Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408188

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408188

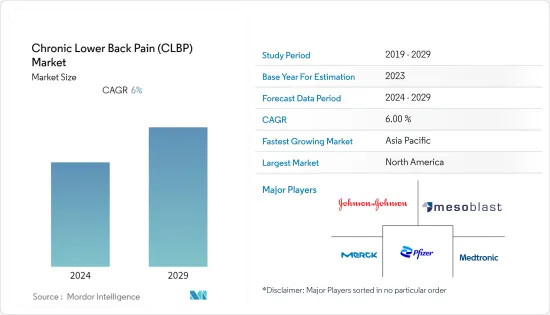

Chronic Lower Back Pain (CLBP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

PUBLISHED:

PAGES: 111 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The chronic lower back pain (CLBP) market is projected to register a CAGR of 6.0% during the forecast period.

Key Highlights

- During the COVID-19 pandemic, the target market growth was considerably influenced in the early stages; treatments resumed due to strict government measures. Elevated stress levels and emotional distress may cause muscle tightness and heightened sensitivity to lower back pain. According to an article published by Medical News Today in September 2022, lower back discomfort can be a sign of acute and chronic COVID-19.

- Viral infections can directly cause muscle pain, and fever-induced immobility can exacerbate muscle strain. Similarly, an article published by the Journal of Medical Science published in November 2021 stated that, among hospitalized people with COVID-19, 69.3% reported pain, with 43.6% reporting back pain and 33.1% reporting lower back pain.

- Moreover, another article published by the International Association for the Study of Pain in January 2023 stated that chronic pain affects 1 in 5 adults globally. The burden of disease due to chronic pain and the demand for effective pain management increased during the COVID-19 pandemic, with joint and muscle pain being reported both in the acute phase and by those with long COVID.

- Post-COVID, the impact on chronic lower back pain increased due to reduced physical activities. For instance, an article published by Osong Public Health Research Perspectives in March 2023 stated that 46.6% of patients who contracted COVID-19 complained of pain, and 92.6% of patients diagnosed with COVID-19 who experienced musculoskeletal pain said no pain before getting COVID-19. Such an increase in chronic lower back pain post-COVID is expected to significantly impact the market during the forecast period.

- The increasing number of nerve and lower back muscle pain cases is expected to boost the market growth. For instance, an article published by StatPearls Publishing in October 2022 stated that peripheral nerve problems impact approximately 2.4% of the global population, with an increase to 8.0% in older people. Similarly, another article published by the same source mentioned in February 2023 stated that chronic low back pain affects 23% of adults worldwide, with a recurrence rate of 24% to 80% in their lifetime. Thus, the increasing prevalence of chronic lower back pain is expected to raise the diagnosis rate and adoption of treatment, leading the market to grow in the forecast period.

- The increasing geriatric population is one of the main reasons to promote market growth. For instance, according to WHO data published in the World Social Report 2023, the global population of individuals aged 65 and over is expected to surpass quadruple, rising from 761 million in 2021 to 1.6 billion in 2050. The number of people aged 80 and above is increasing considerably faster.

- The product approvals in the market are expected to drive the market growth. For instance, in February 2023, Mesoblast Limited announced that the FDA's Office of Tissues and Advanced Therapies (OTAT) granted rexlemestrocel-L regenerative medicine advanced therapy (RMAT) designation for the treatment of chronic low back pain (CLBP) associated with disc degeneration, in combination with hyaluronic acid (HA) as a delivery agent for injection into the lumbar disc. Similarly, in December 2022, the Food and drug administration (FDA) approved the minor spinal cord stimulation (SCS) implant Abbott's Eterna from Abbott to treat chronic pain. Such approvals are expected to boost the market growth during the forecast period.

- Research and development in treating lower back pain by various organizations also promote market growth. For instance in March 2023, a study carried out by Society for Interventional Radiology (SIR) stated that 60% of patients had a 50% or better improvement in pain three years following therapy of VIA Disc injection (VIVEX Biologics), and more than 70% had a larger than the 20-point increase in movement and function.

- However, the side effects of treatments and the availability of counterfeit drugs are expected to hamper the market growth.

Chronic Lower Back Pain (CLBP) Market Trends

The Chronic back pain Segment is Expected to Hold a Major Share in Pain Type of the Chronic Lower Back Pain (CLBP) Market.

- The chronic back pain segment is expected to increase significantly during the forecast period due to the rising prevalence of chronic back pain cases and the overall diagnostic adoption rate. For instance, in an article published by StatPearls in February 2023, back discomfort is joint in adults, and 23% of adults suffer from chronic low back discomfort. This recurrence rate was 24% to 80% in their lifetime. Thus, the high recurrence rate of lower back pain is expected to drive segmental growth.

- Similarly, an article published by the Lancet Rheumatology in June 2023 stated that 619 million people worldwide suffered from low back pain in 2020, and by 2050, that number is expected to reach 843 million. Thus, the global low back pain epidemic is escalating and expected to drive the market segment.

- Moreover, an article published by PubMed in October 2022 stated that most chronic low back pain was 4.2% in people aged 24 to 39 and 19.6% in people aged 20 to 59. Six studies with people aged 18 and up indicated chronic low back pain prevalence ranging from 3.9% to 10.2%, while three reported prevalence ranging from 13.1% to 20.3%.

- As per the same source, the majority of chronic low back pain in the Brazilian elderly population was 25.4%. Lower back discomfort is anticipated to rise in future years, boosting the segmental market growth.

North America is Expected to Hold a Significant Share in the Market and Expected to do the Same in the Forecast Period

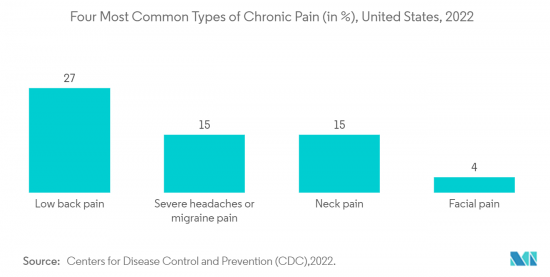

- North America has an increasing number of chronic back pain is expected to drive the market. For instance, according to the Center on an Aging Society (CAS) article published in October 2022, approximately 16 million adults that are 8% of all individuals, suffered from persistent chronic back pain, limiting their ability to do daily tasks, making that sixth most expensive medical problem in the United States.

- Similarly, an article published by Red Cross Therapy (RCT) in December 2022 stated that approximately 80% of Americans experience back pain at least once a year around 8% of people aged 18 and up suffer from chronic back pain to the point where their activities are severely limited. This is expected to increase various treatment adoption in the region and expected to boost the growth in the market.

- Product approvals are expected to boost the market growth in the region. For instance, in October 2022, Nevro Corp. announced that it had received approval from the United States Food and Drug Administration (FDA) for the Senza HFX iQ spinal cord stimulation (SCS) system. Therefore, such approvals of various regional products are expected to drive the market.

Chronic Lower Back Pain (CLBP) Industry Overview

The chronic lower back pain (CLBP) market is fragmented, competitive, and has several major players. A few of the major players are currently dominating the market in terms of market share. Some companies currently dominating the market are Johnson & Johnson Services Inc., Pfizer Inc, Mesoblast Limited, Merck & Co., and Medtronic.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 5000306

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Defination

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Stem Cell therapy for Lower Back Pain

- 4.2.2 Increasing Prevelence of Nerve Pain Disorders

- 4.2.3 Growing geriatric population

- 4.3 Market Restraints

- 4.3.1 Side Effects of Treatments and Availability of Counterfeit Drugs

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Pain Type

- 5.1.1 Acute Pain

- 5.1.2 Subacute Low Back Pain

- 5.1.3 Chronic Back Pain

- 5.1.4 Other Pain Types (Mechanical pain, Radicular pain, Radiculitis)

- 5.2 By Diagnosis

- 5.2.1 Assessment of Pain

- 5.2.2 Clinical History

- 5.2.3 Physical Examination

- 5.2.4 Imaging Guidelines

- 5.3 By End-User

- 5.3.1 Hospitals

- 5.3.2 Orthopedic Clinics

- 5.3.3 Other End -Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle-East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle-East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Johnson & Johnson Services Inc.

- 6.1.2 Pfizer Inc

- 6.1.3 Vertebral Technologies, Inc.

- 6.1.4 Merck & Co.

- 6.1.5 Medtronic

- 6.1.6 Boston Scientific Corporation

- 6.1.7 Mesoblast Limited

- 6.1.8 SpineThera

- 6.1.9 Stayble Therapeutics

- 6.1.10 Eli Lilly and Company

- 6.1.11 Persica Pharmaceuticals

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.