PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686536

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686536

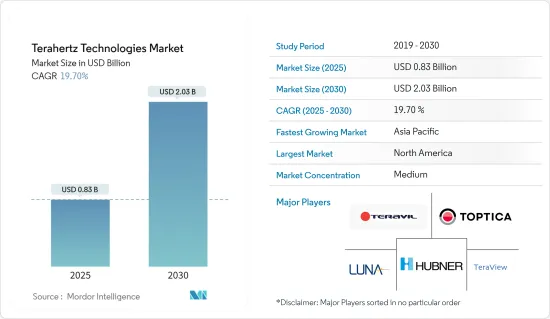

Terahertz Technologies - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Terahertz Technologies Market size is estimated at USD 0.83 billion in 2025, and is expected to reach USD 2.03 billion by 2030, at a CAGR of 19.7% during the forecast period (2025-2030).

Terahertz technology is rapidly emerging, with applications spanning from airport passenger scanning to extensive digital data transfers. The field has witnessed notable scientific advancements. A key driver of growth in the Terahertz Technology Industry is the adoption of terahertz systems within the semiconductor sector.

The Rising Usability of Terahertz Technologies in Various Sectors is Driving its Growth

Key Highlights

- Terahertz waves are prized for their distinctive properties. They can penetrate various materials, including clothing, paper, wood, and even walls, and are adept at detecting air pollution. These traits position them as frontrunners in security and medical imaging systems, fields that THz sources stand poised to transform. In contrast to X-rays, which can be harmful to living tissue due to their ionizing nature, THz radiation is non-ionizing. Its lower photon energy renders it safe for imaging, making it an excellent choice for medical applications. This allows for the generation of high-resolution images of the human body, all while safeguarding patients from harmful radiation exposure.

- Furthermore, with their substantial data-carrying capacity, THz waves promise to accelerate wireless communication in the forthcoming technologies. Hence, the expanding telecommunication infrastructure globally is poised to significantly benefit developing nations. The surging demand for smart devices and applications-ranging from the Internet of Things (IoT) and Artificial Intelligence (AI) to Big Data-underscores the pivotal role of interconnected technologies in data capture and transfer, essential for bolstering urban infrastructure.

Challenges Associated with Market Studied

Key Highlights

- Despite its potential, the studied market faces several growth challenges. For example, the limited commercialization of terahertz technology has led to a widespread lack of understanding, hindering its adoption in various regions. Nevertheless, the research community has made significant strides in recognizing the technology's potential, pinpointing key advantages that could pave the way for a distinct market.

Technological Innovations Favoring the Market Growth

Key Highlights

- Researchers worldwide are harnessing terahertz energy to innovate advanced devices and systems. In January 2024, ShanghaiTech University achieved a milestone in terahertz technology. A Chinese research team developed a novel carbon-based tunable metasurface absorber boasting a broad tunable bandwidth in the terahertz range. This innovative absorber predominantly employs graphene and graphite microstructures. The design emphasizes optimizing absorption efficiency, considering geometry, material properties, polarization sensitivity, and tuning mechanisms.

- Moreover, Chinese researchers are at the forefront of developing cutting-edge terahertz-based technologies. A notable achievement came in October 2023, when Chinese scientists conducted successful tests on a satellite communication device, marking a significant milestone towards 6G network realization. Dubbed "spaceborne optical switching technology," this device can seamlessly transmit light signals across various locations.

Terahertz Technologies Market Trends

Defense and Security End-User Segment is Expected to Hold Significant Market Share

- As the focus on detecting concealed explosives intensifies, terahertz technology is garnering heightened interest for security and defense applications. A hallmark of terahertz technology is its capability to unveil objects obscured by barriers. Thanks to terahertz beams, security personnel can now identify threats like ceramic knives or plastic explosives-non-metallic substances often overlooked-at airports and other high-security venues. This detection prowess stems from T-rays' ability to penetrate clothing while being blocked by the body's upper skin due to its water content.

- Traditional methods like metal detection and X-ray bag scanning can be laborious, especially in bustling public transportation hubs. This underscores the demand for advanced technological solutions capable of conducting security checks from a distance. terahertz technology rises to the occasion, enabling the scanning of numerous individuals without necessitating halts for security checks.

- A groundbreaking device has emerged, generating outputs that surpass the strength of conventional terahertz waves and can be directed with greater precision. This advancement not only fuels innovation and product development across diverse sectors but also bolsters industries and communities harnessing terahertz wave technology. The military potential of terahertz sensors is vast, especially in intelligence, surveillance, and reconnaissance (ISR) roles, such as pinpointing isolated personnel behind enemy lines, target acquisition, and guiding precision munitions.

- Moreover, for the fiscal year 2023-24, India earmarked INR 5.94 trillion (USD 72.6 billion) for defense, marking a 13% uptick from the prior year. This budget aims to bolster India's defense capabilities, including the procurement of fighter jets and infrastructure development along its contentious border with China. These escalating defense expenditures across nations underscore a burgeoning demand for terahertz technology.

- The increasing defense expenditure by countries across the globe is also driving the demand for military aircraft. For instance, according to estimates by Flight Global, a major firm tracking global defense aircraft dynamics, the United States is anticipated to maintain its position as the country with the highest number of military aircraft (13,209) among NATO countries and globally.

- As demand for defense aircraft continues to rise, the adoption of terahertz technology in this segment is set to increase. For instance, terahertz systems can inspect high-performance coatings on military aircraft, ensuring coating thickness is verified with submicron accuracy. Additionally, terahertz measurements play a crucial role in facilitating in-service inspections and repairs of these external coatings. Furthermore, according to Luna Innovations, using a single sensor, terahertz measurement systems can verify the structure of multilayer materials. When equipped with a line scanner gauge, a terahertz system can generate B-scan images to detect defects, analyze subsurface structures, or deliver accurate offset and separation measurements.

North America Holds Largest Market Share

- The United States is a key market for terahertz technologies, primarily owing to the growing homeland security issues, investments in defense, and R&D. In addition, the stringent government regulations regarding the safety and production of aerospace technologies in the US and the growing automotive and aerospace industries are driving the market for Terahertz technologies in the regional market.

- According to the Aerospace Industries Association, the aerospace and defense (A&D) industry generated USD 955 billion in total business output in 2023. Output directly from the industry totaled USD 533 billion, and an additional nearly USD 422 billion in indirect activity was generated through the domestic aerospace and defense (A&D) supply chain. The aerospace and defense (A&D) industry generated USD 425 billion in economic value, representing 1.6 percent of the 2023 nominal GDP in the U.S. Such heightened growth from the aircraft industry is a significant driver for the growth of inspection systems based on terahertz technology.

- Researchers from the US Air Force are exploring technologies for future line-of-sight air-to-air communications. They are focusing on frequencies exceeding 100 GHz, aiming to enable aircraft to exchange crucial battle-management information. To achieve this, Air Force specialists plan to test terahertz communication technologies using modeling and simulation techniques.

- Terahertz waves are harmless to humans and have no ionizing radiation, unlike X-ray machines. These properties of terahertz and sub-terahertz spectral ranges make T-ray-based screening solutions valuable for applications where human health and safety are of utmost importance. Canada is expected to witness significant growth in demand for the technology due to increased demand for security screening equipment across various public places, like airports.

- For instance, according to Statistique Canada, in July 2024, 5.6 million passengers passed through pre-board security screening at checkpoints operated at Canada's eight largest airports, an increase of 3.3% from July 2023. Screened passenger traffic in July 2024 came in above pre-COVID-19 pandemic levels, with 4.1% more screened passengers than in July 2019. Such growing instances of security screening positively impact growth in the studied market.

- In addition, the Canadian government is prioritizing investments in airport infrastructure to enhance mobility, safety, and security for passengers and residents. For example, in February 2024, Montreal Metropolitan Airport (YHU) secured a USD 90 million investment from the Canada Infrastructure Bank (CIB) aimed at constructing a new passenger terminal. This investment is poised to bolster mobility for Canadians traveling to and from Montreal and stimulate economic prospects in the Montreal region. Such investments are anticipated to pave the way for advancing technologies, like terahertz scanners, ensuring the efficient operation of airport infrastructures.

Terahertz Technologies Market Overview

Competition in the market is influenced by factors like robust competitive strategies and the concentration ratio of firms. Buyers increasingly seek efficient solutions, leading to a moderately high sustainable competitive advantage through innovation.

Key players, including TOPTICA Photonics AG, TeraView Limited, and BATOP GmbH, dominate the European market, holding significant market shares. Considering the evolving nature of the market, first mover advantage is anticipated to favor the existing players.

Market players are heavily dependent on technological advancements and consumer willingness to adopt these technologies. However, competitors can also secure an edge by offering innovative solutions and utilizing advanced techniques to extract unique, detailed insights.

While current product penetration is low, it's anticipated to rise in tandem with market growth during the forecast period. New entrants with a strong technical background can leverage emerging opportunities from the market, strengthening their footprint in the market.

Exit barriers are minimal; components can be repurposed for other technologies using duplicated sources, mitigating risks tied to sunk costs. Furthermore, competitive strategies wield a quite strong influence on a company's market position, especially given the ambiguity surrounding product uniqueness, which can sway end-user decisions.

In summary, while the intensity of competitive rivalry stands at a moderately high level, there's potential for further growth in the coming years.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Analysis of Non-destructive Testing Applications of Terahertz Technology

- 4.5 An Analysis Covering Legal and Regulatory Space For Terahertz Technologies at a Consolidated Level For All Technology Types

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand in the Medical Sector and Non-destructive Testing Applications

- 5.1.2 Holistic Approach to Security Through the Usage of Terahertz Technology

- 5.2 Market Restraints

- 5.2.1 Lack of Awareness of the Technology in the Market

- 5.2.2 Lacking the Device Infrastructure to Support the Adoption of Terahertz Technology

6 MARKET SEGMENTATION

- 6.1 By Application Category

- 6.1.1 Terahertz Imaging Systems

- 6.1.1.1 Active System

- 6.1.1.2 Passive System

- 6.1.2 Terahertz Spectroscopy Systems

- 6.1.2.1 Time Domain

- 6.1.2.2 Frequency Domain

- 6.1.3 Communication Systems

- 6.1.1 Terahertz Imaging Systems

- 6.2 By End User

- 6.2.1 Healthcare

- 6.2.2 Defense and Security

- 6.2.3 Telecommunications

- 6.2.4 Industrial

- 6.2.5 Food and Agriculture

- 6.2.6 Laboratories

- 6.2.7 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Spain

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Luna Innovations

- 7.1.2 Teravil Ltd

- 7.1.3 TeraView Limited

- 7.1.4 Toptica Photonics AG

- 7.1.5 Hubner Gmbh & Co. Kg

- 7.1.6 Advantest Corporation

- 7.1.7 BATOP GmbH

- 7.1.8 Terasense GP Inc.

- 7.1.9 Microtech Instrument Inc.

- 7.1.10 Menlo Systems GmbH

- 7.1.11 Gentec Electro-optics Inc.

- 7.1.12 Bakman Technologies LLC

- 7.1.13 QMC Instruments Ltd

- 7.1.14 Bruker Corporation

- 7.1.15 LYTID

- 7.1.16 Attocube Systems AG

- 7.1.17 Helmut Fischer Gmbh

- 7.1.18 Baugh & Weedon Ltd

- 7.1.19 Das-nano

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS