Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689942

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689942

Duplex Stainless Steel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

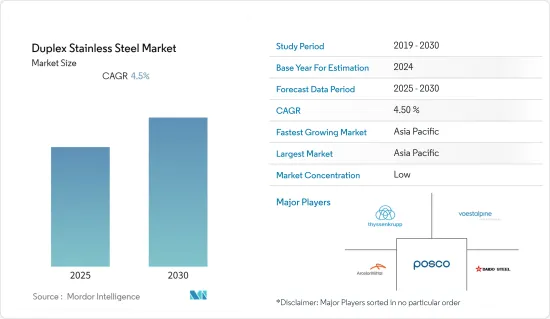

The Duplex Stainless Steel Market is expected to register a CAGR of 4.5% during the forecast period.

Key Highlights

- Over the medium term, factors such as increasing applications for corrosion resistance and rising demand from the oil and gas industry are expected to drive the growth of the market.

- On the other hand, the limited use of duplex stainless steel at higher temperatures is expected to restrain the growth of the duplex stainless steel market.

- The rising demand for duplex stainless steel in new oilfield facilities is expected to offer growth opportunities to the industry.

- The Asia-Pacific region is expected to dominate the market, with the largest consumption being recorded by countries like India and China.

Duplex Stainless Steel Market Trends

Rising Demand from the Construction Industry

- Duplex stainless steel finds major applications in the construction industry. It is used as a construction design material because of its unique characteristics, such as higher strength than carbon steel and higher corrosive resistance compared to austenitic stainless steel.

- The most common building and construction applications for duplexes are spectacular pedestrian bridges, like the Helix Bridge in Singapore, San Diego's Harbor Drive Bridge, and the new Lusail Pedestrian Bridges in Qatar.

- Other applications include handrails in corrosive locations, like the Canary Islands and the Four Freedoms Park in New York. High-strength tension bars and spiders are used in low-profile wall structural supports for glass curtains.

- The rapid development of infrastructure is expected to drive the demand for duplex stainless steel in the coming years.

- China is one of the largest construction markets in the world. The Chinese construction industry's output value amounted to around USD 4.6 trillion in 2022. The Chinese government mainly focuses on improving the infrastructure in small and medium-sized cities. The local body of Beijing has made CNY 6.8 trillion (USD 1 trillion) of government funds available for construction projects.

- A total of 102 mega-projects have been included in Beijing's 2021-2025 development plan. The Chinese government initiated a 1,629-kilometer line from Sichuan province in the southwest to the Tibetan capital, Lhasa, covering more than 3,000 meters through earthquake-prone terrain and glaciers. This project involves a planned investment of CNY 319.8 billion (USD 50.6 billion). Construction activities started at the end of 2020, and the line is expected to be completed by 2025.

- According to China's Ministry of Water Resources, CNY 703.6 billion (USD 98 billion) was invested in water-conservancy infrastructural projects in 2022, recording an increase of 63.95% compared to 2021. The construction of more than 19,000 water-conservancy projects began in 2022, of which 31 were considered to be major projects.

- The Government of India strongly focuses on infrastructural development across the country to boost economic growth. The government is aiming to build 100 smart cities. According to the World Bank's report, India has to invest USD 840 billion in urban infrastructure over the next 15 years in order to meet the requirements of its fast-growing urban population.

- In order to enhance the country's infrastructural sector, the Indian government allocated INR 10 lakh crore (USD 130.57 billion) in 2022. These investments included the allocated budget of INR 134,015 crore (USD 17.24 billion) for the National Highways Authority of India (NHAI), an outlay of INR 60,000 crore (USD 7.72 billion) for the Ministry of Road Transport and Highways, and INR 76,549 crore (USD 9.85 billion) for the Ministry of Housing and Urban Affairs.

- Overall, all such developments in infrastructure across the world are expected to drive the market in the coming years.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the global market, owing to rapid construction and continuous investments across the region.

- China hosts a vast construction sector. Rapid developments in the infrastructural, commercial, and residential sectors over the past two years have boosted the construction sector in terms of volume and value.

- Currently, China accounts for numerous airport construction projects in the development and planning stages. These projects include Beijing Capital International Airport, Chengdu Shuangliu International Airport, and Guangzhou Baiyun International Airport. The government rolled out massive construction plans to shift 250 million people to the newly developed mega-cities over the next ten years.

- Industrial and commercial infrastructure in India has emerged as one of the high-growth sectors. The Indian government has been formulating initiatives like easing the rules to attract FDI inflow in the construction sector to expedite development across the nation.

- In October 2022, the Japan International Cooperation Agency (JICA) announced its intention to participate in more projects conducted by India's private sector. In the coming years, Japan's development agency hopes to increase its global investments in private-sector projects to USD 15 billion, mainly concentrating on Indian initiatives.

- India ranks sixth in the world in the sales of chemicals, and it contributes 3% to the global chemical industry. According to the Indian Brand Equity Foundation (IBEF), under the Union Budget 2022-2023, the government allocated INR 209 crore (USD 27.43 million) to the Department of Chemicals and Petrochemicals. The demand for chemicals is expected to expand by 9% per annum by 2025. This trend is expected to boost the manufacturing capabilities of the chemical industry and the demand for duplex stainless steel for manufacturing chemical processing plants.

- All the above-mentioned factors are expected to significantly boost the market in the Asia-Pacific region during the forecast period.

Duplex Stainless Steel Industry Overview

The global duplex stainless steel market is fragmented, with many players competing against one another. Some of the major companies are Thyssenkrupp AG, Voestalpine AG, ArcelorMittal SA, POSCO, and Daido Steel Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 69446

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Applications for Corrosion Resistance

- 4.1.2 Growing Demand from the Oil and Gas Industries

- 4.2 Restraints

- 4.2.1 Limited Heat Resistance

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Lean Duplex Stainless Steel

- 5.1.2 Duplex Stainless Steel

- 5.1.3 Super Duplex Stainless Steel

- 5.2 End-user Industry

- 5.2.1 Oil and Gas

- 5.2.2 Construction

- 5.2.3 Paper and Pulp

- 5.2.4 Chemical Processing

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AK Steel Holding (Cleveland-Cliffs Inc.)

- 6.4.2 ArcelorMittal S.A.

- 6.4.3 Daido Steel Co. Ltd

- 6.4.4 Jindal Stainless Ltd.

- 6.4.5 Nippon Yakin Kogyo Co. Ltd

- 6.4.6 Outokumpu

- 6.4.7 POSCO

- 6.4.8 SAIL

- 6.4.9 Sandvik AB

- 6.4.10 SeAH Steel Corporation

- 6.4.11 Thyssenkrupp AG

- 6.4.12 Voestalpine AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for Duplex Stainless Steel in New Oilfield Facilities

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.