PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1405717

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1405717

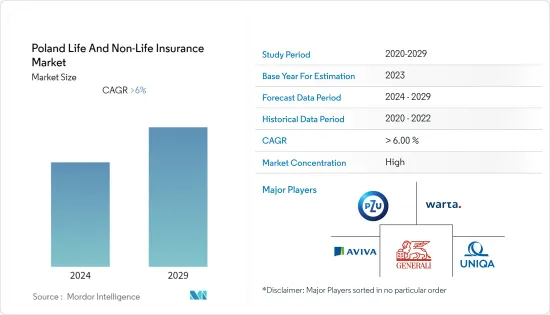

Poland Life And Non-Life Insurance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

Life and Non-Life Insurance Market in Poland has generated a revenue of USD 17.638 billion in the current year and is poised to achieve a CAGR of 6% for the forecast period. Poland has a well-developed insurance market that includes both life and non-life insurance sectors. The market is regulated by the Polish Financial Supervision Authority (Komisja Nadzoru Finansowego - KNF). The KNF oversees the operations of insurance companies, ensures compliance with regulatory requirements, and protects the interests of policyholders.

The Insurance market in Poland consists of both life and non-life insurance segments. Life insurance protects against events such as death or disability, while non-life insurance covers risks like motor accidents, property damage, and liability. The market is well-developed and includes both domestic and international insurance providers

As of 31 December 2021, the Polish Chamber of Insurance had 78 members. Out of the number, 45 were joint stock companies, 24 branches of foreign companies, and 9 mutual insurance companies. As compared to 2020, PIU's membership decreased by 5 insurers. Branches of foreign insurance companies are not subject to the Polish reporting requirements and do not submit financial statements to the Polish Financial Supervision Authority, or PIU. Accordingly, no section of this report is devoted to the activities of branches of foreign insurance companies.

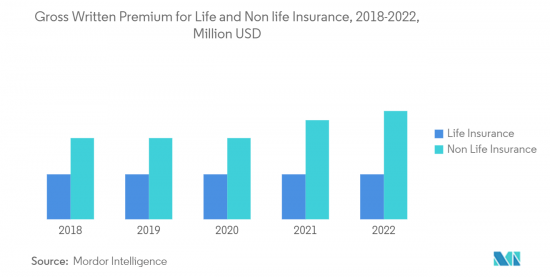

The life insurance market in Poland has been growing steadily over the years. According to the Polish Insurance Association (PIU), in 2022, the life insurance segment accounted for approximately 30% of the total insurance market premium written in Poland.

The pandemic has heightened awareness about health risks, leading to increased demand for health insurance coverage in many countries. This trend may have influenced the health insurance segment in Poland as well, as individuals sought greater financial protection for medical expenses and related risks. The pandemic has introduced new claim patterns in both life and non-life insurance. For life insurance, there may have been an increase in claims related to COVID-19 deaths. Non-life insurance, such as travel insurance, may have experienced a surge in claims for trip cancellations and medical expenses related to the virus.

Poland Life and Non-Life Insurance Market Trends

Non Life Insurance Policies Generate Higher Premium Revenue in Poland

Infrastructure development, such as construction projects, creates opportunities for various non-life insurance products. Construction and engineering insurance, for example, provides coverage against risks associated with construction projects, including accidents, damage, and liability. Certain types of non-life insurance, such as motor insurance, are mandatory in Poland. The government's regulatory requirements for insurance coverage, such as third-party liability insurance for vehicles, have an impact on demand in the non-life insurance market. With increasing levels of motorization and the growing number of vehicles on the roads, the demand for motor insurance has been on the rise. The legal requirement for motor insurance coverage further has an impact on the non-life insurance market in Poland.

M&A activity in Insurance:

There were 14 insurance related transactions on the Polish insurance market from 2015 until 2019 Sept. In 2019, InterRisk Towarzystwo Ubezpieczen Spolka Akcyjna, a subsidiary of Vienna Insurance Group AG acquired an undisclosed majority stake in Towarzystwo Ubezpieczen Wzajemnych (TUW) for an undisclosed consideration. The acquisition will help InterRisk to strengthen its position in the non-life market. Generali Finance Sp. z o.o. acquired a 51% stake in Bezpieczny.pl sp. z o.o., a Poland-based company engaged in the internet sale of insurance products for a consideration of EUR 10m. This acquisition will enable Generali to enhance its sales via the Bezpieczny.pl platform. This will also expand Generali's capacities in the area of e-commerce.

Poland Life and Non-Life Insurance Industry Overview

The report covers the major players operating in the Life and Non-Life Insurance market in Poland. The market is Consolidated, the top 5 companies in the market captured the majority of the market share. Recent M&A activities and insurance penetration quite low are the opportunities for the market players and many factors drive the market during the forecast period. The Competitive landscape can evolve with new entrants, mergers and acquisitions, and changing market dynamics. Additionally, there are other domestic and international insurance companies operating in the Polish market, contributing to the overall competition in both the life and non-life insurance sectors. Following is the list of Major companies Powszechny Zaklad Ubezpieczen SA, Towarzystwo Ubezpieczen I Reasekuracji Warta SA, Generali Towarzystwo Ubezpieczen SA, Aviva Towarzystwo Ubezpieczen Na Zycie SA, Uniqa Towarzystwo Ubezpieczen SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Tax Benefits and Incentives

- 4.2.2 Changing Risk Perception

- 4.2.3 Increasing Motorization

- 4.3 Market Restraints

- 4.3.1 Limited Awareness and Underinsurance

- 4.3.2 Affordability and Cost Concerns

- 4.3.3 Legacy Pension Systems

- 4.4 Insights on Various Regulatory Trends Shaping the Market

- 4.5 Insights on impact of technology in the Market

- 4.6 Industry Attractiveness - Porters' Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights on Government Regulations in the Market

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Insurance Type

- 5.1.1 Life Insurance

- 5.1.1.1 Individual

- 5.1.1.2 Group

- 5.1.2 Non Life Insurance

- 5.1.2.1 Home

- 5.1.2.2 Motor

- 5.1.2.3 Others

- 5.1.1 Life Insurance

- 5.2 By Distribution Channel

- 5.2.1 Direct

- 5.2.2 Agency

- 5.2.3 Banks

- 5.2.4 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concetration Overview

- 6.2 Company Profiles

- 6.2.1 Powszechny Zaklad Ubezpieczen SA

- 6.2.2 Sopockie Towarzystwo Ubezpieczen Ergo Hestia SA

- 6.2.3 Towarzystwo Ubezpieczen I Reasekuracji Warta SA

- 6.2.4 Uniqa Towarzystwo Ubezpieczen SA

- 6.2.5 Generali Towarzystwo Ubezpieczen SA

- 6.2.6 Compensa Towarzystwo Ubezpieczen SA

- 6.2.7 Interrisk Towarzystwo Ubezpieczen SA

- 6.2.8 Aviva Towarzystwo Ubezpieczen Na Zycie SA

- 6.2.9 Wiener Towarzystwo Ubezpieczen SA

- 6.2.10 Ergo Hestia SA*

7 MARKET OPPORTUNTIES AND FUTURE TRENDS

8 DISCLAIMER AND ABOUT US