PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851924

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851924

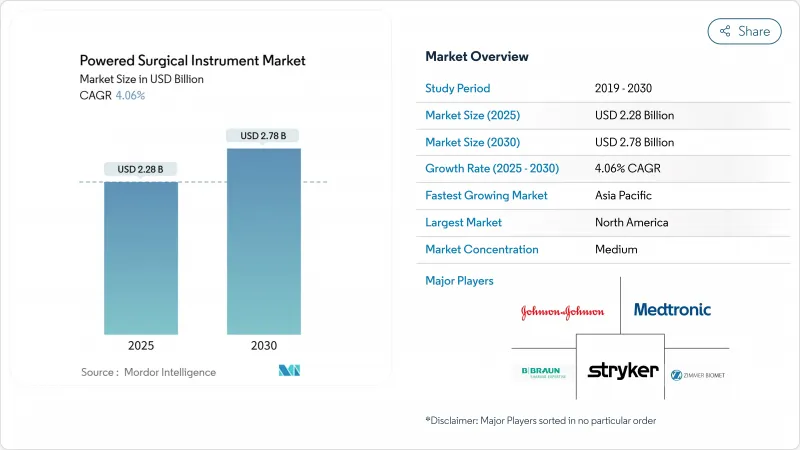

Powered Surgical Instrument - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The powered surgical instruments market size stands at USD 2.28 billion in 2025 and is on track to reach USD 2.78 billion by 2030, advancing at a 4.06% CAGR.

Aging populations, higher surgical volumes, and incremental technological gains sustain growth after the early-adoption phase. Demand is reinforced by minimally invasive technique preferences, while regulatory moves toward standardized sterilization favor incumbent suppliers. Hospitals also prioritize integrated instrument platforms to satisfy value-based care metrics, supporting premium pricing. Asia-Pacific's infrastructure build-out and the rise of specialist day-surgery centers underpin a geographic shift that balances North America's current revenue leadership within the powered surgical instruments market.

Global Powered Surgical Instrument Market Trends and Insights

Rising Volume of Surgical Procedures and Trauma Cases

Global operating-room activity is rising as insurance coverage broadens in emerging economies and urbanization elevates trauma incidence. Emergency departments rely on power-driven drills and saws to stabilize fractures faster than manual tools, improving outcomes and freeing critical-care beds. High-volume centers in Asia-Pacific now integrate hybrid consoles that combine battery and wired modes, shortening turnover time between trauma cases. Traffic accidents and industrial injuries create predictable demand, anchoring the powered surgical instruments market in fast-growing metropolitan regions. Hospitals that treat complex polytrauma increasingly purchase modular handpiece systems to streamline inventory and ensure quick sterilization cycles. Surgeons report shorter operative times, reinforcing administrative support for continued investment in power platforms.

Growing Geriatric Population with Degenerative Disorders

People aged 65 + are the fastest-growing cohort in developed economies, pushing joint-replacement and spinal-fusion volumes upward. These interventions depend on high-torque drills and reamers, securing a long-term revenue base for the powered surgical instruments market. United States reimbursement bundles for hip and knee arthroplasty pressure hospitals to complete procedures efficiently, favoring lightweight battery handpieces that mitigate surgeon fatigue. European day-surgery units now perform same-day hip revisions, leveraging cordless systems to simplify OR setup. Japanese clinics deploy portable consoles to serve rural geriatric patients via mobile surgical teams, widening access. This demographic-linked demand is structural, ensuring a durable sales pipeline for suppliers through 2030 and beyond.

High Capital and Maintenance Costs of Powered Instruments

Initial purchase prices range from USD 50,000 to USD 200,000, while annual service contracts typically equal 10-15% of the original spend, challenging budgets of smaller facilities. Studies show robotic cholecystectomy disposables can exceed laparoscopic equivalents without superior outcomes, prompting administrators to question ROI on advanced consoles. Emerging-market clinics often delay upgrades, buying pre-owned wired systems to avoid battery replacement expense. Multiyear leasing models are spreading, yet interest-rate volatility raises financing costs and may temper acquisition plans in the near term. Consequently, capital intensity restrains penetration even as clinical teams voice strong preference for powered solutions.

Other drivers and restraints analyzed in the detailed report include:

- Continuous Technological Advancements in Powered Surgical Tools

- Increasing Adoption of Minimally Invasive and Outpatient Surgeries

- Shortage of Skilled Surgical Workforce in Low-Income Regions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Lithium-ion battery platforms have propelled the powered surgical instruments market, with battery systems tracking a 4.92% CAGR through 2030. In 2024 wired-electric devices still held 41.23% share, reflecting legacy installations at high-volume centers that value uninterrupted current. Assemblies featuring swappable battery pods cut turnover time in ambulatory suites and gain traction in orthopedic trauma rooms. Hybrid consoles seamlessly transfer from wall power to battery backup during intraoperative repositioning, ensuring sterility of cable-free drapes. Competition now centers on charge-cycle longevity and real-time battery diagnostics that feed into hospital asset software. Over the forecast period, portability advantages keep battery units at the forefront of new installations, especially across Asia-Pacific's expanding day-surgery grid.

Surgeons cite reduced cord clutter and lighter handpieces as key ergonomic benefits during arthroplasty that may last beyond two hours. Pneumatic platforms retain niche demand in neurosurgery for their ultra-smooth torque delivery, but they lack the connectivity that hospitals expect from digital OR investments. Suppliers therefore integrate Bluetooth firmware updates into battery handles, pairing them with sterilizable charging docks. Price-sensitive hospitals in Latin America still favor wired rigs refurbished through trade-in programs that lower upfront expense. Balanced purchasing across power types keeps the powered surgical instruments market diversified while underscoring battery innovation as an enduring growth lever.

Handpieces dominated 60.45% of revenues in 2024, making them the economic cornerstone of the powered surgical instruments market. Saw systems and high-speed drills lead orthopedic demand, while shavers carve share in ENT and sports medicine suites. Meanwhile, accessories and consumables are expanding at a 5.12% CAGR, with single-use burs, blades, and sleeves offering predictable per-case income to manufacturers. Hospitals accept higher variable costs because disposables eliminate re-sterilization labor and align with infection-control audits.

OEMs bundle service contracts with auto-shipping of blades based on usage data from smart consoles, creating annuity-like revenue. Consumable expansion also smooths earnings against cyclical capital budgets, positioning suppliers to weather macroeconomic swings. Plastic-surgery clinics adopt micro-burring tips for rhinoplasty refinements, illustrating how procedure-specific consumables widen the customer base. Digital ordering portals tied to inventory sensors further lock in clients, reinforcing the powered surgical instruments market through sticky relationships.

The Powered Surgical Instrument Market Report is Segmented by Power Source (Wired-Electric, Battery-Powered (Li-Ion, Nimh), and More), Product Type (Handpieces, and More), Application (Orthopedic & Trauma, and More), End-User (Hospitals, and More), Geography (North America, Europe, Asia-Pacific, The Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 35.45% revenue share in 2024. Medicare bundles stimulate capital spending on instruments that cut theater time, while United States surgeons adopt smart consoles capable of predictive service diagnostics. Canada's provincial buying groups favor multi-procedure kits to maximize return under universal budgets, and Mexico's border hospitals tap the powered surgical instruments market to serve medical tourists.

Europe is the second-largest region. Germany, France, and Italy see orthopedic case growth tied to aging citizens, and hospitals adopt value-based contracts that reward shorter length of stay. The United Kingdom aligns purchasing guidelines to NHS cost-per-case thresholds, which puts procurement weight on lifespan analytics from console logs. EU Medical Device Regulation demands robust clinical data that established brands can supply, shielding them against price-led competition while reinforcing patient safety.

Asia-Pacific posts the strongest 5.46% CAGR. China's county hospitals upgrade tool inventories as national insurance expands orthopedic coverage. India's urban clusters open high-volume day clinics that prefer batterized kits. Japan's super-aged society sustains steady hip and spine volumes, while South Korea's cosmetic tourism imports European micro-drills to satisfy foreign patients. ASEAN harmonization has trimmed approval timelines, yet local-content rules spur partnerships between multinationals and regional OEMs. Combined, these dynamics outline a decisive growth vector for the powered surgical instruments market across emerging Asian economies.

- Stryker

- Medtronic

- Johnson & Johnson

- Zimmer Biomet

- B. Braun (Aesculap)

- Smiths Group

- Conmed

- De Soutter Medical

- MicroAire

- Adeor Medical

- Panther Healthcare

- Arthrex

- Brasseler USA

- OsteoMed

- MatOrtho

- NSK Nakanishi

- Bien-Air Surgery

- Ruijin Medical

- Arbutus Medical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Volume of Surgical Procedures and Trauma Cases

- 4.2.2 Growing Geriatric Population With Degenerative Disorders

- 4.2.3 Continuous Technological Advancements in Powered Surgical Tools

- 4.2.4 Increasing Adoption of Minimally Invasive and Outpatient Surgeries

- 4.2.5 Expansion of Specialist Day Surgery Centers in Emerging Markets

- 4.2.6 Transition To Value-Based Care Driving Efficiency Investments in OR Technology

- 4.3 Market Restraints

- 4.3.1 High Capital and Maintenance Costs of Powered Instruments

- 4.3.2 Shortage of Skilled Surgical Workforce in Low-Income Regions

- 4.3.3 Stringent Regulatory And Environmental Policies on Device Sterilization And Battery Disposal

- 4.3.4 Data Security Concerns With Network-Connected Surgical Equipment

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Power Source

- 5.1.1 Wired-Electric

- 5.1.2 Battery-Powered (Li-ion, NiMH)

- 5.1.3 Pneumatic / Nitrogen

- 5.1.4 Hybrid Smart Consoles

- 5.2 By Product Type

- 5.2.1 Handpieces

- 5.2.1.1 Drill Systems

- 5.2.1.2 Saw Systems

- 5.2.1.3 Reamer Systems

- 5.2.1.4 Staplers

- 5.2.1.5 Shavers & Debriders

- 5.2.1.6 Other Handpieces

- 5.2.2 Power Sources & Controls

- 5.2.3 Accessories & Consumables

- 5.2.1 Handpieces

- 5.3 By Application

- 5.3.1 Orthopedic & Trauma

- 5.3.2 Dental & Maxillofacial

- 5.3.3 Neurosurgery & Spine

- 5.3.4 Cardiothoracic & Cardiovascular

- 5.3.5 Plastic & Reconstructive

- 5.3.6 Other Applications

- 5.4 By End-User

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgical Centers

- 5.4.3 Specialty Orthopedic & Dental Clinics

- 5.4.4 Other End-Users

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials As Available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Stryker Corporation

- 6.3.2 Medtronic plc

- 6.3.3 Johnson & Johnson (DePuy Synthes)

- 6.3.4 Zimmer Biomet

- 6.3.5 B. Braun (Aesculap)

- 6.3.6 Smith & Nephew

- 6.3.7 ConMed Corporation

- 6.3.8 De Soutter Medical

- 6.3.9 MicroAire Surgical Instruments

- 6.3.10 Adeor Medical

- 6.3.11 Panther Healthcare

- 6.3.12 Arthrex

- 6.3.13 Brasseler USA

- 6.3.14 OsteoMed

- 6.3.15 MatOrtho

- 6.3.16 NSK Nakanishi

- 6.3.17 Bien-Air Surgery

- 6.3.18 Ruijin Medical

- 6.3.19 Arbutus Medical

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment