PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642003

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642003

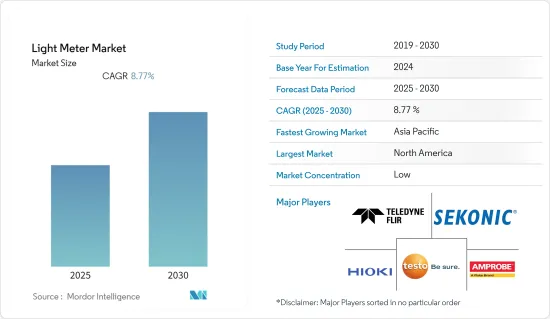

Light Meter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Light Meter Market is expected to register a CAGR of 8.77% during the forecast period.

The Light Meter Market has been driven by the increasing government regulations across the globe for deploying energy-efficient lighting such as LED lighting.

Key Highlights

- The ongoing advancements in lighting technology, including LED lighting, have significantly impacted the lighting meter market. LED lighting is energy efficient, long-lasting, and controllable, making it essential to measure and optimize light levels accurately.

- The light meter market is also driven by factors such as global demand for light meters and advanced technological advancement in the cinematography and photography sector. Light meters play a crucial role in photography and cinematography by assisting professionals in achieving the desired exposure level and lighting conditions for their shoots.

- Furthermore, the increase in government initiatives toward the standardization of lighting protocols would result in the proliferation of the growth rate of the light meter market. Also, government regulations for enhancing workplace lighting will significantly influence the growth of the light meter market.

- However, advancing smartphone applications and light measuring devices to substitute light meters would restrain the market's growth rate. Smartphone applications have been developed to enable iPhones and other smartphones to work as a light meter using its built-in camera as a light sensor.

Light Meter Market Trends

LED Type Light Meters Segment is Expected to Hold Significant Market Share

- LED light meters are used in quality control and testing processes while manufacturing LED lights. Manufacturers use these meters to verify that each LED diode and lighting fixture meets the specific criteria for color temperature, color rendering index (CRI), luminous flux, and other parameters.

- The LED light meters are designed to overcome the problem of erroneous results by using specific algorithmic calculations to measure the LED light spectrum, which may not necessarily fall within the CIE Photopic curve. A light meter can check LED lights to ensure they fall into the desired range for minimal disruption to life.

- These Light meters are essential for measuring the color temperature of LED lights. This measurement helps ensure that LED lighting systems emit light with desired color characteristics, whether it's warm, cool, or daylight-like. Color temperature plays an important role in creating the required light ambiance.

- Moreover, The LED light meters can assess photobiological safety by measuring the potential hazards of LED lighting, such as blue light exposure. Ensuring LED lighting is safe for human health is crucial, especially in settings like healthcare and manufacturing plants.

- The increase in the number of LED lights installed has been significant drives the market growth. LED light meters are essential tools for measuring and assessing various parameters associated with LED lighting. According to the US Department of Energy, The number of LED light installations in the United States is forecast to grow between 2017 and 2035, increasing from about 1.4 billion units installed in 2017 to about 7.9 billion units in 2035. However, the residential sector would grow the most LED light installations in 2025. The outdoor sector should have the highest penetration rate of LED lights.

North America is Expected to Hold Significant Market Share

- The North American light market is witnessing a significant shift towards energy-efficient light technologies. Light meters are crucial in ensuring that these lighting systems operate at their optimal levels, contributing to energy savings and sustainability goals.

- The increasing number of smart cities and the integration of IoT technology in urban infrastructure have driven the demand for light meters. According to The Economist, In 2022, the leading global digital city on the index ranking score of Washington, DC is 71.2. They are crucial in optimizing outdoor lighting in smart cities to improve energy efficiency and safety.

- North America region has a thriving photography and film production industry, and light meters are essential for professionals in these fields to achieve precise lighting conditions and exposure settings for their work.

- Federal and state-level government initiatives promoting energy efficiency and sustainability have encouraged the adoption of LED lighting and, consequently, the use of light meters to verify lighting performance.

- Advancements in light meter technology have led to the development of digital and wireless light meters, making measurements more convenient and efficient for users. The digital transformation of industries has led to increased interest in connected lighting systems that can be monitored and controlled remotely.

Light Meter Industry Overview

The light meter market is fragmented with the presence of major players like FLIR Systems, SekonicA Corporation, Testo SE, Hioki E.E. Corporation, and Amprobe Instrument Corporation ( Danaher Corporation). Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- June 2023 - LIT Systems, founded in Sweden has introduced the LIT DUO 1. The LIT DUO 1 combines color, illuminance, exposure, spectrum, and a flicker meter all into one device inside a durable aluminum body. The concept behind LIT DUO 1 was to make an all-in-one device that filmmakers could use.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Light Meters in the Photography and Cinematography Industry Worldwide

- 4.2.2 Regulations to Improve Workplace Lighting

- 4.3 Market Restraints

- 4.3.1 Development of Smartphone Applications and Light Measuring Devices to Substitute Light Meters

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 General Purpose Light Meters

- 5.1.2 LED Light Meters

- 5.1.3 UV Light Meters

- 5.2 By Application

- 5.2.1 Photography and Cinematography

- 5.2.2 Manufacturing Plants

- 5.2.3 Clinics and Hospitals

- 5.2.4 Others Application

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.3 Asia

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 FLIR Systems

- 6.1.2 Sekonic Corporation

- 6.1.3 Testo SE

- 6.1.4 Hioki E.E. Corporation

- 6.1.5 Amprobe Instrument Corporation ( Danaher Corporation)

- 6.1.6 KERN & SOHN GmbH

- 6.1.7 B&K Precision Corporation

- 6.1.8 Line Seiki Co., Ltd

- 6.1.9 TENMARS ELECTRONICS CO., LTD.

- 6.1.10 Martindale Electric Co. Ltd.

- 6.1.11 LIT SYSTEMS AB

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS