PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1405726

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1405726

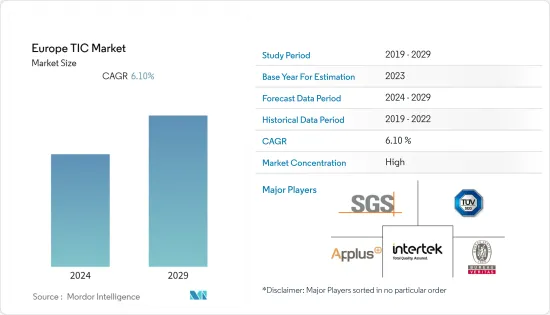

Europe TIC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

The European Testing, Inspection, and Certification Market was valued at USD 56.22 billion in the previous year, and it is expected to witness a CAGR of 6.1% during the forecast period to reach USD 80.20 billion by the next five years. The continuous improvement in industry practice toward achieving superior quality control and workplace safety continues to drive the demand for improved and efficient testing, inspection, and certification-based requirements.

Key Highlights

- Testing, inspection, and certification (TIC) play a significant role, primarily in ensuring that the infrastructure, services, and products meet the standards and regulations of safety and quality. Due to the increased demand for inspection and testing at regular intervals across a few enterprises, such as oil and gas, the TIC market is expected to grow, irrespective of the industrial seasonality. For instance, in March 2023, Rakuten Symphony, in collaboration with its parent Rakuten Mobile, officially established its Open RAN Customer Experience Centre, a test lab in Weybridge, with several retailer partners installed in its on-site, cloud-based radio access network installation.

- Furthermore, the boost in the volume of imports and exports in Europe, especially for products in the food and beverages, consumer electronics, agriculture, and automotive (EV) markets, is anticipated to provide more scope for TIC services in the region. For instance, as per Eurostat, EU imports of goods increased by 41.3 % in 2022 compared with the previous year, while exports rose by 17.9% in 2022.

- The advancement in demand for safety and infrastructure investments in the region is expanding the growth of the studied market. Furthermore, the use of complex technologies, shorter product lifecycles, and the complexity of supply chains in many end-user industries are driving the growth of the studied market. For instance, in June 2022, the EU invested EUR 5.4 billion in sustainable, safe, and efficient transport infrastructure.

- In addition, the European Commission selected 135 transport infrastructure projects for EU grants from 399 project proposals submitted under the CEF, the EU's funding instrument for strategic investment in transport infrastructure. Further, the European Commission is speeding up the financing of 35 military mobility projects to support transporting troops and equipment along the trans-European transport network (TEN-T).

- Rapid technological advancements, which have led to product diversity and, in some cases, shorter life cycles, are expected to increase the usage of TIC services. Emerging technological trends, like connected devices (IoT), mobile payments, smart cities, and connected cars, drive the importance of software testing and inspection on par with hardware testing and inspection. As these technologies become mainstream, the dependency on TIC services is expected to increase.

- Moreover, Certain products require third-party verification for testing, inspection, and certification services, which results in a time-consuming process. The occurrence of time-consuming procedures for providing TIC to specific products impedes product export and import. Most businesses are concerned about this because time-consuming qualification testing causes delays in importing goods, further impeding productivity. As a result of this critical challenge, the TIC market's growth will be slowed.

- Furthermore, the COVID-19 pandemic affected every industry, and the level of resilience varies depending on where demand and production were negatively impacted and where the need was resilient, if not increased. Market participants quickly adopted remote and digital testing to ensure they could continue providing their services. Despite operating constraints and customer challenges, the TIC sector in the region has stayed resilient during the pandemic. Furthermore, the studied market is expected to grow in the future period as several industries, such as automotive, food and agriculture, manufacturing, and oil and gas, are rapidly increasing in the region.

Europe TIC Market Trends

Consumer Goods and Retail Segment is Expected to Hold Significant Market Share

- Due to the increasing competition in Europe from new markets and rising requirements for quality from consumers, quality security and compliance solutions are vital for customers. Most of the retail services and consumer goods make use of testing and certification. Considering the region's growth of online retail platforms, retail and consumer products are expected to become the fastest-growing segment.

- According to the OECD, in 2022, the total retail trade sales volume index in the European Union remained nearly unchanged at around 117.08. Still, the complete retail trade sales volume index achieved its highest value in the observed period in 2022.

- TIC services offered by the market vendors cover the entire consumer products' value chain from the plan, buy, and push to ship, stock, and sell to allow informed quality and sourcing decisions. The testing services verify that the products are safe and conform to various specifications. The advisory and inspection services are helpful as they allow consumers to satisfy regulatory requirements.

- Also, the pandemic has fueled the demand for connected consumer electronics and IoT devices. Hence, various European vendors are increasingly offering services for IoT devices and expanding their presence in this space. The growth in wireless devices also needs certification to address multiple technologies, including Bluetooth SIG, NFC Forum, LoRa Alliance, Sigfox, GCF, and PTCRB for cellular.

- Moreover, rising consumer goods production in the area also creates significant demand for TIC services. For instance, as per Eurostat, in September 2022, compared with September 2021, the production of non-durable consumer goods rose by 5.7%, and that of durable consumer goods increased by 3.6% in the EU.

- Consumer and residence electronics are regulated under a broad range of policy instruments in the EU, including legislation on general product safety, sector-specific regulation, and consumer protection provisions. Consequently, manufacturers and sellers must comply with many rules, creating significant demand for TIC services.

Germany is Expected to Witness Significant Growth

- The growing automotive production and trends, like electric vehicles and autonomous cars, are anticipated to increase the need and adoption of TIC services in Germany. According to KBA, in 2023 thus far, in Germany, there were 887,335 plug-in hybrid electric (PHEV) cars, a significant boost compared to the year before.

- Further, The independent testing institute ISP recently brought into operation its new EV battery testing center in Salzbergen in northwest Germany, which is expected to deliver all testing services for EV batteries.

- Moreover, the country is a significant oil, coal, and natural gas consumer. The country's demand for oil is growing with its economy. With the United Kingdom's exit from the European Union nations, Germany has more supremacy over the EU market than before. The size and location of the country give it considerable influence over the European Union's energy sector. According to the German Association of Energy and Water Industries, in 2022, the country's natural gas consumption stood at 866.2 billion kWh (almost 80 bcm). Domestic production met 5.5% of the country's demand.

- Furthermore, according to the industry association AGEB, the primary power consumption of natural gas in Germany has been increasing. In 2022, natural gas consumption in the country rose to 4,160 petajoules from 4,039 petajoules in the previous year.

- Considering the rising trends, the government has targeted a 55 percent emissions cut in the oil and gas and automotive sectors by 2030 and intends to introduce carbon pricing for building and transportation sector emissions from 2021. Furthermore, Germany's power sector is one of the primary sources of need for testing and inspection services after the oil and gas sector.

- In Germany, the federal states are responsible for official food management and inspection tests. Businesses involved in producing, processing, and selling foodstuffs must document the quality of raw materials used by conducting in-house checks. The growing need for food safety and the increasing international trade are expected to offer potential opportunities during the forecast period.

Europe TIC Industry Overview

The European TIC market is highly fragmented, with the presence of major players like Societe Generale de Surveillance SA (SGS SA), TUV SUD Limited, Applus Services SA, Bureau Veritas SA, and Intertek Group PLC. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- June 2023 - Applus+, one of the global leaders in the testing, inspection, and certification (TIC) sector, announced the acquisition of Rescoll, a leading materials testing and R&D technological partner based in France.

- November 2022- SGS acquired Bucharest-based Industry Laboratory, further improving its range of testing services for the Romanian food market. The lab offers a broad range of microbiological research services, from the enumeration of indicator organisms to detecting foodborne pathogens.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Market Drivers

- 4.3.1 Increasing Trading Across Borders and Stringent Regulations

- 4.3.2 Technological Evolution

- 4.3.3 Mass Customization and Shorter Product Life Cycles

- 4.4 Market Challenges

- 4.4.1 Increase in Lead Times for Assessment Programs Due to the Growing Complexity of the Supply Chain

- 4.4.2 Issue of Certification Post-Brexit

- 4.5 Major TIC Standards and Regulations

- 4.6 Impact of Macroeconomic Trends on the Market

5 TECHNOLOGY SNAPSHOT (TRENDS INFLUENCING THE MARKET)

- 5.1 Influence of Various Technologies such as Smart Sensors, Blockchain, Big Data and Analytics and Connected Devices on the Market

- 5.2 Evolution of TIC for the Additive Manufacturing Industry (Trends, Developments and Outlook)

6 MARKET SEGMENTATION

- 6.1 By Sourcing Type

- 6.1.1 Outsourced

- 6.1.1.1 Type of Service

- 6.1.1.1.1 Testing and Inspection

- 6.1.1.1.2 Certification

- 6.1.2 In-house/Government

- 6.1.1 Outsourced

- 6.2 By End User Vertical

- 6.2.1 Consumer Good and Retail

- 6.2.2 Automotive

- 6.2.3 Food and Agriculture

- 6.2.4 Manufacturing and Industrial Goods

- 6.2.5 Energy and Utilities

- 6.2.6 Oil & Gas and Chemicals

- 6.2.7 Construction

- 6.2.8 Transport, Aerospace, and Rail

- 6.2.9 Life Sciences

- 6.2.10 Marine & Mining

- 6.2.11 Other End User Verticals

- 6.3 By Country

- 6.3.1 Germany

- 6.3.2 France

- 6.3.3 Italy

- 6.3.4 United Kingdom

- 6.3.5 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Societe Generale de Surveillance SA (SGS SA)

- 7.1.2 TUV SUD Limited

- 7.1.3 Applus Services SA

- 7.1.4 Bureau Veritas SA

- 7.1.5 Intertek Group

- 7.1.6 ATG Technology Group

- 7.1.7 A/S Baltic Control Ltd Aarhus

- 7.1.8 CIS Commodity Inspection Services BV

- 7.1.9 DEKRA SA

- 7.1.10 VIC Inspection Services Holding Ltd

- 7.1.11 Vincotte International SA

- 7.1.12 RTM BREDA SRL

- 7.1.13 Kiwa NV

- 7.1.14 AQM SRL

- 7.1.15 Element Materials Technology

- 7.1.16 LabAnalysis SRL

- 7.1.17 Eurofins Scientific SE

- 7.1.18 UL LLC

- 7.1.19 TUV Rheinland Group

- 7.1.20 DNV GL

- 7.1.21 ALS Limited

- 7.1.22 TUV NORD Group

- 7.1.23 Quality Analysis GmbH

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET