PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406935

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406935

Germany Casein And Caseinates - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

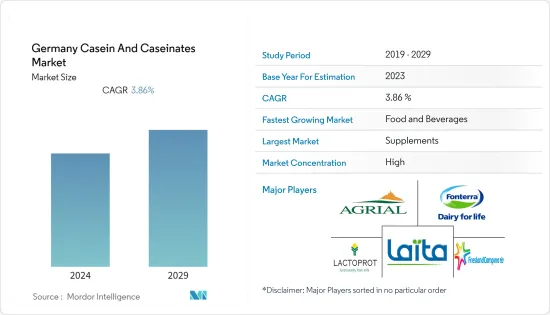

The Germany casein and caseinates market was valued at USD 42.9 million in the current year and is expected to register a CAGR of 3.86% over the next five years.

Key Highlights

- German consumers are following health and wellness trends and prefer foods that are nutrient-dense, such as casein and caseinates, which are high in protein. Moreover, consumer decisions can be influenced by persuasive marketing campaigns emphasizing the advantages of casein and caseinates, such as their ability to build muscle, slow digestion, and adaptability in a range of food products. In the food and beverages segment, the dairy and ready-to-eat/ready-to-cook (RTE/RTC) food industries drive the casein demand, owing to their functionalities, such as increasing shelf life and stability. Rising demand for casein from sports and infant nutrition sectors, owing to its functional traits, are the factors responsible for the fastest growth projection.

- As a result, manufacturers are taking initiatives to increase casein and caseinates production in the country. For instance, in Leezen, the company's German facility, Lactoprot, established the world's first evaporation plant for milk salts and enlarged the capacity of the casein plant to 27,000 l/h. Further, casein and caseinates are used in non-food industries, including adhesives, paints, and plastics, in addition to the food business, which helps to explain the rise in demand. Consumers growing inclination towards plant-based/vegan diets can hinder the growth of casein and caseinates derived from animal sources. Hence, all the abovementioned factors positively drive the market in the region.

Germany Casein And Caseinates Market Trends

Increasing Milk Production is Leading to Innovation in Dairy Industry

- The dairy sector is constantly coming out with innovative, casein and caseinate-enriched products. This can include protein bars, functional beverages, and other dairy-based products. With their slow-digesting capabilities, casein and caseinates also have their application capabilities in the supplements segment.

- They are majorly accepted in the sports nutrition segment and are driven majorly by demand from energy enthusiasts. As they produce a high amount of leucine, which is essential for muscle protein synthesis, their preference is increasing in the segment. For instance, in April 2021, FrieslandCampina Ingredients launched a new portfolio, including Excellion Calcium Caseinate S, to aid in the production of softer protein bars.

- Other products launched included Nutri Whey 800F, Nutri Whey Isolate, Biotis GOS, and Excellion EM9, as well as the new Excellion Textpro. The portfolio was made as a key solution to address the hardening problem that many formulators currently face. The company has distribution networks in Germany. Hence, the mentioned factors act as major drivers for the casein and caseinates market in the country.

Casein Holds a Significant Market Share

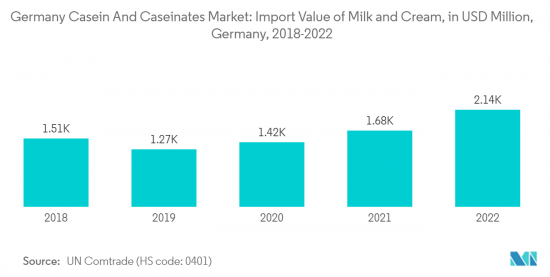

- Caseins have wide applications in animal feed, personal care and cosmetics, food and beverages, and the supplements industry due to their beneficial functional properties. For instance, according to the ITC Trade Map Trade statistics for international business development, the import value of casein in Germany accounted for USD 2,135.674 million in 2022, while the import value in 2021 accounted for USD 1,677.198 million. The import statistics indicate a significant increase in demand. The major exporters of casein to Germany included countries such as Poland, Czech Republic, Netherlands, Austria, and Denmark.

- Additionally, companies in the country are implementing strategies to increase their market share and increase their client base by creating brand awareness. For example, Molkerei MEGGLE Wasserburg GmbH & Co. KG announced its plans to operate under the new company name MEGGLE GmbH & Co. KG. The renaming aimed to represent product diversity and underline the uniformity in the naming of all international companies under the MEGGLE Group. The company is a leading manufacturer of casein in Germany.

Germany Casein And Caseinates Industry Overview

The Germany casein and caseinates market is consolidated due to the strong presence of regional and global players. The major players focus on strategic planning to grow the business portfolio. Apart from business development activity, the acquisition is also considered for business growth to improve the market share. Major players like Agrial Group, Fonterra Co-operative Group Limited, Lactoprot Deutschland GmbH, LAITA, and Royal FrieslandCampina N.V (sorted alphabetically) are making strategic moves to make their businesses grow. Further, the companies have been introducing new and innovative products with the inclusion of label claims, such as naturally derived and organic ingredients, so as to make their product unique from the existing products. Owing to the rapidly developing nature of the market, new product innovation has become the most commonly used strategy among all, as it helps in understanding the changing needs of the application industry in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Executive Summary & Key Findings

2 INTRODUCTION

- 2.1 Study Assumptions and Market Definition

- 2.2 Scope of the Study

3 RESEARCH METHODOLOGY

4 EXECUTIVE SUMMARY

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Trend and Increasing Inclination towards Protein-rich Functional Food and Beverages

- 5.1.2 Increasing Milk Production is Leading to Innovation in Dairy Industry

- 5.2 Market Restraints

- 5.2.1 Competition from Other Substitute Products

- 5.3 Porter's Five Forces Analysis

- 5.3.1 Bargaining Power of Suppliers

- 5.3.2 Bargaining Power of Buyers/Consumers

- 5.3.3 Threat of New Entrants

- 5.3.4 Threat of Substitute Products

- 5.3.5 Intensity of Competitive Rivalry

6 Market Segmentation

- 6.1 End-User

- 6.1.1 Animal Feed

- 6.1.2 Personal Care and Cosmetics

- 6.1.3 Food and Beverages

- 6.1.3.1 Bakery

- 6.1.3.2 Beverages

- 6.1.3.3 Confectionery

- 6.1.3.4 Dairy and Dairy Alternative Products

- 6.1.3.5 RTE/RTC Food Products

- 6.1.3.6 Snacks

- 6.1.4 Supplements

- 6.1.4.1 Baby Food and Infant Formula

- 6.1.4.2 Elderly Nutrition and Medical Nutrition

- 6.1.4.3 Sport/Performance Nutrition

7 Competitive Landscape

- 7.1 Most Adopted Strategies

- 7.2 Market Share Analysis

- 7.3 Company Profiles

- 7.3.1 Agrial Group

- 7.3.2 Fonterra Co-operative Group Limited

- 7.3.3 Hoogwegt Group

- 7.3.4 Lactoprot Deutschland GmbH

- 7.3.5 LAITA

- 7.3.6 MEGGLE GMBH & CO.KG

- 7.3.7 Royal FrieslandCampina N.V

- 7.3.8 Kerry Group plc

- 7.3.9 Arla Foods AMBA

- 7.3.10 Savencia Fromage & Dairy

- 7.3.11 Climax Foods

- 7.3.12 Ergo Bioscience

- 7.3.13 Fooditive Group

8 MARKET OPPORTUNITIES AND FUTURE TRENDS