PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408223

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408223

Europe E-Commerce Apparel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

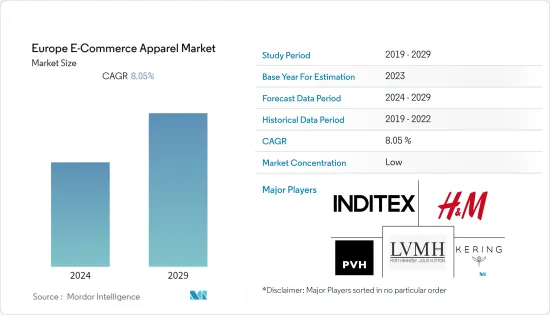

The Europe e-commerce apparel market was valued at USD 86.11 billion for the current year and is projected to register a CAGR of 8.05% over the next five years.

Key Highlights

- The e-commerce apparel industry is undergoing major transformations as a result of growing globalization, technological innovation, and changes in consumer buying patterns. The growing apparel industry and the influence of fashion trends are the major factors driving e-commerce sales in the apparel industry as it provides the customer with the opportunity to try and explore different designs and fits such as regular fit, slim fit, and loose fit trails while staying at home.

- Additionally, as customers are researching more about sustainable fashion options, the continuous innovation in fabric and growing consumers trend towards sustainable fashion have propelled demand, owing to the benefits, it provides to buyers and sellers. Thus, e-commerce has flourished and gained significant relevance among retailers and consumers. While customers research this segment, based on keyword searches, the companies market and suggest their products on the websites, therefore gaining customer attention.

- For instance, in October 2022, Gonser Group announced its plans to develop Mimikry, a new jeans productive technique that is much more sustainable and cost-reducing than traditional methods, with the same final effect. Further, to meet the needs of millennial consumers, fashion eCommerce is continuously evolving. For example, fashion e-commerce is currently experimenting with new technologies such as social commerce, metaverse, non-fungible tokens (NFTs), Web 3.0, and virtual reality to promote its acceptance in both the real world and the virtual one. This is done to find new ways to capture the interest of Gen-Z consumers.

- Moreover, significant strides have been made in the fashion industry, demonstrating how novel and innovative methods for consumers to interact with online stores are strongly favorable to the future of e-commerce retail. Thus, the upcoming market opportunities in the e-commerce apparel market include Virtual reality (VR), augmented reality (AR), and artificial intelligence (AI) that help transform the customer experience. For instance, in August 2022, German luxury fashion house Hugo Boss announced its plans to launch a virtual try-on service in partnership with Reactive Reality, a leading 3D digitization technology company. The company claims that the partnership enables customers in Germany, the United Kingdom, and France to use body measurement-based shopping through these personalized avatars.

- Furthermore, an increasing number of United Kingdom-based fast fashion companies (including Next, Boohoo, and Zara) began charging customers a modest fee to return purchases. This fashion retail practice is likely to catch on as companies attempt to decrease waste and promote sustainability commitments and as tighter margins make unlimited free returns less practical. This trend may encourage budget-conscious shoppers to make in-person purchases so that they can try before they buy. Such instances could restrain the e-commerce apparel market.

Europe E-Commerce Apparel Market Trends

Online Retailers Offering Seamless Shopping Experience

- Customers can buy apparel in the comfort of their homes by clicking a few keys owing to the variety of applications and websites available. Further, busy and hectic lifestyles drive the e-commerce apparel market. Moreover, customers have the choice of where to shop when purchasing online, and they can still browse for clothes online from the comfort of their own homes or on the go.

- Additionally, one can potentially save a tonne of time and effort by shopping online. Since there's access to countless brands and online shops from a smartphone or desktop, it makes them simpler to find the things they desire. People use their preferred search engine to find a specific clothing item from a variety of stores. This is much more convenient than driving and walking around several stores just to find a single product.

- Additionally, another trend gaining traction in fashion e-commerce or e-commerce, in general, is the adoption of chatbots. A growing number of D2C companies are currently implementing chatbots for customer-facing interactions, such as resolving customer inquiries and customer engagement to cross-sell and upsell. For instance, brands such as ASOS, Burberry, Levi's, and Tommy Hilfiger have all adopted retail chatbots to bridge the gap between the customer and the retailer in a more convenient and personalized way.

- Moreover, online shopping opens up a world of options for the customer as people can shop using international/global platforms. This makes it more convenient for consumers to find niche and specialized clothing that may not be readily available in local stores. Furthermore, shopping for clothes online allows individuals to enjoy privacy while shopping. Also, customers do not need to struggle with the inconvenience of shopping in a crowded establishment or standing in long queues for changing rooms and at billing counters during the festive season or when there is a sale. Therefore, customers are more driven toward the e-commerce apparel market.

- For instance, in October 2022, in Poland, the Sinsay clothing brand mobile app recorded 2.5 million downloads in less than six months since its launch and is the most-downloaded app in the "free apps" and "shopping" categories on the AppStore and Google Play. Further, the company claims that currently, they make around 30% of the brand sales through e-commerce orders.

United Kingdom Holds the Largest Market Share

- The United Kingdom holds a significant market share in the Europe e-commerce apparel market as the country was an early adopter of e-commerce. The United Kingdom has a well-established online shopping culture, and customers have embraced e-commerce for purchasing apparel. Online shopping is a convenient choice for purchasing apparel, considering it provides convenience, a wide range of options, and competitive pricing.

- According to Office for National Statistics (UK), in February 2023, internet sales accounted for over 24.3% of textile, clothing, and footwear stores in Great Britain. Hence, the above-mentioned factors drive the e-commerce apparel market in this country. Further, according to the Centre for Retail Research Organization survey, they stated that online sales are expected to account for 28.9% of the online retail industry in 2021.

- Many apparel companies and retailers in the United Kingdom are embracing an omnichannel strategy, merging their online and offline platforms. Customers can browse and purchase apparel online, opt for click-and-collect alternatives, and experience seamless returns and exchanges across several channels. This integration seeks to improve consumer satisfaction by providing a consistent purchasing experience. For instance, in June 2022, Primark announced plans to test click-and-collect services for their childrenswear, which ranges from newborn babywear to age 15 years, in the United Kingdom. The experiment will take place in up to 25 locations in the northwest of England, and customers will have access to an estimated 2,000 selections of children's apparel, accessories, and lifestyle products.

- Customers will be able to make purchases online and add products to their virtual shopping cart before checking out and paying for their purchases. They will subsequently be able to pick up the products at a newly established dedicated customer collection point in the heart of the participating stores. E-commerce platforms and apparel brands continue to adapt and innovate to meet the changing demands and preferences of United Kingdom consumers. As a result, all these factors, along with consumer inclination towards fashion, indicate a positive growth of the e-commerce apparel market in the United Kingdom.

Europe E-Commerce Apparel Industry Overview

The Europe E-Commerce Apparel market is highly competitive owing to the presence of multiple regional and multinational companies offering a wide range of online apparel products and trying to maintain their leadership position in the market studied. Major players in the market include Inditex, Hennes & Mauritz, PVH Corp, LVMH, and Kering SA, each of which holds a significant share of the market studied.

These players have been undertaking business strategies, including product innovations, partnerships, strengthening their hold over online and offline marketing, and mergers and acquisitions to expand their visibility and portfolio of offerings, thus, augmenting the growth of the market. Further, the companies have been introducing new and innovative products with the inclusion of sustainable raw material fabrics to make their product unique from the existing products. Owing to the rapidly developing nature of the market, new product innovation has become the most commonly used strategy among all.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Online Retailers Offering Seamless Shopping Experience

- 4.1.2 Growing Consumer Inclination Towards Latest Sustainable Fashion

- 4.2 Market Restraints

- 4.2.1 Limited Sensory Experience

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Formal Wear

- 5.1.2 Casual Wear

- 5.1.3 Sportswear

- 5.1.4 Nightwear

- 5.1.5 Other Types

- 5.2 End User

- 5.2.1 Men

- 5.2.2 Women

- 5.2.3 Kids/Children

- 5.3 Platform Type

- 5.3.1 Third Party Retailer

- 5.3.2 Company's Own Website

- 5.4 Geography

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 Russia

- 5.4.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Industria de Diseno Textil, S.A. (Inditex)

- 6.3.2 PVH Corp.

- 6.3.3 Fast Retailing Co., Ltd

- 6.3.4 Chanel Limited

- 6.3.5 Adidas AG

- 6.3.6 Hennes & Mauritz AB

- 6.3.7 Marks and Spencer Group plc

- 6.3.8 Associated British Foods plc (Primark)

- 6.3.9 Ralph Lauren Corporation

- 6.3.10 Kering S.A.

- 6.3.11 LVMH Moet Hennessy Louis Vuitton

- 6.3.12 Punta Na Holding Sa (MANGO)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS