PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692514

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1692514

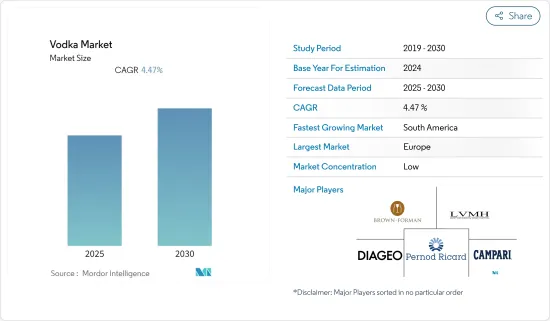

Vodka - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Vodka Market is expected to register a CAGR of 4.47% during the forecast period.

Key Highlights

- In recent years, there has been an increase in the consumption of alcoholic beverages worldwide due to urbanization and socializing trend, especially among young adults. Moreover, the Ministry of Finance (MOF) Taiwan survey shows that the total number of food and drink service business entities in Taiwan reached around 163,640 in 2022. Among those, approximately 28,140 were businesses serving beverages. The number of such establishments in Taiwan steadily increased in the past few years.

- The ready-to-drink (RTD) beverage category has experienced tremendous market growth and innovation over the last several years as consumers prioritized convenience, variety, and quality beverage options. Specifically, vodka-based RTDs overtook tequila as the leading spirits base in 2021, according to a recently released analysis by the IWSR Drinks Market Analysis on the RTD market in the United States. In 2019, vodka comprised just over one-fifth of the spirits-based RTD market. By 2021, however, vodka-based RTD beverages more than doubled their market share and grew to almost 46 percent of the category.

- Strong competitive pressure forces the industry players to constantly innovate by launching differentiated products or service experiences to strengthen brand image, establish market segments, and obtain more significant profit margins. For instance, in 2021, Diageo plc launched a new flavored vodka called Raspberry Crush under the brand Smirnoff in the United Kingdom. The new flavored vodka has red and turquoise color labeling, making it unique.

- Therefore, the abovementioned factors will likely contribute to the growth of the market in the coming years.

Vodka Market Trends

Premiumization of Vodka

- Over recent years, the entire food and beverage industry has seen a consumer demand trend toward more "premium" products. Characterized by an increased focus on flavor, high-quality ingredients, and more appealing packaging, premiumization has significantly impacted the type of products buyers seek. Premiumization has been an especially significant factor in the beverage industry, with the proliferation of budget options making premium products more appealing and consumers likely to treat drinks as something worth spending a little extra on.

- According to a survey by Distilled Spirits Council of the United States (DISCUS), in 2022, premium spirits accounted for 33 percent of all spirits sales volume in the United States. There are several reasons behind this continued growth. Millennials or younger drinkers are the critical drivers of premiumization. With millennials' greater desire for authentic, high-quality, and ethical products and increasing spending power, the demand for vodka will likely be influenced positively soon. Globalization also plays a massive role in this growth, with established Western trends like demand for premium alcohol spreading to new markets.

- As per the survey by IWSR, the number one factor contributing to American consumers' perception of an RTD alcoholic beverage as the premium was offering new flavors. Consequently, players focus on launching new flavors to cater to the customers' demands. For instance, Pernod Ricard, one of the premium spirits organizations in the world, launched 'Absolut Mini' under the brand Absolut in three variants, including Mandarin, Citron, and Raspberry.

Europe Dominates the Market

- Over the years, there has been a considerable rise in the per capita consumption of alcoholic beverages in the region. As per the statistics released by the Swedish Board of Agriculture, the annual consumption volume of spirits in Sweden amounted to 32.3 million liters in 2021, an increase of 21 percent compared to 2019. This represents one of the primary factors behind the continued growth of the vodka market in the region.

- Apart from this, the emergence of a vibrant cocktail culture, especially among young adults, boosts market growth. The National Institute for Health and Welfare survey shows that per capita consumption of mixed alcoholic drinks in Finland increased overall from 2016 to 2022. In 2022, Finns consumed 0.7 liters of mixed alcoholic beverages per person, measured in liters of pure alcohol among individuals aged 15 or older.

- Furthermore, there has been an upsurge in the premiumization of products available due to myriad influences, among them high per capita income, broader options for high-quality products and categories, and consumer appreciation for production and origin. This can further be supported by the survey of the Central Statistical Office of Poland, which highlights fluctuation in the price of premium vodka during the period observed (2019-2021). In 2021, the average price of premium vodka per 0.7 liters increased to 48 zloty from 22.83 zloty in 2020.

Vodka Industry Overview

The global vodka market is highly fragmented owing to the presence of multiple regional and multinational companies offering a wide range of product variants with innovative flavors to maintain their leading position in the market studied. Some of the major players in the market include Diageo Plc, Brown Forman, LVMH Moet Hennessy Louis Vuitton, Pernod Ricard, and Davide Campari-Milano N.V., among others.

These players majorly focus on business strategies, including product innovations, partnerships, and expansion of online and offline distribution networks, to enhance brand visibility and portfolio of offerings, thus, augmenting the growth of the market. For instance, in March 2022, brand directors and partners Stas Karanikolaou and Zack Bia teamed up with Global Brand Equities to introduce Sunny Vodka, the latest addition to their portfolio.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Demand for Premium and Super Premium Vodka

- 4.1.2 Effective Branding and Marketing by Players

- 4.2 Market Restraints

- 4.2.1 Stringent Regulations Pertaining to Vodka

- 4.2.2 Popularity of Non-alcoholic Beverages

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Subsitute Products and Services

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Flavored

- 5.1.2 Non-Flavored

- 5.2 By Category

- 5.2.1 Mass

- 5.2.2 Premium

- 5.2.3 Super-Premium

- 5.3 By Distribution Channel

- 5.3.1 On-Trade

- 5.3.2 Off-Trade

- 5.3.2.1 Supermarkets/Hypermarkets

- 5.3.2.2 Specialty Stores

- 5.3.2.3 Online Retailers

- 5.3.2.4 Other Distribution Channels

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Spain

- 5.4.2.2 United Kingdom

- 5.4.2.3 Germany

- 5.4.2.4 France

- 5.4.2.5 Italy

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Taiwan

- 5.4.3.6 Singapore

- 5.4.3.7 South Korea

- 5.4.3.8 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Diageo PLC

- 6.3.2 LVMH Moet Hennessy Louis Vuitton (Belvedere Vodka

- 6.3.3 Constellation Brands Inc.

- 6.3.4 The Coca-cola Hbc Ag

- 6.3.5 Pernod Ricard

- 6.3.6 Kirker Greer Holdings Limited

- 6.3.7 Bacardi Limited

- 6.3.8 Fifth Generation Inc.

- 6.3.9 Becle SAB de

- 6.3.10 Luctor International

7 MARKET OPPORTUNITIES AND FUTURE TRENDS