PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1258766

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1258766

Diabetic Foot Ulcer Treatment Market - Growth, Trends, and Forecasts (2023 - 2028)

The Diabetic Foot Ulcer Treatment Market is expected to register a CAGR of 5.9% over the forecast period.

The COVID-19 pandemic significantly impacted the diabetic foot ulcer treatment market. Certain lockdown restrictions, along with delayed accessibility to healthcare facilities, hampered wound care procedures significantly. Additionally, wound care treatment being recognized as non-essential treatment, postponed during the pandemic. For instance, according to an article published by CutisCareUSA in 2020, it was reported that wound care practice is recognized as a non-essential procedure, and a number of outpatient wound care centers were closed during the pandemic. Also, according to an article published by National Center for Biotechnology Information in August 2022, it was reported that approximately 50% and 70% decrease was observed in the foot clinic visit respectively in Manchester city and Los Angeles after lockdown restrictions. This resulted in limited access to the healthcare settings for diabetic foot ulcer treatment procedures and hindered the demand and adoption of diabetic foot ulcer treatment devices during the pandemic. This alternatively limited the growth of the market during the pandemic. However, in the post-pandemic situation, there is an increase in the adoption of wound care products owing to the reopening of the wound care facilities, ease of lockdown restrictions, and increasing tele-consultancy for wound care.

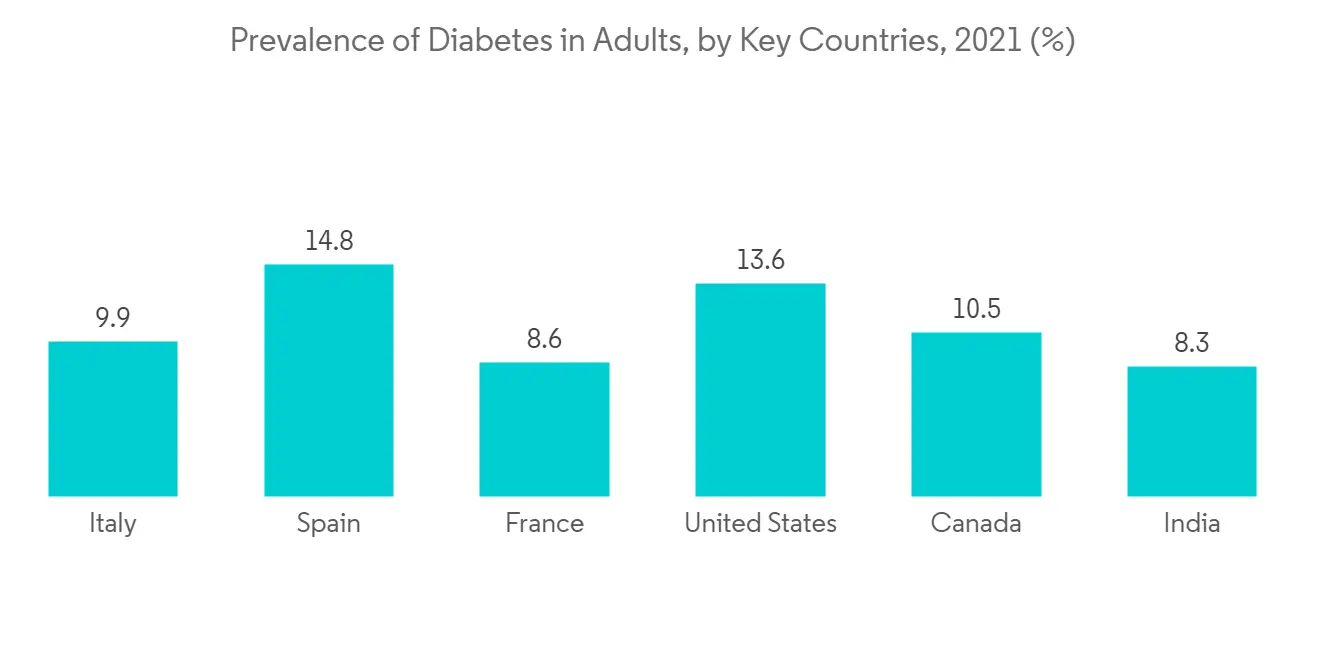

Further, the increasing prevalence of diabetes among the global population is augmenting the risk of diabetic foot ulcers. For instance, in a journal published by the International Diabetes Federation in 2021, it was reported that an estimated 1 in 10 adults suffered from diabetes in 2021 around the globe. According to a report by International Diabetes Federation in February 2022, it was reported that the prevalence of diabetes among the adult population was around 10.0% in Germany, 8.6% in France, and 14.8% in Spain in 2021. According to a report published by National Health Service in September 2022, it was reported that approximately 60,000 patients in the United Kingdom suffered from diabetic foot ulcers every year. Moreover, according to an article published by ANI Media Pvt Ltd in December 2022, it was reported that an estimated 15% of diabetes patients suffer from diabetic foot ulcers. Thus, the increasing number of patients suffering from diabetic foot ulcers is more likely to increase the demand for treatment options and subsequently fuel market growth.

Moreover, technological advancement by the major players in diabetic foot ulcer treatment further fosters the adoption rate of advanced diabetic foot ulcer treatment devices among healthcare professionals. For instance, in January 2020, BenQ Materials Corporation received pre-marketing authorization from Food and Drug Administration (FDA) for Anscare SIMO Negative Pressure Wound Therapy (NPWT) System. This device overcomes the mobility issue for negative pressure wound therapy seamlessly and fuels the adoption rate among healthcare professionals for chronic wound treatment. Also, in April 2020, Huizhou Foryou Medical Devices Co., Ltd. received premarketing authorization for LUOFUCON PHMB alginate dressing which can be used in the management of several wounds, including trauma wounds, diabetic ulcers, and others. Thus, owing to the introduction of such wound care devices and dressing products, the adoption rate of diabetic foot ulcer treatment is anticipated to increase during the study period and fuel market growth.

However, certain factors, including the high cost of chronic wound care devices for the treatment of diabetic foot ulcers, as well as limited awareness among people in developing countries for the available treatment options for diabetic foot ulcers, are limiting the adoption rate of these devices among the general population.

Diabetic Foot Ulcer Treatment Market Trends

Wound Dressings Segment is Anticipated to Hold a Significant Market Share in the Market

Based on product type, the wound dressings segment is expected to contribute a significant proportion of the market. A wide range of product availability, the introduction of advanced wound dressing products, and comparatively lower treatment costs are among the primary factors attributed to the growth of this segment. For instance, in June 2022, Collagen Matrix received pre-marketing authorization for fibrillar collagen wound dressing. This is an absorbent microfibrillar matrix that is used in the treatment of venous stasis ulcers, diabetic ulcers, and acute wounds, among others. In June 2022, Medline Industries, Inc. announced the launch of a new version of Optofoam Gentle EX foam dressing with an aim to treat pressure ulcers, leg ulcers, and others. Additionally, in January 2020, Convatec Group PLC introduced ConvaMax, intending to manage wounds including leg ulcers, pressure ulcers, diabetic foot ulcers, and others precisely. This results in the increasing adoption of wound care dressing products during the study period.

Furthermore, the recent advancement in wound dressings products, including hydrogel dressings and hydrocolloid dressing for the treatment of diabetic foot ulcers, bring a revolution to wound treatment. For instance, in February 2021, the University of Bath, in coordination with Lancaster University, launched a project to treat diabetic foot ulcers with the help of plasma-activated antimicrobial hydrogel therapy. This therapy involved dressing with an antimicrobial molecule and increasing the oxygen levels in the wound with an aim to promote healing and further restrict bacterial growth. This advancement in the wound dressing segment is poised to fuel the adoption rate of wound dressing products during the study period.

Therefore, the wound dressings segment is expected to witness significant growth over the forecast period due to the abovementioned factors.

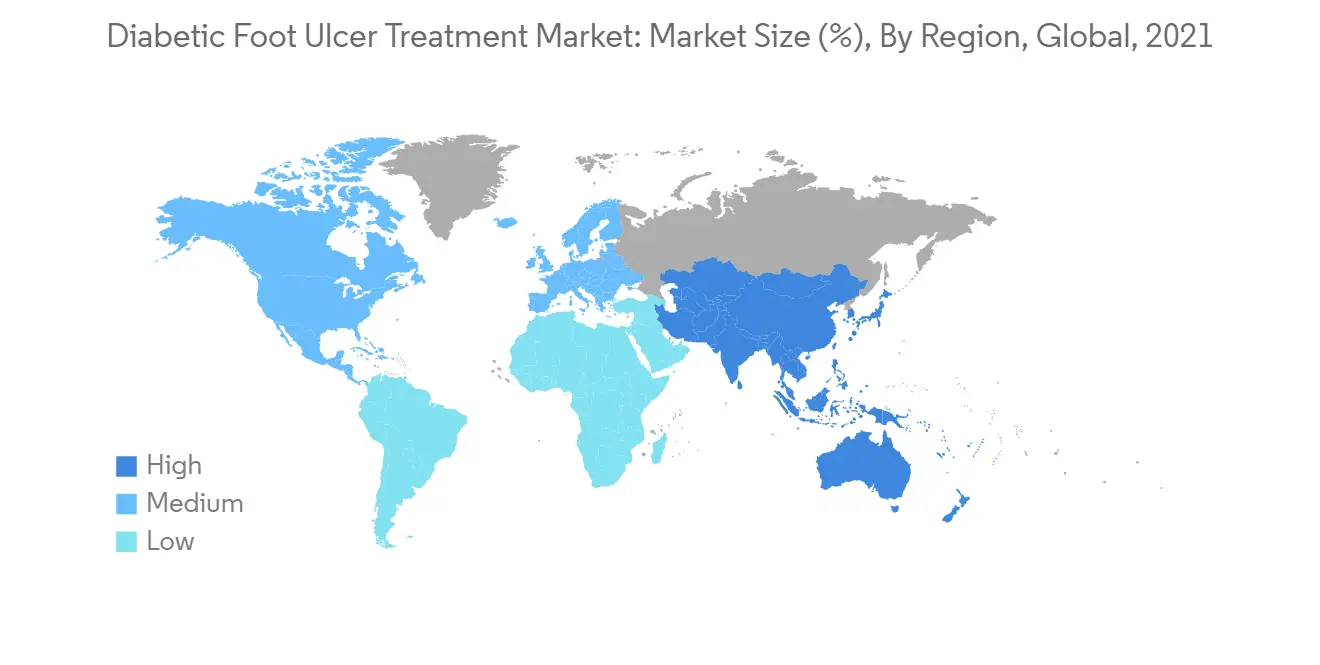

North America is Expected to Dominate the Diabetic Foot Ulcer Treatment Market

North America is expected to dominate the market owing to factors such as the rising prevalence of diabetes and increasing healthcare awareness among the general population on diabetic foot ulcers, among others. For instance, according to the International Diabetes Federation, there were an estimated 14 million adults in Mexico who had diabetes in 2021. Moreover, according to the Canadian Diabetes Association report published in 2022, the prevalence of diabetes was 14% among the Canadian population in 2022 and is expected to increase to 17% by the end of 2032. This increasing patient pool is increasing the healthcare burden for diabetic foot ulcer treatment in North America, resulting in the rising adoption of wound care products during the forecast period.

Additionally, increasing awareness of diabetic foot ulcers among the population in the United States, Canada, and Mexico is also rising the demand and adoption of available treatment options. For instance, Healogics, LLC promoted an awareness campaign on diabetes and related wounds in the United States in November 2022. During this campaign, wound care centers in the United States educated the common people on diabetes and diabetes-related chronic wounds, including diabetic foot ulcers.

Therefore, owing to the aforesaid factors, the growth of the studied market is anticipated in North America.

Diabetic Foot Ulcer Treatment Industry Overview

The Diabetic Foot Ulcer Treatment Market is fragmented in nature due to the presence of several companies operating globally as well as regionally. The key players are Convatec Inc., 3M, and Integra LifeSciences, among others. The other players operating in the market are Coloplast Corp, Cardinal Health, Organogenesis Inc., Medline Industries, Inc., MIMEDX, and Smith+Nephew among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Risnig Prevalence of Diabetes

- 4.2.2 Technological Advancement in the Wound Care

- 4.3 Market Restraints

- 4.3.1 High Treatment Cost of the Advance Wounds

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product Type

- 5.1.1 Wound Dressings

- 5.1.2 Wound Care Devices

- 5.1.3 Other Product Types

- 5.2 By End-User

- 5.2.1 Hospitals and Clinics

- 5.2.2 Ambulatory Surgery Centers

- 5.2.3 Other end-Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle-East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Convatec Inc.

- 6.1.2 Coloplast Corp

- 6.1.3 3M

- 6.1.4 Integra LifeSciences

- 6.1.5 Cardinal Health

- 6.1.6 Tissue Regenix

- 6.1.7 B. Braun SE

- 6.1.8 Organogenesis Inc.

- 6.1.9 Medline Industries, LP.

- 6.1.10 MIMEDX

- 6.1.11 Smith+Nephew

7 MARKET OPPORTUNITIES AND FUTURE TRENDS