PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687075

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687075

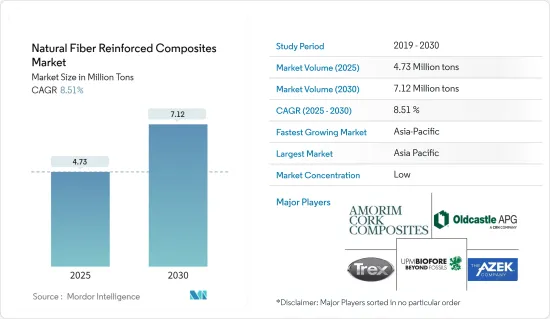

Natural Fiber Reinforced Composites - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Natural Fiber Reinforced Composites Market size is estimated at 4.73 million tons in 2025, and is expected to reach 7.12 million tons by 2030, at a CAGR of 8.51% during the forecast period (2025-2030).

In the medium term, factors such as the increasing demand for bio-based composites and the growth of the global automotive industry are likely to drive the natural fiber-reinforced composites market between 2024 and 2029.

Key Highlights

- However, moisture adsorption, restricted processing temperature, incompatibility with most polymer matrices, and degradation issues due to exposure to the external environment are likely to act as restraints for the market.

- Nevertheless, increasing popularity in the building and construction industry is expected to provide new opportunities for the market.

- Asia-Pacific is expected to dominate the market and is likely to witness the highest CAGR from 2024 to 2029.

Natural Fiber Reinforced Composites Market Trends

The Construction Industry is Expected to Dominate the Market

- There is always a continuous requirement for eco-friendly materials in the building materials industry. Natural fiber-reinforced polymer-based composites are increasingly used in civil engineering construction applications due to their numerous advantages.

- In the building and construction industry, composite materials are extremely significant. Industrial supports, tanks, long-span roof structures, high-rise buildings and lightweight doors, windows, furnishings, lightweight buildings, bridge components, and complete bridge systems have all employed composite materials. Composite materials are becoming increasingly essential in the construction industry to achieve long-term sustainability.

- The construction sector has witnessed major investments in recent years. According to Oxford Economics, the global construction industry is expected to grow by USD 4.5 trillion, or 42%, between 2020 and 2030 to reach USD 15.2 trillion. Also, China, India, the United States, and Indonesia are expected to account for 58.3% of global growth in construction between 2020 and 2030.

- Additionally, the construction sector is a key contributor to China's continued economic development and demand for natural fiber-reinforced composite products. China is amid a construction mega-boom. Moreover, as per the forecast given by the Ministry of Housing and Urban-Rural Development, the Chinese construction sector is expected to maintain a 6% share of the country's GDP going into 2025.

- The construction sector is a key player in China's continued economic development. According to the National Bureau of Statistics of China, the value of construction output accounted for CNY 31.2 trillion (USD 4.5 trillion) in 2022, up from CNY 29.3 trillion (USD 4.2 trillion) in 2021. China is expected to spend nearly USD 13 trillion on buildings by 2030, creating a positive outlook for natural fiber-reinforced composites.

- In North America, the United States has a major share in the construction industry. Besides the United States, Canada and Mexico contribute significantly to investments in the construction sector. According to the United States Census Bureau Data, the annual value of public residential construction in the United States was valued at USD 9.15 billion in 2022, an increase of 35.7% compared to USD 6.74 billion in 2017.

- Similarly, as per the Eurostat, the annual average production in construction for 2023, compared to 2022, increased by 0.2% in the euro area and by 0.1% in the European Union. The highest annual increases in construction production were recorded in Romania (+30.7%), Poland (+18.9%), and Belgium (+10.7%).

- Hence, the aforementioned trends are projected to influence the growth of natural fiber-reinforced composites in the construction sector between 2024 and 2029.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is expected to dominate the global market. With growing construction activities in countries such as China, India, and Japan, the usage of natural fiber-reinforced composites is increasing in the region.

- As per the Ministry of Housing and Urban-Rural Development, the Chinese construction sector is expected to maintain a 6% share of the country's GDP going into 2025. With the given forecasts, the Chinese government unveiled a five-year plan in January 2022 to make the construction sector more sustainable and quality-driven.

- Similarly, the surging application of natural fiber-reinforced composites in the electronics industry is likely to support the country's industry growth. According to the India Brand Equity Foundation (IBEF), the Indian electronics manufacturing industry is expected to reach USD 520 billion by 2025.

- Furthermore, automotive is among the major consumers of natural fiber-reinforced composites. The automotive industry in India is an important indicator of the Indian economic performance, as this sector plays a vital role in both technological advancements and macroeconomic expansion.

- Additionally, the Indian government has created momentum through its Faster Adoption and Manufacturing of (Hybrid and) Electric Vehicles schemes that encourage, and in some segments, mandate the adoption of electric vehicles (EV), intending to reach 30% EV penetration by 2030. The scheme creates demand incentives for EVs and supports the deployment of charging technologies and stations in urban centers. The government has set a target of 70% of all commercial cars, 30% of private cars, 40% of buses, and 80% of two-wheelers and three-wheelers sold in India by 2030 to be electric.

- Hence, the new policies and investments made by different governments are expected to boost the demand for the natural fiber-reinforced composites market in the rest of Asia-Pacific between 2024 and 2029.

Natural Fiber Reinforced Composites Industry Overview

The natural fiber reinforced composites market is fragmented in nature. Major players (not in any particular order) include Trex Company Inc., The AZEK Company Inc., Oldcastle APG Inc., UPM, and Amorim Cork Composites SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Bio-based Composites

- 4.1.2 Growth in the Automotive Industry Worldwide

- 4.2 Restraints

- 4.2.1 Moisture Adsorption, Restricted Processing Temperature, and Incompatibility with Most of the Polymer Matrices

- 4.2.2 Degradation Issue Due to Exposure to the External Environment

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Fiber

- 5.1.1 Wood Fiber Composites

- 5.1.2 Non-wood Fiber Composites

- 5.1.2.1 Cotton

- 5.1.2.2 Flax

- 5.1.2.3 Kenaf

- 5.1.2.4 Hemp

- 5.1.2.5 Other Non-wood Fiber Composites (Jute, Sisal, Abaca, Coir, Pineapple, and Banana)

- 5.2 Polymer

- 5.2.1 Thermosets

- 5.2.2 Thermoplastics

- 5.2.2.1 Polyethylene

- 5.2.2.2 Polypropylene

- 5.2.2.3 Poly Vinyl Chloride

- 5.2.2.4 Other Thermoplastics (Polycarbonate, Polyamide, and Polybutylene Terephthalate (PBT))

- 5.3 End-user Industry

- 5.3.1 Aerospace

- 5.3.2 Automotive

- 5.3.3 Marine

- 5.3.4 Building and Construction

- 5.3.5 Electrical and Electronics

- 5.3.6 Sports

- 5.3.7 Other End-user Industries (Power Industry (Wind Turbines), Medical, etc.)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Nordic Countries

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 Qatar

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 South Africa

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Amorim Cork Composites SA

- 6.4.2 Beologic

- 6.4.3 BPREG Composites

- 6.4.4 Fiberon

- 6.4.5 FKuR

- 6.4.6 Flexform Technologies

- 6.4.7 Green Dot Bioplastics

- 6.4.8 GreenGran BN

- 6.4.9 JELU-WERK J. Ehrler GmbH & Co. KG

- 6.4.10 Oldcastle APG

- 6.4.11 TECNARO GmbH

- 6.4.12 The AZEK Company Inc.

- 6.4.13 Trex Company Inc.

- 6.4.14 UFP Technologies Inc.

- 6.4.15 UPM

- 6.4.16 Wuhu Haoxuan Wood Plastic Composite Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Popularity in the Building and Construction Industry