PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1273341

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1273341

Gene Delivery Systems Market - Growth, Trends, and Forecasts (2023 - 2028)

The gene delivery systems market is anticipated to register a CAGR of 7.3% over the forecast period.

COVID-19 had a significant impact on the gene delivery systems market. For instance, as per an article published by Drug Discovery Today in October 2021, the research, production, clinical development, and market introduction of cell and gene therapy (CGTs) for diseases unrelated to COVID-19 have all been significantly disrupted because of the COVID-19 pandemic. For CGTs with indications for rare, life-threatening conditions, telemedicine is found to be a potent tool to reduce the loss of follow-ups in clinical trials. Furthermore, Prime Therapeutics launched its PreserveRx gene therapy reinsurance product in the initial phase of COVID-19's spread across the United States to support the only two gene therapies available at the time, Luxturna and Zolgensma. Prime coordinated contracting with the manufacturer Novartis Gene Therapy for value-based outcomes in 2021. Further, in August 2021, Novartis launched a new phase three study to expand the use of Zolgensma, the one-time therapy at USD 2.1 million per patient treatment after the U.S. regulator lifted restrictions. Following these initiatives taken by the market players during the pandemic, the market has recovered and is expected to show robust growth over the forecast period.

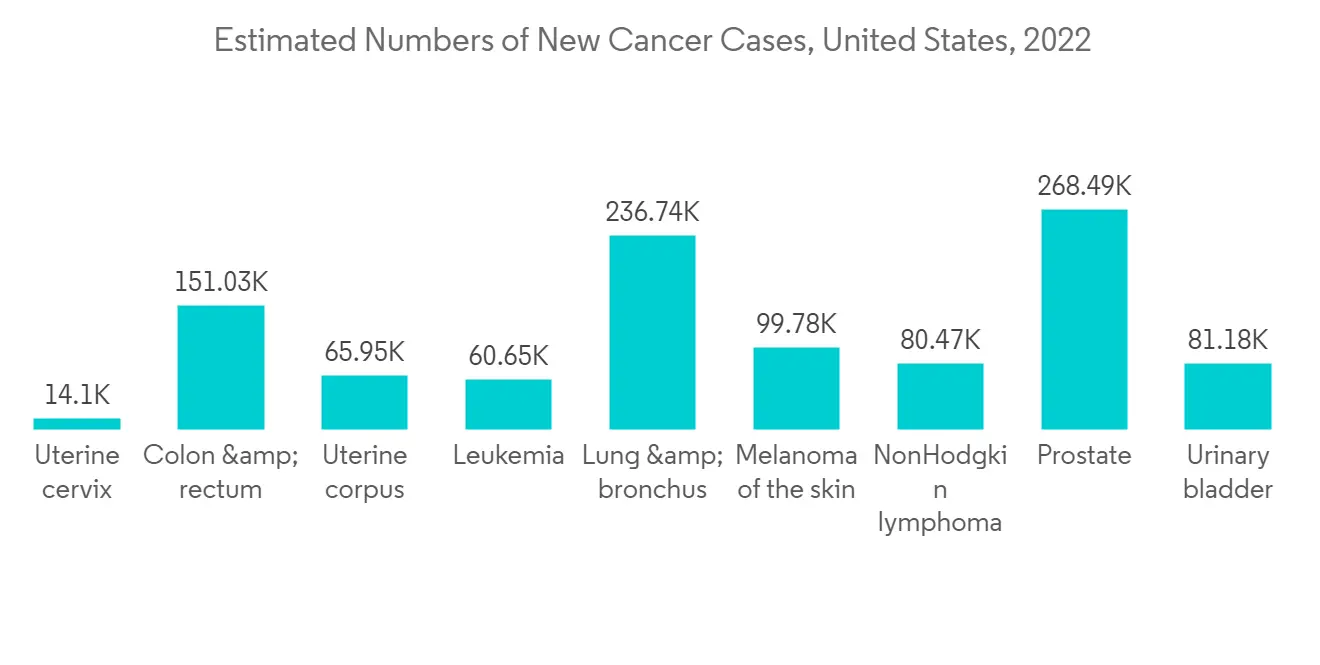

The significant factors contributing to the market growth are the rising incidence and prevalence of chronic diseases and the increasing technological advancement in drug delivery. Some leading chronic diseases in developed countries, such as the United States, are cardiovascular diseases, infectious diseases, cancer, diabetes, and others. For instance, as per a 2023 update from the American Cancer Society, 2 million new cancer cases are likely to be diagnosed in the United States in 2023. Additionally, an article published by the National Library of Medicine, in June 2021 mentioned that in Spain, the reported prevalence of cardiovascular diseases among patients with type 2 diabetes ranged from 6.9% to 40.8% in 2021. According to the same source, the prevalence of coronary heart disease ranged from 4.7% to 37%, stroke from 3.5% to 19.6%, peripheral artery disease from 2.5% to 13.0%, and heart failure from 4.3% to 20.1%. The high incidence of chronic diseases is likely to increase the demand for substantial diagnostic procedures, which drives the market.

Moreover, the increasing ongoing research and development in the field of genomics worldwide are also expected to contribute to the market growth over the forecast period. For instance, in May 2022, Pell Bio-Med Technology Co., Ltd., sponsored a clinical study to evaluate the safety and efficacy in patients who have ever received lentiviral-based gene-edited immune cells manufactured by Pell Bio-Med Technology Co. Ltd. Such research initiatives in the field of gene delivery systems are anticipated to boost the market growth over the forecast period.

Various initiatives taken by the key market players such as product launches, expansion, and partnerships are expected to boost the market's growth during the forecast period. For instance, in June 2021, VIVEbiotech opened its new lentiviral vector manufacturing facilities in Spain, expanding the capacity for lentiviral vectors for use in cell and gene therapies. Such developments are expected to drive the market's growth over the forecast period.

However, the high cost of the treatment is expected to restrain the growth of the studied market over the forecast period.

Gene Delivery Systems Market Trends

Viral Gene Delivery Systems Segment is Expected to Hold the Largest Share in the Gene Delivery Systems Market

Viral gene delivery systems consist of viruses that are modified to be replication-deficient, which can deliver the genes to the cells to provide expression. Adenoviruses, retroviruses, and lentiviruses are used for viral gene delivery. Viral gene delivery systems are likely to hold a significant market share over the forecast period owing to attributes such as long-term expression and short-term expression, the efficacy of therapeutic genes, and the rising advancement in technology over the last few years which have opened up many opportunities for growth in the healthcare industry. The increase in the prevalence of chronic diseases, such as cancer and cardiovascular disorders, has also aided in market growth. For instance, according to the British Heart Foundation England Factsheet, published in January 2022, about 6.4 million people are living with cardiovascular diseases in England. Also, according to the CDC, in 2021, around 18.2 million adults aged 20 and older had coronary artery disease (CAD) in the United States. Heart disease is the leading cause of death among people in the United States. Thus, the rise in chronic diseases will significantly drive the growth of the studied market.

The growing emphasis on governing and raising awareness about these treatments by governments in different countries has resulted in the rapid acceptance of these gene delivery systems worldwide. For instance, as per the September 2022 report from World Economic Forum, the unique nature of personalized gene therapy treatments makes them difficult to regulate within traditional frameworks. The same source stated that, in the United States, over 60 gene therapies are expected to receive approval by 2030, forcing the FDA to quickly evolve to adequately judge the safety and efficacy of these novel treatments. These regulatory changes are creating ripple effects around the globe as countries seek to converge their regulatory requirements, making it easier and quicker for companies to bring their gene therapies to more markets sooner. Such initiatives around the globe are likely to adopt gene therapy and thereby utilize the gene delivery systems and leading to market growth.

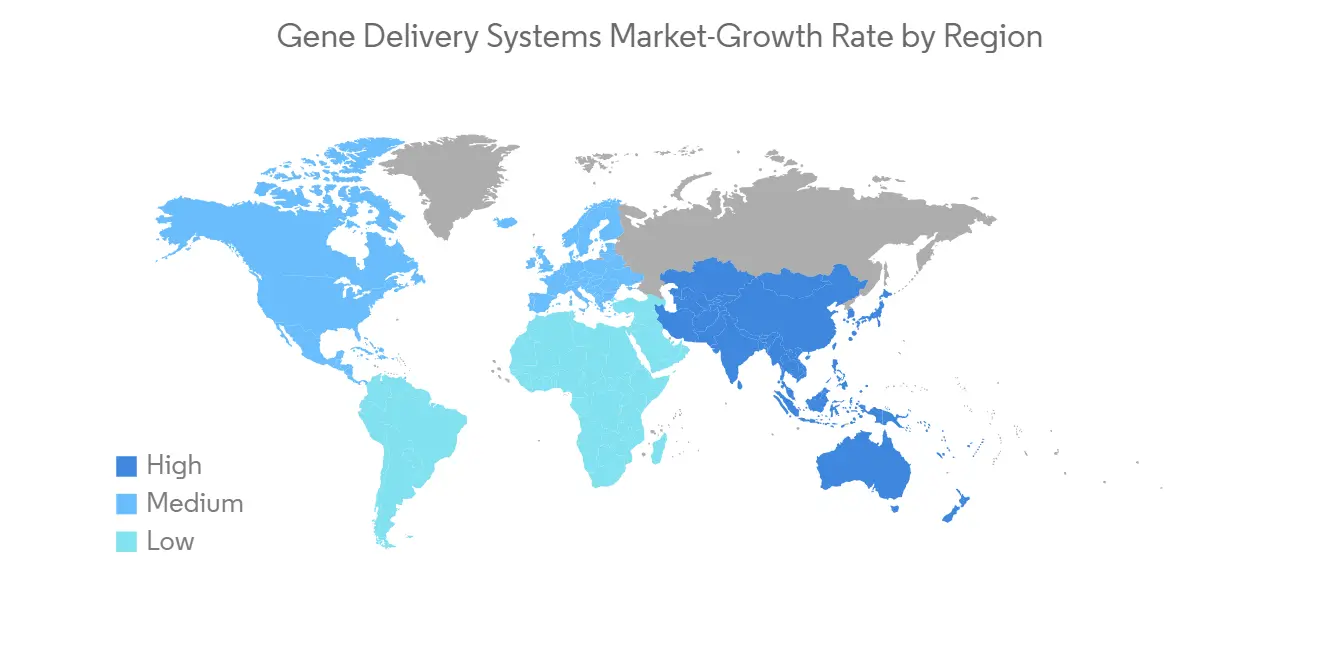

North America is Likely to Show a Significant Market Growth Over the Forecast Period

North America is expected to maintain its overall gene delivery systems market supremacy throughout the forecast period. The factors such as the rising prevalence of chronic diseases, technological advancement, and the domicile presence of major players have been driving the market growth in the region. For instance, per the data published by the American Cancer Society in January 2023, an estimated 1,958,310 new cancer cases will be diagnosed in the United States in 2023. In addition, in the US, the population aged 65 or more was 54.1 million (16% of the total population) in 2019, which is estimated to be 21.6% by 2040.

Additionally, the presence of major market players and key strategies implemented by them, such as partnerships and collaborations, are also contributing to the market growth. For instance, as per the June 2021 news report, Health Canada approved five gene therapies (Kymriah, Yescarta, Spinraza, Luxturna, and Abecma), and there are more in the pipeline. Based on the number of clinical trials in progress, there are likely to be 10-20 gene therapy products approved every year for the next few years. Moreover, government funding in the field of gene therapy to conduct research is one of the primary growth factors of the studied market. For instance, as per a news report published in May 2022, Virica Biotech collaborated with the government of Canada to support the manufacturing of an aav-lpl (lipoprotein lipase) gene therapy to treat lipoprotein lipase deficiency. The USD 40,000 in funding from Innovation, Science and Economic Development Canada (ISED) received by Virica was used to support its work with the National Research Council (NRC) of Canada's Cell and Gene Therapy Challenge program.

Gene Delivery Systems Industry Overview

The gene delivery systems market is consolidated in nature due to the presence of a few companies operating globally as well as regionally. The competitive landscape includes an analysis of a few international as well as local companies which hold market shares and are well-known, including Pfizer, Inc., Becton, Dickinson and Company, Takara Bio, Novartis AG, and F. Hoffmann-La Roche Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Burden of Chronic Diseases and Lifestyle Disorders

- 4.2.2 Technological Advancements in Research by Biopharmaceutical Companies

- 4.3 Market Restraints

- 4.3.1 High Cost of Treatment

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Million)

- 5.1 By Delivery Systems

- 5.1.1 Viral Gene Delivery Systems

- 5.1.1.1 Adenovirus Systems

- 5.1.1.2 Lentiviral Systems

- 5.1.1.3 Retroviral Systems

- 5.1.1.4 Other Viral Gene Delivery Systems

- 5.1.2 Non-viral Gene Delivery

- 5.1.3 Combined Hybrid Delivery Systems

- 5.1.1 Viral Gene Delivery Systems

- 5.2 By Application

- 5.2.1 Oncology

- 5.2.2 Infectious Diseases

- 5.2.3 Cardiovascular Disorders

- 5.2.4 Diabetes

- 5.2.5 Pulmonary Disorders

- 5.2.6 Other Applications

- 5.3 By Route of Administration

- 5.3.1 Oral

- 5.3.2 Injectable

- 5.3.3 Nasal

- 5.3.4 Other Routes of Administration

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Pfizer Inc.

- 6.1.2 Novartis AG

- 6.1.3 F. Hoffmann-La Roche AG

- 6.1.4 Becton, Dickinson and Company

- 6.1.5 Takara Bio

- 6.1.6 Shenzhen SiBiono GeneTech Co. Ltd

- 6.1.7 Bayer AG

- 6.1.8 Amgen Inc.

- 6.1.9 Shanghai Sunway Biotech Co. Ltd

- 6.1.10 Genezen

- 6.1.11 GenScript ProBio

- 6.1.12 Batavia Biosciences

- 6.1.13 Sirion-Biotech GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS