PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408398

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1408398

Chile Data Center Rack - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2030

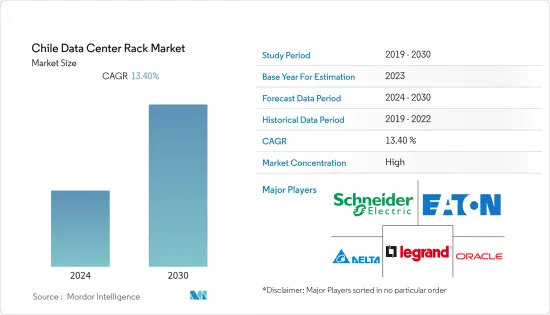

Chile's data center rack market reached a volume of over 56,000 in the previous year, and it is further projected to register a CAGR of 13.4% during the forecast period. The increasing demand for cloud computing among SMEs, government regulations for local data security, and growing investment by domestic players are some of the major factors driving the demand for data centers in the country/region.

Key Highlights

- Under Construction IT Load Capacity: The upcoming IT load capacity of the Chile data center market is expected to reach 480 MW by 2029.

- Under Construction Raised Floor Space: The country's construction of raised floor area is expected to increase to 2.3 million sq. ft by 2029.

- Planned Racks: The country's total number of racks to be installed is expected to reach over 119,000 units by 2029. Santiago is expected to house the maximum number of racks by 2029.

- Planned Submarine Cables: There are close to 8 submarine cable systems connecting Chile, and many are under construction. One such submarine cable that is estimated to start service in 2023 is The Humboldt Cable, where the country is developing a subsea cable project to connect the country with Australia, with the possibility of a subsea cable from Chile to Antarctica holding a length of 14,000 km.

Chile Data Center Rack Market Trends

IT & Telecommunication Holds the Major Share

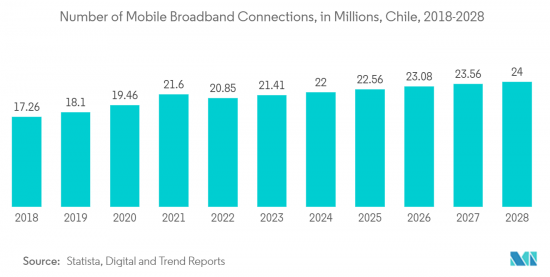

- Chile has the most modern and mature telecommunications infrastructure in South America. The government has made large expenditures on mobile and fiber-optic networks, which now span the whole nation. The government has taken actions to promote the creation of innovative services and technology, including 5G networks and Wi-Fi hotspots. With 26.32 million cellular mobile connections, Chile has the highest regional mobile connection penetration rate.

- The market is currently dominated by 3G and 4G connections, although Chile established the first 5G network in the region in December 2021 after investing USD 3.5 billion. The introduction of 5G networks is expected to boost the country's digital economy and raise demand for high-bandwidth networking equipment.

- The expansion of network connectivity is anticipated as a result of initiatives implemented by governmental bodies. For instance, the Government of Chile claims that approximately 9,000 new 5G base stations will be installed, of which more than 30% will be placed in Santiago and the remaining 9,000 in other regions. All of the nation's public hospitals will also be included in the 5G network's coverage.

- Telecom providers are forming partnerships, getting licensing agreements, and expanding fiber-based network infrastructure to increase broadband connectivity. In March 2022, Mundo, a Chilean fiber-optic internet provider, planned to develop its fiber network in the country with an investment of USD 200 million. The company was to invest this capital in adding 6,000 kilometers of fiber optics to its already existing 7,000 kilometers of fiber.

- In May 2022, the government announced the Zero Digital Gap Plan 2022-2025, aimed at providing network connectivity to all inhabitants of the country. Such instances indicate major data traffic leading to demand for data centers, which are expected to directly lead to more demand for racks.

Full Rack is Expected to Grow Significantly

- In Chile, the increase in the number of data centers and the preference for retail and wholesale data centers, along with newer hyperscale facility construction, is expected to increase the demand for full racks. Digitalization in various end-user sectors is increasing the demand for facilities, leading to market demands.

- There are now more mobile banking services in Chile than a few years ago. In comparison to the prior year, the availability of bank services on smartphones and other mobile devices had increased by 7% as of July 2019. More than 150 fintech businesses operated in Chile in 2021. Many overseas fintechs have selected Chile as a base for their operations for neobanking. A few of the fintech launched in Latin America are Tribal Credit, Jeeves, Clara, and Instacash Preauth. The nation has adopted a fintech law.

- Chile is one of the markets in South America to experience the highest levels of cloud activity. The government's growing investments support the development of various technologies, including 5G, AI, IoT, machine learning, and Big Data. The expansion of the Chilean ICT market is also anticipated to be fueled by the rise of digital transformation. For instance, the cloud service provider, Google Cloud Platform (GCP), revealed incremental information about its cloud regions in Santiago (Chile).

- Further, the government offered an investment of USD 9.1 million to create a digital center that comprises 5G development, local fiber optics development, and international optical fiber interconnections. Moreover, InvestChile has 62 projects in its portfolio related to international services. Together, they represent a potential investment of USD 1,924 million, of which USD 1,743 million corresponds to data centers. Due to these factors, government officials will use more data, thus increasing the demand for full racks with increasing data center facilities in Chile.

Chile Data Center Rack Industry Overview

Chile's Data Center Rack market is consolidated and has gained a competitive edge in recent years. A few major players, such as Delta Power Solutions, Schneider Electric Chile S A, Eaton Corporation Plc. Currently dominate the market. These major players with a prominent market share focus on expanding their customer base across the region. These companies leverage strategic collaborative initiatives and innovations to increase their market share and profitability.

In October 2022, Eaton Corporation announced the launch of its Open Compute Project (OCP) Open Rack v3 (ORV3) compatible solutions. It is purpose-built and preconfigured with a focus on the efficient and scalable delivery of critical power for their data centers seeking to deploy ORV3 racks. The rack will be distributed worldwide, including Chile.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dynamics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Penetration of Cloud Enterprises in the Country

- 4.2.2 Growing Adoption of 5G Deployment

- 4.3 Market Restraints

- 4.3.1 High CaPex for Building Data Center Along With Security Challenges

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers/Consumers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 Impact

5 MARKET SEGMENTATION

- 5.1 Rack Size

- 5.1.1 Quarter Rack

- 5.1.2 Half Rack

- 5.1.3 Full Rack

- 5.2 End-User

- 5.2.1 IT & Telecommunication

- 5.2.2 BFSI

- 5.2.3 Government

- 5.2.4 Media & Entertainment

- 5.2.5 Other End-Users

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Delta Power Solutions

- 6.1.2 Schneider Electric Chile S A

- 6.1.3 Legrand SA

- 6.1.4 Eaton Corporation Plc

- 6.1.5 Oracle Corp.

- 6.1.6 Hewlett Packard Enterprise Co.

- 6.1.7 Rittal GmbH & Co. KG

- 6.1.8 Dell Technologies Inc.

- 6.1.9 Vertiv Group Corporation

- 6.1.10 nVent Electric PLC

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS