PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1273522

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1273522

Hemato Oncology Testing Market - Growth, Trends, and Forecasts (2023 - 2028)

The Hemato Oncology Testing Market is expected to register a CAGR of nearly 5% during the forecast period.

The COVID-19 outbreak significantly impacted the availability of hospital resources for cancer care worldwide. For instance, according to an article published by Hematological Oncology in October 2022, the COVID-19 pandemic introduced significant changes in oncologic practice globally, including lymphoma care with a substantial burden on patients and healthcare providers and the potential worsening of patient outcomes. Moreover, according to an article published by the Journal of Clinical Oncology in September 2022, a study was conducted in the United States, which showed that the number of newly diagnosed multiple myeloma patients decreased by 22% during the initial pandemic. However, in the later phase of the pandemic, there was an increase in the demand for cancer diagnostics, including hematological cancers. Thus, the market witnessed significant challenges during the initial phase of the pandemic, but as the SARS-CoV-2 cases started to decline, cancer care went back to normal, and the market witnessed significant growth over time.

The factors that are driving the market growth are the increasing incidence of hematologic cancer and the growing demand for personalized therapy. According to an article updated by PubMed Central in April 2022, leukemia is considered one of the most common cancers in children younger than five years of age, and it accounts for a high percentage of deaths, creating a significant burden on individuals, families, and countries. The occurrence of leukemia in children is leading to the increase in demand for hemato oncology testing, thereby driving the demand for products and services associated with it.

Besides, the growing demand for personalized therapy is also significantly contributing to the market growth. Personalized medicine aims to provide tailor-made therapies to individual patients depending on the molecular basis of the disease, and it has become popular over recent years. The rise in the prevalence of various types of cancer, affordability of personalized medicine therapy in cancer drugs and various other disease indications, fewer side-effects of personalized medicine, and high adoption in developed markets are factors that are creating demand for personalized therapy. Moreover, various firms are conduction studies to prove the effectiveness of personalized medicine in blood-related cancer. For instance, in September 2021, the UC Cancer Center researchers joined a national collaborative, personalized medicine clinical trial for developing personalized treatments for blood and bone cancer.

Additionally, the launch of products is also propelling the market's growth. For instance, in May 2022, Genes2Me launched next-generation sequencing (NGS) based clinical panels for oncology, personalized medicine, and hereditary diseases in India. Furthermore, in October 2021, Sysmex Inostics developed a new liquid biopsy test for the detection of minimal residual disease (MRD) in acute myeloid leukemia (AML). The new test, AML-MRD-SEQ, uses a targeted next-generation sequencing (NGS) panel that covers 68 regions across 20 genes, including established MRD markers such as NPM1.

However, unfavorable reimbursement scenarios may slow down the growth of the studied market.

Hemato Oncology Testing Market Trends

Services Segment is Expected to Witness Significant Growth over the Forecast Period

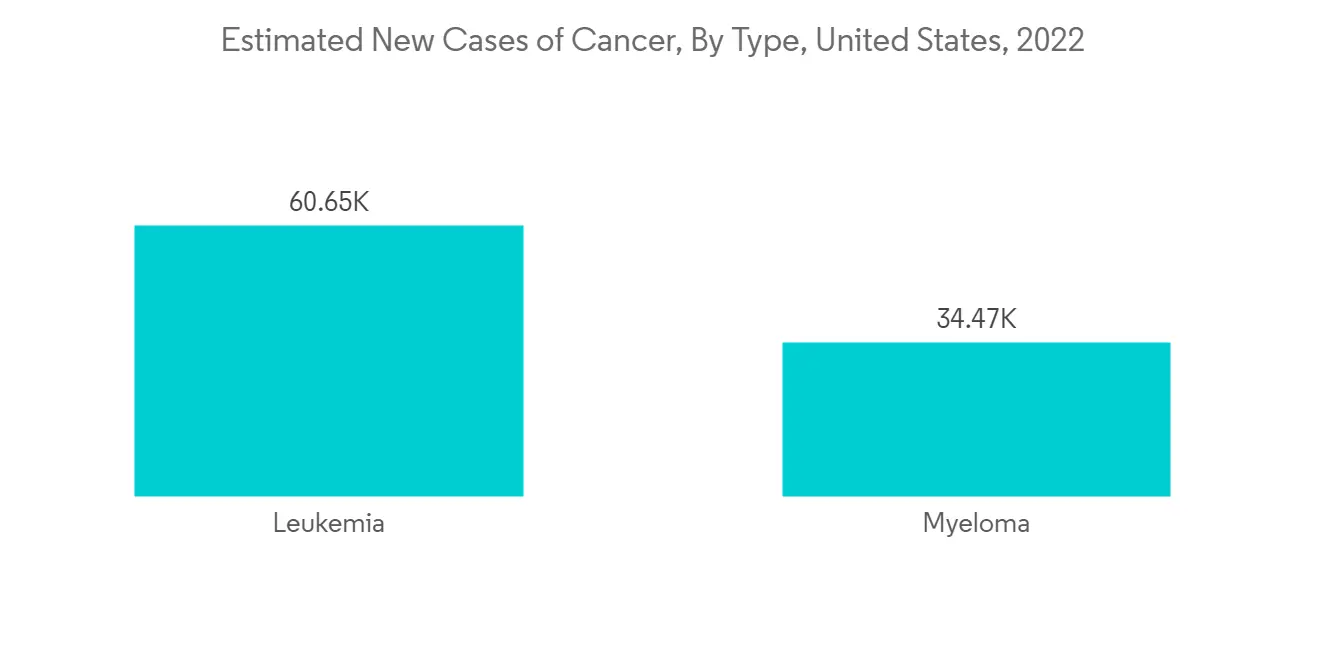

The services segment is expected to witness significant growth in the hemato-oncology testing market over the forecast period. This can be attributed to increasing awareness of advanced therapies such as personalized medicine and the rising prevalence of leukemia, non-Hodgkin lymphoma, and myeloma cancers.

Precision medicine is based on each patient's unique genetic makeup as opposed to traditional medicine, and it provides better treatment for hemato oncology treatment. For instance, in July 2022, The National Cancer Center conducted a prospective cohort study on the gene panel testing for blood cancers (hematological malignancies) developed with Otsuka Pharmaceutical Co., and it showed that the clinical utility of the panel testing was notably high in diagnosis and prognosis. Thus, such initiatives in hemato-oncology testing are expected to boost the testing services for hemato-oncological diseases.

Also, the high global prevalence of leukemia, non-Hodgkin's lymphoma, and myeloma cancer is driving the growth of the studied segment. For instance, according to the data published by Cancer Australia in August 2022, an estimated 5,202 new cases of leukemia were diagnosed in Australia in 2022. Thus, the high incidence of lymphoma, leukemia and myeloma cancer globally is increasing the demand for hemato oncology testing services, thereby propelling the growth of the studied market.

Similarly, according to a report published by ICMR-National Centre for Disease Informatics and Research in 2021, leukemia accounted for nearly half of all childhood cancers in both genders in the 0-14 years age group in India; it had a prevalence of 46.4% in boys and 44.3% in girls in 2021. The other common childhood cancer in boys was found to be lymphoma (16.4%) in 2021. Hence, the high prevalence of hematologic cancers is expected to drive the growth of the studied market.

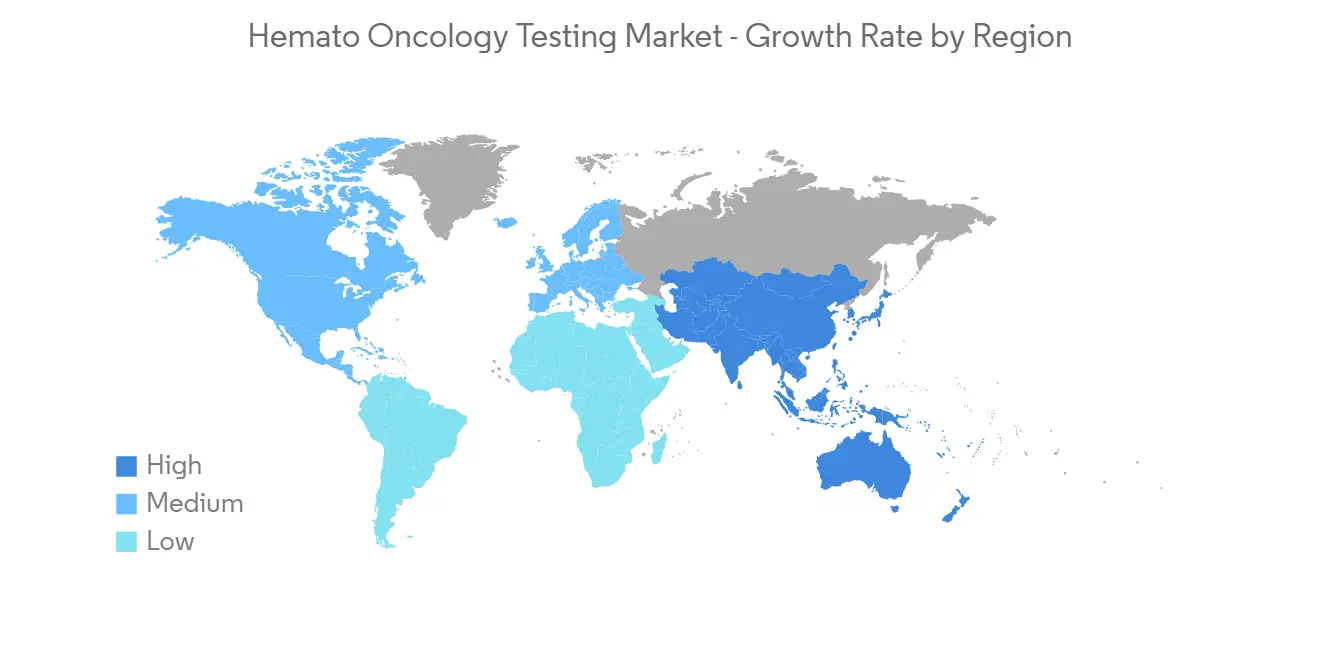

North America Region is Expected to Witness Significant Growth over the Forecast Period

North America is at the forefront of growth in the region and is also an important revenue contributor in the global arena. The large share of this segment can primarily be attributed to the high incidences of hematologic cancer, the aging population, awareness regarding advanced treatment methods, and the strong presence of industry players in the region.

The rising prevalence of leukemia, lymphoma, and multiple myeloma is stimulating the growth of the market in the region. For instance, as per the Canada Cancer Society's statistics for 2022, around 6,700 Canadians were diagnosed with leukemia in 2021, out of which 4,000 were men and 2,700 were women. Also, as per the American Cancer Society's data for 2023, around 59,610 new cases of leukemia and 20,380 new cases of acute myeloid leukemia (AML) are expected to be diagnosed in the United States in 2023. Thus, the high incidence of blood cancer cases is leading to an increase in hemato oncology testing, thereby driving the market in the region.

Furthermore, various organizations are taking initiatives for better blood cancer care which is expected to drive market growth. For instance, in 2021, the Leukemia & Lymphoma Society (LLS) announced that they provided more than USD 241 million in grants to support over 42,000 blood cancer patients in the United States. Hence, such initiatives are also supporting market growth.

Hemato Oncology Testing Industry Overview

The hemato-oncology testing market is fragmented and competitive in nature. The companies have been following various strategies such as acquisitions, partnerships, investments in research activities, and new product launches to sustain themselves among the competitors in the global market. The market consists of several major players, and a few of the major players are currently dominating the market, which include F. Hoffmann-La Roche Ltd, Abbott, QIAGEN, Thermo Fisher Scientific Inc., and Illumina Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Incidence of Hematologic Cancer

- 4.2.2 Growing Demand for Personalized Therapy

- 4.3 Market Restraints

- 4.3.1 Unfavorable Reimbursement Scenario

- 4.4 Porter Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product & Services

- 5.1.1 Assay Kits and Reagents

- 5.1.2 Services

- 5.2 By Cancer Type

- 5.2.1 Leukemia

- 5.2.2 Lymphoma

- 5.2.3 Multiple Myeloma

- 5.2.4 Others

- 5.3 By Technology

- 5.3.1 Polymerase chain reaction (PCR)

- 5.3.2 Immunohistochemistry (IHC)

- 5.3.3 Next-Generation Sequencing (NGS)

- 5.3.4 Other Technology

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Academic & Research Institutes

- 5.4.3 Other End-Users

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 F. Hoffmann-La Roche Ltd

- 6.1.2 Abbott

- 6.1.3 Invitae Corporation (Archerdx, Inc)

- 6.1.4 QIAGEN

- 6.1.5 Thermo Fisher Scientific Inc.

- 6.1.6 Illumina Inc.

- 6.1.7 Bio-Rad Laboratories, Inc.-

- 6.1.8 Molecularmd (Subsidiary of Icon PLC)

- 6.1.9 Asuragen, Inc.

- 6.1.10 Arup Laboratories Inc.

- 6.1.11 Icon PLC

- 6.1.12 Adaptive Biotechnologies.

- 6.1.13 Invivoscribe, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS