicle Motor Micro Controller Market - Growth, Trends, And Forecasts (2023 - 2028)

Currently, the Electric Vehicle Motor Micro Controller Market is valued at USD 3.36 Billion and is expected to reach USD 6.93 Billion over the next five years at a CAGR of 15.58%.

The global coronavirus pandemic has had a negative impact on the market for Electric Vehicle Motor (EVM) controllers due to severe lockdowns, decreased sales, and a halt in automobile production. The market for Electric Vehicle Motor (EVM) controllers has suffered due to the widespread implementation of lockdowns and the rapid global spread of the coronavirus. Manufacturers in the automotive industry are making up for losses caused by the disruption of the ecosystem and the decline in sales of electric vehicles.

On the other hand, while the global automotive industry is recovering from the COVID-19 sales drop, another crisis is preventing its revival. Production of automobiles around the world is disrupted by a worldwide shortage of semiconductors, which may delay the sales of new vehicles. The scarcity of microcontrollers, which are an essential component of the electronic control units that are utilized in contemporary infotainment systems, Advanced Driver Assist Systems (ADAS), Anti-lock Braking Systems (ABS), and other electronic stability systems, has forced automobile manufacturers to reduce production. As a result, automakers halt production at specific locations until the shortage improves. On the other hand, the market is anticipated to move quickly in the near future.

Microcontrollers that are in charge of automating vehicle tasks are in high demand due to the development of automation. MCUs are employed in automobiles to carry out automatic tasks like distributing electricity to various vehicle components, keeping the exhaust system clean, and lowering fuel usage. Due to their low weight, high performance, and low fuel consumption, electric cars are becoming increasingly popular in developing nations. Battery-powered electric vehicles are becoming increasingly popular with consumers due to their low emissions. To use cutting-edge components for electric vehicles, major automakers are investing and expanding their production capacity.

Additionally, as vehicles become electrified, there is a growing demand for fresh, specialized MCUs that are tailored to meet the requirements of Electric Vehicles (EVs). Companies in the industry are developing cutting-edge goods and funding great R&D efforts to meet the spike in demand for EVs.

Electric Vehicle Motor Micro Controller Market Trends

Increased Electric Vehicle Adoption Globally

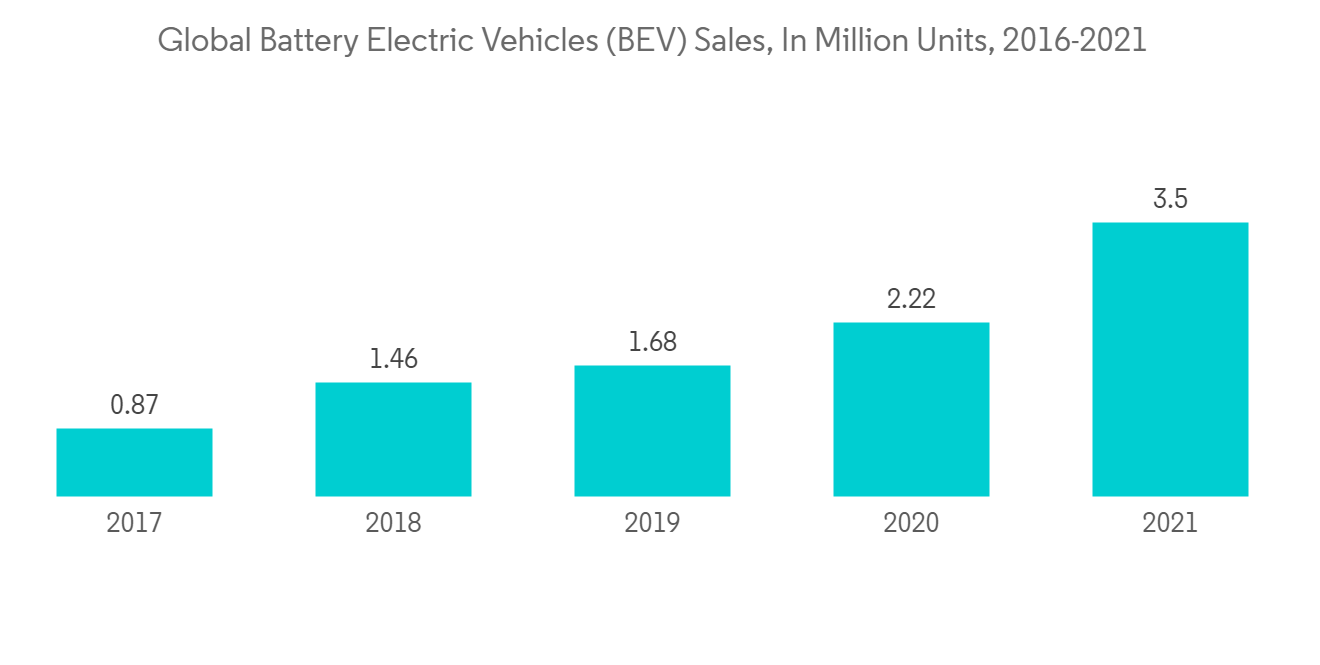

The market is being driven by increased sales of BEVs and PHEVs, as well as lower costs for powertrain components due to material advancements and improved packaging arrangement. In addition, the high cost of batteries has necessitated enhancements to vehicle performance as well as power electronics.

In addition, various programs and policies have been implemented by governments worldwide to encourage consumers to choose electric vehicles over conventional ones. The California ZEV program, which aims to have 1.5 million electric vehicles on the road by 2025, is one such initiative that encourages the purchase of electric vehicles. India, China, the United Kingdom, South Korea, France, Germany, Norway, and the Netherlands are additional nations that provide various incentives.

After COVID-19 spread, sales of electric vehicles increased significantly. Lockdowns imposed by governments worldwide have slowed the economy and hurt sales of electric vehicles and charging infrastructure systems. The availability of additional components, such as inverters and lithium-ion battery packs, was affected. An integral component of electric vehicles is a power inverter. It uses a traction motor to propel the vehicle by converting energy from the batteries.

Manufacturers of electric vehicles have faced a significant challenge in gaining consumer acceptance. Due to factors such as a lack of charging infrastructure and the high cost of EVs (EV costs are almost the same as those of entry-level luxury cars), consumers have been reluctant to purchase electric vehicles despite the benefits they provide. Due to COVID-19, several nations, including India, had to put their plans to construct over 50,000 charging stations and improve the charging infrastructure on hold.

Significantly, several OEMs intend to restructure their product lines solely to produce electric automobiles. For instance, General Motors announced in 2021 that by 2025, it would spend USD 20 billion on electric and autonomous vehicles. By 2023, the company intends to introduce 20 new electric models and sell more than 1 million electric cars annually in China and the United States.

By 2024, Volkswagen intends to invest USD 36 billion in electric vehicles across its mass-market brands. The business claims that by 2025, electric vehicles will account for at least 25% of its global sales.

Asia-Pacific is Leading the Market

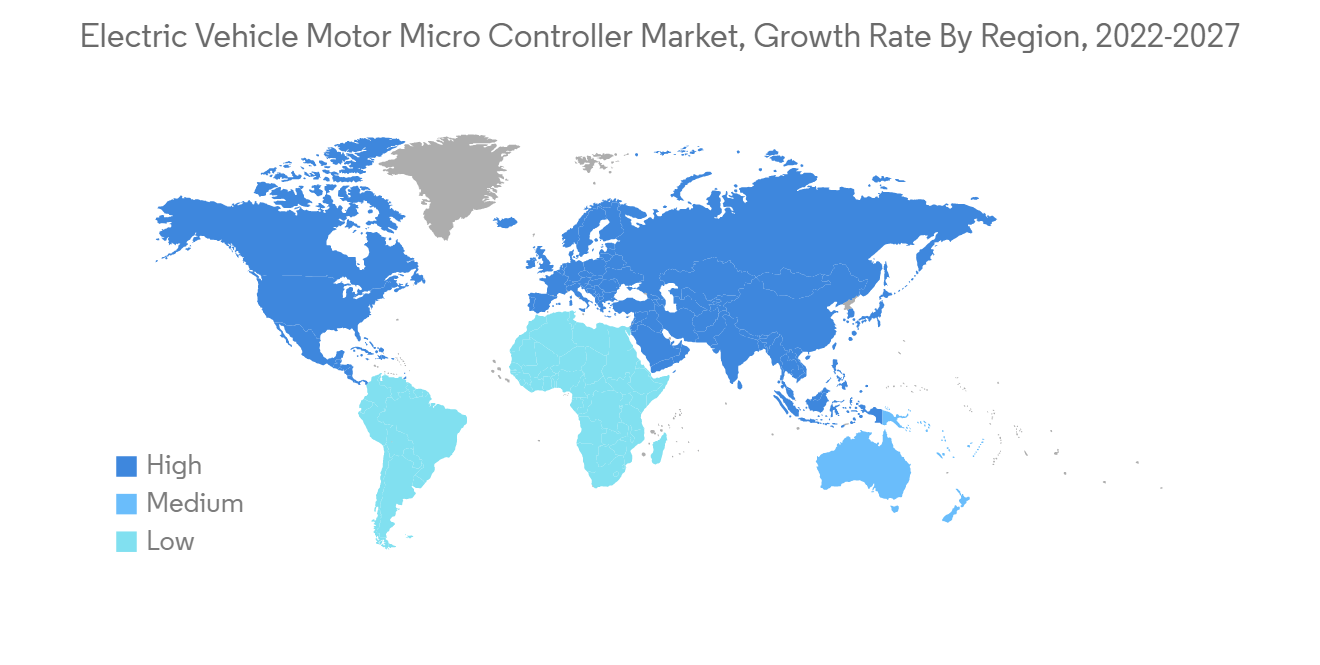

Asia-Pacific accounts for the majority of the global market for electric vehicles. Over the forecast period, the market is expected to grow significantly, with China leading the sales of electric vehicles.

China and Japan support cutting-edge electric vehicle development and technological advancement. Significant electric mobility projects are also being implemented in nations like Indonesia.

China is a key player in the global electric vehicle industry. Moreover, the government of China is encouraging people to adopt electric vehicles. The country is planning to switch to electric mobility by 2040 completely. The Chinese electric passenger car market is also one of the largest worldwide and has been increasing over the last few years. It is expected to grow higher in the forecast period, which will also positively impact the demand for electric vehicle connectors.

As the situation is normalizing, the demand for electric vehicles in Japan shows signs of growth. To cater to the rising demand, partnerships, ventures, and mergers are expected to boost the sales of electric cars components in Japan; for instance,

- April 2022: Honda partnered with General Motors to develop affordable electric vehicles. Automakers plan to create a new architecture based on GM's Ultium EV battery, primarily for small crossover SUVs.

The Indian electric vehicle market is in its growing stage. Automobile manufacturers in India, such as TATA, Mahindra, MG, etc., are taking initiatives to provide affordable electric driving options. Moreover, the government is also supporting electric mobility to reduce the exhaust emissions of greenhouse gases in the country.

The South Korean government has set high goals for its electric vehicle industry over the next ten years. The country is making heavy investments in vehicles and infrastructure to support them. For instance, the government of South Korea is also supporting the purchase of electric cars with a subsidy. The Seoul government is providing a subsidy of approximately USD 7,500 for each electric passenger car.

Car manufacturers are also investing to scale up the growing demand for electric vehicles. For instance,

- Hyundai Motors plans to invest USD 16 billion to increase its market share in the world by 2023. With the increase in the manufacturing and launching of new products, the demand for microcontrollers is bound to grow in the upcoming years.

Electric Vehicle Motor Micro Controller Market Competitor Analysis

The Electric Vehicle Motor Micro Controller Market has a presence of prominent players like Continental AG, Infineon Technologies AG, Toyota Industries Corporation, Robert Bosch GmbH, BorgWarner Inc., etc. The competition, frequent changes in consumer preferences, and rapid technological advancements are expected to pose a threat to the market's growth during the forecast period.

Major players in the global market for Electric Vehicle Motor (EVM) controllers are expanding their presence through mergers and acquisitions or the construction of new facilities. For instance,

- October 2022: Xindong Semiconductor Technology Co., Ltd. will be established in Wuxi, Jiangsu, with Jianjun WEI, its chairman, and Wensheng Technology (Tianjin) Co., Ltd. (Wensheng Technology), according to Great Wall Motor's announcement. With a registered capital of CNY 50 million (around USD 4.20 million), the joint venture will primarily focus on integrated circuit design and the production of microcontrollers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porters 5 Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 AC Permanent Magnet Synchronous Motor Controller

- 5.1.2 AC Asynchronous Motor Controller

- 5.1.3 DC Motor Controller

- 5.2 Power Output

- 5.2.1 1 to 20 KW

- 5.2.2 21 to 40 KW

- 5.2.3 41 to 80 KW

- 5.2.4 Above 80 KW

- 5.3 By Propulsion Type

- 5.3.1 Plug-in Hybrid Vehicle

- 5.3.2 Battery Electric Vehicle

- 5.3.3 Fuel Cell Electric Vehicle

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Russia

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 BorgWarner Inc.

- 6.2.2 Continental AG

- 6.2.3 Delphi Technologies PLC.

- 6.2.4 Denso Corporation

- 6.2.5 FUJITSU

- 6.2.6 Hitachi Automotive Systems

- 6.2.7 Mitsubishi Electric

- 6.2.8 Robert Bosch GmbH

- 6.2.9 Siemens AG

- 6.2.10 Texas Instruments

- 6.2.11 Toyota Industries Corporation

- 6.2.12 Infineon Technology AG

- 6.2.13 Delta Electronics

- 6.2.14 Renesas Electronics Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS