PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1639516

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1639516

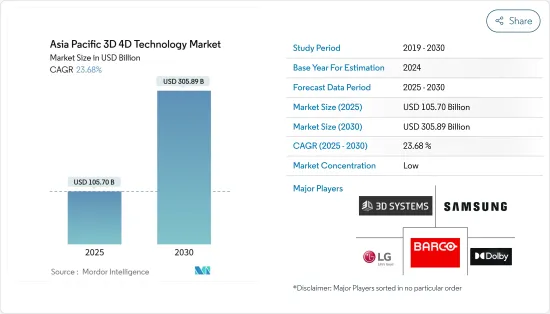

Asia Pacific 3D 4D Technology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Asia Pacific 3D 4D Technology Market size is estimated at USD 105.70 billion in 2025, and is expected to reach USD 305.89 billion by 2030, at a CAGR of 23.68% during the forecast period (2025-2030).

The region has been a significant player in the adoption and advancement of 3D and 4D technology across various industries.

Key Highlights

- The film, gaming, and animation industries have utilized 3D and 4D technology to enhance user experiences. 3D and 4D imaging technologies have played a crucial role in medical diagnosis and treatment planning. These technologies allow for better visualization of patient anatomy and can aid in surgeries and medical research.

- The increasing applications of 3D technology are significantly driving the growth of the market. As the applications of 3D technology continue to expand, the market for related products and services, such as 3D cameras, software, printers, and content creation tools, is expected to grow.

- The entertainment industry's demand for 3D and 4D technology has driven growth in the market. The demand for an enhanced and immersive experience in entertainment content, such as movies, video games, and theme park attractions, has led to significant advancements in 3D and 4D technologies.

- The high costs associated with 3D printing materials have been a significant factor limiting the growth of the 3D and 4D technology market, particularly in the context of 3D printing. The cost of materials can have a direct impact on the feasibility and scalability of adopting 3D printing technologies across various industries.

Asia Pacific 3D 4D Technology Market Trends

3D Printer Application Segment is Expected to Hold Significant Market Share

- 3D printers have many applications within the border 3D and 4D technology market. 3D printing manufactures complex and lightweight components for aircraft, spacecraft, and vehicles. These components are often designed to optimize performance and fuel efficiency.

- The healthcare industry benefits from 3D printing for various applications, including creating patient-specific anatomical models for surgical planning, custom prosthetics and implants, dental devices, and even tissue and organ printing in regenerative medicine. 3D printing is widely used in creating dental crowns, bridges, and orthodontic devices. Customized implants and prosthetics can be tailored to the patient's identical anatomy.

- 3D printing is used in educational settings to teach concepts related to design, engineering, and manufacturing. It also aids researchers in creating physical models for studying complex structures. Artists and sculptors utilize 3D printing to bring their creative vision to life in new and innovative ways.

- Architects use 3D printing to create detailed scale models of buildings and structures. In construction, it's used for prototyping and creating detailed components.

- According to SWZD, in 2022, approximately 50 percent of businesses across the Asia-Pacific region planned to adopt 3D Printing technology within the next two years.

China is Expected to Hold Significant Market Share

- China is positioned as a global manufacturing and technology hub. This extends to 3D printing, where the country has made strides in developing and adopting additive manufacturing technologies for various applications.

- The country has embraced 3D printing across various sectors, including aerospace, automotive, healthcare, and consumer goods. The government's emphasis on technology and innovation has encouraged local industries to explore and implement 3D printing solutions.

- The Chinese government has launched initiatives to promote technological innovation, including 3D and 4D technologies. Policies supporting these technologies' research, development, and adoption have fostered growth in related industries. China has been investing in education and research related to 3D and 4D technologies.

- The automotive industry also utilizes 3D and 4D technologies for design, prototyping, and simulation. As the production of passenger cars increases, there's greater demand for efficient design processes and rapid prototyping. 3D modeling and simulation tools can aid in designing vehicles with optimal performance and safety. According to OICA, with approximately 23.56 million units, China remained the largest market for passenger car sales in 2022.

Asia Pacific 3D 4D Technology Industry Overview

The Asia Pacific 3D 4D technology market is highly fragmented, with the presence of major players like 3D Systems Corporation, Dolby Laboratories, Inc., LG Electronics Inc., Barco N.V., and Samsung Electronics Co., Ltd. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In July 2023, 3D Systems announced that Matrix Moon, an additive manufacturing-focused training center and 3D Systems reseller in India, purchased an EXT 1070 Titan Pellet 3D printer. Matrix Moon has chosen the configuration that includes the optional milling spindle tool head to enable hybrid additive and subtractive manufacturing processes on the same machine.

In September 2022, Autodesk released 3DS Max 2023.2, the latest update to the 3D modeling and rendering software. The update adds a new Array Modifier for tasks ranging from procedural modeling to creating motion graphics and improves chamfer operations, mesh re-triangulation, and glTF export.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

5 MARKET INSIGHTS

- 5.1 Market Drivers

- 5.1.1 Increasing Applications of 3D Technology Across Various End-User Industries

- 5.1.2 Increasing Demand for 3D Technology in the Entertainment Industry

- 5.1.3 Increased Investment in R&D to Drive Development of Cost-Effective 3D Technology

- 5.2 Market Restraints

- 5.2.1 High Product Associated Costs and Availability of 3D Printing Materials

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Electrical & Electronic Components (IC, Transistors, Sensors Etc)

- 6.1.2 3D Printer

- 6.1.3 3D Gaming Console

- 6.1.4 3D Imaging

- 6.1.5 3D Displays

- 6.1.6 Other Applications

- 6.2 By Vertical

- 6.2.1 Healthcare

- 6.2.2 Entertainment and Media

- 6.2.3 Education

- 6.2.4 Government

- 6.2.5 Industrial

- 6.2.6 Consumer Electronics

- 6.3 By Country

- 6.3.1 China

- 6.3.2 Japan

- 6.3.3 India

- 6.3.4 South Korea

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 3D Systems Corporation

- 7.1.2 Dolby Laboratories, Inc.

- 7.1.3 LG Electronics Inc.

- 7.1.4 Barco N.V.

- 7.1.5 Samsung Electronics Co., Ltd.

- 7.1.6 Autodesk, Inc.

- 7.1.7 Stratasys, Inc.

- 7.1.8 Panasonic Corporation

- 7.1.9 Sony Corporation

- 7.1.10 Dreamworks Animation SKG, Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET