PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406950

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1406950

France Plant Protein - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

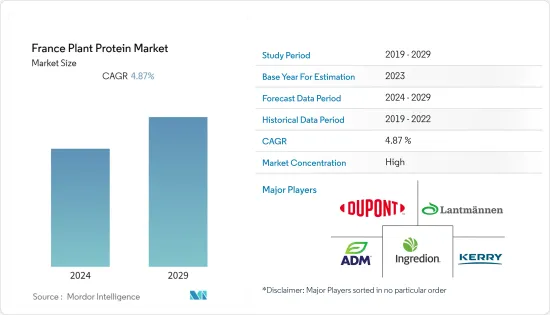

The France plant protein market is expected to grow from USD 346.18 million in 2024 at a CAGR of 4.87% over the next five years.

Key Highlights

- The France plant protein has witnessed substantial growth in recent years, largely driven by changing consumer preferences toward sustainable and plant-based diets. As awareness of environmental and health concerns continues to rise, many French consumers are seeking alternatives to animal-based proteins, making plant proteins increasingly popular. France's younger generations are more sustainability-minded and interested in new food trends. Companies need to appeal to them with affordable and tasty offerings to ensure that alt proteins become a staple part of their diets in the future. On the other end of France's aging population, the silver generation market is huge. For instance, according to the National Institute for Demographic Studies, in 2022, approximately 13.94 million French people were over 65 years and above.

- Furthermore, plant-based protein has become the best replacement for proteins such as whey protein, egg protein, and other proteins from animal sources. This demand for plant-based proteins has risen due to the increasing vegan trend. Manufacturers are introducing their innovative plant-based products by incorporating essential nutrients and eliminating obnoxious additives and preservatives.

- In February 2021, DuPont's Nutrition & Biosciences and the ingredient company IFF announced their merger in 2021. The combined company will continue to operate under the name IFF. The complementary portfolios give the company leadership positions within a range of ingredients, including soy protein.

France Plant Protein Market Trends

Increased Application of Pea Protein

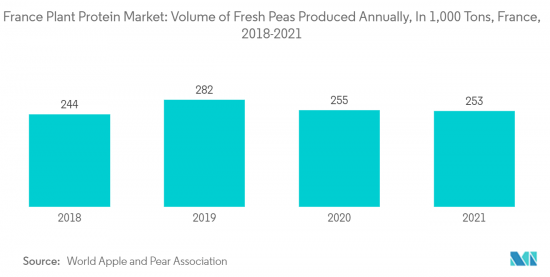

- Pea protein is considered a complete protein that can be used in a variety of egg-based foods such as pasta, vermicelli, cakes, and cookies. Moreover, food manufacturers in developed countries are introducing plant-based food ingredients to appeal to the vegan population, as consumption of animal-based protein may raise the rates of allergies. Although meat proteins provide the body with the necessary amino acid content, they are also associated with high cholesterol levels, obesity, digestion problems, and other related health issues. Thus, consumers in developed countries increasingly prefer vegan or vegetarian protein sources such as yellow pea protein, among others.

- Also, companies like Cargill and Roquette are investing in yellow pea protein as it is a low-allergenic alternative to soy and wheat. An article published by PLOS.org in the year 2022 revealed that cycling, water sports, and gymnastics, mountain sports are some of the fitness activities followed by French consumers. With the growing trend towards the use of vegan products, consumers are adopting plant-based diets, and manufacturers are incorporating the same.

- For instance, TriballatIngredients offers PEPTIPEA, which is a 100% plant-based protein hydrolysate made from yellow pea proteins. It is produced using enzymatic processes for use in functional drinks in sports and weight management nutrition in France.

- Furthermore, pea protein is an ideal meat substitute and is gaining higher traction among vegan and flexitarian consumers. This phenomenon augmented the growth of the product, which helps food manufacturers provide a meat-like nutrition profile to their portfolio of faux meat or vegan meat products such as nuggets, burger patties, and other snacks.

- Pea Protein may be used to extend or completely replace ground meat in canned meat products such as casseroles, chili, spaghetti sauces, meat stews, and meat sauces. It can also be used to extend ground meat in canned products such as patties and meatballs. The region is witnessing many product launches aimed to cope with the demand and meet the customers' increasing needs. For instance, Nestle has announced plans to invest in France in 2021 to launch a new pea-based milk alternative.

Rising Incidence of Obesity and Cardiovascular Diseases

- The increasing incidence of health issues such as blood pressure, diabetes, and obesity is prompting consumers to maintain a healthy lifestyle. Therefore, they are more inclined toward the consumption of dietary supplements and functional foods that contain plant-based proteins. Moreover, plant-based protein increases the intake of fiber, which prevents the risk of cardiovascular diseases and cancer.

- Additionally, plant-based proteins contain less-healthy compounds found in animal-based meat, including saturated fats and cholesterol. France has witnessed a worrisome rise in obesity rates, with a substantial portion of the population being classified as overweight or obese. This surge in obesity has been linked to the consumption of high-calorie, low-nutrient foods, often rich in animal fats and proteins. Consequently, health professionals and consumers alike are now seeking healthier dietary options to combat obesity and its associated health risks.

- In addition to it, cardiovascular diseases, including heart disease and hypertension, have also reached alarming levels in France. These conditions are closely tied to excessive consumption of saturated fats and cholesterol found in animal products. As a result, there is a growing demand for plant-based diets, which are generally lower in saturated fats and can contribute to improved heart health.

- The plant protein market has responded to this demand by offering a wide range of protein-rich products derived from plants such as soy, peas, lentils, and nuts. These plant-based protein sources are not only lower in unhealthy fats but also provide essential nutrients like fiber, antioxidants, and vitamins that are beneficial for overall well-being. Moreover, they are often considered more environmentally sustainable, a factor that resonates well with the environmentally conscious French population.

France Plant Protein Industry Overview

The France plant protein market is fragmented, with the presence of both international and domestic players. The major players in this market are Archer Daniels Midland Company, DuPont de Nemours Inc., Ingredion Incorporated, Kerry Group PLC, and Lantmannen. Key Plant Protein market players are investing in R&D and entering into mergers and acquisitions to enhance their product portfolios. Owing to the rapidly developing nature of the market, new product innovation has become the most commonly used strategy among all, as it helps in understanding the changing needs of the consumers in the market. For instance, in April 2021, Ingredion Inc. launched two new ingredients under its plant-based pea protein segment. It launched Vitessense Pulse 1853 Pea Protein Isolate and Purity P 1002 Pea Starch, which are 100% sustainably sourced from North American farms.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Incidence of Obesity and Cadiovascular Diseases

- 4.1.2 Growing Trend of Veganism Drives the Market

- 4.2 Restraints

- 4.2.1 Associated Allergies With Plant Proteins

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Protein Type

- 5.1.1 Hemp Protein

- 5.1.2 Oat Protein

- 5.1.3 Pea Protein

- 5.1.4 Potato Protein

- 5.1.5 Rice Protein

- 5.1.6 Soy Protein

- 5.1.7 Wheat Protein

- 5.1.8 Other Plant Protein

- 5.2 By End-User

- 5.2.1 Animal Feed

- 5.2.2 Personal Care and Cosmetics

- 5.2.3 Food and Beverages

- 5.2.3.1 Bakery

- 5.2.3.2 Beverages

- 5.2.3.3 Breakfast Cereals

- 5.2.3.4 Condiments/Sauces

- 5.2.3.5 Confectionery

- 5.2.3.6 Dairy and Dairy Alternative Products

- 5.2.3.7 Meat/Poultry/Seafood and Meat Alternative Products

- 5.2.3.8 RTE/RTC Food Products

- 5.2.3.9 Snacks

- 5.2.4 Supplements

- 5.2.4.1 Baby Food and Infant Formula

- 5.2.4.2 Elderly Nutrition and Medical Nutrition

- 5.2.4.3 Sport/Performance Nutrition

6 COMPETITIVE LANDSCAPE

- 6.1 Market Positioning Aalysis

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Archer Daniels Midland Company

- 6.3.2 Cargill, Incorporated

- 6.3.3 DuPont de Nemours Inc.

- 6.3.4 GEMEF Industries

- 6.3.5 Ingredion Incorporated

- 6.3.6 Kerry Group PLC

- 6.3.7 Lantmannen

- 6.3.8 Roquette Freres

- 6.3.9 Tereos SCA

- 6.3.10 Prinova Group LLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS