PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690927

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690927

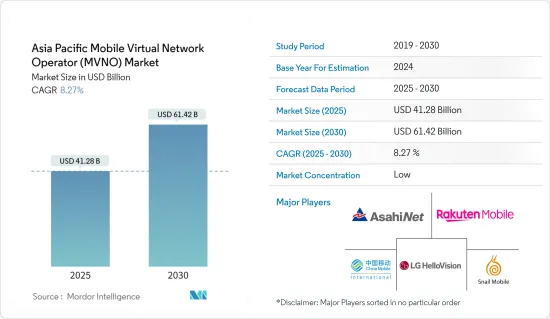

Asia Pacific Mobile Virtual Network Operator (MVNO) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Asia Pacific Mobile Virtual Network Operator Market size is estimated at USD 41.28 billion in 2025, and is expected to reach USD 61.42 billion by 2030, at a CAGR of 8.27% during the forecast period (2025-2030).

Key Highlights

- The constantly growing need for low-cost data and voice services is boosting market growth. This encourages service providers to purchase network services from mobile network operators (MNOs) at wholesale rates and sell them as bundled services at lower rates than those of MNOs. Such low-cost data services allow mobile virtual network operators (MVNOs) to attract consumers and enterprises in the region to purchase data plans from MVNOs at cost-effective rates.

- The increasing smartphone adoption and mobile subscriber base are expected to contribute significantly to industry growth. For instance, according to the data from GSMA, the number of mobile subscribers in South Asia is anticipated to reach 1,089 million by 2025, followed by 510 million subscribers in Southeast Asia.

- In addition, according to the GSMA forecast, the number of mobile subscribers in Northeast Asia is expected to reach 162 million. Such increasing growth of mobile subscribers presents growth opportunities for mobile virtual network operators to expand their market share in the Asia-Pacific region.

- The Asia-Pacific mobile virtual network operators market faces significant challenges due to its dependency on host mobile network operators. This dependency impacts MVNOs' operational and strategic capabilities, restraining their growth and market potential. MVNOs rely on MNOs for network access, which means they have limited control over the quality of service and network coverage. Any shortcomings in the host network directly affect the MVNO's service quality.

- The COVID-19 pandemic has positively fueled the demand for MVNOs' cost-effective data and voice services during the pandemic due to the increased reliance of consumers and businesses on online connectivity. In addition, the digital transformation among businesses in the region spiked post-pandemic, which has further fueled the demand for data services, thus positively impacting the growth of the MVNO market in the Asia-Pacific region.

- In the post-pandemic era, MVNOs in Asia-Pacific countries are analyzed to innovate and introduce new services to meet consumers' and enterprises' evolving needs. From enhanced data offerings to innovative pricing plans, MVNOs are expected to leverage digital technologies, machine learning, and artificial intelligence to deliver personalized and seamless customer experiences. Such developments are expected to positively support the growth of the Asia-Pacific MVNO market in the coming years.

Asia-Pacific MVNOs Market Trends

Enterprise Subscriber Segment is Expected to Witness Significant Growth

- The enterprise segment is analyzed to witness significant growth in the Asia-Pacific MVNO market in the coming years owing to the rising digital transformation among various sectors in Asia-Pacific countries, the growing focus of MVNO operators toward the B2B model considering the growth in the rollout of 5G services in the region, and the rising demand for affordable internet connectivity in businesses across the region.

- The enterprise market is becoming lucrative for MVNO companies, as so many devices connected to a network are less likely to churn compared with the traditional consumer segment. Flexible billing, novel pricing, Bring Your Own Device (BYOD), security, and easy administration are some of the major factors and trends driving the growth of the enterprise segment in the Asia-Pacific MVNO market.

- Moreover, with growing 5G rollouts in Asia-Pacific countries such as India, 5G use cases such as 5G stand-alone and IoT are analyzed to create significant growth opportunities for MVNOs in the enterprise segment. As the IoT ecosystem continues to develop and evolve in Asia-Pacific countries, most of the market vendors are shifting their focus to B2B customers as enterprises increasingly seek real-time connectivity via an array of devices.

- By country, South Korea is analyzed to drive the growth of the enterprise segment owing to the significant presence of MVNOs offering enterprise connectivity solutions, favorable regulatory policies, the growing rollout of 5G services, and digital transformation of businesses in the country. Moreover, new players are entering the enterprise segment to effectively serve the needs of affordable telecommunication services in particular sectors.

- For instance, in June 2024, Woori Bank and LG Uplus signed a memorandum of understanding (MoU) at Woori Bank's Seoul headquarters, solidifying their collaboration in the mobile virtual network operator sector. Their joint focus lies in identifying the specific telecommunication needs within the banking industry, with plans to roll out their MVNO service within the year. With the MoU in place, both entities are set to expedite the creation of unique products and services, fostering a long-term partnership.

- Overall, as industries in the Asia-Pacific region continue to evolve and leverage digital transformation, MVNOs are analyzed to capitalize on new opportunities, from mobile banking to IoT, shaping the future of connectivity. The demand for enterprise voice and data services is analyzed to gain significant traction in businesses to streamline their mobile operations, reduce costs, and improve productivity through customized enterprise solutions.

- The increasing smartphone adoption and mobile subscriber base are expected to contribute significantly to industry growth. For instance, according to the data from GSMA, the number of mobile subscribers in South Asia is anticipated to reach 1,089 million by 2025, followed by 510 million subscribers in Southeast Asia. In addition, according to the GSMA forecast, the number of mobile subscribers in Northeast Asia is expected to reach 162 million. Such increasing growth of mobile subscribers presents growth opportunities for mobile virtual network operators to expand their market share in the Asia-Pacific region.

Mainland China Holds Significant Market Share

- China holds a significant share of the Asia-Pacific MVNO market. The country has always remained at the forefront in the adoption of technological advancements, like 5G technology, connected mobile devices, and smartphone penetration.

- The rollout of 5G networks has opened new opportunities for MVNOs to offer advanced services such as high-speed data, IoT, and smart solutions. The adoption of eSIM technology allows MVNOs to offer more flexible and convenient service activation, attracting tech-savvy customers.

- GSMA's 2024 report, "The Mobile Economy China," reveals that China boasts over 800 million 5G mobile connections. Projections indicate that this year, the share of 5G connections will surpass 50%, solidifying its position as the primary mobile technology in the nation. By the close of 2024, the total number of 5 G connections is expected to exceed 1 billion. In addition, China currently hosts 1.28 billion unique mobile subscribers, showcasing an impressive 88% penetration rate.

- China has been on a consistent trajectory of expanding its mobile phone base station network. In a notable move, China Mobile plans to bolster its 5G infrastructure by adding 410,000 new base stations in 2024, pushing its total count to 2.4 million. This expansion comes even as the company looks to trim its capital expenditure. By the close of 2023, China Mobile had already ramped up its 5G presence, ending the year with 1.9 million stations, a significant jump from the previous year, with an addition of 480,000 sites. Notably, within this count, 620,000 sites were established in collaboration with China Broadnet, focusing on the 700 MHz spectrum.

- The Government of China is pushing the development of the Chinese 5G industry, favoring companies such as Huawei and ZTE, which manufacture the equipment necessary for the technology to work. China is expected to account for the most 5G connections globally in 2025.

Asia-Pacific MVNOs Industry Overview

The Asia-Pacific MVNOs market is highly fragmented, with the presence of major players like Asahi Net Inc., Rakuten Mobile Inc. (Rakuten Group, Inc.), LG Hello Vision Corporation, China Mobile International Limited (China Mobile Limited), and Century Snail Communication Technology Co. Ltd. Players in the market studied are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- May 2024: Giga launched 5G eSIM plans featuring complimentary data roaming to five top destinations. These plans, part of Giga's trio of new offerings, ensure customers enjoy swift, secure, and hassle-free 5G connectivity. The enhanced giga! Mobile plans provided Giga's expansive 5G coverage and highlighted the convenience of eSIM technology. Moreover, subscribers got the benefit of free monthly data roaming in popular spots like Indonesia, Thailand, South Korea, and India.

- March 2024: China Mobile International (CMI) and Singapore Telecommunications Limited (Singtel) signed an MoU during the Mobile World Congress 2024. According to the MoU, CMI and Singtel will jointly build innovative connectivity solutions for enterprise customers to cultivate China and Singapore markets and expand business across the wider Asia-Pacific region.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of Macroeconomic Factors on the Market COVID-19 Impact

- 4.4 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 MVNO Penetration and Characteristics Similar to Major European Countries

- 5.1.2 Regulatory Environment in Most Asian Countries Became Much More Supportive of MVNOs

- 5.1.3 Internet Penetration and e-SIM Solutions Driving the MVNO Market in the Region

- 5.2 Market Restraints

- 5.2.1 Dependency on Host Mobile Network Operators (MNO)

6 MARKET SEGMENTATION

- 6.1 By Operational Mode

- 6.1.1 Reseller

- 6.1.2 Service Operator

- 6.1.3 Full MVNO

- 6.1.4 Other Operational Modes

- 6.2 By Subscriber

- 6.2.1 Enterprise

- 6.2.2 Consumer

- 6.3 By Country

- 6.3.1 China

- 6.3.2 Japan

- 6.3.3 India

- 6.3.4 South Korea

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Asahi Net Inc.

- 7.1.2 Rakuten Mobile Inc. (Rakuten Group, Inc.)

- 7.1.3 LG Hello Vision Corporation

- 7.1.4 China Mobile International Limited (China Mobile Limited)

- 7.1.5 Century Snail Communication Technology Co. Ltd

- 7.1.6 Exetel Pty Ltd

- 7.1.7 Circles.life

- 7.1.8 Tune Talk Sdn Bhd

- 7.1.9 SK Telink Co. Ltd (SK Telecom Co. Ltd)

- 7.1.10 Japan Communications Inc

- 7.1.11 EG Mobile Co. Ltd

- 7.1.12 Sakura Mobile

- 7.1.13 Mobal Communications Inc.

- 7.1.14 BIGLOBE Inc. (KDDI Corporation)

- 7.1.15 Giga (Starhub)

- 7.1.16 Feels Telecom Corporation Co. Ltd

- 7.1.17 Tangerine Telecom

- 7.1.18 Amaysim Mobile Pty Ltd

- 7.1.19 Altel Communications Sdn Bhd

- 7.1.20 reDone Network Sdn Bhd

- 7.1.21 Geenet Pte Ltd

- 7.2 Market Share Analysis for Major Market Vendors

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET