PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408265

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408265

MRI - Compatible IV Infusion Pump Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

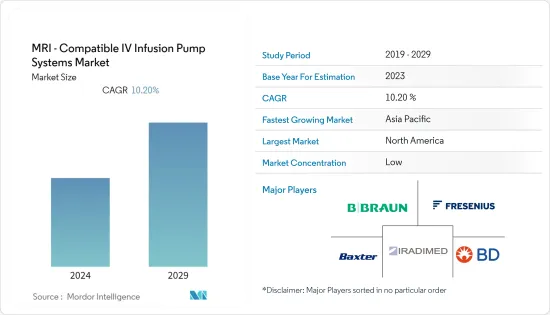

The MRI-compatible IV infusion pump systems market is expected to register a CAGR of 10.2% over the forecast period.

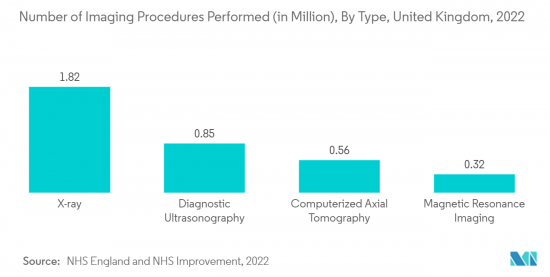

COVID-19 impacted the MRI-compatible IV infusion pump systems market due to a decline in MRI imaging procedures during the pandemic. For instance, as per the article published in the National Library of Medicine in December 2021, there was a decrease of around 26% in the number of MRI procedures in Europe during the pandemic as compared to the number of procedures carried out in 2019. Therefore, the market expansion was constrained by a decline in MRI imaging volume during COVID-19, but the impact was temporary, and MRI procedure volume increased to normal after the first wave of COVID-19. This is expected to boost the MRI-compatible IV infusion pump market over the forecast period.

One of the primary factors driving the growth of the MRI-compatible IV infusion pump market is the rising prevalence of chronic diseases. The rising number of cancer diagnoses is adding to the global mortality rate. Cancer patients must take analgesics for pain relief and chemotherapeutic drugs for treatment. In a hospital, clinic, or home care setting, programmable infusion pumps aid in the administration of analgesics and chemotherapeutic drugs. For instance, according to Cancer Facts and Figures 2023, an estimated 1.9 million new cancer cases will be diagnosed in 2023, among which prostate cancer is estimated to be 186,670, followed by 169,870 cases of lung cancer and 144,490 cases of female breast cancer. As a result, the frequency and incidence of chronic diseases have boosted the demand for MRI-compatible IV infusion pumps, which will drive market growth over the projection period.

Furthermore, technological advances in IV infusion systems are expected to contribute to market growth. For instance, in June 2023, B. Braun Medical Inc. (B. Braun) announced the release of DoseTrac Enterprise Infusion Management Software, the company's next generation of infusion management software. This new software provides organizations with a combination of real-time views and retrospective reporting options to help them better understand their infusion pump fleet and accompanying data. With just one application, the DoseTrac Enterprise Software platform can connect up to 40,000 pumps at an unlimited number of locations. Thus, the existence of technologically advanced software may facilitate the operation of an MRI-compatible IV infusion pump, which is likely to contribute to market growth. Moreover, there is a huge demand for the MRI-compatible IV infusion pump system. For instance, IRadimed reported that they had sold approximately 6,062 MRI-compatible IV infusion pump devices and approximately 1,138 of 3880 MRI-compatible patient vital signs monitoring systems as of December 31, 2021.

In addition, strategic initiatives by market players, such as product launches, mergers, and acquisitions, are expected to boost the market over the forecast period. For instance, in April 2021, BD (Becton, Dickinson, and Company) stated that it had submitted a 510(k) premarket notification to the United States Food and Drug Administration (FDA) for the BD Alaris System, the most extensively used infusion pump in acute care hospitals across the country. The BD AlarisTM System enables doctors to deliver drugs, fluids, and blood products to adult, pediatric, and neonatal patients via a single integrated platform that comprises large-volume pumps, syringe pumps, and patient-controlled analgesia (PCA) modules.

Hence, the growing burden of chronic diseases, technological advancement, and strategic activities by the market players are expected to boost the market over the forecast period. However, the high cost associated with the system may restrain the market.

MRI - Compatible IV Infusion Pump Systems Market Trends

Hospital Segment is Expected to Hold a Significant Share Over the Forecast Period

Hospitals are the primary care settings for the diagnosis and treatment of medical conditions, including cancer, orthopedic, and cardiac diseases. The major factors fueling market growth are the rising inpatient and outpatient visits to hospitals for MRI screening, increasing hospitalization, a rise in the volume of surgical procedures performed, and better treatment facilities provided by hospitals, such as better reimbursement scenarios, early diagnosis, and trained staff.

The growing number of hospital admissions is expected to propel the MRI-compatible IV infusion pump system, thereby boosting segment growth. For instance, according to the American Hospital Association 2023, the overall number of hospital admissions in the United States will be 34 million in 2023. This increase in hospital admission is likely to increase the demand for MRI-compatible IV infusion pumps as most of the patients admitted to the hospital undergo various diagnostic procedures such as MRI imaging, thereby boosting segment growth.

Moreover, growing healthcare expenditure is likely to boost segment growth over the forecast period. For instance, according to the data published by the Organisation for Economic Co-operation and Development (OECD), in June 2022, the healthcare expenditure of France was around USD 6,115 million. Thus, growing healthcare expenditures may increase spending in hospital facilities, which is likely to boost the segment's growth.

Further, the growing number of surgeries in the hospital setting is likely to boost the demand for MRI-compatible IV infusion pump systems and thus boost the segment's growth. For instance, according to the Canadian Institutes of Health Information published in June 2022, in 2021, 55,300 hip and 55,285 knee replacements were performed in Canada. MRI diagnosis is effectively used in hip and knee problem diagnosis, and hence, the growing number of hip and knee replacement surgeries in hospital settings is expected to increase demand for MRI-compatible IV infusion pump systems during and after the MRI scan.

Thus, rising hospital admissions and a growing number of surgeries are expected to boost segment growth over the forecast period.

North America is Expected to Hold a Significant Market Share Over the Forecast Period

North America dominates the MRI-compatible IV infusion pump system market. It is expected to show a similar trend during the forecast period, owing to the region's high prevalence of chronic diseases, the presence of a universal healthcare system in the United States and Canada, and new product launches and approvals.

Musculoskeletal diseases are the major disability-causing diseases and are one of the most prevalent forms of chronic diseases where MRI systems are extensively used in diagnosis and monitoring; hence, demand for MRI-compatible IV infusion pump systems is expected to boost the market. For instance, according to the Centres for Disease Control and Prevention's (CDC) article updated in October 2021, in the United States, about 58.5 million people have doctor-diagnosed arthritis, and arthritis is more common in women (23.5%) compared with men (18.1%). Also, the prevalence of arthritis increases with age, and with the growing geriatric population, the burden of musculoskeletal disorders is further expected to increase, which will drive growth in the market. In addition, the growing burden of cancer is expected to increase MRI diagnosis and thereby boost the market for MRI-compatible IV infusion pump systems over the forecast period. For instance, according to statistics published by the Government of Canada and released in May 2022, about 233,900 Canadians were diagnosed with cancer in 2022, and prostate cancer is expected to remain the most commonly diagnosed cancer.

The presence of universal healthcare coverage reduces the cost of various procedures, including MRI, which encourages people to take tests or receive treatment at regular intervals, which is one of the most significant growth factors for the growth of the MRI-compatible IV infusion pump system market. For instance, in the United States, about 80%-90% of the citizens have health coverage, which is primarily covered by Medicare, Medicaid, and the State Children's Health Insurance Programme (SCHIP), and in Canada, Medicare provides health insurance.

Hence, the growing burden of chronic diseases and the presence of universal healthcare coverage are expected to boost market growth over the forecast period.

MRI - Compatible IV Infusion Pump Systems Industry Overview

The MRI-compatible IV infusion pump systems market is consolidated and consists of a few major players. In terms of market share, some major players currently dominate the market. With technological advancements and quality service provisions, mid-size to smaller companies are increasing their market presence by introducing new products. Some of the market players are B. Braun SE, Baxter International Inc., Becton Dickinson and Co., Fresenius SE & Co. KGaA, and IRadimed Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Burden of Chronic Diseases and Increasing Demand of MRI Diagnostics

- 4.2.2 Increasing In Number of Surgical Procedures and Advancement In MRI Compatible IV Infusion System

- 4.3 Market Restraints

- 4.3.1 High Costs Associated With MRI Compatible IV Infusion Pumps

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Type

- 5.1.1 Non-magnetic Pump System

- 5.1.2 Magnetic Pump System with Shielding

- 5.1.3 Tubing and Disposables

- 5.2 By End Users

- 5.2.1 Hospitals

- 5.2.2 Ambulatory Surgical Centres

- 5.2.3 Diagnostics and Imaging Centres

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 China

- 5.3.4 Rest of the World

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Arcomed AG

- 6.1.2 B. Braun SE

- 6.1.3 Baxter International Inc.

- 6.1.4 Becton Dickinson and Co.

- 6.1.5 Medtronic

- 6.1.6 Eitan Medical Ltd.

- 6.1.7 Flowonix Medical Inc.

- 6.1.8 Fresenius SE & Co. KGaA

- 6.1.9 ICU Medical Inc.

- 6.1.10 IRadimed Corp.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS