PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1403069

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1403069

China Automotive Smart Keys - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

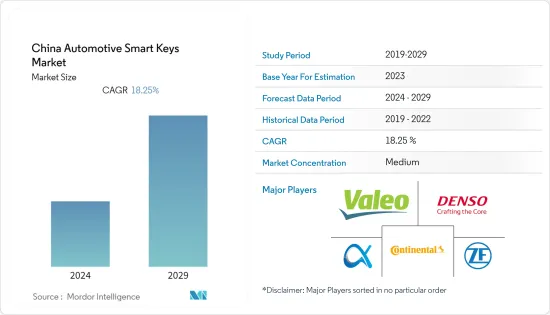

The China automotive smart keys market is valued at USD 4.45 billion in the current year. It is expected to reach USD 6.28 billion within the next five years, registering a CAGR of about 18.25% during the forecast period.

Smart Keys were a critical feature in luxury vehicles, but now they are even becoming part of entry-level cars. With the change in vehicle owner expectations for their vehicles to perform tasks that would involve a minor physical effort on their part, the smart key became a mainstay of the vehicle model design. Here, the driver is not required to insert a metal key into the tumbler. In addition, push-button ignition switches also became common, eliminating the requirement to rotate the mechanical key in an ignition switch cylinder.

Furthermore, with the advancement in smart keys, virtual smart keys are also being preferred. These keys use technology that can turn a smartphone into a smart key. It can be used for controlling functions like vehicle unlock, turning the ignition on, and various other features.

Over the medium term, factors such as rising demand for cars with advanced features, rising vehicle thefts, and a surge in demand for safety, comfort, and convenience features are fueling the automotive smart keys market in China. Moreover, due to increased demand for advanced features in automobiles, automotive companies are implementing features of high-end cars in budget cars to boost their sales and cater to the demand.

Key Highlights

- For instance, in March 2023, a BYD smartwatch with a built-in car key was launched in April. It had features such as smart ignition, comfortable entry, smart locking, raising and lowering windows, and could open the tailgate. The smartwatch is lined up to replace BYD car keys.

The above factors, coupled with new launches and technological advances, will drive the market growth.

China Automotive Smart Keys Market Trends

The Latest Advances in Automotive Security

The automotive industry went under transition in recent years, and with new technology, cars are becoming more innovative, faster, and advanced. However, increased cyber threats with advancements in vehicles make automotive security a growing concern.

As the growth of technological advances in the automotive industry gave rise to increased cyber threats, to cater to such challenges, car manufacturers are focusing on advanced security features such as real-time monitoring, smart keys, biometric authentication, etc.

Moreover, in addition to high-tech solutions for vehicles, automotive manufacturers are finding different ways to enhance automotive security. For instance, some companies are doing R&D on new materials that can withstand theft attempts. Some of the manufacturers are producing smart keys for communication with the car's computer system and automatically lock and unlock doors with the help of radio frequency.

- For example, in August 2022, NXP® Semiconductors announced the NCJ37x Secure Element (SE) for various security-critical automotive applications. It includes smart access key fobs, Qi 1.3 authentication, or car-to-cloud communication.

Thus, the above investments made by automotive giants for various production activities will drive market growth.

OEMs will provide more advance feature in Future

The OEMs offer advanced features relative to door unlocking/locking, control of windows, moon roofs, mirrors, seat adjustment, radio pre-sets, and remote engine starting via key fobs carried by the driver.

A transponder in the smart key features a small chip inside the key head that sends a signal to the signal amplifier and, in turn, to the ECU. It then disengages the immobilizer system and allows the engine to start. The proximity fob needs to be in the range of the system in order for the system to allow the engine to start via a push-button ignition switch. The convenience that these systems provide helps to significantly drive the growth of the market.

Multiple OEMs across the country and international manufacturers are offering innovative products for smart keys for different vehicles. For instance, in July 2023, Dongfeng Nissan Venucia announced the launch of the V-Online DD-i, its first compact plug-in hybrid SUV. The V-Online DD-i is equipped with a 22- or 24-inch one-piece display screen. It comes standard with such functions as NFS non-sensory intelligent start and smart mobile phone virtual key.

Similarly, in March 2023, Chinese company Huawei Car Key surpassed 1 million users to use virtual car keys by using their smartphones and smartwatches.

Thus, the above factors, with new advanced features by automotive manufacturers and the rise in adoption of virtual car keys among users, will drive the market growth.

China Automotive Smart Keys Industry Overview

The China automotive smart keys market is moderately fragmented due to the presence of many local and global players such as Denso Corporation, Continental AG, ZF Friedrichshafen AG, and ALPHA Corporation, amongst others. Major automakers are launching their smartphone application to provide the best features to their customers and to stay ahead in the market. For instance,

- In June 2023, STMicroelectronics NV announced that it will present products and solutions for smart mobility at MWC Shanghai. STMicroelectronics also unveiled the new STPay-Mobile Solution for payments and Digital Car Key solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 The Latest Advances in Automotive Security

- 4.2 Market Restraints

- 4.2.1 Cyber Threats related to Smart Keys

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in USD)

- 5.1 Application Type

- 5.1.1 Single Function

- 5.1.2 Multi-Function

- 5.2 Technology Type

- 5.2.1 Remote Keyless Entry

- 5.2.2 Passive Keyless Entry

- 5.3 By Instrallation Type

- 5.3.1 OEM

- 5.3.2 Aftermarket

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Autoliv Inc

- 6.2.2 Continental AG

- 6.2.3 Delphi Automotive PLC

- 6.2.4 Denso Corporation

- 6.2.5 ALPHA Corporation

- 6.2.6 Valeo SA

- 6.2.7 Hella Gmbh & Co KGaA

- 6.2.8 Tokai Rika Co Ltd

- 6.2.9 Robert Bosch GmbH

- 6.2.10 Hyundai Mobis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS