PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1333714

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1333714

Agrigenomics Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028)

The Agrigenomics Market size is expected to grow from USD 3.96 billion in 2023 to USD 6.10 billion by 2028, at a CAGR of 9.02% during the forecast period (2023-2028).

Key Highlights

- Agrigenomics is the study of plants' genetic makeup and how the genes contribute to crop production. Microarray and next-generation sequencing (NGS) technologies are helping breeders and researchers evaluate and predict genetic merit in plants and animals, informing crucial decisions about selection and health. The research aims to completely understand yield optimization, plant evolution, disease resistance, phylogenetic relationships, pest control, stress tolerance, and food and biofuel optimization.

- The rising applications of agrigenomics in routine agriculture activities, the increasing number of deoxyribonucleic acid/ribonucleic acid (DNA/RNA) sequencing project grants, and technological developments in genomics and agriculture are some of the key drivers expected to drive market growth during the forecast period. The other factors supporting the growth of the global agrigenomics market are the increasing food consumption volume due to the increasing population, the growing use of advanced tools and techniques of genome research testing, and rising investments in research & development activities by government-funded organizations.

- Illumina technology has become increasingly popular in agriculture for developing high-yielding genomics in livestock and crops. This technology enables researchers and breeders to identify genetic variations responsible for desirable traits, such as disease resistance, increased productivity, and improved quality. By sequencing the genomes of various organisms and analyzing the data using Illumina technology, researchers can identify specific genes and genetic markers associated with these traits, which can then be used to develop new and improved strains of crops and livestock. Microarray and next-generation sequencing (NGS) technologies are useful for studying various aspects of plant and animal genomics, including genotype, gene expression and regulation, and epigenetics. These approaches offer the throughput, sensitivity, and precision needed to evaluate genetic markers and discover new ones associated with traits or diseases.

- The increase in applications of genome sequencing in livestock not only enables the study of parent lineage but also aids in understanding the characteristics of infectious agents, such as bacteria and viruses that infest them or live on them. The resolution of the next-generation sequencing enables researchers to study the mutations in infectious agents over time, and help in understanding the transmission patterns of these diseases, thereby contributing to the development of effective treatment.

Agrigenomics Market Trends

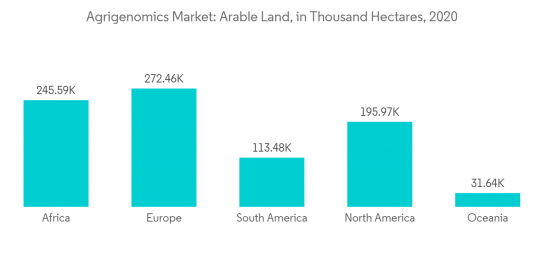

Growing Food Demand and Shrinking Land

- The global population has been increasing rapidly and is projected to reach 9.7 billion by 2050. With this increase in population, there is also a growing demand for food, which has put pressure on the agricultural sector to produce more food. However, the agriculture industry faces several challenges, including climate change, land degradation, water scarcity, and limited resources, making it difficult to meet the increasing demand for food.

- On the other hand, due to industrialization and urbanization, the available arable land is decreasing in many regions globally. Hence, increasing crop productivity is needed to meet the demands. The application of agrigenomics increased crop productivity by developing high-yielding crop varieties and sustainable solutions for livestock products.

- Farmers, breeders, and researchers can easily identify the genetic markers linked to desirable traits, informing cultivation and breeding decisions using modern technology. Although new plant technologies are continuously being developed to fight pest attacks, they are also leading to the development of new and difficult-to-kill strains of pests. The losses in major crops due to fungi are enough to feed nearly 9% of the global population. Thus, it is the key strategy farmers adopt to meet global food demand.

- According to the Food and Agriculture Organization (FAO), many countries are developing sustainable grains to feed the growing world population while safeguarding the natural environment, diversifying food production, protecting plant and animal health, and reducing the drudgery of farming. Genetic resources are also crucial to livestock breeding and protection. Therefore, the government supports the development of policies and standards to protect public and animal health while managing natural resources and developing improved technologies to meet animal genetic resources.

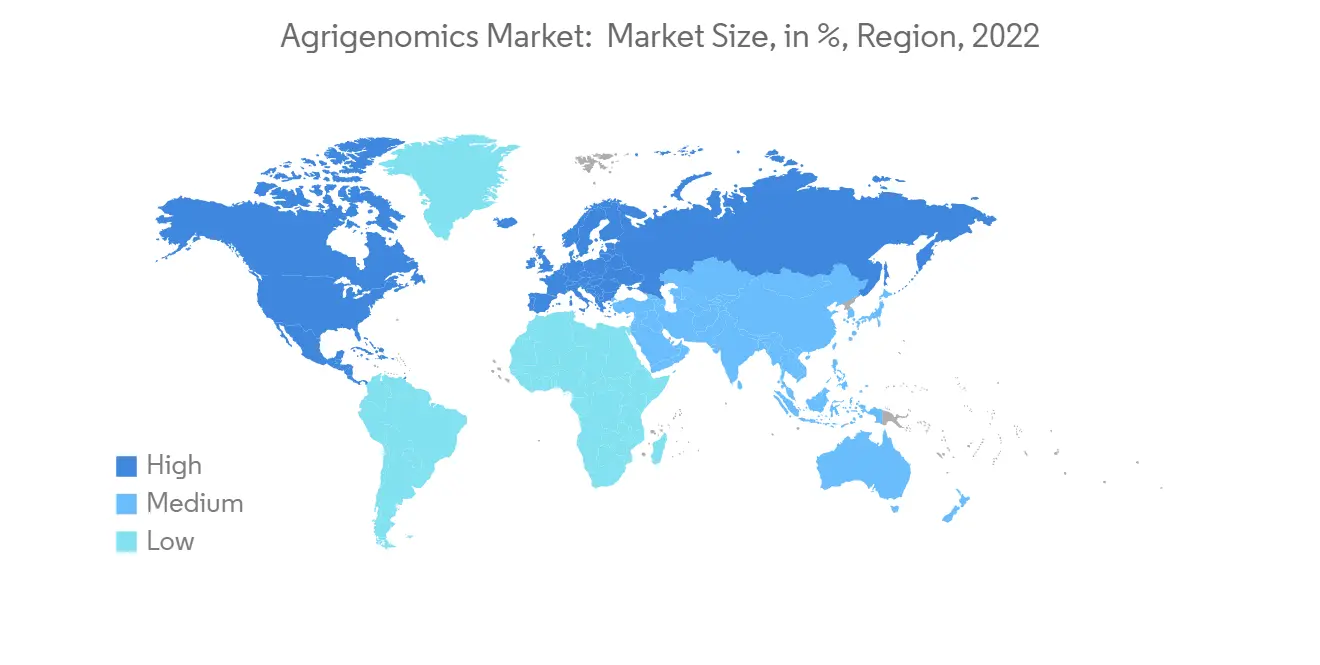

North America Dominates the Market

- The North American agrigenomics market is experiencing steady growth due to the increasing adoption of high-yielding varieties, as they can reduce the usage of harmful pesticides by enhancing the resistant power during the initial stages. Genotyping within agrigenomics provides breeders and researchers powerful, cost-effective tools to detect markers associated with complex genetic traits.

- According to the United States Department of Agriculture (USDA) report, the greater adoption of genetically engineered (GE) seed varieties in crops like corn, upland cotton, soybeans, canola, and sugarbeets is witnessed in the region. For instance, herbicide-tolerant (HT) crops tolerate specific broad-spectrum herbicides (such as glyphosate, glufosinate, and dicamba). Insect-resistant crops contain a gene from the soil bacterium Bacillus thuringiensis (Bt) that produces an insecticidal protein.

- Although other genetically engineered (GE) traits have been developed (such as virus and fungus resistance, drought resistance, and enhanced protein, oil, or vitamin content), herbicide-tolerant (HT) and Bacillus thuringiensis (Bt) traits are the most commonly used in US crop production.

- The adoption of agrigenomics is majorly attributed to overcoming the usage of pesticides in the United States. Strong R&D and innovation of new technologies, coupled with the increasing merger and acquisition (M&A) activities, are the major factors fueling the region's market growth. The greater acceptance of genetically modified (GMO) crops in the United States is a result of their perceived benefits, such as increased yields, reduced use of pesticides, and improved crop quality.

- As you mentioned, more than 90 percent of the corn, soybean, cotton, canola, and sugar beet acreage in the United States is genetically modified. As per the USDA report, in 2020, 94% of the soybean crops in the United States were genetically modified to be herbicide tolerant, followed by cotton, accounting for 83%, and corn, accounting for 10%.

Agrigenomics Industry Overview

The agrigenomics market is a moderately consolidated market, with a few key players holding a majority of the market share. Eurofins Scientific Se, Thermo Fisher Scientific Inc., Illumina Inc, Zoetis Inc, and Tecan Genomics, Inc. are the prominent players in the market studied. New product launches, partnerships, and expansions are the major strategies the leading companies adopt. Along with innovations and expansions, investments in R&D and developing novel product portfolios will likely be crucial strategies in the coming years.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of Substitute Products

- 4.4.4 Threat of New Entrants

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Real-Time PCR (qPCR)

- 5.1.2 Microarrays

- 5.1.3 Next Generation Sequencing

- 5.1.4 Capillary Electrophoresis

- 5.1.5 Other Technologies

- 5.2 Application

- 5.2.1 Crops

- 5.2.2 Livestocks

- 5.3 Service Offerings

- 5.3.1 Genotyping

- 5.3.2 DNA Fingerprinting

- 5.3.3 Assessment of Genetic Purity

- 5.3.4 Trait Purity Assessment

- 5.3.5 Gene Expression Analysis

- 5.3.6 Other Service Offerings

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Share Analysis

- 6.2 Mergers & Acquisitions

- 6.3 Company Profiles

- 6.3.1 Eurofins Scientific Se

- 6.3.2 Thermo Fisher Scientific' Inc

- 6.3.3 Illumina' Inc.

- 6.3.4 Zoetis' Inc.

- 6.3.5 Neogen Corporation

- 6.3.6 Galseq Srl Via Italia

- 6.3.7 Agrigenomics' Inc.

- 6.3.8 Biogenetic Services' Inc.

- 6.3.9 Arbor Biosciences

- 6.3.10 Tecan Genomics, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS