PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1643023

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1643023

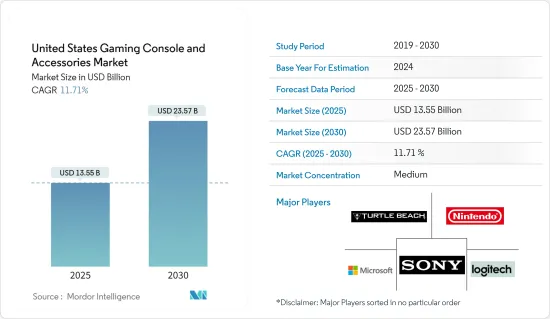

United States Gaming Console & Accessories - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The United States Gaming Console & Accessories Market size is estimated at USD 13.55 billion in 2025, and is expected to reach USD 23.57 billion by 2030, at a CAGR of 11.71% during the forecast period (2025-2030).

Continuous technological advancements in the gaming industry are driving the expansion of the gaming console and accessories market. Game developers in the United States continually strive to enhance gamers' experience, thereby launching and rewriting codes for various consoles/platforms, such as PlayStation, Xbox, and Windows PC, incorporated into one product and provided to the gamers through the cloud platform.

Key Highlights

- The rapid growth of e-sports has increased the demand for advanced gaming keyboards and gamepads. The gaming accessories market is expected to grow over the forecast period with the continuous enhancement of gaming content.

- Integration of newer technologies, Like 3D and AR/VR gaming, is driving the market. The gaming console is no longer limited to characters fighting battles, completing missions, and conquering foes in two-dimensional space. Virtual reality is where technology meshes video games with the real 3D world. Diminishing the lines between fantasy and reality, VR is helping create gaming worlds that are more realistic and immersive for today's technology-obsessed gamers.

- Cloud gaming is an emerging technology across the gaming industry, allowing users to stream high-end games across hand-held devices, such as laptops, tablets, and mobiles, with fast network connectivity, thereby eliminating the requirement for a regular hardware upgrade or a gaming console/PC. Such factors are anticipated to have a negative impact on market growth in the long term.

- Due to the COVID-19 lockdown, people stayed home, and some turned to the gaming platform to spend their time. These platforms attracted more new visitors in online traffic and created a demand for various gaming accessories. Furthermore, the increase in gaming during the COVID-19 lockdown came with a surge in new game releases. Post-pandemic, the market was growing rapidly with the launch of new gaming content in the country.

US Gaming Console & Accessories Market Trends

Launch Of New Gaming Content With High Graphic Requirements Drives the Market Growth

- The release of new game content with high visual needs drives the market. The move from console gaming to on-demand visual entertainment has already begun.

- Furthermore, gaming keyboards are distinguished by advancements and multiple product launches, boosting manufacturer competitiveness and offering gamers various options. Companies are concentrating on creating RGB-lit gaming keyboards to improve gamers' gaming experiences.

- Moreover, gaming consoles offer sophisticated graphics output that is unmatched by other platforms. According to the Entertainment Software Association, 63% of gamers in the United States base their purchasing decisions mostly on graphic quality. The ability to support 4K video benefited gaming consoles.

- Video gaming is no longer a hobby exclusively for the young. The typical gamer's age has increased as generations have grown up with video gaming as a normal part of life. According to an Entertainment Software Association poll, 36% of video game players are between 18 and 34, with 6% being 65 and older. Last year, Americans aged 15 to 19 spent an average of 1.44 hours per day on gaming or leisurely computer use. The 45 to 54-year-old age group played the least quantity of video games. Members in this age range spend only 0.28 hours playing on the computer daily.

- The key players in the country are offering new technologies, making strategic partnerships, and propelling market expansion. For example, in May 2022, one of the leading gaming audio and accessory provider Turtle Beach Corporation announced its best-selling Turtle Beach console gaming accessories and award-winning ROCCAT PC gaming accessories brands have partnered with New Orleans Saints' starting Safety, Chauncey Gardner-Johnson. Gardner-Johnson joins other pro-athlete gamers, including NBA stars Grayson Allen, Immanuel Quickley, and Josh Hart, who have teamed up with Turtle Beach and ROCCAT for all their gaming equipment needs can dominate on the digital battlefield.

Gaming Console Type Segment Holds Significant Market Share

- Gaming consoles have continuously increased demand in recent years, owing to increased players and technical improvements in the United States. The amount of time consumers spend gaming has increased as the number of games and their diversity has grown. In addition, new content is constantly being generated.

- The United States had the most people who played video games. In 2022, the Entertainment Software Association estimated that 66% of Americans and over 215.5 million active video game players of all ages are in the United States. In terms of the average number of individuals that play video games weekly. According to data from the Entertainment Software Association, this number in the United States is 13 hours per week.

- The report further mentioned that 52 % of the people in the US use dedicated gaming consoles to play games. The gaming consoles ranked second in their account regarding the number of gamers using dedicated consoles.

- Moreover, Video games are a common way for gamers to communicate with friends and family. According to a 2022 poll, 83 percent of gamers in the United States played with others online or in person, up from 65 percent in 2020. According to US gamers, friends are the most common people to play online with.

- The market is dominated by home consoles, with several firms like Sony, Microsoft, and Nintendo dominating the industry. Sony announced a host of new peripherals for its next-generation system, the PS5, including a new controller, headset, controller stand, and media remote-the growing popularity of gaming consoles.

US Gaming Console & Accessories Industry Overview

The United States Gaming Console & Accessories Market is fragmented, with major players like Sony Corporation, Microsoft Corporation, Nintendo Co., Ltd., Logitech International S.A., and Turtle Beach Corporation. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- In December 2023, the fifth iteration of the prominent ASTRO A50 Series console gaming headset, the Logitech G ASTRO A50 X LIGHTSPEED Wireless Gaming Headset and Base Station, was released by Logitech G, a United States-based brand of Logitech and a specialist in gaming technologies and gear.

- In November 2023, FaZe Holdings, Inc., a prominent gaming group in the world, and SteelSeries, a global player in gaming and esports peripherals, announced the launching of a new line of co-branded gaming products called FaZe Clan x SteelSeries, which are currently only available at Best Buy retail locations. Arctis Nova 7 Wireless Headset | FaZe Clan Edition, Apex 9 Mini Keyboard | FaZe Clan Edition, Aerox 3 Wireless Mouse | FaZe Clan Edition, QcK Heavy XXL | FaZe Clan Edition are a few offerings provided in the partnership.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Launch Of New Gaming Content With High Graphic Requirements

- 5.1.2 Integration Of Newer Technologies Like 3D and AR/VR Gaming

- 5.2 Market Restraints

- 5.2.1 Increasing Threat From Cloud Gaming Services

- 5.2.2 Rising Demand For Mobile-based Platform

6 OVERALL GAMING MARKET SCENARIO IN UNITED STATES

7 DEMOGRAPHIC ANALYSIS OF GAMING POPULATION BY AGE AND GENDER

8 MARKET SEGMENTATION

- 8.1 By Type

- 8.1.1 Gaming Console

- 8.1.2 Accessories

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 Sony Corporation

- 9.1.2 Microsoft Corporation

- 9.1.3 Nintendo Co., Ltd.

- 9.1.4 Logitech International S.A.

- 9.1.5 Turtle Beach Corporation

- 9.1.6 Razer Inc.

- 9.1.7 Corsair Components Inc.

- 9.1.8 Mad Catz Global Limited

- 9.1.9 Kingston Technology Corporation

- 9.1.10 Performance Designed Products LLC

- 9.1.11 PowerA

10 MARKET OPPORTUNITIES AND FUTURE TRENDS