PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408320

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408320

Interactive Patient Care Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029

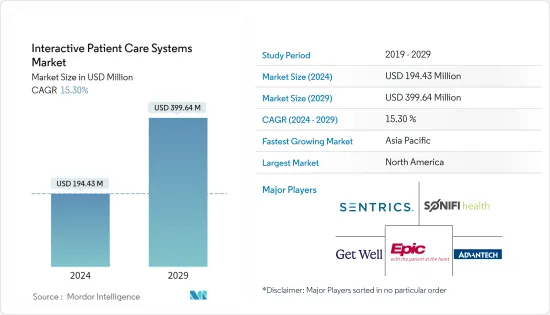

The Interactive Patient Care Systems Market size is estimated at USD 194.43 million in 2024, and is expected to reach USD 399.64 million by 2029, growing at a CAGR of 15.30% during the forecast period (2024-2029).

The COVID-19 pandemic initially substantially impacted the interactive patient care system market. The increased hospitalizations during the pandemic increased the usage of interactive patient care solutions. For instance, according to an article published by the Journal of Deutsches Arzteblatt International in November 2022, a study was conducted in Germany, which showed that the number of inpatient admissions due to COVID-19 significantly increased during the early pandemic, which also expectedly increased the usage of interactive patient care systems in the hospitals. Thus, the COVID-19 outbreak affected the market's growth significantly. However, as the pandemic subsided, the market is expected to experience pre-pandemic growth levels during the study's forecast period.

Factors such as the rising incidence of chronic diseases coupled with the increased need for patient engagement solutions and the increasing technological advancements and rising adoption of interactive patient care systems are expected to boost the market growth.

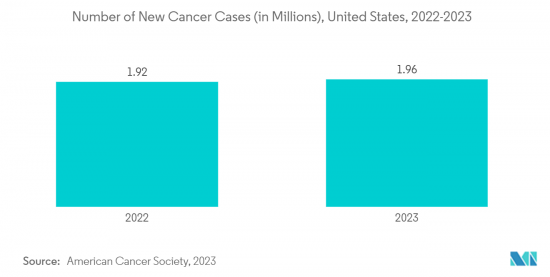

The rising prevalence of chronic diseases worldwide, such as cancer, diabetes, and cardiovascular diseases, is a significant factor driving the market growth. It is expected to boost the need for patient engagement solutions such as interactive patient care systems in both inpatient and outpatient settings. For instance, according to an article published by the Chinese Medical Journal in February 2022, an estimated 4,820,000 and 2,370,000 new cancer cases were diagnosed in China and the United States in 2022. Hence, the growing burden of cancers is expected to drive the adoption of interactive patient care systems, which will cause the growth of the studied market.

Moreover, according to an article published by the Journal of Environmental Research and Public Health in February 2023, digital health technologies are being rapidly adopted in healthcare infrastructures worldwide. The source also stated that organizations like the American Telemedicine Association provide interactive patient engagement services for chronic diseases like heart disease, asthma, and diabetes. Thus, the rising adoption of interactive patient care systems is also a significant factor driving market growth.

In addition, new product launches and strategic activities by major players in the market are positively affecting the growth of the studied market. For instance, in January 2021, GetWellNetwork acquired Docent Health, an innovative enterprise consumer engagement platform that enables healthcare organizations to scale personalized outreach through AI-enabled communication technology. Thus, owing to such acquisitions, the studied market is expected to grow significantly over the forecast period.

Therefore, owing to the factors above, such as the rising prevalence of chronic diseases, the increasing adoption of interactive patient care systems, and the rising strategic activities by market players, the studied market is anticipated to grow over the analysis period. However, the lack of skilled professionals is likely to impede market growth.

Interactive Patient Care Systems Market Trends

Inpatient Solutions Segment is Expected to Witness Significant Growth Over the Forecast Period

Inpatient solutions refer to interactive patient care systems in hospitals and clinics where the patients are kept for recovery and rehabilitation. Factors such as the rising number of hospitalizations worldwide due to various chronic diseases and the increasing prevalence of chronic diseases such as cancer, diabetes, and asthma, among others, are expected to boost the growth of the studied segment during the forecast period.

For instance, according to the data published by the Canadian Institute for Health Information in February 2023, there were almost 2.9 million acute inpatient hospitalizations in Canada in 2022, which increased from 2.7 million in 2021. Thus, the high hospitalization rate in Canada is also expected to boost the adoption of interactive patient care systems, likely driving segment growth.

Moreover, the rising prevalence of various chronic diseases worldwide is also expected to drive segment growth, as it would also increase inpatient hospitalizations, thus increasing the demand for interactive patient care systems. For instance, according to the article published by PubMed in March 2022, when the research was conducted in primary healthcare centers in southern Sweden, the overall prevalence of heart failure (HF) was 2.06%. 99.07% of the patients with HF were associated with multimorbidity. Thus, the target population's high burden and persistent risk of CVD are expected to drive segment growth.

Therefore, the inpatient solutions segment is expected to grow significantly over the forecast period. It is due to the abovementioned factors, such as the rising hospitalization rates and the increasing prevalence of various chronic diseases.

North America is Expected to Hold a Significant Share in the Market Over the Forecast Period

North America is expected to hold a significant market share due to the easy availability of technologically advanced products and the increased adoption of interactive patient care systems. Moreover, the rising prevalence of various chronic diseases and the increasing geriatric population in the region are also among the key factors contributing to the growth of the studied market in North America.

For instance, according to the data updated by the Canadian Institute for Health Information in July 2022, it was estimated that about 2.4 million Canadians had heart disease in 2022. Thus, with the increasing burden of conditions across the country, interactive patient care system adoption is expected to increase, driving market growth.

Moreover, the rising activities, such as expansions and product launches by market players in the country, are also expected to enhance segment growth. For instance, in March 2022, GetWell expanded its population health offerings. It includes interactive patient care platforms to help payers and at-risk providers tech-enable and scale their programs to engage more members.

Therefore, owing to the factors mentioned above, such as the high prevalence of various chronic diseases and the increasing activities by market players, the growth of the studied market is anticipated in the North American region.

Interactive Patient Care Systems Industry Overview

The interactive patient care systems market is fragmented in nature due to the presence of several companies operating globally as well as regionally. The competitive landscape includes analyzing a few international and local companies that hold market shares and are well known. Some of the key market players include GetWellNetwork, Inc., Epic Systems Corporation, SONIFI Health Incorporated, Advantech Co., Ltd., and Sentrics, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Incidence of Chronic Diseases Coupled With The Increased Need for Patient Engagement Solutions

- 4.2.2 Increasing Technological Advancements and Rising Adoption of Interactive Patient Care Systems

- 4.3 Market Restraints

- 4.3.1 Lack of Skilled Professionals

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Type

- 5.1.1 Inpatient Solutions

- 5.1.2 Outpatient Solutions

- 5.2 By Product

- 5.2.1 Hardware

- 5.2.2 Software

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Clinics

- 5.3.3 Other End Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 GetWellNetwork, Inc.

- 6.1.2 Epic Systems Corporation

- 6.1.3 SONIFI Health Incorporated

- 6.1.4 Advantech Co., Ltd.

- 6.1.5 Sentrics

- 6.1.6 Evideon

- 6.1.7 Aceso Interactive Inc

- 6.1.8 PDi Communication Systems, Inc.

- 6.1.9 Lincor

- 6.1.10 InterSystems Corporation

- 6.1.11 Hopitel Inc

- 6.1.12 Oneview Healthcare

7 MARKET OPPORTUNITIES AND FUTURE TRENDS