PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1403755

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1403755

Canada Minimally Invasive Surgery Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

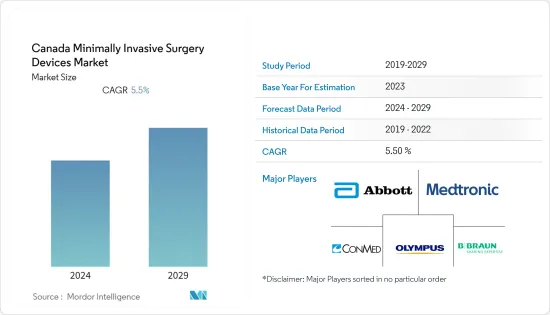

The Canada minimally invasive surgery devices market is poised to register a CAGR of 5.5% over the forecast period.

COVID-19 has impacted the growth of the market owing to the lockdown restrictions, which led to the suspension of non-urgent and elective procedures during the early period. For instance, according to an article published in the British Journal of Surgery in January 2021, it has been observed that about 30,033 surgical procedures were performed during the 2020 pandemic as compared to 255,501 surgical procedures performed in the pre-pandemic period. However, with the released restrictions, the companies are focusing on developing advanced products. For instance, in January 2021, PENTAX Medical, in collaboration with CapsoVision, Inc., increased the at-home availability of the CapsoCam Plus video capsule system, preventing virus transmission, with Health Canada licensing. Thus, the studied market has witnessed significant growth and is expected to grow over the forecast period.

Factors such as the increasing prevalence of lifestyle-related and chronic disorders, as well as technological advancements, are expected to boost the market growth. The advantages offered by minimally invasive surgical (MIS) procedures, such as less post-operative pain, fewer major operative, and post-operative complications, faster recovery times, less scarring, less stress on the immune system, and smaller incisions over conventional procedures, make it a more preferred choice for performing surgeries.

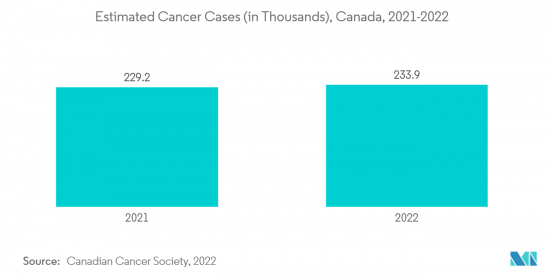

The growing prevalence of chronic diseases, such as cancer, diabetes, cardiovascular diseases, and others, is the key factor driving the demand for minimally invasive surgical procedures. This is anticipated to augment the market growth over the forecast period. For instance, as per the data published by the Canadian Cancer Society, in May 2022, colorectal cancer is expected to be the fourth most diagnosed cancer in Canada, 2022 and nearly 24,300 Canadians are predicted to be diagnosed with colorectal cancer, which represents 10% of all new cancer cases in Canada in 2022. Thus, the increasing burden of cancer among Canadian people increases the demand for surgical procedures, which is expected to increase the demand for surgical devices, thereby boosting the market growth.

Additionally, according to the 2022 statistics published by the International Diabetes Federation, 2.9 million people were living with diabetes in Canada in 2021. In addition, this number is projected to increase to 3.2 million in 2030. The high blood sugar caused by diabetes can damage the nerves that control the heart and blood vessels, leading to a variety of cardiovascular diseases like coronary artery disease and stroke, which can narrow the arteries. This is anticipated to raise the demand for surgical procedures, which is anticipated to fuel the demand for minimally invasive surgical devices, thereby boosting the market growth.

With the rising burden of heart disease, the demand for interventional devices is increasing. Also, governments across the Canadian province are investing heavily to improve the healthcare infrastructure. For instance, as per a press release by the Ontario Government in April 2022, Conavi Medical, a Toronto-based medical device company that develops, manufactures, and commercializes innovative medical technologies to guide common minimally invasive heart procedures, planned to invest USD 6.7 million to make substantial improvements to its existing facility and implement state-of-the-art IT systems to develop medical technologies used for heart procedures. Such investments are expected to fuel market growth.

Therefore, owing to the aforementioned factors, such as the high burden of chronic diseases, diabetes, and new product launches, are expected to increase the market growth over the forecast period. However, the shortage of experienced professionals is likely to impede the growth of the minimally invasive surgery devices market over the forecast period.

Canada Minimally Invasive Surgery Devices Market Trends

Gastrointestinal Segment Expects to Witness Significant Growth Over the Forecast Period

The gastrointestinal segment is expected to witness significant growth in the minimally invasive surgery market over the forecast period due to factors such as the rising incidence of gastrointestinal diseases among the population.

The major diseases associated with the gastrointestinal system are irritable bowel syndrome (IBS), Crohn's disease, peptic ulcers, and others. According to the 2022 update by CDHF, GERD is a common disorder that has a significant impact on the Canadian community. The people suffering from GERD symptoms are absent from work 16% of each year, which represents USD 21 billion in costs or 1.7 billion hours of lost productivity annually. As per the source above, approximately five million Canadians experience heartburn and/or acid regurgitation at least once each week. Such a burden of GERD in the country is accelerating the demand for endoscopic treatments in Canada, fueling the market growth.

Additionally, the growing prevalence of cancer related to the gastrointestinal tract, such as colon and rectum cancers, is expected to drive the demand for minimally invasive procedures. For instance, according to 2022 statistics published by the Canadian Cancer Society, about 4,100 Canadians (2,600 men and 1,450 women were diagnosed with stomach cancer in 2022. The high burden of gastric cancer among the population raises the demand for technologically advanced endoscopes to perform the surgery, which in turn is anticipated to augment the segment growth over the forecast period.

Furthermore, new product launches in the country increase the availability of advanced surgical devices in the market. This is also anticipated to boost the segment's growth over the forecast period. For instance, in November 2022, PENTAX Medical, a healthcare company focused on diagnostic and therapeutic endoscopy solutions, launched their new Performance Endoscopic Ultrasound (EUS) system, a combination of the new ARIETTA 65 PX ultrasound scanner and their best-in-class J10 Series Ultrasound Gastroscopes in Canada.

Thus, owing to the aforementioned factors, such as the high burden of gastrointestinal diseases and new product launches, the studied segment is expected to grow significantly during the forecast period.

Robotic-assisted Surgical Systems Segment is Expected to Hold a Significant Market Share Over the Forecast Period

The robotic-assisted surgical systems segment is expected to grow over the forecast period owing to factors such as the rising prevalence of chronic diseases, rising technological advancements, and the rising company focus on developing advanced products in the country.

The complex procedures, such as orthopedic replacements or thoracic surgery, performed in the country increase the demand for robotic surgery that provides a clear view of the deep tissues and structures. For instance, according to the data published by the Canadian Institute for Health Information, in December 2022, about 700 outpatient hip and knee replacements were performed during 2021-2022 in Canada. In addition, as per the same source, 62% of patients in Canada received joint replacements between October 2020 and September 2021. Thus, the high number of replacement procedures is expected to fuel the market growth over the forecast period.

Increasing adoption of robotic-assisted surgery systems, increased awareness of the advantages of minimally invasive procedures, and rising product approvals in the country are all increasing the availability of robotic surgical systems in the market. This is anticipated to increase its adoption during complex surgeries, hence propelling the market's growth. For instance, in December 2021, Medtronic Canada ULC received the Health Canada license for the Hugo robotic-assisted surgery (RAS) system for use in urologic and gynecologic laparoscopic surgical procedures. Also, in October 2021, Medtronic Canada ULC, a subsidiary of Medtronic plc, launched the Mazor X System for robotic-guided spine surgery. The Mazor platform, one of the first specialized robotic-assisted spine surgery technologies that offers a fully integrated procedural solution for surgical planning, workflow, execution, and confirmation, is the first dedicated robotic-assisted spine surgery platform being launched in Canada.

Therefore, the studied market is anticipated to grow over the forecast period due to the aforementioned factors, such as the high burden of chronic diseases, increasing new product launches, and approvals.

Canada Minimally Invasive Surgery Devices Industry Overview

Canada's minimally invasive surgery devices market is consolidated owing to the presence of few players in the market. Some of the key players in the market are Olympus Corporation, CONMED Corporation, Medtronic PLC, Braun Melsungen AG (Aesculap Inc), Stryker Corporation, Abbott Laboratories, and Johnson & Johnson, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Prevalence of Lifestyle-related and Chronic Disorders

- 4.2.2 Technological Advancements

- 4.3 Market Restraints

- 4.3.1 Shortage of Experienced Professionals

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Million)

- 5.1 By Products

- 5.1.1 Handheld Instruments

- 5.1.2 Guiding Devices

- 5.1.3 Electrosurgical Devices

- 5.1.4 Endoscopic Devices

- 5.1.5 Laproscopic Devices

- 5.1.6 Monitoring and Visualization Devices

- 5.1.7 Robotic Assisted Surgical Systems

- 5.1.8 Ablation Devices

- 5.1.9 Laser Based Devices

- 5.1.10 Other MIS Devices

- 5.2 By Application

- 5.2.1 Aesthetic

- 5.2.2 Cardiovascular

- 5.2.3 Gastrointestinal

- 5.2.4 Gynecological

- 5.2.5 Orthopedic

- 5.2.6 Urological

- 5.2.7 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Olympus Corporation

- 6.1.2 Medtronic PLC

- 6.1.3 Abbott Laboratories Inc

- 6.1.4 CONMED Corporation

- 6.1.5 B. Braun SE (Aesculap Inc)

- 6.1.6 Johnson & Johnson

- 6.1.7 Smith & Nephew Plc

- 6.1.8 Stryker Corporation

- 6.1.9 Zimmer Biomet Holdings Inc

- 6.1.10 Koninklijke Philips N.V.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS