Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693705

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693705

Stepper Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

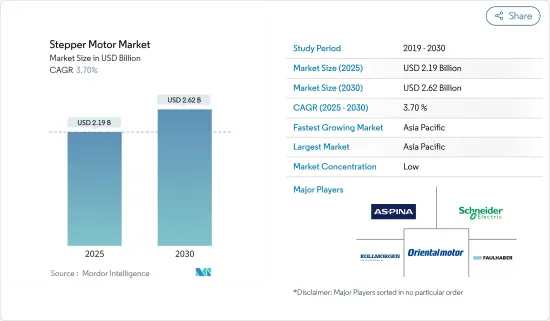

The Stepper Motor Market size is estimated at USD 2.19 billion in 2025, and is expected to reach USD 2.62 billion by 2030, at a CAGR of 3.7% during the forecast period (2025-2030).

Key Highlights

- A stepper motor is an electromechanical system that transduces an electrical signal into a mechanical one. These motors are designed to accomplish a discrete movement and reach a precise position. This movement in stepper motors is achieved by using a magnetic field provided by coils and sensed by magnets, which force the rotating part to respond and align itself in the lowest energy state (equilibrium), giving motion. Hence, stepper motors generally comprise a fixed part (i.e., stator) made of cyclically energized coils and a moving part (i.e., rotor) made of ferromagnetic material or magnets.

- The low cost and precise movement features of stepper motors significantly expand their application area. Currently, stepper motors are available in many familiar industrial and commercial applications. Some typical domestic applications of these motors include applications in air conditioning louvres, driving electrically operated drapes, turning pipe valves on or off, and the zoom and autofocus mechanisms in digital or phone cameras. Furthermore, in the commercial sector, these motors can commonly be found in ATMs, rotating security cameras, etc.

- A significant driving aspect behind the growth of the market studied is the efforts by industrial organizations to accelerate their digital transformation, which includes the shift toward the "Industry 4.0" concept, which governs a higher adoption of automation, robotics, and advanced solutions, such as AI and IIoT, in industrial setups. Considering the benefits, governments across various countries are also taking initiatives to promote the adoption of advanced manufacturing and industrial solutions.

- Over the years, the medical equipment market has witnessed significant growth, driven by technological development, the growing desire of government entities across various countries to offer high-quality healthcare infrastructure, and the growing awareness among consumers regarding personal healthcare devices.

- Furthermore, stepper motors are among the most widely used motors across various end-user industries, as they offer excellent speed control, repeatability of movement, and precise positioning. Additionally, the absence of any contact brush makes these motors highly reliable, as it minimizes mechanical failure and maximizes the motor's operating lifespan.

Stepper Motor Market Trends

Hybrid Type of Motors to Witness Significant Growth

- A hybrid stepper motor is a variety of permanent magnet-type and variable reluctance motors. The rotor in hybrid stepper motors is magnetized axially, much like the permanent magnets in stepper motors. Still, the stator is electromagnetically charged like a variable reluctance stepper motor.

- It has a higher output torque, a higher pulse rate, quicker acceleration and response, less noise, and better performance delivery because it operates on the combined principles of permanent-magnet and variable-reluctance variants. Additionally, they are incredibly dependable and require little maintenance, owing to their sturdy and straightforward construction.

- A vital feature of a hybrid stepper motor is its ability to operate in either a two-phase or three-phase configuration. Two-phase stepper motors use two stator windings that are alternately energized to rotate the rotor by attracting and repelling each other. In contrast, three-phase stepper motors use three stator windings that are energized sequentially, causing the rotor to rotate multiple steps per revolution.

- Industrial robotics options are becoming very popular due to the rapid advancement of the robotics and automation industry, as evidenced by their extensive deployment in the manufacturing sector. The development of hybrid stepper motors depends on the advantages of industrial robots, such as their suitability as independent vehicles and the provision of private assistance on the floor.

- Moreover, despite the global economic challenges, the IFR World Robotics 2023 report revealed a positive future for the industrial robot installation industry. In 2024, industrial robot installations in Asia/Australia are expected to reach 370,000 units, accounting for the highest number of installations.

Asia-Pacific is Expected to Witness Significant Growth

- Asia-Pacific anticipates dominance in the global market, primarily due to the presence of countries like Japan, China, India, and South Korea. These countries are renowned for their electronic materials industry, significantly contributing to the market's interest in this region. Moreover, the region's continuous investments in the medical and robotic sectors are projected to further augment the market's prospects.

- Furthermore, there has been a substantial increase in the implementation of robotics in different sectors within India in recent times. Government initiatives such as the National Strategy for Robotics aim to position India as a global leader in robotics to actualize its transformative potential. It also builds upon Make in India 2.0, which has identified robotics as one of the 27 sub-sectors to enhance the country's integration in the global value chain. This substantial growth signifies a highly promising future for the robotics industry in India. Additionally, the continuous advancements in advanced technology and manufacturing capabilities are anticipated to propel the growth of the robotic industry in the region, consequently generating a surge in market demand.

- Despite the robotic industry, the market for stepper motors is also expected to increase significantly, owing to rising developments in the region's medical industry. The demand for medical equipment is experiencing a significant surge due to the rapidly growing population and the escalating healthcare expenditures in countries such as India, China, and other nations.

- For instance, as per the Government of India, the valuation of the Indian medical devices and equipment market stood at USD 11 billion in 2023 and is estimated to reach USD 50 billion by 2025. This industry has been witnessing consistent growth owing to heightened investments.

- The government has implemented the Production Linked Incentive Schemes to encourage local manufacturing. These schemes provide financial incentives amounting to USD 400 million for medical devices. As a result, numerous companies are making significant investments to augment the production capacities of healthcare equipment.

Stepper Motor Market Overview

The stepper motor market is fragmented, with major players such as Kollmorgen (Regal Rexnord Corporation), Faulhaber, Oriental Motor Co. Ltd, ASPINA Group (Shinano Kenshi Co. Ltd), and Schneider Electric SE. Market participants use partnerships, innovations, investments, and acquisitions to enhanced their product offerings and gain a sustainable competitive advantage.

- December 2023: Kollmorgen launched the P80360 stepper motor, an advanced solution that incorporates closed-loop operation to enable real-time position correction. This advanced drive not only offers versatile programming capabilities and extended positional control but also guarantees enhanced reliability and efficiency through its closed-loop feedback system. With a phase current capacity of up to 3A peak and an input voltage range of 100-240 VAC single-phase, the P80360 stepper drive is compatible with all stepper motors.

- October 2023: FAULHABER unveiled the AM3248 stepper motor, showcasing its remarkable speed and torque. This new motor outperforms similar models by five times with an impressive capability of reaching up to 10,000 rpm. Despite its compact 32 mm diameter, it delivers exceptional performance, making it an proper choice for various applications, including aerospace, laboratory automation, large optical systems, the semiconductor industry, robotics, and 3D printing.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 93600

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Technological Developments

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Supply Chain Analysis

- 4.5 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Robotics and Automation Solutions

- 5.1.2 Increasing Usage of Stepper Motors in the Healthcare Industry

- 5.2 Market Restraint

- 5.2.1 Performance Limitations and Competition from Servo Motors

6 MARKET SEGMENTATION

- 6.1 By Type of Mortor

- 6.1.1 Hybrid

- 6.1.2 Permanent Magnet

- 6.1.3 Variable Reluctance

- 6.2 By Application

- 6.2.1 Medical Equipment

- 6.2.2 Robotics

- 6.2.3 Industrial Equipment

- 6.2.4 Computing

- 6.2.5 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Kollmorgen (Regal Rexnord Corporation)

- 7.1.2 Faulhaber

- 7.1.3 Oriental Motor Co. Ltd

- 7.1.4 ASPINA Group (Shinano Kenshi Co. Ltd)

- 7.1.5 Schneider Electric SE

- 7.1.6 Nanotec Electronic GMBH & Co. KG

- 7.1.7 JVL AS

- 7.1.8 I.CH Motion

- 7.1.9 Changzhou Fulling Motor Co. Ltd

- 7.1.10 Shanghai MOONS Electric Co. Ltd

- 7.1.11 Minebea Mitsumi Inc.

- 7.1.12 Nippon Pulse America Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.