PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1332584

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1332584

India Spray Dried Food Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028)

The India Spray Dried Food Market size is expected to grow from USD 3.79 billion in 2023 to USD 4.80 billion by 2028, at a CAGR of 4.84% during the forecast period (2023-2028).

Key Highlights

- The market is driven by the varied applications of spray-dried ingredients with their functional benefits in the food industry. The spray-dried food powders prepared using spray drying technology offer extended shelf life, reduced storage requirements, and lower cost of bulk packing.

- Furthermore, rising consumer awareness of health benefits from dietary consumption is another reason for increasing the consumption of spray-dried ingredients in the food service industry in India, as spray drying involves a shorter drying treatment time (90-120 seconds), with high efficiency compared to other conventional drying techniques, thus retaining the heat-sensitive nutrients in the food products. The growing desire for nutrient-rich foods and their numerous applications in many industries, particularly dairy or fruit, and vegetables, is the key factor driving the global market for spray-dried food.

- Furthermore, the market for spray-dried foods is also being driven by expanding prospects in the food and beverage industry, including the bakery, snack, and confectionery segments, as well as a growing extension of the shelf life of these items for extended periods. For instance, according to the United States Department of Agriculture (USDA) Foreign Agriculture Service (FAS), the production volume of skimmed milk power increased to 740 thousand metric tons in 2023 from 635 thousand metric tons in 2019. Thus, the growing consumption of dry-particulate foods is driving the demand for the spray-dried food market.

- However, the market is being constrained by factors including high initial capital requirements, high maintenance costs, and the availability of rival cutting-edge technologies like freeze drying and vacuum drying.

India Spray Dried Food Market Trends

Increasing Demand from Dairy Industry

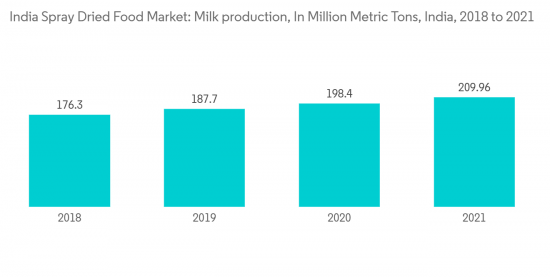

- The dairy industry has mostly used spray drying as a well-known technology in India. It is the world's largest milk producer, with an output of more than 209.96 million tons of cows' milk in 2021, according to Food and Agriculture Organization Corporate Statistical Database (FAOSTAT). By spraying the milk solution or suspension into a hot drying gas medium, spray drying is a solid dispersion-based method that turns a material from a liquid to a dried powder state. Also, it is a preservation technique that reduces the water content of milk, enhancing its shelf life.

- Milk is converted into different forms using many drying methods, including spray drying. The most often produced items employing the spray drying technique are various dairy products, including milk powder, milk protein concentrates, ice cream powder mix, dry creamers, and many others.

- Whey powder is a product obtained through spray-drying and can be manufactured by separating protein from milk by adopting separation techniques before drying. The separation process removes most of the carbohydrates and leaves only minerals like calcium, phosphorus, and magnesium behind, which are then bound with proteins. Thus, it is a rich protein source when compared to skimmed milk powder and whole milk powder. The manufacturers of sports nutritional products widely prefer whey protein concentrate due to its wide availability, strong amino acid profile, and easy digestibility.

- Meanwhile, the consumption of sports nutrition has increased among fitness enthusiasts and active lifestyle consumers as it aids in gaining energy and muscle and supports weight management across countries like India. According to MuscleBlaze in India, the company saw its annual sales grow by nearly 25% in 2020, and the growth was largely propelled by the popularity of products, such as its Biozyme Whey Protein.

- Also, according to the United Nations Commodity Trade (UN COMTRADE) Statistics Database , the import of protein concentrates and textured protein substances to India witnessed a growth in the imports of the same, i.e., 4,480,336 kg in the year 2021. Thus, the increasing demand for similar products is driving the growth of the Indian spray dried food market.

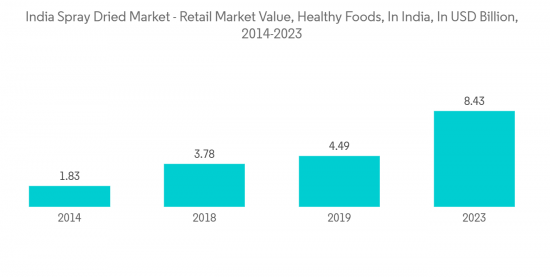

Consumer Inclination Toward Nutrient-rich Foods

- The food industry is undergoing significant transformation, producing ingredients-rich food products because of consumers' growing awareness of the impact of food ingredients on their health. In place of synthetic substances for the preservation of some foods, consumers have preferred more natural foods and fewer inorganic goods. The use of spray drying can help with the creation of cutting-edge procedures because it is essential for maintaining the active constituents like antioxidants, vitamins, and other volatile compounds in many food products, such as spices and herbs, fruit and vegetable powders, especially.

- Also, there is much interest from food manufacturers in producing natural plant-based powder forms of colorants, pigments, and biomaterials due to their potential capabilities. The use of synthetic colorants diminishes in parallel with consumer demand because of the adverse effects on health and the environment they have. However, natural colorants have some limitations, such as stability and availability. For this reason, it is not possible to use natural colorants directly in food processing, and the natural colorants are degraded in process conditions.

- Therefore, natural colorants' stability and characteristics are enhanced using different methods. One of the most effective methods is drying, which is considered a good way to protect sensitive materials such as natural colorants. Among these drying techniques, spray drying is one of the most widely used methods for heat-sensitive food. The powder of natural colorants obtained by spray dryers has a long shelf life, high stability, and applicability. Besides, spray drying is extensively used for the encapsulation process, when it entraps bioactive materials within a protective matrix to improve the stability of sensitive and functional food ingredients, such as natural food colorants.

- For instance, results from several research demonstrated that spray drying enhanced both recovery and product qualities. A recent study published in the journal Powder Technology discovered that mango powder, spray-dried (using dehumidified air), had a greater total carotenoid content than its cast-tape dried equivalents.

India Spray Dried Food Industry Overview

The India spray-dried market is highly fragmented, particularly with the significant presence of numerous local and regional players. Major Key Players are Drytech Processes, Aarkay Foods, Foods & Inns, Venkatesh Naturals, Mevive International, Green Rootz, and Naturex. Some of the other domestic players in the Indian spray-dried market include HBH Foods, RB Foods, Natural Dehydrated Vegetables, Vee Kay International, National Food & Spices, Aayush Food Products, Kirti Foods Pvt Ltd., and others. The players are adopting and improvising their market offerings with the continuously evolving market scenario

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Defination

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Fruits

- 5.1.2 Vegetables

- 5.1.3 Dairy Products

- 5.1.4 Meat, Poultry and Seafood

- 5.1.5 Other Product Types

- 5.2 Application

- 5.2.1 Bakery and Confectionery

- 5.2.2 Dairy

- 5.2.3 Infant Foods

- 5.2.4 Nutraceuticals

- 5.2.5 Pet Foods

- 5.2.6 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Givaudan S.A. (Naturex)

- 6.3.2 Drytech Processes Pvt Ltd.

- 6.3.3 Foods & Inns Ltd.

- 6.3.4 Venkatesh Natural Extract Pvt. Ltd .

- 6.3.5 Green Rootz

- 6.3.6 Mevive International Food Ingredients

- 6.3.7 Aarkay Food Products Ltd.

- 6.3.8 Vinayak Ingredients (India) Pvt. Ltd.

- 6.3.9 Saipro Biotech Private Limited

- 6.3.10 Nestle S.A.

- 6.3.11 Dohler GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS