PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906931

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906931

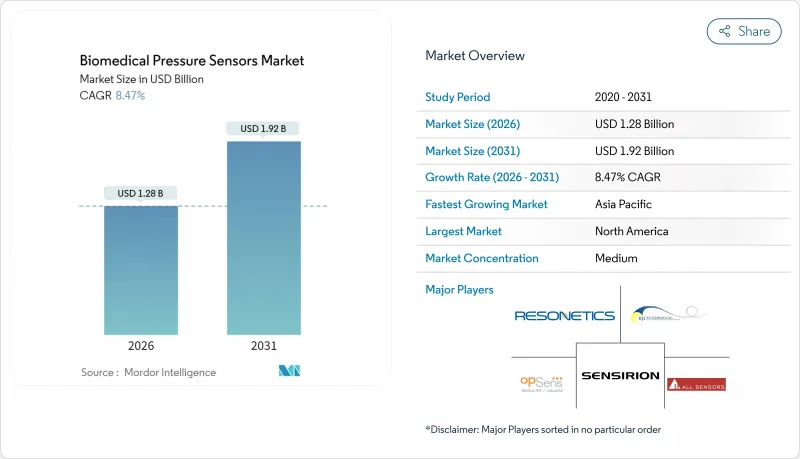

Biomedical Pressure Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The biomedical pressure sensors market was valued at USD 1.18 billion in 2025 and estimated to grow from USD 1.28 billion in 2026 to reach USD 1.92 billion by 2031, at a CAGR of 8.47% during the forecast period (2026-2031).

Strong demand for miniaturized, wireless, and clinically accurate sensors underpins this growth, while regulatory convergence and value-based care incentives accelerate hospital and home-care adoption. MEMS technology maturity has driven sub-millimeter sensor footprints without compromising accuracy, expanding use in minimally invasive and implantable devices. North America leads the biomedical pressure sensors market due to its advanced healthcare infrastructure, whereas the Asia-Pacific region records the fastest regional expansion as manufacturing capacity and digital health investments rise. Competitive intensity is rising as medical-device majors partner with semiconductor firms to integrate analytics, cloud connectivity, and battery-free operation, creating differentiated end-to-end solutions.

Global Biomedical Pressure Sensors Market Trends and Insights

Growing Demand for Low-Cost, High-Performance and Reliable Sensors

Downward pricing pressure across healthcare systems is steering procurement toward sensors that remain clinically precise while costing below USD 10 per unit. Yield improvements in 200 mm MEMS fabs have reduced production costs by approximately 15% per year since 2024, enabling broader deployment in resource-constrained settings. Enhanced hermetic packaging now delivers a mean time between failures of above 10 years, which is pivotal for implantables exposed to biofluids. Cost competitiveness is particularly transformative in Asia-Pacific public hospitals adopting continuous monitoring as part of universal health coverage. These dynamics collectively add 1.8 percentage points to the forecast CAGR.

Rising Prevalence of Chronic Diseases Driving Continuous Physiological Monitoring

More than 655 million people live with cardiovascular disease, fostering continuous blood-pressure tracking through wearables that transmit readings to cloud dashboards. Diabetes care has similarly shifted toward insulin pumps that rely on embedded pressure sensors for accurate dosing. With the global population aged >=65 expected to hit 1.6 billion by 2050, the addressable patient pool expands sharply. Continuous monitoring reduces unplanned hospitalizations and aligns with payer incentives for value-based care, elevating the biomedical pressure sensors market trajectory by an estimated 2.1 percentage points.

Environmental Impact on Sensor Stability

Temperature coefficients reaching 0.5% per °C can introduce clinically significant errors if left uncompensated, forcing manufacturers to integrate on-chip calibration resistors and software-based linearization. High humidity in tropical markets accelerates polymer-seal degradation, prompting the design of new moisture-barrier layers. MRI-suite electromagnetic fields demand specialized shielding, complicating sensor-system design and increasing bill-of-materials costs. Collectively, these factors shave 1.2% points off the biomedical pressure sensors market CAGR.

Other drivers and restraints analyzed in the detailed report include:

- Miniaturization and MEMS Breakthroughs Enabling Invasive and Implantable Use-Cases

- Adoption Surge in Remote-Patient-Monitoring and Tele-Health Pressure Patches

- Stringent Multi-Jurisdictional Safety and Biocompatibility Approvals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wireless passive sensors, though accounting for a smaller slice today, are expected to outpace all other technologies at a 9.35% CAGR, lifted by battery-free operation that eliminates explant surgeries. The biomedical pressure sensors market size for wireless passive solutions is projected to surpass USD 415 million by 2031, reflecting aggressive hospital purchase programs in North America and pilot deployments in Europe. Piezoresistive devices maintain volume dominance due to time-tested manufacturing lines and sub-USD 5 unit economics. Fiber-optic sensors address niche MRI-compatible use-cases, adding resilience where electromagnetic immunity is mandatory. Hybrid chips combining capacitive and piezoresistive elements help stabilize drift and have begun sampling to cardiac-device OEMs.

The biomedical pressure sensors market is witnessing technology convergence as MEMS houses integrate pressure sensing with temperature or flow measurement to offer single-chip vital-sign modules. Self-calibration routines embedded in firmware now compensate for thermal drift in under 30 seconds, cutting maintenance cycles for dialysis machines. Telemetric sensors with sub-GHz radios extend off-body communication ranges beyond 2 meters, vital for ambulatory-surgery workflows where patients move between wards.

Monitoring applications retained a 29.25% share in 2025, with clinicians leveraging continuous arterial-line substitutes to detect hemodynamic instability early. The biomedical pressure sensors market share for monitoring reflects hospital protocols that mandate 24-hour blood-pressure trending in critical-care units. Diagnostic uses remain sizable, especially in catheter-based cardiology, where real-time pressure data guides stent placement. Therapeutic systems such as infusion pumps employ closed-loop pressure control to ensure accurate drug delivery, reinforcing daily demand volumes.

Consumer wellness devices drive a 9.60% CAGR as leading smartphone brands launch cuff-less blood-pressure wearables that log readings into personal health records. Imaging-system manufacturers integrate micro-sensors into contrast injectors, improving dosing precision and reducing adverse events. Over the forecast window, application boundaries blur; devices originally sold for diagnostics increasingly embed therapy features, prompting regulators to refine combination-product guidance.

The Biomedical Pressure Sensors Market Report is Segmented by Technology (Self-Calibrating, Fiber-Optic, and More), Application (Diagnostic, Therapeutic, Medical Imaging, Monitoring, and More), End-User (Hospitals and Clinics, Ambulatory Surgery Centres, and More), Sensor Type (Invasive and Non-Invasive), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 38.40% of 2025 revenue, driven by USD 200 billion in annual medical device R&D spending, robust reimbursement frameworks, and a well-established hospital network. Regional buying consortia increasingly negotiate enterprise-wide contracts that bundle sensors with cloud dashboards, creating predictable upgrade cycles every three years. U.S. academic hospitals lead the early adoption of implantable pressure sensors for heart-failure management trials, establishing reference sites that influence community hospital purchasing.

The Asia-Pacific region is forecast to advance at an 11.32% CAGR as China deploys USD 1 trillion in healthcare modernization projects by 2030, expanding bed capacity and digitizing primary-care clinics. Japan's population over 65 represents more than 30% of its citizens, intensifying demand for at-home pressure monitoring to defer long-term care admission. India's Ayushman Bharat scheme covers over 500 million beneficiaries, accelerating public tenders for low-cost wearable sensors compatible with tele-health consults. South Korea and Taiwan invest in 300 mm MEMS fabs to localize supply chains, amplifying technology diffusion.

Europe maintains a solid share driven by precision-engineering clusters in Germany and Switzerland that support high-performance sensor production. The full enforcement of the EU Medical Device Regulation in 2025 directs procurement toward suppliers with comprehensive clinical evidence, indirectly favoring large incumbents that can finance multi-center trials. Intra-EU digital health initiatives promote interoperable sensor data standards, encouraging cross-country remote care pilots. The Middle East and Africa are pursuing hospital-building programs, particularly across Gulf Cooperation Council states, whereas Latin America is slowly scaling up telemedicine to serve dispersed rural populations.

- Medtronic plc

- Edwards Lifesciences Corporation

- Sensirion Holding AG

- TE Connectivity Ltd.

- Smiths Group plc (Smiths Medical)

- Honeywell International Inc.

- Merit Medical Systems Inc.

- ICU Medical Inc.

- Opsens Inc.

- All Sensors Corporation (Amphenol Corporation)

- Resonetics LLC

- RJC Enterprises LLC

- NXP Semiconductors N.V.

- STMicroelectronics N.V.

- Omnivision Technologies Inc.

- TDK Corporation (InvenSense)

- Silicon Microstructures Inc.

- GE HealthCare Technologies Inc.

- Fujikura Ltd.

- Kulite Semiconductor Products Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for low-cost, high-performance and reliable sensors

- 4.2.2 Rising prevalence of chronic diseases driving continuous physiological monitoring

- 4.2.3 Miniaturisation and MEMS breakthroughs enabling invasive/implantable use-cases

- 4.2.4 Adoption surge in remote-patient-monitoring and tele-health pressure patches

- 4.2.5 Integration with digital-twin hemodynamic modelling platforms

- 4.2.6 Force-feedback requirements in robotic minimally invasive surgery

- 4.3 Market Restraints

- 4.3.1 Environmental impact on sensor stability (temperature, humidity, radiology)

- 4.3.2 Lack of meaningful product differentiation commoditising ASPs

- 4.3.3 Stringent multi-jurisdictional safety and biocompatibility approvals

- 4.3.4 Bio-fouling driven signal-drift in long-term implantables

- 4.4 Impact of Macroeconomic Factors

- 4.5 Industry Supply Chain Analysis

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 Self-calibrating

- 5.1.2 Fiber-optic

- 5.1.3 Telemetric

- 5.1.4 Capacitive

- 5.1.5 Wireless Passive

- 5.1.6 Piezoresistive

- 5.2 By Application

- 5.2.1 Diagnostic

- 5.2.2 Therapeutic

- 5.2.3 Medical Imaging

- 5.2.4 Monitoring

- 5.2.5 Fitness and Wellness

- 5.2.6 Other Applications

- 5.3 By End-user

- 5.3.1 Hospitals and Clinics

- 5.3.2 Ambulatory Surgery Centres

- 5.3.3 Home-care Settings

- 5.3.4 Sports and Fitness Facilities

- 5.3.5 Research Institutes

- 5.4 By Sensor Type

- 5.4.1 Invasive

- 5.4.2 Non-invasive

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 South-East Asia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Medtronic plc

- 6.4.2 Edwards Lifesciences Corporation

- 6.4.3 Sensirion Holding AG

- 6.4.4 TE Connectivity Ltd.

- 6.4.5 Smiths Group plc (Smiths Medical)

- 6.4.6 Honeywell International Inc.

- 6.4.7 Merit Medical Systems Inc.

- 6.4.8 ICU Medical Inc.

- 6.4.9 Opsens Inc.

- 6.4.10 All Sensors Corporation (Amphenol Corporation)

- 6.4.11 Resonetics LLC

- 6.4.12 RJC Enterprises LLC

- 6.4.13 NXP Semiconductors N.V.

- 6.4.14 STMicroelectronics N.V.

- 6.4.15 Omnivision Technologies Inc.

- 6.4.16 TDK Corporation (InvenSense)

- 6.4.17 Silicon Microstructures Inc.

- 6.4.18 GE HealthCare Technologies Inc.

- 6.4.19 Fujikura Ltd.

- 6.4.20 Kulite Semiconductor Products Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment