PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1403087

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1403087

Global Blood Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

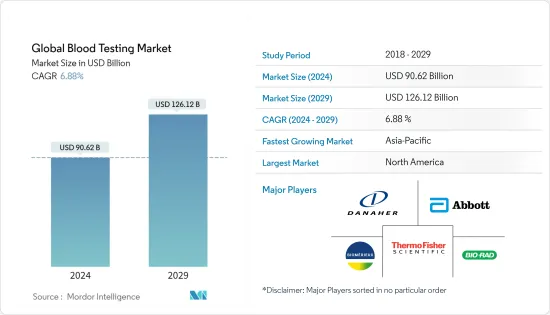

The Global Blood Testing Market size is estimated at USD 90.62 billion in 2024, and is expected to reach USD 126.12 billion by 2029, growing at a CAGR of 6.88% during the forecast period (2024-2029).

The outbreak significantly impacted the blood testing market as COVID-19 cases increased worldwide. Also, the rising adoption of blood testing to perform the COVID-19 diagnosis routines is expected during the forecast period. According to the article published in the Nature Journal in May 2022, the study constructed a machine-learning model for COVID-19 diagnosis that was based on and cross-validated on the routine blood tests of 5333 patients with various bacterial and viral infections, including 160 COVID-19-positive patients. Due to these factors, the COVID-19 impact on the market was expected to be positive. However, the market is currently growing at a stable pace owing to a resumption of diagnosis services, and it is expected to witness a similar trend over the coming years.

Factors such as the growing burden of chronic diseases, rising demand for home healthcare, the introduction of advanced technology-enabled products, the implementation of favorable government initiatives, and rising research and development expenditures on developing blood tests are expected to drive the market.

The blood, plasma, and serum are the most important factors in the body's circulation system. These are also widely studied for the detection of biomarkers, especially for cancer detection and early diagnosis. The growing burden of several chronic diseases increased the demand for their early and effective diagnosis, as delay in diagnosis may lead to complications that can be fatal. For instance, according to the Breast Cancer Factsheet Now 2021, around 55,000 women and 370 men in the United Kingdom are diagnosed with breast cancer yearly. Breast cancer claimed the lives of an estimated 600,000 people in the United Kingdom. This figure is expected to climb to 1.2 million by 2030. The huge prevalence of cancer cases worldwide requires regular monitoring and diagnosing of these diseases, which is expected to fuel the market growth during the study period.

According to the European Centre for Disease Prevention and Control's January 2023 publication, up to December 31, 2022, 4,110,465 cases of dengue and 4,099 deaths were reported. The majority of cases were reported from Brazil (2,363,490), Vietnam (367,729), the Philippines (220,705), Indonesia (125,888), and India (110,473). Early detection of disease progression associated with severe dengue boosts the demand for blood testing for timely diagnosis of the diseases, thus driving the market. Furthermore, product launches by market players are expected to propel the market's growth over the forecast period. For instance, in June 2022, in association with Datar Cancer Genetics, Apollo Cancer Centers will introduce a blood test to detect breast cancer early in asymptomatic individuals. The test, EasyCheck-Breast, can help detect breast cancer even before the first stage.

Thus, the studied market is expected to grow significantly during the study period due to the abovementioned factors. However, a stringent regulatory approval process is expected to hinder the market growth during the study period.

Blood Testing Market Trends

Glucose Testing is Expected to Hold Significant Share of the Blood Testing Market.

A blood glucose test measures the total amount of glucose in the blood. The symptoms of various disorders like diabetes usually appear suddenly, and are why blood sugar levels must be checked. Self-testing blood sugar is also important to manage diabetes and prevent complications. The rising prevalence of type I and type II diabetes, coupled with the growing cases of hereditary diabetes, also supports the growth of the glucose testing segment.

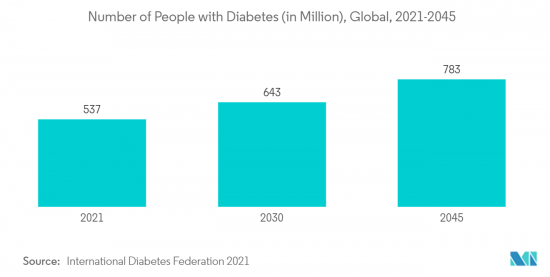

Furthermore, the prevalence of diabetes increased in recent years, and many reports predict that this prevalence will increase further in the future. For instance, as per the December 2021 report by the International Diabetes Federation, approximately 537 million adults (20-79 years old) lived with diabetes in 2021 across the globe. The total number of people living with diabetes is projected to rise to 643 million by 2030 and 783 million by 2045. It will increase the demand for blood glucose testing, which will help the market grow.

The presence of portable glucose meters that patients can use for routine checkups anywhere, anytime, resulted in a significant share of this segment. Furthermore, diabetes monitoring is carried out before any surgical intervention for the patient with diabetes, which consequently influences the demand for these products. The launch of new products in the segment is expected to drive market growth during the study period. For instance, in May 2022, Labcorp launched an at-home collection kit through Labcorp OnDemand that measures hemoglobin A1c (HbA1c) from a small blood sample to measure the sugar level.

Thus, the segment is expected to grow significantly over the forecast period due to the abovementioned factors.

North American Region Holds the Significant Share in the Blood Testing Market

The North American region acquired a significant market share due to technological advancements such as miniaturized diagnostic devices, which render rapid and accurate test results with higher market penetration in the region and favorable medical insurance policies that enhance the market adoption of products. The United States is expected to dominate the market in the North American region.

The rising burden of chronic diseases in the United States, such as cancer, diabetes, thyroid disease, and other diseases requiring blood tests, will boost the market. For instance, according to Cancer Facts and Figures 2023, published in January 2023 by the American Cancer Society, an estimated 1.9 million new cancer cases will be diagnosed in 2023. Among these, prostate cancer is estimated to be among 288,300, followed by 23,830 cases of lung cancer and 300,590 cases of female breast cancer. Furthermore, according to statistics published in May 2022 by the Government of Canada, about 233,900 Canadians were diagnosed with cancer in 2022, and prostate cancer is expected to remain the most commonly diagnosed cancer. Thus, the huge burden of cancer in the region is expected to increase demand for blood testing, thereby boosting market growth over the forecast period.

Furthermore, launching technologically advanced blood tests in the country will also positively contribute to market growth. For instance, in January 2022, Eurofins subsidiary empowerDX launched PFAS Exposure in the United States, a direct-to-consumer at-home test to determine levels of per- and polyfluorinated alkyl substances (PFAS) in a person's blood and measure 47 of the PFAS chemical compounds. Also, in August 2021, Smart Meter launched the iGlucose monitor for managing gestational diabetes. iGlucose provides an easy and reliable way to test, monitor, and manage blood glucose levels, ensuring that all care providers can immediately access testing results.

Thus, the abovementioned factors are expected to drive the market's growth in the North American region.

Blood Testing Industry Overview

The blood testing market is fragmented and consists of several major players. The companies implemented certain strategic initiatives, such as mergers, new product launches, acquisitions, and partnerships, which helped them strengthen their market position. The major players are Danaher Corporation, BioRad Laboratories, Thermofisher Scientific, Abbott Laboratories, and BioMerieux S.A. The key players are also involved in various strategic alliances, such as acquisitions and collaborations, and launching advanced products to secure their position in the global market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Burden of Chronic Diseases

- 4.2.2 Rising Demand for Home Healthcare and the Introduction of Advance Technology-enabled Products

- 4.2.3 Implementation of Favorable Government Initiatives & External Funding for R&D Exercises

- 4.3 Market Restraints

- 4.3.1 Stringent Regulatory Approval Process

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size By Value - in USD)

- 5.1 By Type

- 5.1.1 Glucose Testing

- 5.1.2 Lipid Panel Testing

- 5.1.3 Prostate Specific Antigen (PSA) Testing

- 5.1.4 Blood Urea Nitrogen (BUN) Testing

- 5.1.5 Thyroid Stimulating Hormone Testing

- 5.1.6 Other Types (Direct LDL testing, Testosterone Testing)

- 5.2 By Methods

- 5.2.1 Manual Blood Testing

- 5.2.2 Automated Blood Testing

- 5.3 By End User

- 5.3.1 Diagnostic Laboratories

- 5.3.2 Hospitals

- 5.3.3 Other End Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Abbott Laboratories

- 6.1.2 Becton, Dickinson and Company

- 6.1.3 BioMerieux SA

- 6.1.4 BioRad Laboratories

- 6.1.5 Danaher Corporation

- 6.1.6 F. Hoffmann-La Roche AG

- 6.1.7 Novartis International AG

- 6.1.8 Thermo Fisher Scientific

- 6.1.9 Una Health Ltd

- 6.1.10 Shimadzu Corporation

- 6.1.11 Waters Corporation

- 6.1.12 PerkinElmer Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS