PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1404301

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1404301

China Automotive Sunroof - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

The China automotive sunroof market is valued at USD 4.1 billion in the current year. It is expected to reach USD 6.2 billion within the forecast year, registering a CAGR of about 10.12 % during the forecast period.

A sunroof is often considered an additional feature in automobiles, which is available in fixed or operable (venting or sliding) openings in an automobile roof. Sunroof, as a feature in automobiles, was installed way back in 1932, when Mercedes Benz offered the first car sunroof.

Sunroofs are transparent and non-transparent panels that can be manually or electrically operated and are available in many sizes and shapes. At present, original equipment manufacturers (OEMs) are developing advanced technologies to manufacture sunroofs, which include different composite materials for developing lightweight sunroof solutions. Furthermore, the market for aftermarket sunroofs is also increasing with an increase in the demand as people get it installed aftermarket, which costs them less as compared to OEM fitting.

Over the medium term, factors such as rising demand for cars with sunroofs, advancement in glass technology, and surge in demand for safety, comfort, and convenience features are fueling the automotive sunroof market in China. Moreover, the increasing penetration of solar sunroofs in electric vehicles and its rising sales create lucrative growth opportunities for the market.

The above factors, coupled with infrastructure expansion and government initiatives, will drive market growth.

China Automotive Sunroof Market Trends

Increased Adoption of Sunroofs in Sports Utility Vehicles

A rise in the adoption of sunroofs in vehicle rooftops globally is expected to augment the automotive sunroof market during the forecast period. The rise in the use of sunroofs from the aftermarket is also significantly driving the demand for the automotive sunroof system.

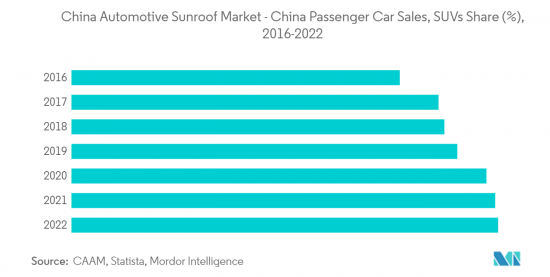

SUVs (Sports Utility Vehicles) are big cars, ideal for rough surfaces and off-road. These cars can accommodate about five to seven people. The automotive sunroof market for SUVs includes the scope for the multi-utility vehicle (MUV). At present, original equipment manufacturers (OEMs) are developing advanced technologies to manufacture sunroofs, including composite materials for developing lightweight sunroof solutions installed in SUVs. It focuses on the launch of new models in the market to cater to the high demand.

For instance, in May 2023, Shanghai Auto Show 2023, various companies BYD showcased its Yangwang U8 and U9 SUV models for launch in China deployed with panoramic sunroofs.

Similarly, in August 2023, the Kia compact electric SUV was introduced in China with features like Sunroof and LED headlamps to be launched later in 2023.

Moreover, sunroofs are linked to the increasing craze for SUVs, which is driving car sales in recent years. According to our analysis, more than 50% of the SUVs in the market feature sunroofs, and big car manufacturers now introduced sunroofs in the compact SUVs segment. Considering the scenario, sunroof makers are expecting the demand will continue to grow exponentially as people are getting more fascinated by SUV culture with high demand for sunroofs installed in it.

Increase in production of Vehicles will Boost the Market

China dominated the Asia-Pacific region as an automaker. Dealerships are rapidly expanding into China's interior parts, and the market is not witnessing any contraction. According to the China Association of Automobile Manufacturers (CAAM), automotive sales in China increased by 9.3% in the first 2 quarters of 2023 as compared to last year. It was boosted by more substantial discounts and tax incentives for electric vehicles.

Webasto, Yachiyo, and Inteva are the major players in the Chinese sunroof industry. Webasto tried to maintain China as its high-priority production site. Over the years, the company focused on establishing new automated plants in China while upgrading the existing ones to extend its production capacity. The company also enjoys support from major automotive giants, such as Beijing Benz, BMW, Shanghai GM, Chang'an Ford, Shanghai Volkswagen, and Wuhan Shelong.

Moreover, according to the company Webasto, the share of vehicles produced in China with sunroofs is very high. It holds a market share of more than 50%, which continues to grow with increasing vehicle sales.

Growing car customization trends and higher younger population demand for aftermarket sunroof installations are some of the major factors driving the market for sunroofs in the country.

Thus, the above factors, coupled with high sales and growing adoption of sunroof, will drive the market growth.

China Automotive Sunroof Industry Overview

The China automotive sunroof market is consolidated with just a couple of players, such as Webasto Group, Inalfa Roof Systems Group BV, and Inteva Products LLC, dominating the market. Due to the high profitability of the market, these major players focus on the acquisition of small regional players for a higher penetration into the regional markets.

Inalfa Roof Systems is the most active sunroof player over the last four years. Inalfa opened new facilities in Shanghai, Cherokee, Poland, Chongqing, and South Korea. The company also extended its Slovakian facility and opened a new technical center in the United States.

Inteva opened new facilities in Romania and China. The company also relocated a facility to Solingen, Germany. It opened new manufacturing facilities in China and South Korea and acquired ArvinMeritor's body systems business.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increased Adoption of Sunroofs in Sports Utility Vehicles

- 4.2 Market Restraints

- 4.2.1 High Maintenance Cost of Sunroof

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD)

- 5.1 By Material Type

- 5.1.1 Glass

- 5.1.2 Fabric

- 5.1.3 Other Material Types

- 5.2 By Type

- 5.2.1 Built-In Sunroof Systems

- 5.2.2 Tilt 'N Slide

- 5.2.3 Panoramic

- 5.3 By Vehicle Type

- 5.3.1 Hatchback

- 5.3.2 Sedan

- 5.3.3 Sports Utility Vehicle

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Webasto Group

- 6.2.2 CIE Automotive

- 6.2.3 Inteva Products LLC

- 6.2.4 Inalfa Roof Systems Group BV

- 6.2.5 Yachiyo Industry Co. Ltd

- 6.2.6 Johnan America Inc.

- 6.2.7 Signature Automotive Products

- 6.2.8 Magna International Inc.

- 6.2.9 Mitsuba Corporation

- 6.2.10 AISIN SEIKI Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS