PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690891

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690891

ASEAN Probiotic Supplements - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

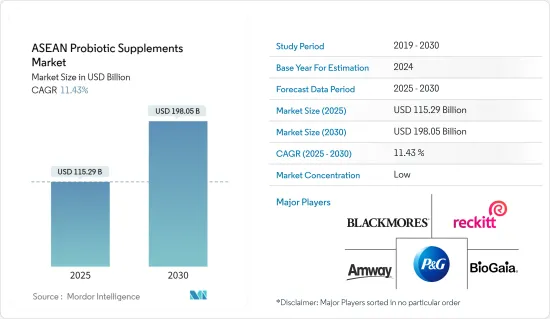

The ASEAN Probiotic Supplements Market size is estimated at USD 115.29 billion in 2025, and is expected to reach USD 198.05 billion by 2030, at a CAGR of 11.43% during the forecast period (2025-2030).

The probiotic supplements market has been experiencing steady growth due to increased awareness among Southeast Asians on the health benefits of probiotics. Factors like rising demand for functional foods, dietary supplements, and a growing focus on preventive healthcare contribute to this growth. Owing to such factors, there are significant product launches that cater to the increasing demand. For instance, in 2023, Fonterra, under its brand Nurture, introduced a probiotic powdered drink targeting gut-conscious consumers in Singapore and expanding to Indonesia, Malaysia, and Thailand, targeting a growing middle-income group. Consumers continue to browse for probiotics products, which offers opportunities for retailers to adopt a strategy that matches consumers' current needs by showcasing products that are essential to their needs.

Additionally, the willingness of consumers to spend on health-based products such as probiotics to support their nutritional needs, as well as specific health goals, including digestive health and weight management, promotes the market's growth in the region. For instance, as per the data released by DOS (Singapore Department of Statistics), in terms of expenditure, the consumer price index of health care, which dietary and health supplements fall under, had gone up by 4.5% Y-o-Y as of September 2023. Furthermore, to address the preferences of diverse consumers, key companies are experimenting with new formulations. Formulations are evolving to include Kosher and Halal probiotics, time-release options, combinations with different ingredients for added health benefits, and sugar-, dairy-, and allergen-free options.

ASEAN Probiotic Supplements Market Trends

Probiotic Supplements are Widely Consumed in the Form of Capsules and Powders

Probiotic supplements in the form of capsules and powders are gaining more popularity in ASEAN countries than other forms. Capsules are one of the most popular forms of probiotic supplements, as they offer convenience and ease of consumption since they are pre-measured and can taken with water or any other beverage. Further, probiotic powders are versatile, as they can be easily mixed into various foods and beverages such as smoothies, yogurt, and water. This flexibility appeals to consumers who prefer to customize their intake or those who have difficulty swallowing pills. Also, several clinical research studies show that probiotics may promote weight loss by releasing appetite-regulating hormones. Thus, the growing consumer interest in weight management to overcome obesity is likely to influence the demand for probiotic supplements in the region.

Probiotics are a driving force within the booming digestive health supplement category, and people of all age groups have been consuming them over the past few years. However, major consumption is observed among millennials due to their growing awareness of health and wellness through multi-channel publicity, which influences their consumption patterns to a large extent. This shows people's awareness of the benefits of probiotic supplements. Being technologically advanced, millennials update themselves with the facts related to health and, thereby, try to amend their routines and consumption habits accordingly.

Indonesia holds a Significant Share in the Market

The increase is mainly because of the increasing demand from the younger population. Indonesians are experiencing an improved standard of living due to better-paying jobs, leading to an expansion of the middle class. This middle-income population spends more on health products, such as probiotic supplements. A growing population, increased consumer awareness of health issues, and the fast-paced lives of people are causing changes in lifestyle patterns. As a result of this growing consumer trend, several changes have occurred in the Indonesian probiotic supplement market. These include research activities sponsored by probiotic manufacturers, which are anticipated to drive healthy expansion during the projected period.

The growing middle-income population in Indonesia is driving the demand for probiotics, from 52 million in 2021 to 53.6 million in 2023, according to the World Bank's Aspiring Indonesia-Expanding the Middle-Class report. As a result, the dietary habits of people in Indonesia have evolved toward more balanced nutrition, accompanied by a high rate of urbanization. With access to the most up-to-date information, middle-income consumers are demanding healthier and diverse food options and health supplements, including probiotic supplements.

ASEAN Probiotic Supplements Industry Overview

The ASEAN probiotics supplements market comprises various global and regional players. The market studied was led by Procter & Gamble, BioGaia, Reckitt Benckiser LLC, Amway Corporation, Blackmores Limited, Nestle SA, and Church & Dwight Co. Inc. Leading companies are taking necessary measures to expand their business in terms of geography by establishing new manufacturing units and launching popular products in different countries to boost sales and enhance brand presence. Most of the manufacturing companies in ASEAN are entering into contract manufacturing for probiotic supplements. Additionally, players are investing in research and development to maintain their market position with new product innovations to enhance their brand presence in the region.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Innovations in Probiotic Formulations

- 4.1.2 Increasing Focus on Digestive Health to Reduce the Impact of Chronic Disorders

- 4.2 Market Restraints

- 4.2.1 High Cost of Research and Development for Developing New Probiotic Strains

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Form

- 5.1.1 Tablets/Capsules

- 5.1.2 Powders

- 5.1.3 Liquids

- 5.1.4 Other Products

- 5.2 Distribution Channel

- 5.2.1 Supermarkets/Hypermarkets

- 5.2.2 Pharmacies and Drug Stores

- 5.2.3 Specialty Stores

- 5.2.4 Online Stores

- 5.2.5 Other Distribution Channels

- 5.3 Geography

- 5.3.1 Indonesia

- 5.3.2 Malaysia

- 5.3.3 Thailand

- 5.3.4 Vietnam

- 5.3.5 Singapore

- 5.3.6 Philippines

- 5.3.7 Rest of ASEAN

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Markey Share Analysis

- 6.3 Company Profiles

- 6.3.1 Bio Gaia

- 6.3.2 Reckitt Benckiser LLC

- 6.3.3 Procter & Gamble

- 6.3.4 Amway Corporation

- 6.3.5 Church & Dwight Co. Inc.

- 6.3.6 Pharma Care Laboratories Pty Ltd

- 6.3.7 Nature's Way Products LLC

- 6.3.8 GNC Holdings LLC

- 6.3.9 Blackmores Probiotics

- 6.3.10 Nestle SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS