PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1237838

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1237838

Linear Low-Density Polyethylene (Lldpe) Market - Growth, Trends, And Forecasts (2023 - 2028)

The Global Linear Low-density Polyethylene (LLDPE) market is estimated to register a CAGR of over 5% during the forecast period. Due to the impact of COVID-19, linear low-density polyethylene production and the ethylene raw material supply chain were highly affected but eventually recovered in 2021. Due to hygiene and safety concerns, the packaging industry has seen an enormous surge, thereby increasing the demand for the LLDPE market, which is expected to recover further in 2022. The automotive, healthcare, e-commerce, and packaging industries are among the major end-user industries of linear low-density polyethylene.

Key Highlights

- The major factors driving the growth of the market studied are the rise in demand for packaging and surging demand for film and sheets.

- On the flip side, substituting other polyethylene products and banning plastics reduce market growth during the forecast period.

- The development of Metallocene linear low-density polyethylene (mLLDPE) is likely to act as an opportunity in the future, mLLDPE has relatively more puncture resistance than LLDPE.

Linear Low-density Polyethylene Market Trends

Rise in Demand for LLDPE Films

- Linear low-density polyethylene is used in the packaging industry because of its properties, such as higher impact strength, tensile strength, puncture resistance, elongation, etc.

- Food and beverage manufacturing companies use LLDPE films for packaging to secure their product from harmful chemicals and less moisture content. The recent increase in ready-to-eat and pre-cooked products globally has surged LLDPE's market share.

- The growth in disposable income and the increasing preference for fast food and food delivery services contributed to increasing demand for LLDPE films.

- Following a dip in 2020, the global packaging industry resumed steady growth in 2021, as COVID-19 affected numerous end-use sectors.

- Packaging is the most extensive application of LLDPE films. China, the United States, Japan, India, and Germany are amongst the top countries with the fastest growth rate in the packaging industry across the world.

- Rapid growth in the e-commerce industry directly correlates to the LLDPE demand for e-commerce packaging.

- All the above factors are expected to significantly impact the demand for LLDPE films from the packaging industry during the forecast period.

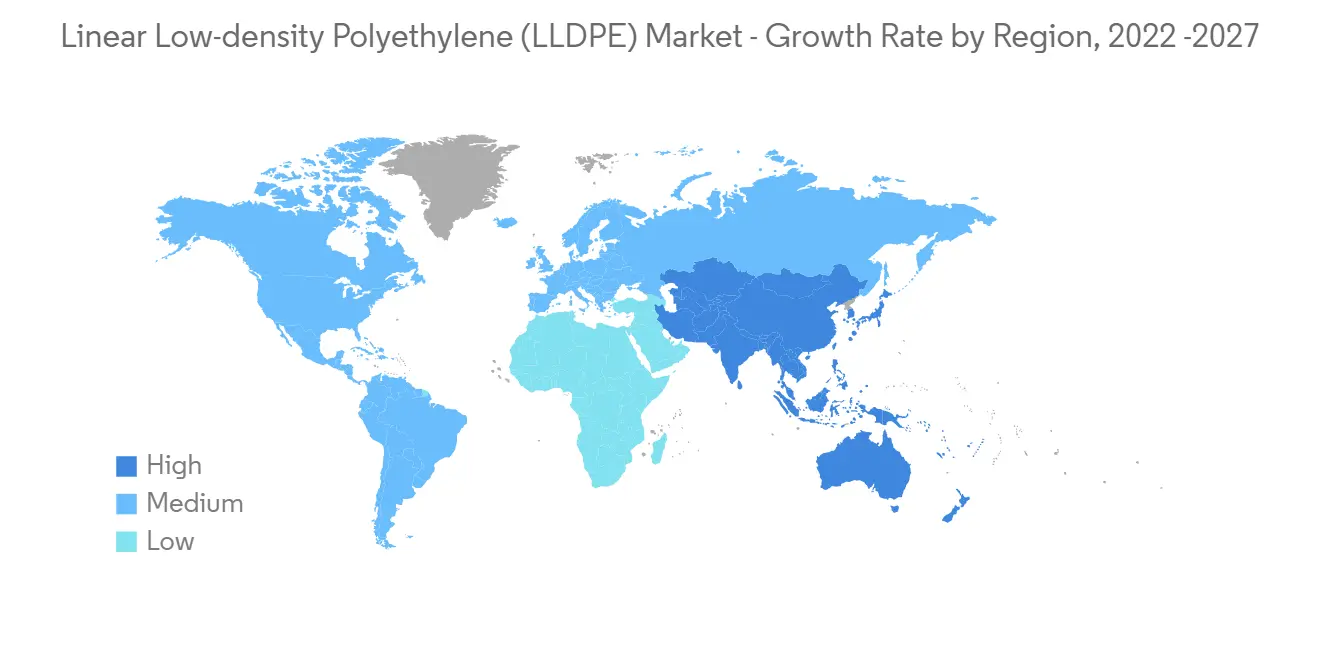

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region accounts for the largest share of the Linear low-density polyethylene (LLDPE) market, owing to rapid industrialization and rising LLDPE-based packaging material demand in the region. The packaging business in the Asian market is expanding at a rapid pace with the increased manufacturing activities in the pharmaceutical, food processing, and automotive industries.

- The packaging industry in China is expected to register tremendous growth with a CAGR of nearly 6.8%, reaching USD 0.2 trillion by 2025. This positive momentum in the packaging industry is expected to boost the market demand for LLDPE in the country.

- The packaging industry primarily uses LLDPE films. LLDPE is also used in the injection molding manufacturing sectors in automotive plastic parts, toys, and water bottles. An increase in injection molding also increases the LLDPE market.

- According to the OICA, the Asia-Pacific automotive plastic parts market is expected to grow. In 2021, automotive production in China reached USD 26.08 million. The increase in automotive production is estimated to drive the demand for the market studied.

- Indian food processing is the largest consumer of packaging at 45%, followed by pharmaceuticals and personal care products. Increasing demand from these end-user segments is creating a huge potential for expansion.

- Due to all these factors, the market for linear low-density polyethylene is expected to have a high demand in the Asia-Pacific region during the forecast period.

Linear Low-density Polyethylene Market Competitor Analysis

The Linear low-density polyethylene LLDPE market is partially consolidated in nature. Some of the major players in the market include INEOS, Formosa Plastic Corporation, Dow, Mitsubishi Chemicals, LG Chem, Exxon Mobil Corporation, SINOPEC, SABIC, Lyondellbasell Industries Holdings BV, Reliance Industries Limited, and Chevron Phillips Chemical Company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increase Demand from the Packaging Industry

- 4.1.2 Surging Demand for Film and Sheets

- 4.2 Restraints

- 4.2.1 Substitution of Other Polyethylene Products

- 4.3 Industry Value Chain Analysis

- 4.4 Poter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Thret of Substitute products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

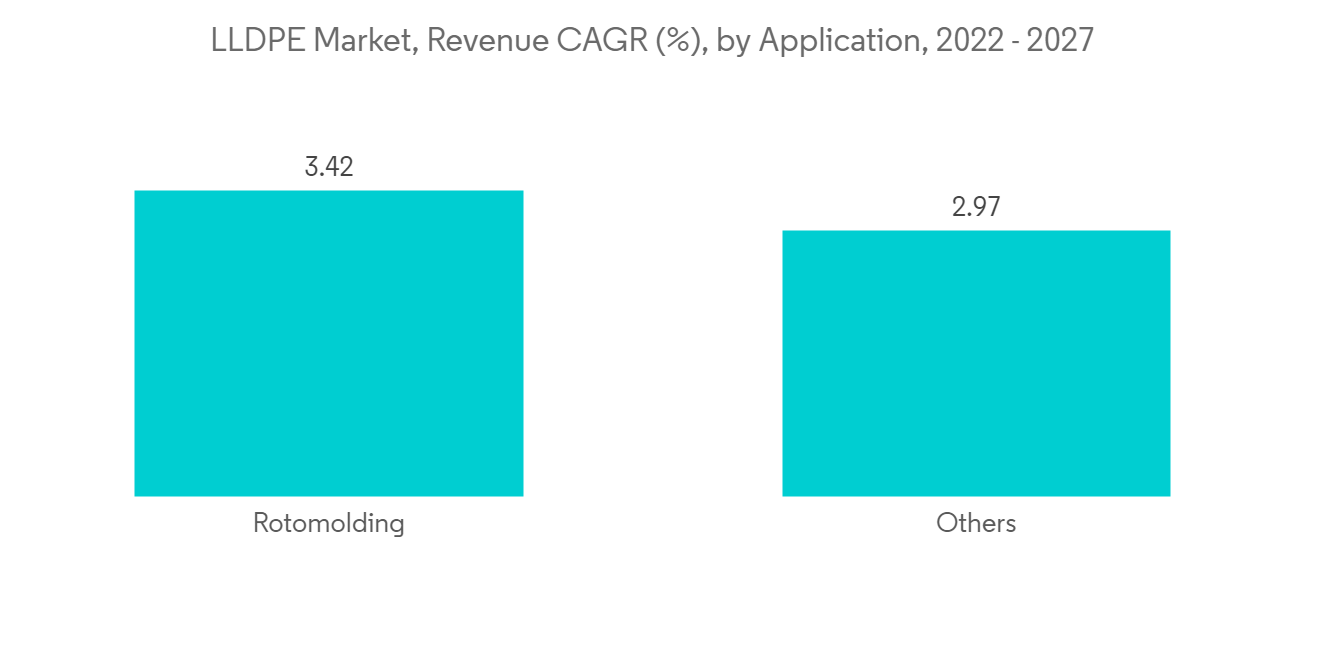

- 5.1 Application

- 5.1.1 Films

- 5.1.2 Molding

- 5.1.3 Injection Molding

- 5.1.4 Other Application Types

- 5.2 End-user Industry

- 5.2.1 Agricultute

- 5.2.2 Electrical and Electronics

- 5.2.3 Packaging

- 5.2.4 Constrution

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Chevron Phillips Chemical Company

- 6.4.2 CNPC

- 6.4.3 Exxon Mobil Corporation

- 6.4.4 Formosa Plastic Corporation

- 6.4.5 INEOS

- 6.4.6 LG Chem

- 6.4.7 Lyonde Bassells Industries Holdings BV

- 6.4.8 Mitsubishi Chemicals

- 6.4.9 Nova Chemicals Corporate

- 6.4.10 Reliance Industries Limited

- 6.4.11 SABIC

- 6.4.12 SINOPEC

- 6.4.13 The Dow Chemical Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for LLDPE in the Pharmaceutical Industry