PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408229

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408229

GCC Paper Cup - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

The GCC paper cup market is valued at USD 351.88 million in the current year and is expected to attain a CAGR of 3.40% during the forecast period to reach USD 437.26 million in the next five years. The recyclability of paper cups is one of the key factors driving the growth of the paper cup market. These cups can be recycled indefinitely because they are made of paper. Manufactured on par with environmental regulations, users benefit from the cost advantages of packaging while eliminating disposal concerns. It helps the vendors to contribute to the sustainability goals through their products.

Key Highlights

- The rise in tea, coffee, and soft drinks consumption on account of a considerable increase in the population is one of the key factors catalyzing the demand for paper cups in the region. The burgeoning food and beverage (F&B) industry and the escalating order for disposable packaging in quick service restaurants (QSRs) to minimize the risk of leakage and spillage of different food products and beverages positively influence the market. The emerging trend of social gatherings on special occasions also drives the country's need for disposable plates, cups, and other containers.

- The environmental damage caused by plastic cups has led various organizations to encourage the utilization of paper cups due to their eco-friendly nature, which has positively impacted the global paper cups market. Moreover, on account of increasing awareness about cleanliness and hygiene, consumers consider disposable paper cups safer than reusable cups, as they are exposed to high heat during manufacturing, killing bacteria and rendering the product practically sterile.

- Increasing adoption of disposable cups to serve hot and cold beverages in quick-service restaurants is likely to drive their demand in the coming years. In addition, the rising usage of such cups for drinking water in several commercial and residential parties is expected to conduct their demand.

- Significant and broad-based inflation (including raw materials, labor, distribution, and energy), the decline in consumer demand, availability of raw materials, and movements in currency rates are considered relevant short-term business risks and uncertainties in the operations. Geopolitical, general political, economic, and financial market conditions, as well as potential further escalation of the geopolitical crisis, can also adversely affect the implementation of the strategy and business performance and earnings. The COVID-19 pandemic disturbed the trading conditions, operating environment, and demand for the products.

- The outbreak of the COVID-19 pandemic had a considerable impact across various industries, including the packaging industry, as the widespread lockdown and restriction on workforce utilization in factories significantly impacted demand and production. A significant portion of the need for paper cups was mainly from coffee shops, on-the-go restaurants, and others.

GCC Paper Cup Market Trends

Hot Paper Cup to Witness Significant Growth

- Hot paper cups are hugely demanded across the region, with the growing population, immense commercial and institutional infrastructure growth, and high spending capacity of the individuals. Also, the consumption of hot paper cups is spiked owing to the fast and hectic lifestyle of people in the region.

- As a growing number of premium and specialist operators raise the standard for quality, service, and choice throughout the region, Saudi Arabia and the United Arab Emirates have emerged as important centers for development and innovation. Paper cups are increasingly used to serve tea and coffee in the beverage sector, substantially impacting global expansion.

- In the past three decades, temperatures in the region have increased far more quickly than the global average. As precipitation has fallen, scientists believe droughts may become more frequent and severe. Due to the region's alarming worldwide warming and other environmental issues, users are concerned that everyday products must be environment-friendly.

- Paper cups are biodegradable because of the absence of plastic or styrofoam. These throwaway cups degrade quickly because of their disposable nature. The cups are constructed of water and wood pulp. There can be no doubt that it is the safest option for food and beverages industries.

- Also, offices and corporate centers in the Gulf Cooperational Council (GCC) are robust in places including Saudi Arabia, Qatar, the United Arab Emirates. These offices' cafeterias and breakout zones majorly use disposable hot paper cups.

- With the growth of tourist footfall in the region, there would be a recovery in demand for disposable cups for refreshers in hotels, restaurants, and malls. The rapid growth of industrial and commercial buildings, changes in the lifestyle of people would drive the growth of hot paper cups across the region over the forecast period.

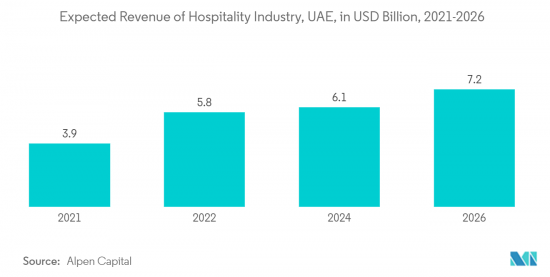

- The United Arab Emirates' (UAE) hotel sector is expected to generate over USD 7 billion in revenue in 2026, according to Alpen Capital. A large user of throwaway goods like paper cups is the hospitality sector, which includes hotels, restaurants, cafes, and other places. The use of paper cups to serve clients' beverages is probably going to rise as the hospitality sector's income in the UAE rises. The GCC paper cup market may benefit from this growing demand.

Quick Service Restaurants to Witness Significant Growth

- During the projection period, the quick-service restaurant industry is predicted to grow considerably in the region. The expansion of the market is largely fueled by shifting consumer tastes and an increase in the workforce. In the GCC, since there is frequently little entertainment, eating out is a rather frequent pastime. More than a third of visitors to malls come for meals rather than shopping. For both hot and cold beverages, most quick-service restaurants utilize disposable paper cups. As a result, paper cups are in high demand throughout the area.

- Additionally, the GCC's developing infrastructure which includes new highways, airports, malls, parks, and entertainment venues allows for the opening of several fast food and beverage companies. Additionally, increased road traffic increases demand for quick and ready-to-eat food and beverages.

- Many coffee shops and eateries now only provide carryout or curbside pickup. To ensure food delivery during the lockdowns, some businesses limited their in-store capacity and developed creative delivery methods. The need for paper cup solutions is expected to rise dramatically in the food and beverage sector. This is mostly due to the rising need for hygiene goods, which has made paper an attractive packaging option.

- The United Arab Emirates' gross domestic product was predicted by the International Monetary Fund (IMF) to increase consistently between 2022 and 2027 and reach USD 6,302.9 US (+13.19%). The country's overall productivity and the increase in consumer spending are both reflected in the gross domestic product. As the UAE's GDP increases, more economic activity and higher income levels are being experienced. People's increased discretionary income frequently causes them to spend more on goods and services. Consumers are more inclined to attend restaurants and other hospitality venues as a result of having more discretionary income, which raises the demand for items like paper cups. The GCC Paper Cup Market may expand as a result of this rise in consumer expenditure.

GCC Paper Cup Industry Overview

The market is moderately fragmented, with few major players such as Huhtamaki Group, HotpackPackaging Industries LLC, and more. Companies focus on innovations as part of their business expansion and towards recyclability.

In November 2022, HotpackGlobal opened a manufacturing facility in Qatar. The cutting-edge manufacturing facility is a specialized factory that will create a wide range of Hotpack'spaper products, including folding and corrugated cartons, paper bags, and cups. It is situated in Doha's new industrial region.

In September 2022, Huhtamaki and Stora Enso launched a paper cup recycling initiative. The Cup Collective program aims to recycle used paper cups on an industrial scale and provide consumers and businesses convenient access to used paper cups, which can then be renewed into valuable recycled raw material.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes Products

- 4.4 Assessment of Impact of the COVID-19 on the Market

- 4.5 Import-Export Analysis

- 4.6 Government Regulations/Requirements

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand For on-the-go Consumption of Beverages

- 5.1.2 Sustainability Measures, Coupled with Recent Innovations, Have Played A Role in Extending Shelf Life of Products

- 5.2 Market Restraints

- 5.2.1 Ongoing Market Fragmentation and the Dependence on Materials Expected to Affect Margins

6 MARKET SEGMENTATION

- 6.1 By Cup Type

- 6.1.1 Hot Paper Cup

- 6.1.2 Cold Paper Cup

- 6.2 By Application

- 6.2.1 Quick Service Restaurants

- 6.2.2 Institutional

- 6.2.3 Other Applications

- 6.3 By Country

- 6.3.1 Saudi Arabia

- 6.3.2 United Arab Emirates

- 6.3.3 Qatar

- 6.3.4 Rest of GCC

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ENPI Group

- 7.1.2 Huhtamaki OYJ

- 7.1.3 Gulf East Paper & Plastic Industries LLC

- 7.1.4 Golden Paper Cups Manufacturing LLC

- 7.1.5 Maimoon Papers Industry LLC

- 7.1.6 Hotpack Global

- 7.1.7 SAQR Pack

- 7.1.8 Arkan Mfg Paper Cup Company

- 7.1.9 Saham Group

- 7.1.10 Ultracare LLC

8 MARKET OPPORTUNITIES AND FUTURE TRENDS