PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690959

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690959

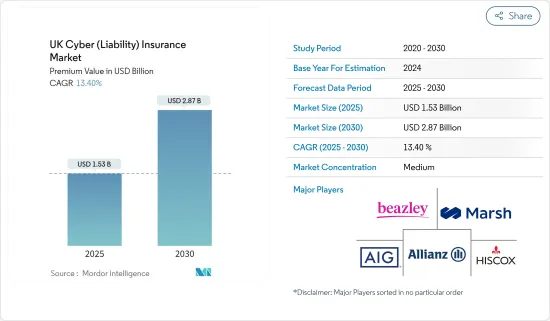

UK Cyber (Liability) Insurance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The UK Cyber Insurance Market size in terms of premium value is expected to grow from USD 1.53 billion in 2025 to USD 2.87 billion by 2030, at a CAGR of 13.4% during the forecast period (2025-2030).

While the concept of insurance and its function of risk mitigation has remained the same over time, policies have had to adapt to stay relevant and accommodate the changing nature of risks. This includes insurance firms providing services throughout an insurance contract beyond solely paying out for claims as was traditionally the case. As a result of this evolution, several new forms of insurance have emerged-cyber insurance being one of them. Cyber risks have developed and gained increasing attention over the last 10-20 years, considering our increasing reliance on technology and connectivity. Cyber insurance caters to a spectrum of risks. At one end, there are higher-frequency, 'daily life '-type risks, such as data fraud, theft, or other privacy breaches. On the other end, there are 'extreme scenario '-type risks, such as NotPetya and Wannacry, which can result in severe disruption to many businesses. In the NotPetya attack, the virus froze the user's computer and demanded a ransom to be paid. Businesses with strong trade links with Ukraine, such as the UK's Reckitt Benckiser, Dutch delivery firm TNT, and Danish shipping giant Maersk, were affected. e WannaCry ransomware crypto-worm, which is estimated to have hit over 230,000 computers across at least 150 countries. The attack used a specific Microsoft Windows vulnerability to encrypt data and demand ransom payments. Among the range of sectors and industries hit, one of the largest agencies to suffer was the NHS, which was still largely reliant on outdated software and operating systems, making it vulnerable to attack.

Cyber insurance has and will continue to play an important role in the UK economy, both through the direct benefits to the UK business as well as the impact on the economy more broadly. Looking ahead, the cyber insurance market is expected to continue to undergo major development and rapid growth over the next few years, reflecting the increased awareness of risks as well as the likely increase in the frequency of cyber events driven by the broader trend of increasing digitization of businesses, which in part, were hastened by the COVID-19 pandemic. This poses challenges for data security as the quantity of data susceptible to cyber-crime increases. To tackle the challenges that arise from increasing connectivity, it is expected that coverage of cyber risks will continue to expand. To reflect this, the relevance and importance of cyber coverage in the overall functioning of the economy is expected to increase significantly.

The UK cyber insurers are adapting and improving their risk mitigation and containment processes (alongside UK cyber security firms). By sharing these techniques with businesses, UK cyber insurers can help to reduce the risks posed by cyber incidents. The complexity of cyber risks also means that reinsurance can play an important role in expanding the supply of cyber insurance.

UK Cyber Insurance Market Trends

Impact of Cyber Insurance Policy Coverage

Until recently, cyber insurance products covering business interruption losses and physical damage were only offered by a few insurers. Now, however, 96% of insurers cover business interruption losses, and an increasing number of insurers are also offering coverage for first-party losses. Coverage is continually changing and expanding to reflect the dynamic nature of cyber risks and trends. As the variety of cyber incidents and types of losses that cyber insurance increases can cover, the benefit to UK businesses of investing in cyber insurance will also likely increase. Cyber insurers and brokers are also becoming better able to understand a particular company's insurance needs, tailoring cover appropriately. Some cyber insurance policies may require the insured organization to meet specific cybersecurity standards or demonstrate improvements in security practices. Failing to meet these requirements could affect coverage.

Impact of Disruptive Cyber Security Breach for Businesses

Cyber insurance policies typically have coverage limits that may not fully cover the costs associated with a severe breach. Businesses may still be responsible for covering certain expenses beyond the policy limits. Most cyber insurance policies have deductibles, which means the business must pay a certain amount out of pocket before the insurance coverage kicks in. The size of the deductible can significantly impact the financial burden on the organization. Even with cyber insurance, a major data breach can harm a business's reputation. Customers and partners may lose trust in the organization, leading to a loss of business and long-term damage. Cyber insurance may cover certain legal expenses and fines resulting from a breach, but not all costs may be covered. Regulatory fines and legal settlements can still have a significant financial impact on the organization. Cyber insurance can help cover the costs of incident response, forensic investigations, and recovery efforts. However, the full extent of these costs can be challenging to predict, and insurance may only cover some aspects.

UK Cyber Insurance Industry Overview

The UK cyber insurance landscape was characterized by a mix of established insurance giants, specialized cyber insurers, insurtech startups, and intermediaries working together to address the growing demand for cyber liability coverage. The market's competitive nature was driving innovation in policy design and risk assessment methodologies to meet the unique challenges posed by cyber threats. Adoption of technological platforms and up-gradation to new technology leads to an increase in the threat of cybercrimes. Innovation and technological advancement took pace as COVID-19 and urbanization struck general people to the adoption of cyber insurance to mitigate the risk of loss due to the threat of cybercrimes. Companies across the world have huge investments in this segment of the market. In the United Kingdom, the Cyber (liability) insurance market has many companies fragmented over minor shares. Swiss Re, Allianz, Beazley, Hiscox, Marsh, Tokio Marine Kiln, and AXA XL are among the cyber insurance companies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Data Privacy Regulations

- 4.2.2 Business Interruption

- 4.3 Market Restraints

- 4.3.1 Complexity and Lack of Understanding

- 4.3.2 Cost of Coverage

- 4.4 Value Chain Analysis

- 4.5 Market Opportunities

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights on Technological Innovations in the Market

- 4.8 Insights on Consumer Behavior Analysis

- 4.9 Government Regulation in Market

- 4.10 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Packaged

- 5.1.2 Standalone

- 5.2 By Application Type

- 5.2.1 Banking & Financial Services

- 5.2.2 IT & Telecom

- 5.2.3 Healthcare

- 5.2.4 Retail

- 5.2.5 Other Application Types

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 AIG

- 6.2.2 Allianz

- 6.2.3 Beazley

- 6.2.4 Hiscox

- 6.2.5 Marsh

- 6.2.6 Tokio Marine Kiln

- 6.2.7 AXA XL

- 6.2.8 CFC Underwriting

- 6.2.9 NIG

- 6.2.10 Zurich*

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 DISCLAIMER